house-price-france

advertisement

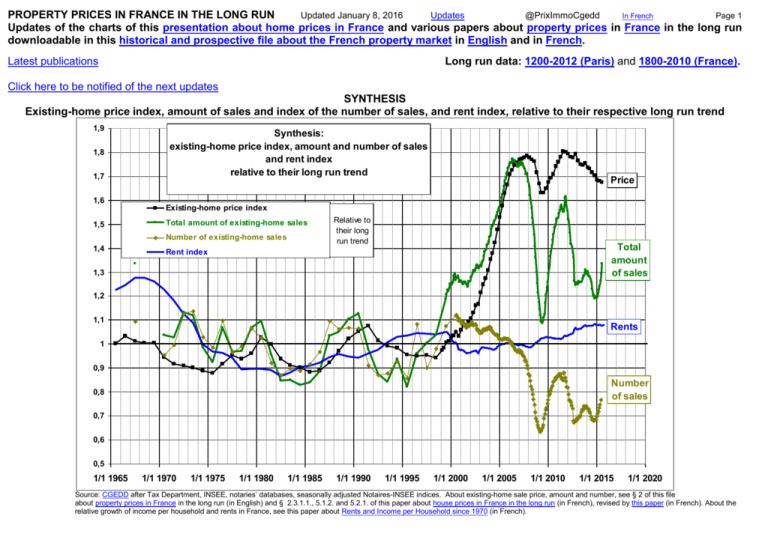

PROPERTY PRICES IN FRANCE IN THE LONG RUN Updated January 8, 2016 Updates @PrixImmoCgedd In French Page 1 Updates of the charts of this presentation about home prices in France and various papers about property prices in France in the long run downloadable in this historical and prospective file about the French property market in English and in French. Latest publications Long run data: 1200-2012 (Paris) and 1800-2010 (France). Click here to be notified of the next updates SYNTHESIS Existing-home price index, amount of sales and index of the number of sales, and rent index, relative to their respective long run trend 1,9 1,8 1,7 1,6 1,5 1,4 Synthesis: existing-home price index, amount and number of sales and rent index relative to their long run trend Existing-home price index Auxtunnel 1 Total amount of existing-home sales Auxtunnel 1 Number of existing-home sales Auxtunnel 1 Rent index Price Relative to their long run trend Total amount of sales 1,3 1,2 1,1 Rents 1 0,9 Number of sales 0,8 0,7 0,6 0,5 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after Tax Department, INSEE, notaries’ databases, seasonally adjusted Notaires-INSEE indices. About existing-home sale price, amount and number, see § 2 of this file about property prices in France in the long run (in English) and § 2.3.1.1., 5.1.2. and 5.2.1. of this paper about house prices in France in the long run (in French), revised by this paper (in French). About the relative growth of income per household and rents in France, see this paper about Rents and Income per Household since 1970 (in French). 1. SINCE 1800 Page 2 1.1. Home price index in constant currency 10 9 8 7 6 5 4 Home price index (France and Paris) in constant currency 1.2. Total amount of home sales as a % of gross domestic product 1965 1914 14% Basis 2000=1 Home price index France Home price index Paris 3 Disposable income per household France 1/1/3800 1/1/3800 Temporary 1/1/3800 increase in interest 1/1/3800 rates after 1/1/3800 1870 1/1/3800 Crimea defeat 1/1/3800 w ar 1/1/3800 1/1/3800 1/1/3800 1/1/3800 1/1/3800 1/1/3800 1/1/3800 1/1/3800 1/1 1/1 1/1/3800 1850 1900 1/1/3800 1/1/3800 1/1/3800 Auxabscisse 0,1 2 1 0,9 0,8 0,7 0,6 0,5 0,4 0,3 0,2 0,1 1/1 1800 12% Exit from rent controls Rent controls + inflation 2.21, Q3 2015 Total amount of property sales as a % of gross domestic product 1965 1914 sales of any type of property (residential and commercial, old and new, incl. land) subject to transaction tax, cumulated on 12 months Nov. 2015: 11.4% 1.62, Q3 2015 1844 1990 1914 1948 10% 1965 1881 1853 1930-35 " safe haven" out of 1940-44 stocks " safe haven" against inflation Nov. 2015: 8.8% 8% 1831 1980 Nov. 2015: 7.0% 6% 1848 1995 1871 1/1 1950 1/1 2000 1/1 2050 1984 4% Total Of w hich taxed at the current regular rate and antecedent rates Of w hich existing homes Auxabscisse 2% 1948 0% 1/1 1800 Source CGEDD after INSEE, notaries’ databases, seasonally adjusted Notaires-INSEE indices, Duon, Toutain, Villa (CEPII). 1.3. Value of an investment in stocks relative to long term trend (**) Jul. 1825 100 90 80 70 60 50 1/1 1950 1/1 2000 1/1 2050 Source: CGEDD after Tax Department, INSEE and Toutain. By exception, rates other than the regular rate apply to some donations. Cf. [13], [15]. 