Lecture 14: Duopoly and Oligopoly

advertisement

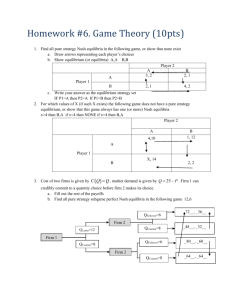

Lecture 14: Duopoly and Oligopoly Consider the case of a firm selling 10 units of its product at $10 a unit, who now decides to produce and sell an 11th unit. How does it calculate its extra revenue? Extra Revenue from selling an incremental unit for a pricetaking firm Revenue Gain = $10 $10 $100 10 If a price-taking firm selling 10 units at $10 each decides to increase output by a unit, its revenue will increase by $10, as indicated by the shaded area above. But if the firm is a price-taker, the firm has a downward sloping demand function. If the firm must charge all customers the same price, it can only sell that unit by lowering the price it charges for the first ten units. This price reduction will offset – and, under some conditions more than offset the revenue gain on the 11th unit. Extra Revenue from selling an incremental unit for a pricemaking firm $10 B $100 A D 10 If a price-making firm selling 10 units at $10 each decides to increase output by a unit, its revenue will increase by the gain in revenue on the 11th unit less the loss in revenue on the first 10 units, as given by area A less area B. Still, there is a third case. We know that the demand function of any firm depends on the prices of substitutes, particularly close substitutes. Suppose, for instance that our pricetaking firm, in an effort to increase sales, cuts is price. There may well be a reaction from its close substitutes. Suppose for instance, that its effort to increase sales from 10 to 11 units leads its competitor to cut its price. How do you price when you must take the reactions of your competitors into account? Extra Revenue from selling an incremental unit for a pricemaking firm, taking competitive reactions into account $10 B $100 A D D' 10 If a price-making firm selling 10 units at $10 each decides to increase output by a unit, its revenue will increase by the gain in revenue on the 11th unit less the loss in revenue on the first 10 units, as given by area A less area B. However, that answer becomes incomplete if competitors react and begin cutting their prices in response. Then the demand function shits to D'. Economists refer to this as the duopoly or oligopoly problem. A Duopoly is a firm whose profits depend on the behavior of another firm, while an oligopoly is a firm whose profits depend on the behavior of a few firms. It tends to simplify things to concentrate on the case of Duopoly, because nothing, or at least very little, is gained by consider oligopoly, except to make the mathematics slightly more complicated. When do you have a Duopoly/Oligopoly? A duopoly/oligopoly exists if a firm’s profits depend on the behavior of another firm or firms. Another approach commonly used is to define oligopoly in terms of something called the four firm concentration ratio, a number conveniently computed by the US Department of Commerce. Simply, it measures the fraction of the market for a particular product held by the top four firms. (There are also eight firm concentration ratios, etc., but the one that gets the attention is the four firm concentration ratio). However a four firm concentration ratio can misses the point. Automobile Industry and also Joe’s Corner Grocery. Consider the US Thus, there is no firm that can ignore the lessons of the competitive market and there are almost no firms that can ignore the lessons of the duopoly model, for it faces situations where the behavior of other firms impacts its profits. The Cooperative Solution Consider a duopoly for widgets. Suppose the demand curve for widgets is given by q = 100-2p, and that the marginal cost of producing widgets is $5. We know that the following solutions apply for a monopolist and for a competitive firm The Basic Data Price Monopolist Competitive Industry $27.50 $5.00 Quantity 45 90 If you don’t recall these results, go back to your notes. The best the two firms can do together is to cooperate and set total production to 45 widgets (maybe at 22.5 each) and reap the profits. A monopolist can do no better. This arrangement will maximize their combined profits. Economists are dubious of these arrangements working out. While certainly firms do attempt to cooperate, they cannot cooperate by sitting down and working out a formal agreement. Such a contract is not enforceable and its mere existence would be a violation of the Sherman Act. What must be developed is a strategy of cooperation that does not involve explicit cooperation. Several ideals have been suggested. First, firms adopt strategies that appear to be legal, but do not involve explicit cooperation. For example, I might post a sign “I will meet my competitor’s price”. This strategy is perfectly legal, and essentially signals a cooperative strategy. Second, firms find more complicated ways of signaling. For example, announce will cut (or raise) prices 10 days hence and then see what other firms do. In some