ECONOMIC RECOVERY IN THE UK

advertisement

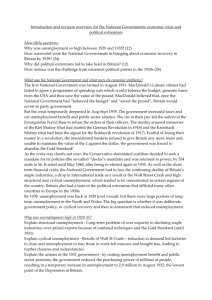

ECONOMIC RECOVERY IN THE UK 1932-37 1. CAUSES OF RECOVERY 2. NATURE OF RECVERY 3. HISTORIOGRAPHY: OPTIMISTS vs. PESSIMISTS OPTIMISTS: ALDCROFT AND RICHARDSON ALDCROFT: ECONOMIC PERFORMANCE INDUSTRIAL PRODUCTION INDUSTRIAL PRODUCTIVITY GDP 1920-29 2.8% 1924-29 1900-13 2.3% 1.00% 3.8% CAUSES OF IMPROVED PERFORMANCE:LEGAC OF WAR (i) TECHNOLOGICAL PROGRESS (ii) NEW PRODUCTS (iii) INDUSTRIAL STRUCTURE ‘VIABLE INDUSTRIAL BASE’ UNEMPLOYMENT IN 1920s = NECESSARY ‘SHAKE-OUT’ OF LABOUR FROM STAPLES H. W. RICHARDSON ECONOMIC RECOVERY AFTER 1932 (1) BEGAN EARLIER THAN ELSEWHERE (2) WAS MORE SUSTAINED (3) WAS MORE RAPID CASUAL FACTORS (1) (2) (3) (4) (5) ‘NEW’ INDUSTRIES (VEHICLES, ELECTRICALS, CHEMICALS) = A DISTINCT ‘DEVELOPMENT BLOCK’ RISING REAL INCOMES + CONSUMPTION AFTER 1929 CHANGING TERMS OF TRADE CHEAP MONEY HOUSEBUILDING BOOM, 1932-35 N.B. EXPANSION OF ‘NEW’ INDUSTRIES SUFICIENT TO CAUSE RECOVERY EVALUATION OF RICHARDSON (1) WERE THE ‘NEW’ INDUSRIES RESPONSIBLE FOR RECOVERY? (2) WAS THERE AN ECONOMIC RECOVERY WORTHY OF THE NAME IN THE 1930s? 1. ‘NEW’ INDUSTRIES AND RECOVERY PESSIMISTS: ALFORD; DOWIE; BUXTON; VON TUNZELMANN (a) ‘NEW’ INDUSTRY DEVELOPMENT BLOCK TOO SMALL 1932: ALL EXCEPT VEHICLES DISINVESTING 1932-4: 7% OF TOTAL EMPLOYMENT 3 ½ % OF INDUSTRY NET INVESTMENT (b) SLOW PACE OF STRUUCTURAL CHANGE 1937: VEHICLES, ELECTRICALS, ARTIFICIAL FIBRES = 9.7% OF MANUFACTURING CAPITAL STOCK COTTON TEXTILES = 8.4% (c) SUPPLY-SIDE DEFICIENCES (i) FAILURE TO ACHIEVE US-STYLE SCALE ECONOMICS (ii) ORGANISATIONAL INERTIA (iii) WEAK LABOUR RELATIONS STRUCTURES WERE NEW INDUSTRIES CAUSE OF RECOVERY? NO RECOVERY INITIATED BY ONSET OF BOOM IN PRIVATE-SECTOR HOUSE BUILDING- INTENSIFIED BY RELAXATION OF MONETARY CONSTRAINTS ON GROWTH (CHEAP MONEY) CYCLICAL RECOVERY AUGMENTED AFTER 1933 BY:(i) RISING NET INVESTMENT IN ‘NEW’ INDUSTRIES (ii) REVIVAL OF STAPLES (N.B. IRON AND STEEL) (iii) CONFIDENCE + NOTE ROLE OF REARMAMENT AFTER 1936 WAS THERE AN ECONOMIC RECOVERY IN THE 1930s? 1932-37 % INCREASE REAL INCOMES GDP IND. PRODUCTION GROSS FIXED INVESTMENT EXPORTS 19% 23% 46% 47% 28% UNEMPLOYMENT IN THIRD QUARTER, 1937:- 9% = 1.4M 1938 = 12% + IN TERMS OF UNEMPLOYMENT UK ACHIEVED A CYCLICAL RECOVERY WITH LIMITED EFFECTS ON STRUCTURL UNEMPLOYMENT CHANGES IN DURATION OF UNEMPLYOMENT, 6/32-2/38 LONDON SE SW MIDLANDS NORTH SCOTLAND WALES % APPLICANTS AVERAGE UNEMPLOYED 12 MONTHS OR MORE JUNE 1932 FEBRUARY 1938 4.4 5.8 3.8 6.6 8.8 8.6 14.6 15.9 19.6 25.0 27.6 29.7 21.1 30.7 UNEMPLOYMENT SPELL (WEEKS) JUNE 1932 16.2 15.3 19.7 25.4 31.0 41.8 33.3 FEBRUARY 1938 15.5 17.0 20.0 30.3 49.3 56.1 61.8 SOURCE: N.F.R. CRAFTS, Ec.H.R. 1987 AGE RANGE WORST AFFECTED: 45-64 WAS UNEMPLOYMENT BNEFIT SYSTEM RESPONSIBLE FOR PERSISTENCE OR UNEMPLOYMENT BENJAMIN & KOCHIN SIGNIFICANT PROPORTION OF 1930s UNEMPLOYMENT WAS ‘VOLUNTARY’ DUE TO EXCESSIVELY HIGH RATIO OF U BENEFIT TO WAGES REDUCED WORK AND JOB-SEARCH INCENTIVES CRITICISMS 1. FAULTY STATISTICAL PROCEDURES 2. GENEROSITY OF BENEFIT SYSTEM EXAGGERATED 3. MISUNDERSTANDING OF JUVENILE LABOUR MARKET 4. NO EVIDENCE OF ‘MALINGERING’ LEGACY OF STRUCTURAL UNEMPLOYMENT RESOLVED BY REARMAMENT AND WWII