1.4. Inflation and long term interest rate 60% Sep. 1881 Nov. 1858 1/1 1900 Inflation and long term interest rate Mar. 1831 40 30 20 Dec. 1841 1/1 1850 1915 Mar. Apr. 1814 1815 Nov. 1870 Mar. 1848 Value of investments in French and US stocks relative to the long term trend Jul. 1914 50% Average inflation on last 10 years Long term interest rate on gov't debt End-of-month values 40% Jan. 1929 Inflation Auxabscisse 0 Jan. 1943 30% 10 9 8 7 6 5 May 1926 20% French stocks US stocks 4 Sep. 0,5 1939 0,4 3 10% Jun. Dec. Sep. 0,6 1965 1999 1929 Jun. Nov. 0,7 Jun. 1881 2 1802 Dec. 1835 Feb. Aug. 0,8 1852 Dec. 2015: 0.97% Nov. 1937 1987 0,9 1916 0% Nov. 2015: 0.0% 1 1/1 1/1 1/1 1/1 1/1 1/1 Dec. 2015: 0.93 1 2 0,9 1800 1850 1900 1950 2000 2050 0,8 Dec. 2015: 0.75 3 0,7 -10% 4 0,6 Jun. Dec. 0,5 5 Mar. 1877 Jun. 1814 1842 Apr. 1949 Feb. 2009 6 0,4 Dec. 1920 1942 Aug. 1982 1/1 1/1 Oct. 1857 1/1 1/1 1/1 1/1 Jun. 7 1932 1800 1850 1900 1950 2000 2050 -20% 8 9 Source: CGEDD after Arbulu, Schwert, Shiller, EuroNext, S&P, Chabert, Lévy-Leboyer, INSEE, STAT-USA and US Department of Labor. Source : CGEDD after Vaslin, Loutchitch, Banque de France (TMO then TME), Chabert, Lévy-Leboyer and INSEE. 10value of an investment in US stocks has been winding around a long term trend which grows by 6.6% per year plus inflation. In the 19th century, the value of an investment in French stocks wound around a (**) Since 1802, the parallel long term 20 trend; from 1914 to 1965, it crumbled relative to this long term trend; since 1965, it has been winding around the same long term trend as US stocks. Cf. [2], [4]. 30 40 2. SINCE 1965 2.1. 1,9 Price index, amount and number of existing-home sales Home price index, amount of sales and index of the number of sales relative to their long run trend Existing homes 1,8 1,7 1,6 1,5 1,4 Page 3 2 Existing home-price index (last 3 months) Auxtunnel 1 Total amount of existing-home sales (last 12 months) Auxtunnel 1 Number of existing-home sales (last 12 months) Auxtunnel 1 2.2. International comparison Price 1.67 Q3 2015 Relative to their long run trend Total amount France USA (FHFA) USA (S&P/C-S) UK (DCLG) UK (Halifax) Germany (Destatis) Germany (Gewos) Spain Netherlands Aux 0,9 Aux 1,1 Auxtunnel 1 International comparison: home price index relative to disposable income per household Basis 2000=1 1,5 1.34 Nov. 2015 1,3 1,2 1,1 1,1 1 1 0,9 0,9 Number 0,8 0,7 0,6 0,5 1/1 1965 0,5 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after INSEE, notaries’ databases, seasonally adjusted Notaires-INSEE indices and Tax Department Source: CGEDD after INSEE, notaries’ databases, seasonally adjusted Notaires-INSEE indices, Freddie Mac, FHFA, R. Shiller, The long term trend by which we divide the home price index is the disposable income per household, in parallel S&P/C-S, Census Bureau, Bureau sof Economic Analysis,and of Labor Statistics, UK Office for National Statistics, HBOS, to which it has been growing from 1965 to 2001, cf. [2], [4]. About the long term trend by which we divide the Destatis, Gewos, INE, Ministerio de Fomento, R. Vergés, Centraal Bureau Voor de Statistiek. The methodology of an index amount of sales of existing homes (total of the amount of all sales) and the number of sales of existing homes, see [13]. may impact its long term trend: the differences in the long term trends of the various indices shown on this chart may be caused at least in part by differences in methodology. Cf. [2], [4], [6]. 