Policy Challenges in Achieving Inclusive Growth

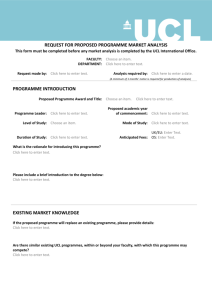

advertisement