CHAPTER VIII - Indian Railway

advertisement

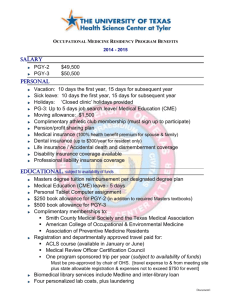

CHAPTER VIII DEARNESS ALLOWANCE 801. Title.—These rules may be called the "Railway Servants Dearness Allowance Rules". 802. Application.—These rules shall apply to all whole time railway servants including temporary staf the provision of rule 804 below and shall not apply to those who draw dearness allowance in accordance orders, e.g. ex. State Railway employees. 803. Definition.—Unless there is anything repugnant in the subject or context, the terms defined belo the sense here-in-explained. Such of the terms as have not been defined will have the same meaning to them in the Indian Railway Establishment Codes:— (i) Pay.—It includes— (a) Pay as defined in rule 103 (35) R-I (b) Pension and/or Pensionary equivalent or other forms of retirement benefits subject to the provision below, if any, drawn by re-employed pensioners. Note: 1, No portion of running allowance will be treated as pay for the grant of Dearness Allowance. Ho case of such of the staff who have retained pre-authorized scales, the pay shall include running allowan during the month subject to a maximum of 75% of pay. 2. In the case of retired Railway servants, non-Govt. servants, employees of Quasi-Govt. bodies, the de allowance during the period of their reemployment on Railways, shall be granted on the pay fixed on re plus the gross amount of pension and/or pensionary equivalent benefits, provided that in either case th not exceed the maximum of the scale of the post in which the person is reemployed. In the case of retired Military Pensioners, whose pay on re-employment in a railway post is fixed withou account the military pension, Dearness Allowance shall be granted on the basis of the pay of the post on In cases where a part of the Pension is taken into account for the purpose of the fixation of pay on reem that part of the pension subject to the limits laid down above will be treated as pay. For this purpose, the amount of pension will be the amount originally sanctioned (i.e. before commutati the amount of pension, if any, held in abeyance as a condition of reemployment. 3. The compensatory (construction or survey) allowance granted to staff employed on loco building projects, surveys and construction works vide rule 427 of the Indian Railway Establishment Code, Vo not be included in 'pay' for the purpose of calculating dearness allowance. 4.The emoluments received from foreign Government in the shape of pay, leave salary or pension, will into account for determining the eligibility to dearness allowance. (ii) Whole-time railway servant includes temporary staff, staff paid from contingencies, piece-workers, w and apprentices drawing stipends, but excludes an employee whose remuneration is fixed specially with market conditions and not at a rate already sanctioned for his class. Note.—The apprentices recruited under the apprentice Act, 1961 and Apprentice Rules, 1962 are not el dearness allowance under these rules. 804. Scales of allowance A. For Railway servants who are drawing pay in the revised scales of pay (effective from 1-1-86) : (i) The All India Average Consumer Price Index numbers for Industrial Workers (General) Base 1960—1 used for grant of compensation to employees for price rise and such compensation would be paid from 1 with salary for March. (ii) The compensation may be paid for the price rise above the 12 months index average of 608 (Base 1 which the pay scales are related. (iii) Employees drawing basic pay up to Rs. 3500/- is allowed 100% neutralization in the compensation (iv) The compensation is to be shown as a distinct element of remuneration. (i) Amount of Dearness allowance admissible on 30-6-1959. Pay Dearness allowance per month Rs. Rs. Upto 50 45 Exceeding 50 but not exceeding 100 55 Exceeding 100 but not exceeding 150 60 Exceeding 150 but not exceeding 200 65 Exceeding 200 but not exceeding 300 70 Exceeding 300 but not exceeding 500 70 Exceeding 500 but not exceeding 750 85 Exceeding 750 but not exceeding 1000 100 Above Amount by which Pay falls Short of Rs. 11 (ii) Additional Dearness Allowance sanctioned after 1.7.59. Pay Additional Dearness Allowance with effect fro Rs. Below 60 37 60 and above but upto 100 60 101 and above but below 160 70 160 and above but below 245 90 245 and above but below 330 110 330 and above but below 900 120 900 and above but below 2250 100 2250 and above Amount by which the pay falls short of 2350 805. Allowance to contract officers.—Dearness allowance may be granted to officers engaged on co specified periods who may be otherwise eligible for it irrespective of whether there is a provision contract for the grant to them of any concession or allowance of a general nature which may be officers of corresponding status, in the regular service and subject to the condition that they have n been allowed in the fixation of their pay an element of compensation to meet the increase in the cost o 806. Allowance to officers on adhoc rates of pay :- The dearness allowance will be admissible on officers on adhoc rates of pay whose pay was fixed without taking into account any allowance draw prior to their appointment on the ad hoc rates of pay, as compensation, for the high cost of 807. Allowance to military officers.