UPDATE 112

advertisement

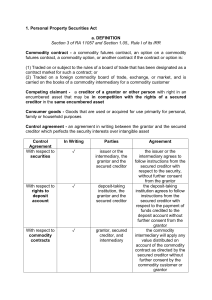

UPDATE 19 JULY 2013 PERSONAL PROPERTY SECURITIES LAW IN AUSTRALIA J O’Donovan Highlights Commentary in chapters 5, 10, 12, 14, 15, 20, 25, 35, 40, 45, 50, 52, 55, 62, 63 and 65 has been extensively reviewed and amended consequent upon recent international case law. Material Code 30175725 Thomson Reuters (Professional) Australia Limited 2013 Looseleaf Support Service You can now access the current list of page numbers at http://www.thomsonreuters.com.au/support/livepages/productsupport-looseleaf.aspx. If you have any questions or comments, or to order missing pages, please contact Customer Care LTA ANZ on 1300 304 195 Fax: 1300 304 196 Email: LTA.Service@thomsonreuters.com COMMENTARY The commentary in the service has been amended consequent upon the commencement of case developments overseas. Chapters which have been reviewed and amended by the author include chapters 5, 10, 12, 14, 15, 20, 25, 35, 40, 45, 50, 52, 55, 62, 63 and 65. Commentary on the following developments are noteworthy. Chapter 5: The PPS Regime [5.1780] Extension of the period for registration New commentary has been inserted regarding the effect of Corp Act, s 588FM. The author notes that, if the secured party does not register its security interest within the prescribed time, it can apply for an extension under Corp Act, s 588FM but in some cases the secured party may find it easier to execute a new security agreement rather than face the risk that the grantor will become insolvent within the next six months. Adopting this course of action affects the secured party’s priority but avoids the impact of the vesting rules. Chapter 10: The scope of the Act [10.1010] Deemed security interests Commentary regarding “pooling arrangements” has been added. Section 13(2)(d) contemplates that a PPS lease does not include certain leases or bailments prescribed by the PPS Regulations 2010, regardless of the length of the term of the lease or bailment. Regulation 1.9 provides that “pooling arrangements” are not PPS leases. A pooling arrangement is one or more lease or hire arrangements in which interchangeable personal property, such a pallets or aircraft engines, is passed between a number of users and then returned to the owner, in circumstances where none of the arrangement has the effect of securing payment or the performance of an obligation. Hence, pooling arrangements are neither security interests under s 12(1) nor deemed security interests under s 12(3). Chapter 12: Transitional provisions [12.1070] The perfection rule New commentary has been inserted regarding: when a transitional security interest can arise; and the rules determining perfection. Personal Property Securities 2 Chapter 14: Drafting issues [14.1710] Clauses for general security agreements It is noted that, six major Australian law firms have drafted PPSA model clauses for a General Security Agreement. It is hoped that these standard clauses will be widely adopted to minimise disputes over documentation. The firms have provided helpful footnotes to explain the background to the model clauses. Chapter 15: The PPS Register [15.4000] Reviewing the register This is a new heading and addresses the review of the PPS Register businesses should undertake periodically to check what registrations have been recorded against their assets. [15.4610] Releases and discharges This is another new heading and addresses the situation where there is a partial release of a security interest. Chapter 20: Enforceability [20.2290] Control of intermediated securities The further test for control introduced in s 26(3A) of the PPSA is also the subject of new commentary. It is explained that, this provision overcomes the difficulties that arose with the original definition of control because the intermediary was technically the ASX Settlement and Transfer Corporation Pty Ltd. If the definition of control had not been expanded, the ASX would have been inundated with notices from financiers asserting control of securities accounts. Section 26(3A) allows for perfection by control to be achieved by entering into tripartite CHESS sponsorship agreements between a secured party, the debtor and its broker intermediary. The agreements provide that CHESS securities may not be dealt with without the secured party’s consent. [20.9010] Discharge of Security Interests Commentary under this heading has been extensively expanded. The author notes that, where the collateral is consumer goods or registered by serial number, the secured party is required to register a financing change statement to discharge any relevant registration within 5 business days of the repayment of all outstanding amounts. There is no similar requirement in relation to security interests in other collateral. Accordingly, the author in turn addresses sales of land and personal property, mergers and acquisitions and the court’s role in these situations. Personal Property Securities 3 Chapter 35: Priorities between security interests [35.1630] Transitional security interests This is a new heading within the chapter. The author addresses the special priority rules that apply to transitional security interests, the cessation of temporary perfection, cases where PPSA 2009 does not govern priorities and the general situation where transitional security interests trump interests perfected by control. Chapter 40: Agricultural interests, accessions and commingling [40.20] Definitions and collateral classes The author explores the meaning of “crops” and “livestock”. Interestingly he notes that, despite the inclusive definition of “livestock” in s 10 of PPSA 2009, it should be possible for a grantor to grant one security interest in livestock and another security interest in their unborn young because they are separate items of personal property. The unborn young would be treated as after-acquired property of the grantor and the security interest would attach when the progeny are born. [40.535] Right to receive rent from land A right to receive rent under a land mortgage that specifically indentifies the land is excluded from PPSA 2009. However, there is a specific priority rule in s 73(6) recognising the priority of such an interest in land over a PPSA security interest in the right to receive the rent. This issue is addressed in this new paragraph. Chapter 50: Procedural matters [50.110] Information to be provided to the secured party The author has included new guidance concerning s 275 of the PPSA 2009 and the right of interested persons to request a secured party to send or make available to specified persons certain information. He notes that, it is advisable for secured parties to ensure that, any commercially sensitive data is not contained in the security agreement because the secured party cannot avoid disclosing this information if the grantor is in default, even if there is a confidentiality obligation under the security agreement. In particular, franchisors and mining companies need to take steps to segregate commercially sensitive data from the security agreement. Index and Tables Both the Table of Cases and Statutes and the Index have been updated and reissued in this update. Personal Property Securities 4

![013—BD Global [DOC 117KB]](http://s3.studylib.net/store/data/005892885_1-a45a410358e3d741161b3db5a319267b-300x300.png)