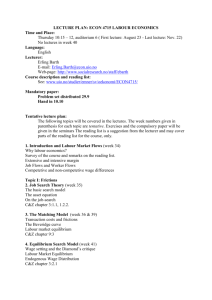

LABOUR MARKET FLEXIBILISATION

advertisement