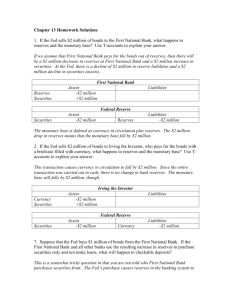

Money Creation: Banking System & Monetary Multiplier

advertisement

Chapter 32 - Money Creation Chapter 32 Money Creation QUESTIONS 1. What is the difference between an asset and a liability on a bank’s balance sheet? How does net worth relate to each? Why must a balance sheet always balance? What are the major assets and claims on a commercial bank’s balance sheet? LO1 Answer: An asset of a commercial bank is something owned by the bank or owed to the bank (cash, securities, loans, etc...). A liability of the bank is a claim against the bank by non-owners (checkable deposits, etc...) and the owners of the bank. This last liability is the net worth of the bank. The balance sheet must balance by definition. That is, the sum of assets must equal the sum of liabilities plus net worth for the bank to ensure appropriate accounting of transactions. The major assets of a bank are reserves, securities, loans, and vault cash (this last one is relatively small when compared to the others). The major claim on the bank is checkable deposits. 2. Explain why merchants accepted gold receipts as a means of payment even though the receipts were issued by goldsmiths, not the government. What risk did goldsmiths introduce into the payments system by issuing loans in the form of gold receipts? LO1 Answer: When early traders began to use gold in making transactions, they soon realized that it was both unsafe and inconvenient to carry gold and to have it weighed and assayed (judged for purity) every time they negotiated a transaction. So by the sixteenth century they had begun to deposit their gold with goldsmiths, who would store it in vaults for a fee. On receiving a gold deposit, the goldsmith would issue a receipt to the depositor. Soon people were paying for goods with goldsmiths’ receipts, which served as one of the first types of paper money. Merchants were willing to accept this receipt because they knew that it could be exchanged for gold or reused to purchase goods and services for the merchant. The potential problem was that if the goldsmith issued more receipts than he had in gold the goldsmith was vulnerable to “panics” or “runs.” For example, if a goldsmith issued paper money equal to twice the value of his gold reserves he would be unable to convert all that paper money into gold in the event that all the holders of that money appeared at his door at the same time demanding their gold. 3. Why is the banking system in the United States referred to as a fractional reserve bank system? What is the role of deposit insurance in a fractional reserve system? LO1 Answer: The banking system in the United States is a fractional reserve bank system because the banks do not hold enough cash or reserves on hand to pay every depositor on demand at the same time. That is, if everyone went to the bank at the same time and tried to close their accounts the bank would not be able to meet this demand. 32-1 Chapter 32 - Money Creation To avoid the potential of these bank runs there is deposit insurance in the United States and other countries. By guaranteeing depositors that they will always get their money, deposit insurance removes the incentive to try to withdraw one’s deposit before anyone else can. It thus stops most bank runs. 4. Why does the Federal Reserve require commercial banks to have reserves? Explain why reserves are an asset to commercial banks but a liability to the Federal Reserve Banks. What are excess reserves? How do you calculate the amount of excess reserves held by a bank? What is the significance of excess reserves? LO2 Answer: Reserves provide the Fed a means of controlling the money supply. It is through increasing and decreasing excess reserves that the Fed is able to achieve a money supply of the size it thinks best for the economy. Reserves are assets of commercial banks because these funds are cash belonging to them; they are a claim the commercial banks have against the Federal Reserve Bank. Reserves deposited at the Fed are a liability to the Fed because they are funds it owes; they are claims that commercial banks have against it. 5. “Whenever currency is deposited in a commercial bank, cash goes out of circulation and, as a result, the supply of money is reduced.” Do you agree? Explain why or why not. LO2 Answer: Students should not agree. The M1 money supply consists of currency outside of the banks (cash in the hands of the public) and checking account deposits of the public in the commercial banks. The deposit of currency into a checking account in a bank has changed the form of the money supply but not the amount. 