5. horizontal pd

advertisement

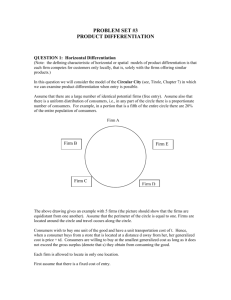

Product Differentiation •Horizontal product differentiation: Consumers have different preferences along one dimension of a good. - e.g. some consumers prefer hot salsa, some prefer mild. •Vertical product differentiation: Consumers have the same ordinal preferences, but not the same cardinal preferences. –e.g. all consumers prefer better fuel efficiency, but their willingness to pay will differ. •Firms seek to be unique along some dimension that is valued by consumers. –Differentiation can be based on the product itself, the delivery system, or the marketing approach. •If the firm/product is unique in some respect, the firm can command a price greater than cost. 1 Horizontal Product Differentiation Location Models A realistic transport cost model to replace Cournot, Bertrand and Joint Maximising Models Assumes: Firms can NOT manipulate the Intensity of Competition Products are differentiated by t and t are exogenously determined Firms choose “location” along a spectrum –Can think of this as the same product in different location, or –Can think of this as different products 2 Hotelling (1929) Umbrellas Linear Market Consumers uniformly distributed with density 1 along this interval Duopoly Consumers incur transport cost t per unit of distance d traveled to the seller Consumers choose to buy from the firm that provides highest net value Each consumer located at certain point on the spectrum Consumer must transport the good from firm Net value = V - p – td Will not purchase if net value < 0 let p* = p + td consumers buy from the seller with lowest p* let one seller be located at A, the other at B 3 p* 0 A B 1 “indifferent consumer” Slope of the (exogenous) umbrellas given by t Height of the umbrella stem given by p (seller at location B has lower p than seller at A) Total cost to the consumer from buying from a particular seller = p+td Consumers buy from seller with lowest p+td 4 Equation of the indifferent consumer PA+tdA = pB + tdB All consumers located to the left of the indifferent consumer will buy from seller at A (since pA+tdA < pB + tdB) All consumers located to the right of the indifferent consumer will buy from seller at B (since pA+tdA > pB + tdB) Finding the indifferent consumer allows us to divide the market between firms A and B Note, for a given location, higher t costs result in higher p* Location Models: two stage game Stage 1 Location Choice (a,b) Stage 2 NE Prices (given location a,b) 5 Hotelling (1929) – “Simple Location Model” No price Competition in Stage 2 Stage 1: Firms A ad B Choose location along a Spectrum The Principal of Minimal Differentiation – Focus on the Catchment Area Payoff for A(B): line segment covered If both firms located at the end…. A B a b l then firms have an incentive to move inwards. 6 A and B are back-to-back, but not in centre: AB b a Incentive for A to jump in front of B….. A and B are back-to-back in centre: A a B b Neither firm has an incentive to move location, given the location of the other The Midpoint is a Nash Equilibrium in Locations Downs Theory of Modern Voting 7 Hotelling (1929) two stage game Stage 1 Stage 2 Location Choice NE Prices (given location a,b) (a,b) Stage 1: A B a b l 8 Stage 2: A B “indifferent consumer” A “indifferent consumer” B No Nash Equilibrium in Pure Strategies 9 D’Aspremont et al (1979) Assumes Quadratic Transport Costs Stage 2 Given locations, find a NE in prices d1 a < q1 = a + d1 A d2 Indifferent consumer l–a–b and B b > q2 = b + d2 10 “indifferent consumer” p1 + td12 = p2 + td22 d1 > 0 d2 < 0 d2 d1 a A B b With quadratic costs there is a NE in prices p1 + td12 = p2 + td22 d1 + d2 = l – a – b solving for market share, we get l a b ( p2 p1 ) 2 2t (l a b) l a b ( p1 p2 ) q2* b d 2 b 2 2t (l a b) q1* a d1 a 11 Now solve for a Nash equilibrium in prices: Max 1 p1q1 p1 1 0 p1 Max 2 p2 q2 p2 2 0 p2 s.t. p2 p1 R ( p2 ) s.t. p1 p2 R( p1 ) The NE in prices solves as: a b ) 3 ba p2* t (l a b)(1 ) 3 p1* t (l a b)(1 Thus, prices depend on locations: p1*(a,b) and p2*(a,b) 12 Stage 1: Choose locations 1(a,b) and 2(a,b) Solve for a Nash equilibrium in locations… Results indicate that 1 0 a and 2 0 b thus, bigger a will reduce firm 1’s profit incentive to minimise a and move toward end likewise for firm b so find NE in locations occurs at a = b = 0, where firms locate at the extreme points of the market trade off market coverage against increased competition that firms face by locating near each other 13 Assumption underlying the location models: distribution of consumers was uniform along the line Non-uniform distribution of consumers: where to locate? Trade-off: how much competition there is in a certain niche against the available niches 14 d’Aspremont et al: 1. price competition strong 2. concentration of consumers is uniform optimal location is at the extremes “locate in a niche” Hotelling: 1.no price competition 2.concentration of consumers is uniform optimal location is at the midpoint “locate where the demand is” General Predictions: Could be anywhere along the linear city…. Optimal location trades off the intensity of price competition with market coverage….. 15 Salop (1979) Circular Road Model 1. N Sellers are located symmetrically around the circle 2.Circumference is normalised to = 1 3.Distance between each seller is thus 1/N Stage 1: Enter with sunk cost = Stage 2: given number of firms N, find NE in prices Solve in Backward Induction process 16 p p p 1/N – d d d 1/N – d seller* Representative where TC = 0: Seller* profit function, sales = 2d indifferent consumer: p + td = p + t[1/N – d] _ so pp 1 2d t N 17 _ p p 1 p.2d p t N seller maximises it’s profit by choosing p, given p, _ 1 pp p 0 p N t t S.N.E. p = p p* t N as t 0 p MC as N p MC 18 Recall, the P(N) function that links price cost margins to a given N P, for any given N, depends on the ‘intensity of competition’ (Bertrand is most intense) Horizontal Product Differentiation relaxes the intensity of competition SHORT RUN p pmonop Differentiated Bertrand Homogenous Bertrand ½t MC 1 2 N 19 Bertrand under Exogenous Product Differentiation Stage 2: Given N, solve for Nash Equilibrium in Prices as pi* t N Thus, equilibrium profits solve as: 1 xi 2d N s xi 2ds N i.e. where p p where s is market size t s s i pi xi . t 2 N N N 20 Stage 2: Enter with sunk cost ? Last firm enters where expost entry profit = s i t 2 N Thus, solving for equilibrium number of firms: N * t s 21 C=1 /N 1 Homogenous Bertrand (t=0) Differentiated Bertrand (t1) Differentiated Bertrand (t2) s / t2 > t1 Greater product differentiation induces more entry (so less concentration) for any given s/ 22