cases this is legal, while in others it clearly is not. Third, firms find back door ways of cooperating. Trade associations founded for perfectly legal cooperative efforts often provide a venue for cutting deals. The Cournot Duopoly Model Suppose firms cannot cooperate by these devices. Economists have developed a series of models designed to explain Duopoly behavior. These give us some guides to how a firm ought to behave. They also give us some guides to the deficiencies in the models. We will consider two basic models: the The Cournot Model and The Bertrand Model (or Cournot in Prices Model) The Basic Cournot Model Each firm maximizes profits taking the output of the other firms as fixed. Suppose the market demand for widgets is given by the demand function D. Suppose that firm "B" is now producing qB widgets. Then firm A takes its demand function as A firm's demand function under the Cournot Model P q b D DA Q In a Cournot Model, each firm takes its demand function as the market demand function less the quantity currently being produced by its competitors. This the demand function for A, is simply the market demand function shifted to the left by q b, the quantity currently being produced by firm b D-qB Is this realistic? Surely firm A knows that firm B will respond to any changes it makes. Surely no one would want to make decisions without taking into account how others will react to those changes. Thus, we should modify the model to allow for these reactions. Perhaps, but this is the Cournot model and it does not consider such reactions. A Graphical Solution This makes the problem of profit maximization quite simple. Suppose the firms have straightforward linear cost functions and linear demand functions. The firm's demand function is the industry demand curve shifted to the left by the other firm's output. Then profit maximization proceeds in a straightforward manner. Profit maximization under the Cournot Model D P D’ MC MR q a The firm's demand function is simply the market demand function shifted over by the amount of the other firm's production. It then proceeds to set MR = MC. A Mathematical Illustration From the example above, Firm A maximizes profits given by = (50-qb/2)q - q2/2 - 5q. This requires that A set output according to the equation q = 45 - qb/2 Notice, we have solved for q under the assumption that B's output is q b. Thus, we know how A's output will change as B's output changes. This equation is referred to as the reaction function. This equation also gives us insight into how B will react and what will be the final solution. B will be going through the same calculations and come up with its own reaction function q = 45 – qa/2. Assuming that this is exactly what the second firm does, we will probably see a series of rounds of quantity adjusting. There is another way we could arrive at the same solution. Consider our two reaction functions: Firm A: q = 45 - qb/2. Firm B: q = 45 – qa/2. We know that the solution requires that qa = qb and we can solve the reaction functions for the solution qa = qb = 30. The General Solution to the Problem There is a more general solution to the problem. First, when we have a demand curve of the form q=a–bp And in the case of two firms with constant marginal cost c, the two reaction functions will be Firm A: q = a/2 –2c/b – qb/2 and Firm B: q = a/2 –2c/b – qa/2 We can always solve these equations. A Graphical Solution to our Numerical Example We have two reaction functions, and we can simply plot the two reaction functions and see where they intersect. Cournot Equilibrium as the Intersection of Two Reaction Functions A's Output 90 B's Reaction Function 45 A's Reaction Function B's Output 45 90 Each firm has a reaction function giving its output as a function of the others. There is only one intersection. To read this graph, suppose B's output is 90. Then A will produce 0. And, if A produces 90, B will produce 0. The Cournot Equilibrium occurs when A and B are each producing 30. The Mechanics of Plotting the Reaction Function Put A’s output on the Y-axis and B’s on the X-axis. Two points will get us going: A’s Reaction Function If B Produces Then A Produces 0 (Monopoly Output) 45 (Competitive Output) 90 0.0 And ditto for B's reaction function: B’s Reaction Function If A Produces Then B Produces 0 (Monopoly Output) 45 (Competitive Output) 90 0.0 Combining these two functions we have a graphical way of getting output equilibrium. Note the equilibrium is at qa = qb = 30. This graphical technique works only for linear demand curves. A Second Example Suppose the industry demand curve is Q = 200 – 5p and that the product can be produced for a marginal cost of $10 each. We know that the competitive solution will involve 150 units of the product selling for $10 each. In the case of the monopoly solution, the inverse demand function is P = 40 – 0.2Q Thus a monopolist's profits would be = (40- 0.2 Q) Q – 10 Q = 30 Q – 0.2Q2 Profit maximization requires