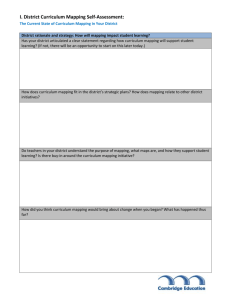

Comments Template QRT VA final

advertisement