2.3. Home price index and rent index 2.4. Comparison per area 2,7 1,8 2,6 1,7 Home price index and rent index relative to disposable income per household France, basis 2000=1 2,5 2,4 2,3 1,6 Home price index relative to disposable income per household, basis 2000=1 Rent index relative to disposable income per household, basis 2000=1 1,5 2,2 1,3 1,2 2.38 (Paris, Q3 15) Auxtunnel 0 Differentiation Paris / Region of Paris / Province Auxtunnel 0,9 Auxtunnel 1 Auxtunnel 1,1 Base 1965=1 1.98 (Paris Region, Q3 15) 2 NB1: the perimeters of the rent index and the price index are Auxtunnel 0,9 different => bias => dividing the former by the latter does not yield a gross rental Auxtunnel 1 income index. NB2: the divider is the average income per household of all Auxtunnel 1,1 households, whether tenants or owner-occupiers. Tenants' income per household grows slower than all households'. NB3: many structure effects. 1,4 relative to disposable income per household 2,1 Auxtunnel 0 France Paris Region of Paris Province Home price index 1,9 1,8 1,7 NB: the divider of all four ratios is the disposable income per household over all of France 1.67 (France, Q3 15) 1,6 1.55 (Province, Q3 15) 1,5 1,4 1,3 1,1 1,2 1 1,1 0,9 0,9 Tunnel 1 0,8 0,8 1/1 1965 0,7 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after INSEE, notaries’ databases and seasonally adjusted Notaires-INSEE indices. Cf. [2], [3] and [4]. 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after INSEE, notaries’ databases and seasonally adjusted Notaires-INSEE indices. “Province” means France minus the region of Paris. Cf. [2]. The abscissas are the middle of the basis of the quantities represented. Example: on chart 2.1., the 12 month-cumulated amount of transactions at end December 2008 relative to its long term trend is shown on abscissa July 1st, 2008. Page 4 3. Home price index and home purchase finance 3.1. Home price index 1,5 3.2. Affordability index 2 1,4 1,9 1,8 Affordability index Basis 1965=1 Home price index relative to disposable income per household 1,3 France, basis 1965=1 1,7 1,6 1,2 Home price index relative to disposable income per household, basis 1965=1 Auxtunnel 0 1,5 1,1 Auxtunnel 0,9 1,4 Auxtunnel 1 1,3 Auxtunnel 1,1 1 0,9 1,2 1,1 1 0,8 Affordability index at nominal interest rate Affordability index at 'real' interest rate Auxtunnel 1 Tunnel 0,7 0,9 0,6 0,8 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after INSEE, notaries’ databases and seasonally adjusted Notaires-INSEE indices. 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after INSEE, notaries’ databases, seasonally adjusted Notaires-INSEE indices & Banque de France. Comparing this chart to chart 3.3. below shows that periods when interest rates (nominal or net of inflation) have been low (resp. high) (chart 2.3.) have not coincided particularly with periods when the home price index has been high (resp. low) with respect to its long term trend (chart 2.1.). Although counter-intuitive, this phenomenon is the fundament of the diversifying power of housing investment with respect to bond investment. Cf. [2], [4]. 20% 3.3 Interest rate and inflation The “affordability index at nominal interest rate” reflects the quantity of existing housing a household may purchase for a given initial monthly mortgage payment relative to its income and a given deposit relative to its income. It is assumed that, in 1965, the purchase was financed 50% by a mortgage (15 year fixed rate), 25% by home resale and 25% by a deposit. When inflation is high (1968-1985), we use the “affordability index at real interest rate” which is similar but assumes that the mortgage interest rate is equal to the nominal interest rate minus the inflation rate. This is fancy (in part because the real interest rate can be negative when inflation is high) but partly reflects the impact of expected inflation (assumed equal to past 12 month inflation) on the initial mortgage payment accepted by borrowers and lenders. Housing subsidies are not included (their impact is small compared to the volatility of the index). Cf. § 2.3.3. of [2] and [4]. 