INTRODUCTION TO OTHER (Non

advertisement

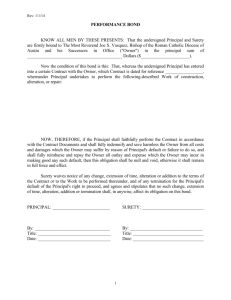

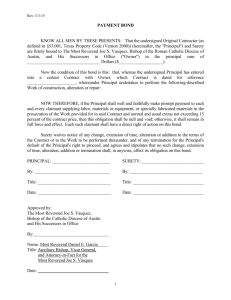

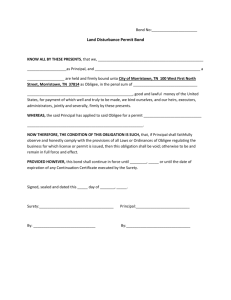

INTRODUCTION TO OTHER (Non-AIA) BOND FORMS EJCDC Bond Forms C-430 Bid Bond-Penal Sum Form (2007) The C-430 Bid Bond provides for the forfeiture of the penal sum of the bond upon the default of the Bidder. A default shall occur upon the failure of the Bidder to deliver within the time required by the Bidding Documents (or any extension thereof agreed to in writing by Owner) the executed Agreement required by the Bidding Documents and any performance and payment bonds required by the Bidding Documents. Payment of the penal sum is the extent of the Bidder’s and Surety’s liability and recovery of the penal sum under the terms of the C-430 Bid Bond is the Owner’s sole and exclusive remedy upon default of the Bidder. Other interesting provisions contained in the C-430 Bid Bond form include (1) a requirement that payment under the bond is due and payable within 30-days of receipt of written notice of the Bidder’s default; (2) the surety waives notice of any and all defenses based on or arising out of any time extensions to issue Notice of Award, provided that the total time for issuing the Notice of Award shall not exceed 120-days in the aggregate; and (3) the bond form shall be deemed to include any applicable statute that has been omitted from the bond form as if fully recited at length. C-435 Bid Bond-Damages Form (2007) Unlike the EJCDC C-430 Bid Bond, which sets the surety’s liability at the defined penal sum, the C-435 Bid Bond provides: “Bidder and Surety, jointly and severally, bind themselves….to pay to Owner upon default of Bidder any difference between the total amount of Bidder’s Bid and the total amount of the Bid of the next lowest, responsible Bidder who submitted a responsive Bid ad determined by Owner for the work required by the Contract Documents…” If there is no such “next lowest, responsible Bidder,” and the Owner has not abandon the project, then the surety shall be liable to pay the owner the penal sum set forth on the face of the bond form. In no event shall the surety’s obligations shall exceed the penal sum. C-610 Construction Performance Bond (2007) EJCDC C-610 Construction Performance Bond (2007) provides that “[i]f the Contractor performs the Contract, Surety and Contractor have no obligation under this Bond, except to participate in conferences as provided in Paragraph 2.1.” EJCDC C-610 requires the owner to “formally terminate the Contractor’s right to complete the Contract” in addition to declaring a default. This language places the burden squarely upon the owner to follow all formal termination protocols set forth in the underlying construction contract and have a valid basis for terminating the contractor. Failure on either regard could provide the surety a defense to a subsequent performance bond claim. Once an owner has satisfied the conditions in paragraph 2, the EJCDC C-610 places responsibility on the surety to be responsive by taking one of the following actions: o Arrange for Contractor, with consent of Owner, to perform and complete the Contract; or o Undertake to perform and complete the Contract itself; or o Obtain bids or negotiated proposals from qualified contractors acceptable to owner for completion of the Contract; or o Waive its right to perform and complete, and after investigation determine the amount for which it may be liable to Owner or deny liability in whole or in part. The surety must proceed with one of these options “with reasonable promptness.” The surety shall be deemed to be in default of the performance bond if, after 15 days of receiving an additional written notice from the owner demanding performance of its obligations, the surety fails to do so. If the surety undertakes the responsibility to perform and complete, the surety, under certain circumstances, may be obligated for the costs of correcting defective work performed by the Contractor; additional legal, design professional, and delay costs resulting from Contractor’s Default; and liquidated damages or actual damages caused by delayed performance by the Contractor.1 However, the Surety’s liability for these types of costs are limited to the amount of the bond. C-615 Construction Payment Bond (2007) 1 C-615 Construction Payment Bond form specifically provides that, with respect to the Owner, the surety’s obligation shall be null and void if the Contractor (1) promptly makes payment, directly or indirectly, for all sums due Claimants and (2) defends, indemnifies and holds harmless the Owner from all claims, demands, liens or suits alleging non-payment by the Contractor. Id. at ¶5. Another unique aspect of the C-615 Construction Payment Bond (2007) is the use of the defined term “Claimant.” Claimant is defined as: An individual or entity having a direct contract with Contractor, or with a first-tier subcontractor of Contractor, to furnish labor, materials, or equipment for use in the performance of the Contract. The intent of this Bond shall be to include without limitation in the terms “labor, materials or equipment” that part of water, gas, power, light, heat, oil, gasoline, telephone service, or rental equipment used in the Contract, architectural and engineering services required for performance of the Work of Contractor and Contractor’s subcontractors, and all other items for which a mechanic’s lien may be asserted in the jurisdiction where the labor, materials, or