that ' = 30 – 0.4Q = 0, or Q = 75. We can then plot the reaction function quite simply: A’s Reaction Function If B Produces Then A Produces 0 (Monopoly Output) 75 (Competitive Output) 150 0.0 And ditto in the opposite reaction. B’s Reaction Function If A Produces Then B Produces 0 (Monopoly Output) 75 (Competitive Output) 150 0.0 I leave it as an exercise to show that the reaction functions cross at Q=50. That is, each firm produces 50 units of output. The easiest way to do this is to plot the two reaction functions and then take it from there. The General Case Consider the more general case. Suppose that the industry demand curve is q=a–bp In the case of two firms with constant marginal cost c, the two reaction functions will be Firm A: q = a/2 –2c/b – qb/2 and Firm B: q = a/2 –2c/b – qa/2 Suppose our market demand function is a straight-line demand function. Marginal cost is c. The demand function hits the marginal cost line at Q 1. Intuitively this is the quantity bought and sold in a competitive industry, with price equal to marginal cost. Reaction Functions for the Cournot Model: First Steps D MR MC = c Q1/2 Q1 Qo To plot the general reaction functions for the Cournot model, notice that the monopoly firm will always produce at Q 1/2, half the output of a competitive industry, when marginal costs are constant. Suppose the industry is monopolistic. Output will be determined by the quantity where MR = MC. Thus, we know for a linear demand function the intersection of MR and MC will occur at Q1/2. To plot the general reaction functions, suppose firm B is producing at the competitive level, Q1. Then A's profit maximizing level of output is zero. On the other hand, if B is not producing, then A's profit maximizing level of output is the monopoly level of output, Q 1/2. If we connect these two points, we have A's reaction function. In turn, the same logic will lead us to B's reaction function. A’s Reaction Function If B Produces Then A Produces 0 (Monopoly Output) Q1/2 (Competitive Output) Q1 0.0 And ditto in the opposite reaction. B’s Reaction Function If A Produces Then B Produces 0 (Monopoly Output) Q1/2 (Competitive Output) Q1 0.0 The point where the two reaction functions cross is Q 1/3. In short, if there are two firms sharing a Cournot Duopoly (and where there is a linear demand function and where there is constant marginal cost), then each firm will produce 1/3 of the output that will be produced in a competitive industry. There is a pattern: With a linear demand curve and constant marginal cost, the monopolist produces half as much output as would be demanded if the product sold at marginal cost. With two Cournot duopolists, they produce 2/3 as much output as would be demanded if the product sold at marginal cost. Generalized Cournot Reaction Functions, Linear Demand Functions and constant marginal cost A Q1 B's Reaction Function Q1/2 Q1/3 A's Reaction Function B Q1/3 Q1/2 Q1 Suppose there are two firms producing a product with a linear demand function, and constant marginal cost, where Q 1 is the amount that would be produced under competition. These are the Cournot reaction functions. Note that each firm produces 1/3 of competitive output. Extensions to Multiple Firms You might ask if the 2/3 rule generalizes. It does When there are n Cournot duopolists, they produce n/(n+1) as much output as would be demanded if the product sold at marginal cost. Thus if there are three Cournot duopolists, each will produce 1/4 as much as output as would be demanded if the product sold at marginal cost. Total output will be ¾ as much as would be demanded if the product sold at marginal cost. If there are four, they will produce 4/5 as much output as would be demanded if the product sold at marginal cost, etc. I leave the proof as an exercise. An Application to the Wudget/Widget Example Assuming a marginal cost of production of $500 a unit, and given the following demand curve, the manufacturer would price it at $1,300 a unit. Q = 630,000 – 300p If the marginal cost is $500 a unit, a monopolist maximizes profits by selling 240,000 units at a price of $1300. Suppose that next year marginal cost drops to $400 a unit. The monopolist will cut is price to $1,250 and sales rise to 255,000 units. If the firm were so foolish as to price at marginal cost, the price would be $400 and 510,000 units would be sold. Our Cournot model provides us a means of predicting how prices will change over time when additional firms join the market. To be specific, suppose in the third year, another producer enters the market, and a Cournot duopoly arises. Then total production will rise to 340,000, as the price drops to $967 a unit. Note that we take advantage of the notion that output will be 2/3 that of the competitive solution. Finally, suppose that, each year after than a new producer enters the market Sales and Price Data, Wudget and New Competitors Year Price 0 1 2 3 4 5 $1300 $1250 $967 $825 $740 $683 Quantity 240,000 255,000 