3.4 Mortgage length to purchase the same dwelling, first-time buyer 15% 45 years Long Term Interest Rate and Inflation 40 years Interest rate Inflation Interest rate minus inflation 10% Mortgage length to purchase the same existing dwelling with the same deposit to income and initial payment to income ratios, basis 1965=15 years 35 years 30 years 25 years 5% 21.4, Q3 2015 20 years 15 years 10 years 0% 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 5 years Mortgage length 'at nominal interest rate' Mortgage length 'at real interest rate' 0 years -5% 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after INSEE and Banque de France (TMO before 1989, TME from 1989 to 2003, interest rate on residential Source: CGEDD after INSEE, notaries’ databases, seasonally adjusted Notaires-INSEE indices & Banque de France. The mortages with an initial fixed-rate period longer than 1year fom 2004). deposit is assumed equal to 10% of the price in 1965 and growing like the income per household. The balance is financed by a mortgage (no home resale since this is a first time purchase). Excluding housing subsidies (their impact is small compared to the volatility of the index). About the “length at interest rate net of inflation”, cf. chart 3.2. above. Cf. § 2.3.3. of [2]. 4. Volumes 4.1. Number of property sales taxed at the regular transaction tax rate Page 5 4.2. Rotation speed of housing stock Cumul. last 3 months Cumul. last 12 month 1 200 000 300 000 Number of property sales taxed at the regular transaction tax rate 1 000 000 3,5% Rotation speed of individuals' housing stock (average on last 12 months) 1 122 000 (Nov. 15) 3,0% 250 000 All types of property Of which existing-homes 800 000 792 000 200 000 (Nov. 15) 600 000 150 000 2,5% Meaning: in 1999, 3.04% of dwellings held by individuals were sold. 2,0% Number of property sales taxed at the regular transaction tax rate, all types of property: existing homes, existing commercial property and VATexempt land 400 000 200 000 100 000 Of which existing homes 1,5% Left scale Cumul. last 12 months Cumul last 12 months Right scale Cumul. last 3 months (deseas.) Cumul. last 3 months (deseas.) NB: the rotation speed is the number of sales of existing dwellings divided by the number of dwellings held by individuals (dwellings held by private of public coporations being rarely sold, it seems preferable to exclude them from the ratio). Prior to 1992, the number of sales of existing dwellings is known only by an approximate retropolation 50 000 1,0% 0 1/ 1965 1/ 1970 1/ 1975 1/ 1980 1/ 1985 1/ 1990 1/ 1995 1/ 2000 1/ 2005 1/ 2010 1/ 2015 0 1/ 2020 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after CGDD/SOeS (Existan), Tax Department (MEDOC & Fidji) and notaries’ databases. Numbers are rounded to the nearest ‘000 but should not be considered accurate to the ‘000. The precision of the estimates is lower prior to 1992. Sales taxed at the regular transaction tax rate include not only existing-home sales (which represent around 2/3 of the total number and 80% of the total amount on average over all of France), but also sales of commercial properties and of VAT-exempt constructible land. “Province” means France minus the region of Paris. Cf. [14], [16], [18]. 