Car Allowance Rebate System Legislative Alert in Afghanistan and

advertisement

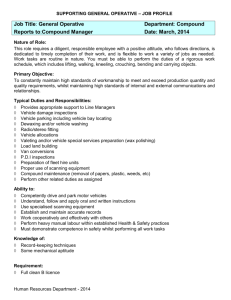

Legislative/Regulatory Alert To: Chief Motor Vehicle Administrators Chief Law Enforcement Officers FR: Neil Schuster, President & CEO DATE: June 25, 2009 RE: Cash for Clunkers Becomes Law On June 24, 2009, President Obama signed the Iraq and Afghanistan War Supplemental Appropriations which included the Car Allowance Rebate System (CARS), commonly referred to as “Cash for Clunkers. The CARS program aims to remove older, less fuel efficient vehicles from the road and replace them with new, more fuel-efficient vehicles by subsidizing consumers with federal vouchers. The administrative functions of the provision fall upon the U.S. Department of Transportation’s (DOT) The National Highway Traffic Safety Administration (NHTSA), the U.S. Environmental Protection Agency (EPA), and the automobile dealers that DOT will register as eligible participants in the program. DOT is appropriated $1,000,000,000 to implement the law. The program also requires reliance on federal systems to carry out certain aspects of its mandate – specifically recording vehicle identification number (VIN) of the disposed vehicle and recording the VIN of all new fuel efficient vehicles purchased or leased. This section of the law specifically cites coordination with The National Motor Vehicle Title Information System (NMVTIS) for recording vehicle identification number (VIN) of the disposed vehicle. While NMVTIS could potentially also serve as the mechanism for NHTSA to maintain a database of the VINs of the purchased vehicles, this is not specified in the law and has not yet been determined. AAMVA is engaged in discussions with NHTSA and EPA to determine how NMVTIS will be used as part of implementing the law. Under the CARS program, NHTSA is directed to establish a voluntary program that will: Authorize the issuance of an electronic voucher to offset the purchase price or lease price for a qualifying fuel efficient vehicle upon surrender of an eligible trade in vehicle to a dealer participating in the program. Register dealers for participation in the program, requiring all participating dealers to accept vouchers as partial or down payment on qualifying vehicles, and transfer each eligible trade-in vehicle to an entity for disposal. Make electronic payments to dealers for eligible transactions accepted by registered dealers Establish and provide for enforcement measures to prevent and penalize fraud under the program To qualify for a $3,500 value: The new vehicle is a passenger vehicle with a fuel economy value that is at least 4 MPG higher than the combined fuel economy value of the trade-in The new vehicle is a category 1 truck and the combined fuel economy value of the truck is at least 2 miles per gallon higher than the combined fuel economy value of the trade-in The new vehicle is a category 2 truck that has a combined fuel economy value of at least 15 MPG and the trade in is a category 2 truck with a combined fuel economy value that is at least 1 MPG lower than the new vehicle, or The new vehicle is a category 2 truck that has a combined fuel economy value of at least 15 MPG and the trade-in vehicle is a category 3 truck of model year 2001 or earlier. The new vehicle is a category 3 truck and the trade in vehicle is a category 3 truck of model year 2001 or earlier and is of similar size of larger than the new vehicle as determined by the Secretary To qualify for a $4,500 value: The new vehicle is a passenger vehicle with a combined fuel economy value at least 10 MPG higher than that of the trade-in The new vehicle is a category 1 truck and the combined fuel economy is at least 5 MPG higher than that of the trade-in The new vehicle is a category 2 truck that has a combined fuel economy value of at least 15 MPG and is 2 MPG higher than that of the category 2 truck trade-in. Exactly how the program will work will be detailed in the rules which are required to be promulgated by NHTSA in the next 30 days. The rules will include: Means for registering dealers with the program Procedures for reimbursement of dealers Requirements for dealers to use vouchers in addition to other rebates/discounts Requirements for dealers to disclose to the person trading in the vehicle the best estimate of the scrappage value of the vehicle. Requirements for dealers to accept and transfer the amount paid for scrappage up to $60 and allow the dealer to keep any amount more than $60 designating $50 of the excess payment to pay for administrative costs of the program. Clarify that dealers will not be reimbursed for storage costs of trade-ins Requirement and procedures for the disposal of eligible trade-in vehicles A list of entities dealers may transfer trade-in vehicles for disposal Enforcement of penalties The law as written outlines other basics of the program, including Period of eligibility – vouchers can be used between the date of enactment and 1 year after the