Best Practice Examples for Implementing EU Directives

advertisement

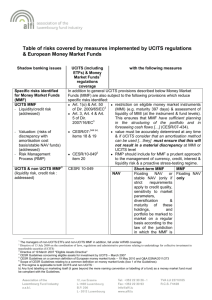

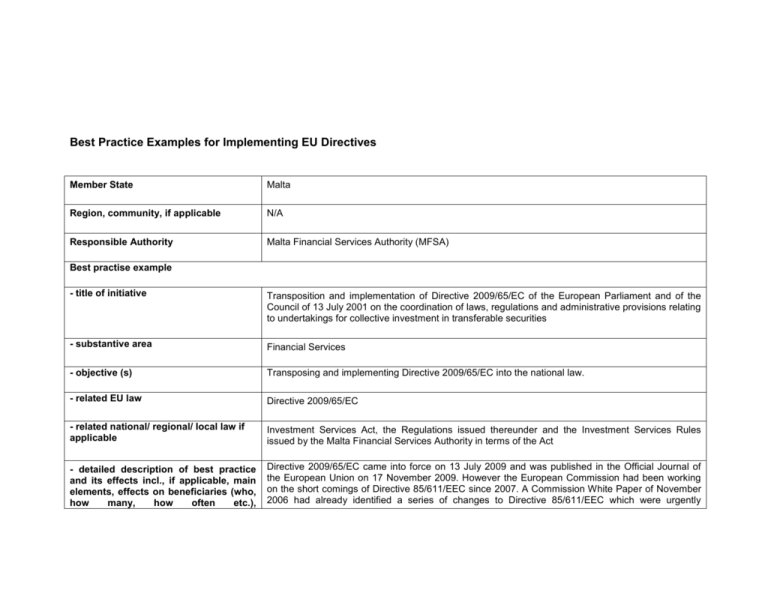

Best Practice Examples for Implementing EU Directives Member State Malta Region, community, if applicable N/A Responsible Authority Malta Financial Services Authority (MFSA) Best practise example - title of initiative Transposition and implementation of Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2001 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities - substantive area Financial Services - objective (s) Transposing and implementing Directive 2009/65/EC into the national law. - related EU law Directive 2009/65/EC - related national/ regional/ local law if applicable Investment Services Act, the Regulations issued thereunder and the Investment Services Rules issued by the Malta Financial Services Authority in terms of the Act - detailed description of best practice and its effects incl., if applicable, main elements, effects on beneficiaries (who, how many, how often etc.), Directive 2009/65/EC came into force on 13 July 2009 and was published in the Official Journal of the European Union on 17 November 2009. However the European Commission had been working on the short comings of Directive 85/611/EEC since 2007. A Commission White Paper of November 2006 had already identified a series of changes to Directive 85/611/EEC which were urgently improvements to former practice, date of implementation, duration of procedure, costs of procedure, egovernment elements, qualifications of cost reductions where possible- and other information you would like to add needed. All the documents related to the consultations issued in relation to Directive 85/611/EEC and feedback statements issued are available on the Commission’s website: http://ec.europa.eu/internal_market/investment/ucits_directive_en.htm. A first public consultation was launched by the European Commission on the possible adjustments to the UCITS Directive on 23 March 2007. This public consultation was closed on 15 June 2007. Following this, on 16 July 2008, the European Commission proposed an improved framework for investment funds. This important revision was being proposed because Directive 85/611/EEC was not functioning properly and yet UCITS funds as at end of 2006 accounted for over “€6.4 trillion of assets in total which is equivalent to half of the Union's GDP and represents 11.5% of European household financial assets.” [Ref. IP/08/1161]. The intention was that the improvements to the Directive would eventually help in “reinforcing the competitiveness of UCITS on global markets. Currently 40 % of UCITS originating in the EU are sold in third countries, mainly Asia, the Gulf region and Latin America. As part of the Commission's Better Regulation Strategy and its firm commitment to simplify the regulatory environment, the new Directive will replace 10 existing directives with a single text.” [Ref. IP/08/1161]. On 13 February 2009, the European Commission sent to the Committee of European Securities Regulators (CESR) (as from 1 January 2011 the European Securities Markets Authority) a 'Provisional request for technical advice on the new UCITS Directive implementing measures'. This provisional request had been divided into three parts namely: Part I related to the smooth operation of the management company passport. The European Commission was bound to adopt the rules relating thereto by 1st July 2010. Part II related to implementing measures which allow the key investor information to become an operational tool. Part III covered areas such as fund mergers, master/feeder structures and the notification procedure. Since the Directive imposed the deadline of 1 July 2010 for the adoption of certain level 2 measures, the European Commission felt that CESR had to start working at them as soon as possible. In this regard, CESR issued a “Call for Evidence” and invited all interested parties to submit their views on what CESR should consider in its advice to the Commission by 31 March 2009. Given the considerable challenge which the transposition and implementation of this Directive posed, the Authority intended from the very early stages of the transposition process to adopt an approach which ensured a smooth transposition and transition to this new regime. Thus in order to facilitate communication with the industry, the Authority created an “ad hoc” section on the website entirely dedicated to UCITS IV. This section contains the European Directives, the consultation documents issued by the Committee of European Securities Regulators (CESR) as well as the consultations documents and circulars issued by the Authority to brief the financial services industry. Throughout this process, the Authority’s main aim was and is that of constantly