equipment were furnished.2 The original C-615 Construction Payment Bond (2007) required the payment bond surety to answer a claim within 45 days. Similar to the 45 period contained in the A312-1984 Payment Bond Form, this 45 day period for the surety to respond to payment bond claims was fairly uncontroversial until some courts began strictly construing this timing provision against sureties by striking otherwise valid surety defenses not asserted within the 45 day time period. This line of cases and EJCDC’s reaction to them is discussed later. The interim change to the C-615 Construction Payment Bond form promulgated by EJCDC simply removed paragraph 6, which required the surety to respond within 45 days of receiving a payment bond claim. A new form, EJCDC C-615(A), was published with the support of the Surety and Fidelity Association of America and the National Association of Surety Bond Producers.3 ConsensusDOCS Bond Forms ConsensusDOCS 260: Performance Bond ConsensusDOCS 260 Performance Bond form is a shorter and simpler document than its more complex counterpart, the AIA A312. However, there are still many similarities shared by the two publications. The ConsensusDOCS 260 Performance Bond contains language waiving the surety’s right to be notified of changes to the underlying contract. However, the language in the ConsensusDOCS 260 Performance Bond is somewhat narrower, providing a waiver by the surety of any notice of “alterations or extensions of time made by the Owner in the 2 3 Id. at ¶ 15.1. Id. Contract.” The surety is only waiving notices of change of the time of completion of the work, not to changes in the scope of the work. ConsensusDOCS 260 Performance Bond does not contain such a condition before declaring a principal in default and does not require the parties to “meet and confer” prior to the declaration of default by the Owner. However, the ConsensusDOCS 260 does provide for the traditional declaration of default. Specifically, this bond form states that “[i]f the Contractor is in default pursuant to the Contract and the Owner has declared the Contractor in default, the Surety promptly may remedy the default or shall…” ConsensusDOCS 260 also gives the surety the traditional options of completion, payment, or denial of the claim. However, under the completion option, the surety’s liability appears limited to the “completion of the construction work.” 4 Conversely, the A312-1984 delineates more specifically that the surety is liable for the correction of defective work as well as the completion of the work; additional legal, design professional, and delay costs; and liquidated damages, if provided by the underlying contract. ConsensusDOCS 260 and the A312 bond forms is the accrual point for the running of the two-year limitation period to file a lawsuit against the surety. Although this contractual limitation is subject to any shorter or longer period prescribed by applicable statute, which may also control when the time limitation to sue the surety begins to run, the A312 provides for three possible accrual points, whereas the ConsensusDOCS 260 only provides one accrual point. ConsensusDOCS 261: Payment Bond The ConsensusDOCS 261 Payment Bond form is a very straight forward bond form that binds the Contractor and surety to ensure payment of “all sums for all labor, materials, and equipment furnished by Claimants as defined by the bond form. If the Contractor pays “all sums for all labor, materials, and equipment furnished for use in the performance of the work required by the contract” the surety’s obligations under the bond become null and void. Surety waives any right to be notified of alterations or extensions of time made by the owner in the contract. This waiver language is more restrictive than the waiver notice included in the AIA A312, which provides that the surety waives notice of “any change, including changes of time to the construction contract or to related subcontracts, purchase orders and other obligations.”5 4 5 Id.; see also ConsensusDOCS 260 Performance Bond, ¶ 2. AIA A312-1984 § 10. Claimant is defined as “an individual or entity having a direct contract with the contractor or having a contract with a subcontractor having a direct contract with the contractor to furnish labor, materials or equipment for use in the performance of the Contract.” The most significant contrast of the ConsensusDOCS 261—Payment Bond form is its lack of any 45-day (or 60-day) deadline for the surety to respond to payment bond claims. ConsensusDOCS 262: Bid Bond ConsensusDOCS 262 is a typical “damage-type” bid bond where the surety is liable to the owner for the difference between the amount of Contractor’s bid and the amount of such agreement the owner in good faith executes with another party to perform the work covered by Contractor’s bid, but not to exceed the bond penal sum. One significant difference with the ConsensusDOCS 262—Bid Bond is the absence of any language requiring conforming payment and performance bonds to be procured from a “good and sufficient surety”, but simply relies upon the Contractor to procure such bonds or bonds as are specified in the contract documents for the faithful performance of the work and for the prompt payment for labor and materials furnished in the performance of the work. No timeframe in which the surety is to make payment under the bond. 30th IRMI Construction Risk Conference November 14 -18, 2010 The Peabody Orlando http://www.irmi.com/conferences/crc/default.aspx INDLibrary1 0000000.0001536 1000364v1