6. “When a commercial bank makes loans, it creates money; when loans are repaid, money is destroyed.” Explain. LO3 Answer: When a bank makes a loan it also creates a checkable deposit of equal value. This increase in checkable deposits results in an increase in M1. When we apply this logic to the multiple bank-fractional reserve banking system the process (expansion of the money supply) is compounded. The reverse logic applies when a loan is paid off. The individual writes a check to pay off the loan, which reduces checkable deposits. (Recall that cash or reserves held by banks are not part of M1). 7. Suppose that Mountain Star Bank discovers that its reserves will temporarily fall slightly below those legally required. How might it temporarily remedy this situation through the Federal funds market? Now assume Mountain Star finds that its reserves will be substantially and permanently deficient. What remedy is available to this bank? (Hint: Recall your answer to question 6.) LO3 Answer: If Mountain Star Bank discovers that its reserves will temporarily fall slightly below those legally required it can borrow reserves on the Federal funds market to cover its shortfall. They will borrow from banks that have excess reserves in the short-term. If Mountain Star finds that its reserves will be substantially and permanently deficient it will need to reduce the amount of loans outstanding or sell securities to permanently increase its reserves. 32-2 Chapter 32 - Money Creation 8. Explain why a single commercial bank can safely lend only an amount equal to its excess reserves but the commercial banking system as a whole can lend by a multiple of its excess reserves. What is the monetary multiplier, and how does it relate to the reserve ratio? LO4 Answer: When a bank grants a loan, it can expect that the borrower will not leave the proceeds of the loan sitting idle in his or her account. Most people borrow to spend. Therefore the lending bank can expect that checks will be written against the loan and that the bank will shortly lose reserves to other banks, as the checks are presented for payment, to the full extent of the loan. In short, when a bank grants loans to the full extent of its excess reserves, it can shortly expect to lose these excess reserves to other banks. From this it can be seen why a bank cannot safely lend more than its excess reserves. If it did, it would soon find that its cash reserves were below its legal reserve requirement. From the above it can be seen why the commercial banking system can safely lend a multiple of its excess reserves. Whereas one bank loses reserves to other banks, the system does not. With a legal cash reserve requirement of, say, 20 percent, Bank “B” on receiving as a new deposit the $100 loaned by Bank “A” (the excess reserves of Bank “A”), may safely lend $80 (80 percent of $100). Bank “C”, on receiving as a new deposit the $80 loan of Bank “B”, loans 80 percent of that, namely $64. Note that the $100 initial excess reserves of the banking system have already resulted in the money supply increasing by $244 (= $100 + $80 + $64). The money supply will continue to increase, at a diminishing rate (Bank “D” will increase the money supply by $51.20 in loaning this amount), until the total increase in the money supply is $500. The algebra underlying the monetary multiplier is that of an infinite geometric progression. Designating the fixed fraction of the previous number as b (0.8 in our case) and k as the sum of the progression, we have: k 1 b b 2 b 3 ...... b n Solving this for a very large n, we get, k 1 / 1 b In our example, the multiplier k is 1/(1 - 0.8) = 1/.2 = 5. And 5 is the reciprocal of the reserve ratio of 20 percent of 0.2. The multiplier is inversely related to the reserve ratio. 9. How would a decrease in the reserve requirement affect the (a) size of the money multiplier, (b) amount of excess reserves in the banking system, and (c) extent to which the system could expand the money supply through the creation of checkable deposits via loans? LO5 Answer: The monetary multiplier is k = 1/(1- required reserve ratio). (a) Thus, a decrease in required reserve ratio will result in an increase in the multiplier because each bank will need to hold less reserves and therefore can make more loans. (b) This also implies that the bank will see an increase in excess reserves after the fall in the required reserve ratio. (c) The ability to make more loans results in an increase in the potential money creation through the fractional reserve banking system. 10. LAST WORD Explain how the bank panics of 1930 to 1933 produced a decline in the nation’s money supply. Why are such panics highly unlikely today? 