briefing the industry on developments concerning the Level 2 implementing measures. The industry is being regularly circulated with consultation documents outlining the Authority’s orientation in the transposition of specific provisions of the Directive. All the documents are available for download from the Authority’s website. To date the Authority has circulated the following documents: CESR Documents 02/08/2010 CESR`s Guidelines on Risk Measurement and the Calculation of Global Exposure and Counterparty Risk for UCITS 21/07/2010 CESR`s template for the KII – Consultation Document – [CESR/10 -794] 21/07/2010 CESR`s Guidelines for the transition from the Simplified Prospectus to the KII – Consultation Document – [CESR/10-672] 21/07/2010 CESR`s Guidelines on clear language and layout for the KII – Consultation Document – [CESR/10-532] 21/07/2010 CESR level III Guidelines on the selection and presentation of performance scenarios in the KII –Consultation Document – [CESR/10-530] 08/07/2010 CESR’s guidelines on the methodology for calculation of the ongoing charges figure in the Key Investor Information Document 08/07/2010 CESR’s guidelines on the methodology for the calculation of the synthetic risk and reward indicator in the Key Investor Information Document 20/05/2010 – (CESR 10-049) CESR’s Guidelines on common definition of European money market funds 20/05/2010 Feedback - CESR’s Guidelines on a common definition of European money market funds - (Ref. CESR/09-850). 20/04/2010 CESR’s Guidelines on Risk Measurement and the Calculation of Global Exposure and Counterparty Risk for UCITS – Consultation Paper – (CESR 10-108) 20/04/2010 CESR’s technical advice to the European Commission on the level 2 measures related to the UCITS Management Passport – Feedback Statement – (CESR 09-990). 20/04/2010 CESR’s technical advice to the European Commission on the format and content of Key Information Document disclosures for UCITS – Feedback Statement – (CESR 09995). 20/04/2010 CESR’s technical advice to the European Commission on level 2 measures related to mergers of UCITS, master-feeder structures and cross-border notification of UCITS – Feedback Statement – (CESR 09-1226). 31/01/2010 Mapping of duties and liabilities of UCITS depositaries (CESR 09-175) 05/01/2010 CESR’s technical advice to the European Commission on the level 2 measures relating to mergers of UCITS, master-feeder UCITS structures and cross-border notification of UCITS (CESR/09-1186) 05/01/2010 Annex to CESR’s technical advice on the level 2 measures related to the format and content of KID disclosures for UCITS: methodology for the calculation of the synthetic risk and reward indicator (CESR/09-1026). 05/01/2010 Annex 2 to CESR’s technical advice to the European Commission on the level 2 measures related to the format and content of KID disclosures for UCITS - Methodology for calculation of the ongoing charges figure (CESR/09-1028). 11/11/2009 money market funds CESR Consultation Paper (CESR-09-850) A common definition of European 28/10/2009 CESR’s technical advice to the European Commission on the level 2 measures related to the UCITS management company passport (CESR/09-963) 28/10/2009 CESR’s technical advice to the European Commission on the level 2 measures related to the format and content of Key Information Document disclosures for UCITS (CESR/09-949) 17/09/2009 CESR Consultation Paper (CESR/09-785) - CESR’s technical advice to the European Commission on level 2 measures relating to mergers of UCITS, master-feeder UCITS structures and cross-border notification of UCITS 04/08/2009 CESR Consultation Paper (CESR/09-716) - Addendum to the technical advice at level 2 on Key Information Document 08/07/2009 CESR Consultation Paper (CESR-09-624) Technical advice to the European Commission on the level 2 measures related to the UCITS management company passport 08/07/2009 CESR Consultation Paper (CESR/09-552) - Technical advice at level 2 on Key Information Document MFSA Circulars 27/12/2010 the UCITS Directive Circular to the financial services industry on possible legislative changes to 02/08/2010 UCITS IV Circular on the recent developments on the UCITS IV Directive relating to the publication of the UCITS IV – Level II Implementing Measures and CESR’s Level III Guidelines on risk measurement and the calculation of global exposure and counterparty risk. 21/07/2010 UCITS IV Circular on the recent developments on the UCITS IV Directive relating to the issue by CESR of four consultation documents outlining Level III Guidelines on the practical implementation of the requirements on the key investor information document (‘KII’). 08/07/2010 UCITS IV Circular on the recent developments on the UCITS IV Directive relating to the adoption of the European Commission’s Level II Implementing Measures and CESR’s Level III Guidelines. 