View

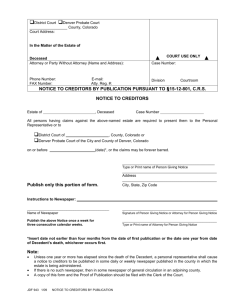

advertisement