—Military officers in civil employment drawing civilian rates of p eligible for the allowance under the rules in this chapter while Military officers drawing Military rates o allowance will be governed by the rules or orders on the subject applicable to the personnel of the Arme 808. Allowance on varying rates of pay.—The admissibility and the amount of allowance to be draw servants drawing varying rates of pay during the course of a month will be determined by the emolume during each particular broken period of a month. 809. Allowance on joining and leaving service.—In the case of a railway servant joining or leaving course of a month, the allowance will be determined with reference to the monthly rate of pay and will b proportionate to the actual days of employment in the month. 810. Allowance during Foreign service.—A railway servant in foreign service may draw dearness al the foreign employer on the basis of foreign service pay, if the foreign employer is willing to bear the provided that the rates of, as well as, the monetary limits (including marginal adjustments) for the eligi allowance are not higher than those sanctioned for railway servants. 811. Drawal of allowance during deputation out of India.—A railway servant drawing pay not exce prescribed limits while on deputation out of India will, during the first six months of his stay on deputati country draw D.A. at the rate at which he would have drawn it, had he not proceeded on deputation a The allowance will not be admissible to railway servants posted ex-India to specified posts. Also Dearne or Dearness Pay is not. admissible in conjunction with foreign allowance. 812. Drawal of allowance during suspension.—In addition to subsistence allowance, a railway serva suspension shall be entitled to dearness allowance appropriate to the actual subsistence allowance adm time to time. 813. Drawal of allowance during leave and joining time :— (a) During leave in India—Railway servant who proceeds on leave with leave salary will draw Dearn Allowance, based on the leave salary actually drawn both in respect of the monetary limits within whic allowance is admissible and for the purpose of calculation of the amount of allowance admissible. (b) During Leave ex-India—The allowance shall be admissible to railway servants during an leave outside India on average or half average pay, other than leave preparatory to retirement. The allo based on leave salary actually drawn at the rates current from time to time. Note : 1—Leave salary shall comprise of only the following elements of pay which are taken into accoun grant of dearness allowance during duty— (a) Basic pay, special pay and personal pay. (b) Gross amount of pension and/or pensionary equivalent of other retirement benefits in case of re-e railway servants. (c) Average Running allowance limited to a maximum of 75% of pay in the case of those who are drawi authorized scales of pay. No portion of running allowance shall be taken into account in the case of thos drawing pay in authorized scales of pay. 2—For the purpose of computation of leave salary in the case of those drawing pay in pre authorized sc the average pay, half average pay etc. will be calculated excluding the dearness pay, and the Dearness should be determined in the usual manner. (c) During Joining time.—In the case of joining time granted under rule 1101-R-I the railway servant dearness allowance based on pay or leave salary admissible for the joining time period as per rule 1113 814. Allowance during study leave.—Dearness allowance is admissible to railway servants based on sanctioned during study leave whether in India or abroad. 815. Drawing of allowance during unpaid holidays. —During unpaid holidays, workshop for the allowance at the full rate applicable to them. staff will 816. Dearness allowance to re-employed persons whose re-employment runs concurrently preparatory to retirement.—If a railway servant while on leave preparatory to retirement avails hims leave concurrently with his new appointment in the Railway he will be granted dearness allowance in re new appointment based only on the pay of such appointment. The allowance will neither be admissible o salary, nor will the leave salary be taken into account in calculating the allowance. 817. Liability of the allowance to income tax.—The allowance is liable to income-tax under Section Indian- Income-tax Act of 1922. The deduction shall be made at source as in the case of salaries. 818. Classification of the allowance.—The allowance shall be classified as compensatory allowance. 819. Dearness allowance during leave preparatory to retirement to Nationals of Nepal and Bh rail-way servant who is a Nepalese, and Bhutanese National shall be eligible to dearness allowance d preparatory to retirement spent by him in Nepal and Bhutan respectively in the same way as it is allowe Railway servants of Indian Nationality during leave preparatory to retirement spent by them in India. ------------------------*----------------------------