date regulations are implemented. Number of vouchers per person and per trade-in – One voucher can be used for a single person, and 1 voucher may be issued for the joint registered owners of a single eligible trade-in vehicle. There is no combination of vouchers for purchasing a single vehicle. Cap on funds for category 3 trucks – no more than 7.5 percent of the total funds for the program can be used for vouchers for the purchase of category 3 trucks. Incentives permitted – the availability or use of federal, state or local incentives shall not limit the value or issuance of a voucher under the program No additional fees – a dealer may not charge additional fees associated with the voucher program. Penalties – Anyone who violates provisions of the Act is liable for a civil penalty of no more than $15,000 for each violation. It also outlines requirements of the automobile dealer related to each trade-in vehicle, including that dealer: Will arrange for the vehicle’s title to be transferred to the United States and will accept possession of the vehicle on behalf of the United States Will not sell, lease, exchange, or otherwise dispose of the vehicle Will transfer the vehicle (including engine block) and the vehicle title to an entity that will ensure that the vehicle will be crushed or shredded within DOT regulatory prescription and that it will not be sold, leased or exchanged for use as an automobile by that entity. However, nothing precludes a person responsible for the crushing or shredding from selling any parts of the disposed vehicle other than the engine block and drive train (unless the transmission, drive shaft, or rear end are sold as separate parts) or retaining the proceeds from such a sale The Secretary (DOT) is responsible for coordinating with the Attorney General to ensure that the National Motor Vehicle Title Information System and other publicly accessible systems are appropriately updated on a timely basis to reflect the crushing or shredding of vehicles under this Act and appropriate re-classification of the vehicles’ titles. The commercial market shall also have electronic and commercial access to the vehicle identification numbers of vehicles that have been disposed of on a timely basis. Cash for Clunkers Program Eligibility Chart June 19,2009 Eligible Trade In Vehicle "Clunker" Car, light truck, or large light duty truck: • With combined (hwy/city average) fuel economy of 18 mpg or less, which can be found by visiting www.fueleconomy.gov • Manufactured less than 25 years since the date of the trade-in. OR Category 3 Work Truck • An 8,500 to 10,000 lb GVW work truck model year 200 I or older. Ownership Requirements • Is in drivable condition. New vehicle requirements for $3,500 credit New Passenger Car: Must achieve a combined (highway/city) fuel economy improvement of at least 4 mpg (minimum of 22 mpg) above the trade-in. New Light Duty Truck: Must achieve a combined (highway/city) fuel economy improvement of at least 2 mpg (minimum of 18 mpg) above the trade-in. New Large Light Duty Truck (6,000-8,500 Ibs GVW): Must achieve a combined (highwaylcity) fuel economy improvement of at least I mpg (minimum of 15 mpg) above the trade-in. New vehicle requirements for $4,500 credit New Passenger Car: Must achieve a combined (highway/city) fuel economy improvement of at least 10 mpg (minimum of22 mpg) above the trade-in. New Light Duty Truck: Must achieve a combined (highway/city) fuel economy improvement of at least 5 mpg (minimum of 18 mpg) above the trade-in. New Large Light Duty Truck (6,000-8,500 Ibs GVW): must achieve a combined (highway/city) fuel economy improvement of at least 5 mpg (minimum of 15 mpg) above trade-in. • Continuously insured consistent with applicable State law. AND • Registered to the same Owner for a period of not less than 1 year immediately prior to such trade-in. Effective Dates and Limitations Effective July 1,2009 through November 1,2009* *The National Highway Traffic Safety Administration (NHTSA) must finalize detailed rules and create an online system for dealers to complete these transactions. NHTSA has to complete the final rule 30 days after the bill becomes law. Category 3 Work Trucks (8,500-10,000 Ibs GVW): No fuel economy requirement. • Dealer must certify the old vehicle will not be resold for reuse as an automobile or truck in the United States or any other country. • Dealer must transfer the old vehicle to an entity that will ensure the vehicle is crushed, shredded, and not returned to road use. No customer income limitations under this program. New vehicle must be $45,000 MSRP or less. • Limit 1 voucher per customer. No $4,500 work truck voucher Scrappage Requirements • Not more than 1 voucher may be issued for the joint registered owners of a single eligible tradein vehicle. • Excludes leases less than 60 months. These are the general guidelines as written in the bill. NHTSA must finalize specific rules for this process, which will be sent to dealers as soon as it is complete.