20/05/2010 Circular addressed to the Malta Funds Industry on the harmonised definition of European Money Market Funds 20/04/2010 Circular addressed to the Malta Funds Industry regarding UCITS IV 05/01/2010 UCITS IV Circular on the Master-Feeder UCITS Structure 05/12/2009 UCITS IV Circular on the Key Investor Information (‘KII’) 11/11/2009 Circular addressed to the Maltese investment fund industry regarding CESR’s consultation paper on a common definition of European money market funds 22/10/2009 UCITS IV Circular addressed to the financial services industry regarding the recast EU Directive on Undertakings for Collective Investment in Transferable Securities (‘UCITS IV Directive’) Certainly more Circulars are in the pipeline since it is the intention of the Authority to consult with the industry as much as possible to ensure a smooth transition to the new regulations and to obtain the views of the industry on the proposed legislation. The Authority also organises briefing sessions. Thus towards the end of 2009, at the very initial stages of the transposition process, the industry was given an update on the new features of this Directive together with reference to the possible implications of UCITS IV on the local industry. Similarly, recently during November 2010, during another briefing session, the industry was kept abreast of all the developments regarding the transposition process and as to when eventual consultation documents will be launched. The industry was also given an insight as to how the transposition process was affected and what to expect from the aspect of regulations. Similarly, once the transposition process is finalised and the Regulations have been approved, the Authority is planning to hold training and briefing sessions for the industry to brief them on the new developments and on the new legislation. The Chairman of the Authority has also accepted to Chair an international conference on fund servicing being held in Malta on 29 - 30 March 2011. Titled “Malta in a New Funds Landscape”, the event is being organised by the industry to stimulate awareness and discussion on new developments in EU funds legislation, and is supported by the MFSA. The first day will be entirely dedicated to examine and explore the new developments that are unfolding under UCITS IV. The programme will kick off with a keynote presentation by the Deputy Director of the Securities and Markets Supervision Unit of the MFSA about “The Key Factors in Implementing UCITS IV and in comparison with UCITS III”. A number of European fund practitioners will take part in the debate the notification procedure under UCITS IV, the implementation of the Key Investor Information Document, technical issues related to the master-feeder structures, the Management Company Passport and Cross-Border Merger issues. UCITS fund governance issues and the interaction between UCITS IV, the AIFMD and UCITS V going forward will also be examined. (Copy of Programme Attached) The Authority also avails itself of its monthly publication – MFSA News Page on the Times of Malta and of the extended newsletter which is circulated to a very extensive database of contacts. Whenever a relevant consultation is issued a news item is included in the newsletter to draw the attention of the public thereto. Worth noting is that this approach is now a consolidated one. It was first adopted in view of the transposition and implementation of the MiFID Directive which was the central element of the Commission’s Financial Services Action Plan. The MiFID introduced a comprehensive regulatory regime covering investment services, trading platforms and financial markets in Europe. The transposition process entailed a comprehensive revision of the local legislation and therefore the Authority had to devise a strategy through which the industry had to be kept abreast of all the changes which were due to be implemented. Furthermore, this approach was adopted in the transposition and implementation of other EU Directives relating to financial services This process should be finalised before June 2011 and the Authority intends transposing the Directive and its implementing measures in a single rule book for UCITS. This will give Malta a competitive edge as a jurisdiction and will provide possible investors and promoters an overview of the applicable legislative process. Transposition and Implementation Deadline: July 2011 Expected finalisation of transposition process: The Authority is planning to finalise the transposition process by February 2011 and to issue the Regulations for consultation as well as initiate the iter for parliamentary approval. Contact person Isabelle Agius Regulatory Development Unit Malta Financial Services Authority iagius@mfsa.com.mt Website www.mfsa.com.mt