4.3. Yearly change in the number of property sales taxed at the regular transaction tax rate, whether residential or not 4.4. Amount of existing-home sales and mortgages 14% 40% 12-month change in the 12-month and 3-month cumulated number of sales taxed at the regular transaction tax rate 13% 30% 12% Amounts of existing-home sales and mortgages as a % of households' disposable income, last 12 month cumulated 12-month change in the 12-month cumulated number 12-month change in the 3-month cumulated number 20% 11% Sales 10% Mortgages 9% 10% 8% 7% 0% 12/ 04 12/ 05 12/ 06 12/ 07 12/ 08 12/ 09 12/ 10 -10% 12/ 11 12/ 12 12/ 13 12/ 14 12/ 15 6% 5% 4% -20% 3% 2% -30% 1% 0% -40% Source: CGEDD after Tax Department (MEDOC & Fidji). Cf. [16]. 1/1 1965 1/1 1970 1/1 1975 1/1 1980 1/1 1985 1/1 1990 1/1 1995 1/1 2000 Source : CGEDD after Tax Department (MEDOC) and Insee. Cf. [13]. 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Mortgage and government debt interest rates 5% Mortgage debt outstanding 6% Page 6 5.2. Households’ new and outstanding mortgages 5.3. Households’ mortgage debt and gov’t debt New mortgages 5. Debt 5.1. Households’ mortgage debt and gov’t debt interest rates Households' new mortgages and mortgage debt outstanding as a % of households' gross disposable income 16% 80% 14% Oct. 15 70% 70% 12% 60% 10% 50% 8% 40% 6% 30% 4% 20% 100% 80% Households' mortgage debt and Maastricht government debt Sep.15 97% Households'mortgage debt as a % of households'disposable income Maastricht general government debt as a % of gross domestic product 4% 3% (1) Long term gov't debt interest rate (*) Oct. 15 70% 60% (2) Fixed-rate mortgage interest rate (**) 2% 40% Spread (2)-(1) Spread (2)-(1), smoothed over 12 months 1% 2% 0% 1/12 1999 1/12 1/12 2000 2001 1/12 1/12 2002 2003 1/12 1/12 2004 2005 1/12 2006 1/12 1/12 2007 2008 1/12 1/12 2009 2010 1/12 1/12 2011 2012 1/12 1/12 2013 2014 1/12 2015 (*) TME (**) Interest rate on new residential mortages, initial fixed-rate period longer than 1year -1% Source: CGEDD after Banque de France and INSEE New mortgages (12-month cum.) 0% 1,2% 1,25 1,2 Region of Paris minus Paris Province 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 Source : CGEDD after Banque de France and INSEE. Cf. [19]. 900 000 6.2. Existing and new: number of existing dwellings sold and of new dwellings started 800 000 Apartment price index relative to detached house price index Basis Q4 2000=1 0% 0% 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1/1 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 Source : CGEDD after Banque de France and INSEE. Cf. [19]. 1,3 1,4% 10% Mortgage debt outstanding (right scale) 6. Miscellaneous 5.4. Builders’ debt as a % of GDP 6.1. Apartments vs detached houses: relative change in the price indices 1,6% Builders' outstanding debt as a % of gross domestic product 20% 700 000 Sales of EXISTING dwellings and NEW dwelling starts 792 000 Nov. 2015 Number of EXISTING dwellings sold Number of NEW housing units started (*) Change in the number of households 600 000 12 month cumul. (*) Excl. overseas depts prior to 2000 1,0% 500 000 0,8% 1,15 400 000 0,6% Series change in 2000 351 000 Nov. 2015 1,1 300 000 0,4% 1,05 200 000 0,2% 1 100 000 0,0% 1/1 1/1 1/1 1/1 1/1 1/1 1/1 0,95 1990 1995 2000 2005 2010 2015 2020 1/1 1995 0 