Tutorial_8_solutions

advertisement

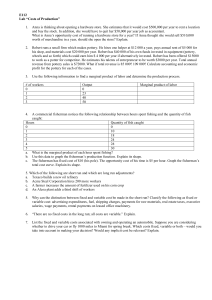

Your aunt is thinking about opening a hardware store. She estimates that it would cost $500,000 per year to rent the location and buy the stock. In addition, she would have to quit her $50,000 job as an accountant. a. Define opportunity cost. b. What is your aunt’s opportunity cost of running a hardware store for a year? If your aunt thought she could sell $510,000 worth of merchandise in a year, should she open the store? Explain. 2. Suppose that your college charges you separately for tuition and for room and board. a. What is the cost of attending college that is not an opportunity cost? b. What is an explicit opportunity cost of attending college? c. What is an implicit opportunity cost of attending college? 3. A commercial fisherman notices the following relationship between hours spent fishing and the quantity of fish caught: Hours Quantity of fish (in pounds) 0 0 1 10 2 18 3 24 4 28 5 30 a. What is the marginal product of each hour spent fishing? b. Use these data to graph the fisherman’s production function. Explain the shape. c. The fisherman has a fixed cost of $10 (his pole). The opportunity cost of his time is $5 per hour. Graph the fisherman’s total-cost curve. Explain its shape. 4. Your cousin Vinnie owns a painting company with fixed costs of $200 and the following schedule for variable costs: 1. Quantity of Houses Painted per month 1 2 3 4 5 6 7 Variable costs $10 $20 $40 $80 $160 $320 $640 Calculate the average fixed cost, average variable cost, and average total cost for each quantity. What is the efficient scale of the painting company? 5. Consider the following table of long-run total cost for three different firms: Quantity Firm A Firm B Firm C 1 60 11 21 2 70 24 34 3 80 39 49 4 90 56 66 5 100 75 85 6 110 96 106 Does each of these firms experience economies or diseconomies of scale? 7 120 119 129 1. The answers are as follows: a. The opportunity cost of something is what must be given up to acquire it. b. The opportunity cost of running the hardware store is $550,000, consisting of $500,000 to rent the store and buy the stock and a $50,000 opportunity cost, because your aunt would quit her job as an accountant to run the store. Because the total opportunity cost of $550,000 exceeds revenue of $510,000, your aunt should not open the store, as her profit would be negative. 2. The answers are as follows: a. Because you would have to pay for room and board whether you went to college or not, that portion of your college payment is not an opportunity cost. b. The explicit opportunity cost of attending college is the cost of tuition and books. c. An implicit opportunity cost of attending college is the cost of your time. You could work at a job for pay rather than attend college. The wages you give up represent an opportunity cost of attending college. 3. a. The following table shows the marginal product of each hour spent fishing: Variable Marginal Hours Fish Fixed Cost Total cost cost Product 0 0 10 0 10 --1 10 10 5 15 10 2 18 10 10 20 8 3 24 10 15 25 6 4 28 10 20 30 4 5 30 10 25 35 2 b. Figure 1 graphs the fisherman’s production function. The production function becomes flatter as the number of hours spent fishing increases, illustrating diminishing marginal product. Figure 1. c. The table shows the fixed cost, variable cost, and total cost of fishing. Figure 2 shows the fisherman’s total-cost curve. It has an upward slope because catching additional fish takes additional time. The curve is convex because there are diminishing returns to fishing time because each additional hour spent fishing yields fewer additional fish. Figure 2. 4. The following table illustrates average fixed cost (AFC), average variable cost (AVC), and average total cost (ATC) for each quantity. The efficient scale is four houses per month, because that minimizes average total cost. Quantity 0 1 2 3 4 5 6 7 VC 0 10 20 40 80 160 320 640 FC 200 200 200 200 200 200 200 200 TC 200 210 220 240 280 360 520 840 AFC --200 100 66.7 50 40 33.3 28.6 AVC --10 10 13.3 20 32 53.3 91.4 ATC --210 110 80 70 72 86.7 120 5. The following table shows quantity (Q), total cost (TC), and average total cost (ATC) for the three firms: Firm A Firm B Firm C Quantity TC ATC TC ATC TC ATC 1 60 60 11 11 21 21 2 70 35 24 12 34 17 3 80 26.7 39 13 49 16.3 4 90 22.5 56 14 66 16.5 5 100 20 75 15 85 17 6 110 18.3 96 16 106 17.7 7 120 17.1 119 17 129 18.4 Firm A has economies of scale because average total cost declines as output increases. Firm B has diseconomies of scale because average total cost rises as output rises. Firm C has economies of scale for output from one to three and diseconomies of scale for levels of output beyond three units.