Chapter 9: The Japanese Corporation and Industrial Relations

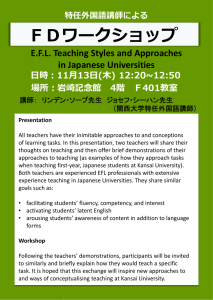

advertisement