1/1 1950 1/1 1960 1/1 1970 1/1 1980 1/1 1990 1/1 2000 1/1 2010 1/1 2020 1/1 2000 1/1 2005 1/1 2010 1/1 2015 1/1 2020 Source: CGEDD after Banque de France and INSEE Source: CGEDD after Notaires-INSEE indices corr. for seasonal varns. Source: CGEDD after notaries’ database, Tax Department, CGDD/SOeS and Insee. Cf. [14], [16], [18], [30]. From 1965 to 2000, apartment prices grew slower than detached house The elasticity of home prices with respect to the number of dwellings being around -1 to -2, the number of dwellings built impacts prices by around 1.5% per year in « province » and 1% per year in the home prices only marginally, as pointed in this paper, cf. [11]. region of Paris minus Paris. Cf. [12]. The sharp increase in home prices About the relationship between housing potential demand and growth in the number of households, cf.[30]. from 2002 has coincided with an inversion of this long term trend. 7. References Page 7 * Long Run Investment [1] Long Run (1800-2010) Series: numerical values used to make the charts above. [2] « Le prix des logements sur le long terme » (« Home Prices in the Long Run »), J. Friggit, CGEDD, 2010. [3] « Loyers et revenus depuis les années 1970 », J. Friggit, CGEDD, 2013. [4] « Long Term (1800-2005) Investment in Gold, Bonds, Stocks and Housing in France – with Insights into the USA and the UK: a Few Regularities », J.Friggit, CGEDD, 2007. [5] « Placements en actions et en logement: quelques régularités sur longue période » (« Investments in Stocks and Dwellings : some Regularities in the Long Run »), J.Friggit, Réflexions Immobilières n°33, 2002. * Home Prices in the Long Term [6] « Comparing Four Secular Home Price Indices », J. Friggit, CGEDD, 2008. [7] « Documents sur le problème du logement » (« Documents about the Housing Problem»), G.Duon, Études Économiques, National Statistical Service, Ministry of the Economy, 1946, n°1. * Home Prices in the Recent Past [8] Notaires-INSEE indices of existing home prices: complete historical values and methodology in English (INSEE Méthodes n° 111). [9] « Managing Hedonic Housing Price Indices : the French Experience », C. Gouriéroux & A. Laferrère, OECD-IMF Workshop on Real Estate Price Indexes, Paris, Nov. 2006, http://www.oecd.org/dataoecd/2/24/37583497.pdf. [10] « La saisonnalité du prix des logements » (« Home Price Seasonality »), J.Friggit, short paper, Études Foncières n° 121, 2006. [11] « L’élasticité du prix des logements par rapport à leur nombre » (« The Elasticity of Home Prices with Respect to their Number »), J. Friggit, CGEDD, 2015. [12] « Evolution relative du prix des appartements et du prix des maisons : l’inversion de 2001 » (« Apartment versus House Price Trend : the Inversion of 2001 »), J. Friggit, CGEDD, 2011. * Amounts and Number of Property Sales and of Existing-home Sales [13] « Droits de mutation et montant des transactions immobilières - 1800-2008 » (« Property Transaction Taxes and Amounts of Transactions, 1800-2008 »), J.Friggit, CGEDD, 2009 [14] « Le montant et le nombre des transactions de logements anciens depuis 1967 et leurs « tendances longues » », J. Friggit, CGEDD, 2015. [15] Calculation of the property transaction tax base : method [16] Methodology for estimating the number of property sales, « Diverses évaluations du nombre de transactions de logements anciens », J. Friggit, CGEDD, 2008 and « Estimation du nombre de transactions de logements anciens à finalité conjoncturelle », J. Friggit, CGEDD, 2008. [17] Property