340,000 382,500 408,000 425,000 As you can see, the solution is getting closer and closer to the competitive solution, as the price approaches $400, the competitive price. How many bidders to get competition? Our discussion of Cournot Equilibrium suggests that as the number of firms grows, the price approaches the competitive price. Leonard Wiess studied how many bidders are required to get the lowest bid. The idea is simple. If there is one bidder, they will charge the monopoly price. As the number of bidders increases, the price should decline at a slower rate. When the curve flattens out, we are presumably at the competitive price, and the number of bidders is an estimate of the number of bidders ensuring competition. The data suggest that 4-8 bidders are enough. Price as a Function of the Number of Bidders Pm Pc Number of Bidders When there is one bidder, the monopoly price, P m, prevails. As the number of bidders increases, the price drops. At some point, the price stops dropping, indicating that we are getting a competitive equilibrium. Nash Equilibrium This Cournot solution is also a Nash Equilibrium, after the mathematician John Nash (another winner of the Nobel Prize in Economics). Nash Equilibrium involves the following steps: Each person is acting rationally Each person believes his actions will not change the decision of others No person has an incentive to change. Bertrand Duopoly Model (Cournot in Prices) Here, instead of calling out quantities, the two firms call out prices in sort of a winner-take-all sort of world. It also involves Nash Equilibrium. Consider q = 100-2p Suppose that each firm is to call out a price p a and pb, with the “winner”, the firm calling out the lowest price, to be the one that gets the market. You know, as firm A that the demand function you face is as follows: Reactions in the Bertrand Model Your Price Your Market pa > pb pa = pb 0 (0.5)(100-2pa) That is, the two firms split the market (100-2pa) pa > pb How then should you call out your price? Clearly there is only one Nash Equilibrium, and that is at pa = pb = 5. Only at marginal cost pricing do the two competitors have no incentive to change. When do you have a Bertrand duopoly and when do you have a Cournot duopoly? Some people ask when to use the Bertrand model and when to use the Cournot Model. The answer is that it depends. However as a rule, the following will do the trick: If it is a winner takes all situations then the Bertrand duopoly model is applicable. Otherwise, Cournot. Some Applications As a customer of a duopoly You are in the business of purchasing a commodity from one of two firms. You know that there is a possibility for the firms to exercise duopoly powers. You would like to structure your dealings with them so as to prevent them from doing so. In particular, you want to get them to act as competitive firms and thus charge you marginal cost. Pashigian presents the problem of getting bids on getting a building cleaned. You have three strategies: Take bids from each firm on doing a certain number of square feet. I.e., Acme Cleaners offers to clean A square feet and Brilliant Cleaners then offers to clean B square feet. You determine your demand price for having A + B square feet cleaned and then give them the job at that price. You offer the job to the one with the lowest bid. You tell both to submit a bid per square foot and you will then give the job to low bidder. You invite the two firms to submit a bid. The job will then be split between the two firms but at the lower bid. Of course, the lower the bid, the more square feet you will have done. The first strategy results in Cournot Equilibrium; the second results in Bertrand Equilibrium, while the third is just a bad strategy. Clearly, as the manager of the firm putting the job out for bid, you want to go the second strategy. The two bidders would like you to go the first strategy (or, if they are particularly greedy, the third strategy). As a manager of such a firm Assume you are one of a few firms in an industry. You want to make the duopoly work. You want to cooperate with your counterpart at the other firm. One solution, of course, is simply to operate like a cartel. That is, adopt the cooperative arrangement. Here, you have two problems. Ethical and Legal Problems Cartels are illegal, and efforts to collude overtly with your counterpart clearly violate the law. The Cheating Problem You will need ways of keeping cheating to a minimum. You need to adopt policies that (a) give you evidence that the other party is cheating and (b) conduct your business in such a way that the other party feels you are not. How to do it If possible, get the customer to rely on sealed bids, which are publicly opened. Try to make repeat sales to the same customers. Try to get the customer to break a job into many auctions. Try to find ways to signal your fellow firm(s) that you will cooperate. Get the government on your side. Note: this is not a complete list.