Economics 514

advertisement

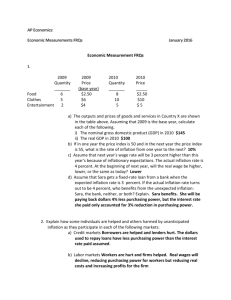

Please write your answers on this exam paper. Name________________ Student ID ________________ Economics 514 Macroeconomic Analysis Midterm Exam 3 December 14, 2011 Write all answers on the white exam paper. Do not turn in the blue books. 20 points each. 1. A price taking company produces using rented capital. The capital rental rate is Rt = .5. The firm must also pay a tax, measured in goods, tw, for each quantity Pt of capital it uses so that total tax revenue is tw∙Kt. The firms production function is of the form Yt 1.5 K t K t 2 . We can write the optimal level of capital as a linear function of the tax, tw, Kt * A B tw . a. Solve for A & B. FOC : MPKt 1.5 2 Kt R tw .5 tw P K * .5 .5tw A = .5; B = -.5 b. Calculate the tax revenue when tw = 0, .5, and 1. tw∙K* = .5tw-.5tw2 0 0 .5 .125 1 0 c. Solve for the level of the tax that generates the maximum level of revenue. Max .5tw-.5tw2 FOC: .5 = tw 2. The demand for real balances is given by the Baumol-Tobin theory so that we can write Mt Y t Pt it The growth rate of output is always 3%, gY = .03. The real interest rate is always 9%, r=.09. At time 0, Y0 = M0 = 100. The growth rate of money is set at a permanent level, gM . Solve for the price level, P0, when gM = .1 and when gM= .03. Explain briefly, in words, why the answer for gM = .1 is larger than for gM= 0.03. P0 it gM π .1 .07 .03 0 i .16 .09 P0 .4 .3 When money growth is high, inflation and interest rates are high. This means the cost of holding cash is high so they are willing to make many trips to the bank. Money circulates more quickly and prices will be higher. Please write your answers on this exam paper. 3. Consider an economy in which expenditure is a negative function of the real interest rate and an exogenous shock: yt t d rt Where d = 1 where the demand shock is a completely unpredictable standard normal variable Et 1 t 0 with a variance Et 1 t 2 2 1 . The central bank sets the real interest rate as an increasing function of their measure of the inflation rate rt b tFED . The central bank cannot measure current inflation perfectly. Instead, the measure of inflation equals the true value plus some white noise tFED t t where Et 1 t 0 with a variance Et 1 t 2 2 . Workers sign dollar wage contracts to keep their real wages fixed at an equilibrium level. If prices rise faster than wages, then firms will increase output above potential output, yt =0 yt ( t gtW ) Assume rational expectations, so gtW Et 1 t . a. Assume that b = 1. Write the model consistent expectations of output and inflation at time t-1. Et 1 yt Et 1 ( t gtW ) Et 1 ( t Et 1 t ) Et 1 t Et 1 Et 1 t 0 yt t b ( t t ) 0 Et 1 yt Et 1 t b ( t t ) Et 1 t b Et 1 t b Et 1 t Et 1 t 0 b. Assume that b=1. Write actual output and inflation as a function of t and t . yt ( t gtW ) t yt t b ( t t ) t b ( yt t ) (1 b) yt t b t yt yt 2 1 t b t t 1 b 1 t 2 b 2 t 2 2btt t2 2 1 2b b 1 b 2 E[t 2 ] 1 2 2 2 E[ yt ] E[ ] b E[t ] 1 2b b2 t 1 2b b2 2 c. Solve for the volatility of output under two different monetary policies: Insensitive) b = 1; and Sensitive) b = 100. Examine the volatility of output E yt 2 under two scenarios which depend on how well the central bank measures current inflation. In the first Clear scenario, the central bank observes inflation perfectly, Et 1 t 2 2 0 ; in the Unclear scenario, central bank does not observe inflation easily, Et 1 t 2 2 4 . Which monetary policy generates the lowest output volatility in each scenario? Explain. E yt 2 Et 1 t 0 Et 1 t 2 2 4 2 2 Insensitive) b = 1 .25 Sensitive) b = 100 1/10,201 5/4 = 1.25 40,001/10,201 1 b 2 2 2 E yt = 1 2b b2 Under the sensitive monetary policy Please write your answers on this exam paper. 4. Consider an economy in which expenditure is a negative function of the real interest rate: yt d rt Where d = 1. The central bank sets the real interest rate as an increasing function of the inflation rate rt b t . Workers sign dollar wage contracts to keep their real wages fixed at an equilibrium level. If prices rise faster than wages, then firms will increase output above potential output, yt yt yt .5 ( t gtW ) Assume rational expectations, so gtW Et 1 t . Assume that potential output follows a random walk so yt yt 1 t where Et 1 t 0 a. Assume that b = 1. Write the model consistent expectations of output and inflation at time t-1 as a function of yt 1 . b. Assume that b=1. Write actual output and inflation as a function of yt 1 and t . 1 1 yt yt 1 ) b b .5 .5 1 yt 1 yt 1 t b b yt yt 1 t .5 ( t t 1 yt yt 1 t yt 1 b .5 .5 1 1 b b b 1 yt yt 1 t , t yt 1 t 1.5 1.5 c. Solve for the level of b that would always set output equal to potential output, yt . What would inflation be at this level of b? If you set b = ∞, then y is potential output and inflation is always zero Please write your answers on this exam paper. 5. Below is a picture of the Keynesian AS-AD model. Draw what happens to the equilibrium if there was a shift outward in potential output. yP πt AS AS2 AD yt In the below graph, draw an AD curve that would insure that output was always equal to potential output even after potential output changes. yP πt AS AD AD yt What kind of monetary policy might generate such an AD curve? b = ∞,