32-3 Chapter 32 - Money Creation Answer: Because we have a fractional reserve banking system, bank reserves support a multiple amount of demand deposit money. When depositors collectively withdraw funds and “cash out” their accounts, bank reserves fall. Although demand deposits fall by the amount of cash withdrawn, the remaining demand deposits are too high relative to the reduced reserves. Banks therefore must call in loans or sell securities to get reserves. Both actions reduce the money supply. Such panics are unlikely today because deposits are insured by the Federal Deposit Insurance Corporation (FDIC), which covers the Bank Insurance Fund (BIF) for bank deposits up to $100,000 for each depositor, and also the Savings Association Insurance Fund (SAIF), which covers deposits up to $100,000 in savings and loan associations. Because Congress stands behind these insurance funds, depositors are not worried about the loss of their funds and, therefore, will not rush to withdraw them whenever they might be slightly worried about a particular institution’s financial health. PROBLEMS 1. Suppose the assets of the Silver Lode Bank are $100,000 higher than on the previous day and its net worth is up $20,000. By how much and in what direction must its liabilities have changed from the day before? LO1 Answer: $80,000 increase. Feedback: Consider the following example. Suppose that assets of the Silver Lode Bank are $100,000 higher than on the previous day and its net worth is up $20,000. By how much and in what direction must its liabilities have changed from the day before? By definition (balance sheet approach) the total amount of assets must equal liabilities plus net worth. Assets = liabilities + Net worth We can extend this logic to changes. That is, the change in assets must equal the change in liabilities plus the change in net worth. Δ Assets = Δ liabilities + Δ Net worth Substituting the values above, we have: $100,000 = Δ liabilities + $20,000 This implies that Δ liabilities = $80,000, which is obviously an increase in liabilities. 2. Suppose that Serendipity Bank has excess reserves of $8000 and checkable deposits of $150,000. If the reserve ratio is 20 percent, what is the size of the bank’s actual reserves? LO2 Answer: $38,000 Feedback: Consider the following example. Suppose that Serendipity Bank has excess reserves of $8000 and checkable deposits of $150,000. If the reserve ratio is 20 percent, what is the size of the bank’s actual reserves? The first step is to calculate the required reserves for the bank, which equals the product of the required reserve ratio (decimal from) and checkable deposits. Required reserves = 0.20 x $150,000 = $30,000 The second step is to calculate actual reserves, which is the sum of required reserves and excess reserves. 32-4 Chapter 32 - Money Creation Actual Reserves = Required Reserves + Excess Reserves = $30,000 + $8,000 = $38,000 3. The Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio is 20 percent. Households deposit $5000 in currency into the bank and that currency is added to reserves. What level of excess reserves does the bank now have? LO3 Answer: $4,000 Feedback: Consider the following example. The Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio is 20 percent. Households deposit $5000 in currency into the bank and that currency is added to reserves. What level of excess reserves does the bank now have? The first step is to calculate checkable deposits. This equals the original checkable deposits plus the new deposit, $105,000 (= $100,000 + $5,000). The second step is to calculate required reserves for the deposits, which equals the product of the required reserve ratio (decimal from) and checkable deposits. Required Reserves = 0.20 x $105,000 = $21,000 The third step is to calculate excess reserves, which equals actual reserves minus required reserves. Since the $5,000 deposit was added to the original reserves of $20,000 the new (actual) reserves equal $25,000. Excess Reserves = Actual Reserves - Required Reserves = $25,000 - $21,000 = $4,000 4. Suppose again that the Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio is 20 percent. The bank now sells $5000 in securities to the Federal Reserve Bank in its district, receiving a $5000 increase in reserves in return. What level of excess reserves does the bank now have? By what amount does your answer differ (yes, it does!) from the answer to question 3? LO3 Answer: $5,000; $1,000 Feedback: Consider the following example. Suppose again that the Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio is 20 percent. The bank now sells $5000 in securities to the Federal Reserve Bank in its district, receiving a $5000 increase in reserves in return. What level of excess reserves does the bank now have? By what amount does your answer differ (yes, it does!) from the answer to question 3? The $5,000 sale of securities is directly transferred into the reserves of the bank. This increases reserves by $5000 to $25,000 as above, but since this was a sale of securities there is no change in checkable deposits immediately following the transaction (. The fact that checkable deposits have not changed implies that the required reserves have not change, so required reserves still equal $20,000 \. Thus, excess reserves equal $5,000 (= actual reserves - required reserves = $25,000 0 - $20,000). 