transaction tax base, per department, month and tax type since 2000 (Tax Department - MEDOC) (data) [18] Number of existing-home sales since 1967 (data). * Households’ mortgage debt [19] « Projection à horizon 2030 de la dette immobilière des ménages » (« Projection to 2030 of Households’ Mortgage Debt »), J. Friggit, CGEDD, 2010. * Stock prices and interest rates in the long term [20] « La Bourse de Paris au XIXe siècle » (the Paris Stockmarket in the 19th Century) , P. Arbulu, Connaissances et Savoirs, 2007, book based on « Le marché parisien des actions au XIXème siècle: performance et efficience d'un marché émergent » (« Paris Stockmarket in the 19th Century : Performance and Efficiency of an Emerging Market »), P.Arbulu, dissertation for a doctorate in management, Orléans University, 1998. [21] « Le marché financier français au XIXe siècle », (« the French Financial Market in the 19th Century »), collective, directed by P.-C. Hautcoeur et G. Gallais-Hamonno, Publ. de la Sorbonne, 2007. [22] « Le marché des rentes françaises au XIXème siècle et la crédibilité financière de l’État » (« the French Government Bond Market in the 19th Century and the Financial Credibility of the State »), J.M. Vaslin, dissertation for a doctorate in management, Orléans University, 1999. [23] « Des variations des taux d’intérêt en France de 1800 à nos jours » (« Interest Rate Variations in France from 1800 to Present »), L.-J. Loutchitch, Alcan, Paris, 1930 [24] « Indexes of US Stock Prices from 1802 to 1987 », G.Schwert, Journal of Business, vol.63 n°3, 1990. [25] « Irrational Exuberance », Second Edition, R.Shiller, Princeton University Press, 2005 (also treats of long term home prices). * Macroeconomic and Demographic Aggregates in the Long Term [26] « L’économie française au XIXème siècle, analyse macroéconomique » (« The French Economy in the 19th Century, Macroeconomic Analysis »), M. Lévy-Leboyer et F. Bourguignon, Économica, 1985. [27] « Essai sur les mouvements des revenus et l’activité économique en France de 1789 à 1820 » (« Essay on the Movements of Incomes and Economic Activity in France from 1789 to 1820 »), A. Chabert, Librairie de Médicis, 1949. [28] « Le produit intérieur brut de la France de 1789 à 1982 » (« French Gross Domestic Product from 1789 to 1982 »), J.-C. Toutain, Cahiers de l’ISMEA n°15, 1987. [29] Séries longues macroéconomiques (« Long Term Macroeconomic Series »), P.Villa, CEPII. [30] « La demande potentielle de logements à l’horizon 2030 : une estimation par la croissance attendue du nombre des ménages » (« Housing Potential Demand at horizon 2030, an estimate by the expected growth in the number of households»), Alain Jacquot, SOeS, août 2012. Updates of this document, as well as additional documents, may be downloaded at http://www.cgedd.developpement-durable.gouv.fr/house-prices-in-france-property-a1117.html. The interpretation of several of these charts is delicate. Therefore it is strongly recommended to have a look at the references mentioned below the charts. Values may be provisional for the most recent months or quarters. The charts may be copied, provided they are in full, without any addition or omission and that the source mentioned below each of them is reproduced in full, followed by the link http://www.cgedd.developpement-durable.gouv.fr/house-prices-in-france-property-price-index-french-a1117.html. J.Friggit - CGEDD/S2. The analyses and points of view are the author’s, and, in particular, not necessarily CGEDD’s.