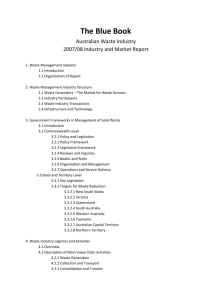

Skill Shortages in the Resources Sector

advertisement