5. The balance sheet at the top of the next page is for Big Bucks Bank. The reserve ratio is 20 percent. LO3 32-5 Chapter 32 - Money Creation a. What is the maximum amount of new loans that Big Bucks Bank can make? Show in columns 1 and 1′ how the bank’s balance sheet will appear after the bank has lent this additional amount. b. By how much has the supply of money changed? c. How will the bank’s balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against the bank? Show the new balance sheet in columns 2 and 2′. d. Answer questions a, b, and c on the assumption that the reserve ratio is 15 percent. Answer: (a) $2,000; Column (1): Reserves = $22,000; Securities = $38,000; Loans = $42,000; Checkable deposits = $102,000 (b) Increase in the money supply by $2,000 (c) Column (2): Reserves = $20,000; Securities = $38,000; Loans = $42,000; Checkable deposits = $100,000 (d) Part (a): $7,000; Column (1) Reserves = $22,000; Securities = $38,000; Loans = $47,000; Checkable deposits = $107,000 (d) Part (b): Increase in the money supply by $7,000 (d) Part (c): Column (2): Reserves = $15,000; Securities = $38,000; Loans = $47,000; Checkable deposits = $100,000 Feedback: Consider the following example. Suppose that Big Bucks Bank has the simplified balance sheet shown below and that the reserve ratio is 20 percent: LO3 Part a: What is the maximum amount of new loans that Big Bucks Bank can make? Show in columns 1 and 1′ how the bank’s balance sheet will appear after the bank has lent this additional amount. The first step is to calculate required reserves, which equals the product of the required reserve ratio (decimal from) and checkable deposits. Required Reserves = 0.20 x $100,000 = $20,000 32-6 Chapter 32 - Money Creation The second step is to calculate excess reserves, which equals actual reserves minus required reserves. Excess Reserves = Actual Reserves - Required Reserves = $22,000 - $20,000 = $2,000 After making a loan of $2,000 (excess reserves) loans will increase by $2,000. There is no change in reserves initially (checks have not been drawn against the loan yet) or securities. Once the bank makes the loan it will also credit the borrower’s account (checkable deposits) equal to the value of the loan. Thus, checkable deposits will increase by $2,000. Liabilities and net worth (1) (2) Assets (1) (2) Reserves Securities Loans $22,00 0 38,000 40,000 $22,000 38,000 42,000 Checkable deposits $100,000 $102,000 _____ Part b: By how much has the supply of money changed? The immediate effect is an increase in the money supply by $2,000. Checkable deposits have increased by $2,000 (note that we have not worked through the monetary multiplier yet, this is the immediate effect of the transaction.) Part c: How will the bank’s balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against the bank? Show the new balance sheet in columns 2 and 2′. After checks are drawn against the loan checkable deposits will fall by $2,000 (the amount of the loan) and reserves will fall by $2,000 (the amount of the loan) after the checks clear. Liabilities and net worth (1) (2) Assets (1) (2) Reserves Securities Loans $22,00 0 38,000 40,000 $22,000 38,000 42,000 $20,000 38,000 42,000 Checkable deposits $100,000 $102,000 $100,000 Part d: Answer questions a, b, and c on the assumption that the reserve ratio is 15 percent. Part a: What is the maximum amount of new loans that Big Bucks Bank can make? Show in columns 1 and 1′ how the bank’s balance sheet will appear after the bank has lent this additional amount. The first step is to calculate required reserves, which equals the product of the required reserve ratio (decimal from) and checkable deposits. 32-7 Chapter 32 - Money Creation Required Reserves = 0.15 x $100,000 = $15,000 The second step is to calculate excess reserves, which equals actual reserves minus required reserves. Excess Reserves = Actual Reserves - Required Reserves = $22,000 - $15,000 = $7,000 After making a loan of $7,000 (excess reserves) loans will increase by $7,000. There is no change in reserves initially (checks have not been drawn against the loan yet) or securities. Once the bank makes the loan it will also credit the borrower’s account (checkable deposits) equal to the value of the loan. Thus, checkable deposits will increase by $7,000. Liabilities and net worth (1) (2) Assets (1) (2) Reserves Securities Loans $22,00 0 38,000 40,000 $22,000 38,000 47,000 Checkable deposits $100,000 $107,000 _____ Part b: By how much has the supply of money changed? The immediate effect is an increase in the money supply by $7,000. Checkable deposits have increased by $7,000 (note that we have not worked through the monetary multiplier yet, this is the immediate effect of the transaction.) Part c: How will the bank’s balance sheet appear after checks drawn for the entire amount of the new loans have been cleared against the bank? Show the new balance sheet in columns 2 and 2′. After checks are drawn against the loan checkable deposits will fall by $7,000 (the amount of the loan) and reserves will fall by $7,000 (the amount of the loan) after the checks clear. Liabilities and net worth (1) (2) Assets (1) (2) Reserves Securities Loans $22,00 0 38,000 40,000 $22,000 38,000 47,000 $15,000 38,000 47,000 Checkable deposits $100,000 $107,000 $100,000 6. Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio is 25 percent. LO5 32-8 Chapter 32 - Money Creation a. What is the amount of excess reserves in this commercial banking system? What is the maximum amount the banking system might lend? Show in columns 1 and 1′ how the consolidated balance sheet would look after this amount has been lent. What is the size of the monetary multiplier? b. Answer the questions in part a assuming the reserve ratio is 20 percent. What is the resulting difference in the amount that the commercial banking system can lend? Answer: (a) $2 billion; $8 billion; Column (1) Reserves = $52, Securities = $48, Loans = $108, Checkable deposits = $208; Money multiplier = 4 (b) $12 billion; $60 billion; Column (1) Reserves = $52, Securities = $48, Loans = $160, Checkable deposits = $260; Money multiplier = 5 Feedback: Consider the following example. Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio is 25 percent. LO5 Part a: What is the amount of excess reserves in this commercial banking system? What is the maximum amount the banking system might lend? Show in columns 1 and 1′ how the consolidated balance sheet would look after this amount has been lent. What is the size of the monetary multiplier? The first step is to calculate required reserves, which equals the product of the required reserve ratio (decimal from) and checkable deposits. Required Reserves = 0.25 x $200 billion = $50 billion The second step is to calculate excess reserves, which equals actual reserves minus required reserves. Excess Reserves = Actual Reserves - Required Reserves = $52 billion - $50 billion = $2 billion 32-9 Chapter 32 - Money Creation The third step is to calculate the maximum amount the banking system (not a single bank as in problem 5) might lend. This is found by taking product of the monetary multiplier and the amount of excess reserves. The monetary multiplier = 1/required reserve ratio = 1/0.25 = 4 Maximum amount of loans = 4 x $2 billion = $8 billion Assets Liabilities and Net Worth (1) Reserves Securities Loans $ 52 48 100 $52 48 108 (2) Checkable deposits $200 $208 Two things to note here: (1) The banking system does not lose reserves (2) checkable deposits increase by the amount of the loans (money creation through the fractional reserve banking system). Part b: Answer the questions in part a assuming the reserve ratio is 20 percent. What is the resulting difference in the amount that the commercial banking system can lend? We follow the same steps, but with a required reserve ratio of 20 percent. The first step is to calculate required reserves, which equals the product of the required reserve ratio (decimal from) and checkable deposits. Required Reserves = 0.20 x $200 billion = $40 billion The second step is to calculate excess reserves, which equals actual reserves minus required reserves. Excess Reserves = Actual Reserves - Required Reserves = $52 billion - $40 billion = $12 billion The third step is to calculate the maximum amount the banking system (not a single bank as in problem 5) might lend. This is found by taking product of the monetary multiplier and the amount of excess reserves. The monetary multiplier = 1/required reserve ratio = 1/0.2 = 5 Maximum amount of loans = 5 x $12 billion = $60 billion Assets Liabilities and Net Worth (1) Reserves Securities Loans $ 52 48 100 $52 48 160 (2) Checkable deposits $200 $260 With the required reserve ratio of 20% (rather than 25%) the banking system can lend $52 billion more (=$60 billion - $8 billion). 7. If the required reserve ratio is 10 percent, what is the monetary multiplier? If the monetary multiplier is 4, what is the required reserve ratio? LO5 32-10 Chapter 32 - Money Creation Answers: 10; 25 percent. Feedback: Consider the following example. If the required reserve ratio is 10 percent, what is the monetary multiplier? If the monetary multiplier is 4, what is the required reserve ratio? The monetary multiplier equals one divided by the required reserve ratio. The monetary multiplier = 1/required reserve ratio = 1/0.1 = 10 We can rearrange this question to solve for the required reserve ratio when given the monetary multiplier. required reserve ratio = 1/monetary multiplier = 1/4 =0.25 (or 25%) 32-11