2016 Lay Assigned Compensation Worksheet and Instructions ()

advertisement

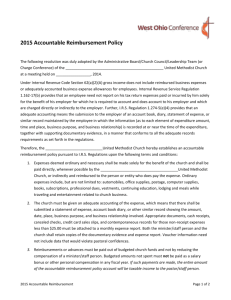

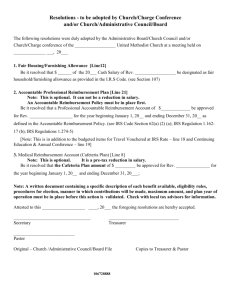

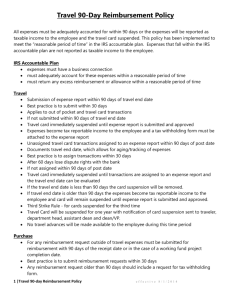

OREGON-IDAHO CONFERENCE THE UNITED METHODIST CHURCH 2016 LAY SUPPLY COMPENSATION & EXPENSE WORKSHEET ( PLEASE TYPE ) CHURCH:______________________________ Full time ½ time NAME: ¾ time ¼ time ________________________________ YEARS OF SERVICE: ___________ EFFECTIVE DATE: __________________________ 2015 $ 2016 I. CASH SALARY $ INSTRUCTIONS Please make sure that all signatures appear on the form . Salary: Housing Allowances are not available to lay employees. Lay employees are eligible for the UMPIP program of the General Board of Pension and Health Benefits and can choose to designate a portion of their salary as a pre-tax contribution to a pension plan – either at the General Board or other fund. The church can also make contributions as well. Contact Lisa in the conference office for assistance. Reimbursable Expenses: (Business & Professional Expenses): Use the worksheet to calculate a budget amount for this area. The line items are provided as a guide for estimating expenses, they are not binding. Use the total amount in the Accountable Reimbursement section of the Resolution. Remember: These expenses are an administrative cost of the church and are not part of pastoral compensation. If your church shares a pastor with another church make sure you budget adequately for travel expenses within the circuit. Be sure to adopt a reimbursement rate for use of a personal automobile. The current IRS rate is 56.5 cents per mile. The 2016 rate will be published late in 2015 or early 2016. For planning purposes, you might want to use 56.5 cents per mile. Note: It is imperative that your church have in place an accountable reimbursement policy. Without a properly adopted policy in place, all expense reimbursements made to the pastor could be considered taxable income. A sample policy is available from your district office. TAXES AND BENEFITS The following items need to be included in the church budget but are not considered part of Compensation F ICA (Social Security & Medicare): 7.65 of Cash Salary* Withheld from employee check and matched by employer contribution of 7.65%, deposited with Federal Income Tax on Form 941. ORWBFTx: (Oregon Workers Benefit Fund Tax - Oregon only) .014 x hours worked/month* Withheld from employee check and matched by employer contribution of .014 times number of hours worked, deposited to State with State tax withholding and SUI. SUI (State Unemployment Insurance): Tax rate determined individually for each employer, contact State Employment Department. Employer contribution only, deposited to State with State tax withholding and, in Oregon, with ORWBFTx. Worker’s Compensation Insurance: Rate determined by insurer. All churches are required to have worker’s compensation insurance for all employees (clergy and lay.) Contact State Insurance Commission or Insurance company (Liberty NW, SAIF) for policy details. *Note – These are 2015 rates, changes to rates for 2016, if any, will be reported by agency by end of 2015. ACCOUNTABLE REIMBURSEMENT WORKSHEET & RESOLUTION Business and Professional Expenses are administrative costs of the local congregation and not part of the pastor’s compensation ACCOUNTABLE REIMBURSEMENT CALCULATION WORKSHEET All expenses must be vouchered A. Travel expenses (including auto mileage) _______________ B. Continuing Education _______________ C. Books & Periodicals _______________ D. Business Meals & Entertainment _______________ E. Office Supplies _______________ F. Telephone _______________ G. Annual Conference Session Expenses _______________ H. Other Business & Professional Expenses _______________ TOTAL ESTIMATED BUSINESS and PROFESSIONAL EXPENSES $ These expenses are Non-Taxable only if the church has properly adopted an accountable reimbursement plan and the employee satisfies the IRS requirements for substantiating claims. If the church has adopted NO accountable reimbursement plan, then all payments of Business and Professional Expense allowances and/or reimbursements are taxable income to the employee. It is essential that the church adopts a detailed plan. Samples are available on request. The Charge/Church Conference of the _______________________________________________ United Methodist Church (church name) of _____________________________________________ on __________________ adopts the following resolution: (city and state) (date) Recognizing that certain expenses of ministry paid by the lay person assigned to ministry are part of the ordinary and necessary costs of ministry in this church, The ___________________________ United Methodist Church has established a detailed accountable reimbursement policy to defray them directly. The reimbursement account shall be an annual line item in the Church budget. It shall be in addition to the lay person assigned to ministry’s annual salary and not part of compensation. The reimbursement account budgeted for 2016 shall be $ __________________________. (Worksheet Total) AUTOMOBILE REIMBURSEMENT RATE: For the period of this agreement, the reimbursement rate for use of a personal automobile will be: _________¢ per mile (not to exceed the IRS allowable rate). This resolution is applicable for the calendar year 2016 or for the period of _______________ to _________________. (date) (date) Note that if you are filling this out for less than a full calendar year, you will still use annualized amounts. Be sure to note the number of months the resolution covers. The amounts are assumed to be approved on a pro-rata basis. Adopted this __________________day of ___________________________. _________________________________ Secretary, Charge/Church Conference _______________________________________ ________ Chair, Administrative Board/Council Date _______________________________________ ________ District Superintendent Date _________________________________ ________ Lay Person Assigned Date