Conference Report - Creative New Zealand

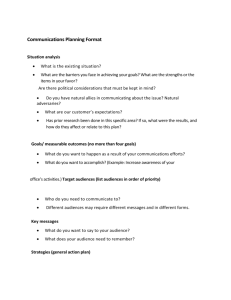

advertisement

INSIGHT REQUIRED Conference Report Written and edited by Christine Young, arts consultant 1 Table of contents Introduction ........................................................................................ 3 Alan Brown: Knowing Me, Knowing You: Emerging Practices in segmentation ................................................. 4 Breakout Sessions ............................................................................... 8 Alan Brown: Building the Customer database of the Future ................. 8 Not My Cup of Tea – why people don’t attend the arts.................................................... 10 Andrew McIntyre: Silent Witness – What visitors really do in exhibitions ............................................ 11 James Austin, Fundraising Institute of New Zealand and Louise Parkin, Saints Information Ltd: How research pays – building a case for support .............................. 14 2 Introduction Creative New Zealand’s Audience and Market Development programme conceived and delivered the second 21st Century Arts Conference which was held at the Michael Fowler Centre, Wellington Convention Centre on 25 and 26 June, 2009. This year’s 21st Century Arts Conference explored what it means for an arts organisation to be insight-guided and brand-driven. Inspirational keynote speakers from the arts and commercial sector combined theory with examples of best practice from New Zealand and beyond, and provided solutions that organisations could implement immediately. Creative New Zealand CEO Stephen Wainwright opened the 21st Century Arts Conference 2009 with a challenge and a quote from Michael King’s Being Pakeha Now: “If we want to remain New Zealanders, to feel like New Zealanders, to act like New Zealanders, to present ourselves to the wider world as New Zealanders – then we must be able to listen to our own voices and trace our own footsteps; we must have our own heroes and heroines to inspire us, our own epics to both uplift and caution us….” This set the scene for two days that examined how arts organisations can – and should – use audience insights, and how each organisation can listen to its own voice to shape its brand and its relationship with its audience. Following on from the 2008 conference, which introduced the seven strategic pillars of audience focus, the 2009 conference focused on two of these seven pillars: how arts organisations can become more insightguided and brand-driven. 3 Insight-guided Audience research is the lifeblood of successful organisations; insight-guided organisations monitor changes in the external environment, respond to them, and have a dialogue with audiences. Audience insights can and should drive the development of programming. This is not to suggest that the organisation’s artistic vision is subjugated to audience whim, but that programming and communications are informed by a deep understanding of your audience and their views. Alan Brown: Knowing Me, Knowing You: Emerging Practices in segmentation Every good arts organisation, says Brown, should have a good mental image of its audience. The arts face a world of increasing diversity and need to recognise social factors impacting on attendances. He highlights: Increasing ethnic diversity, especially in cities Greater choice in entertainment options Increasing divergence in expectations of what is an enjoyable evening out. Fragmentation and diversification of cultural tastes. It is harder to satisfy people with the same experience New frontiers of digital consumption An expectation that all leisure experiences can be customised The critical role of social context. In many cases it is not the programme or the artist but social promise that gets people out of the house. The primary reason that latent demand for the arts is untapped is that the social context is missing. “There are thousands of people in communities who’d love to go to your programme but will never get it together to go out.” The solution lies in reaching the “initiators” – those 15-52% of people who are the natural social organisers and who invite others to do things. Demand for more shorter, more intense and more convenient experiences. People have less time and want more impact. Demand for more interpretive assistance – people want more insight into what they are seeing. Offer a really good briefing (not a lecture) on your work. More value is attached to setting and format. Given this increasing diversity in audiences, each arts organisation must understand what type of audience it attracts. Segmentation (subdivision of a market into discrete customer groups that share similar characteristics), if used at all by arts companies, has been relatively unsophisticated (based, for example, on demographic data) – and/or instinctive (models of who the arts company thought was attending, based on past purchase behaviour). Insights from Segmentation 1. Concurrence Marketing. Arts organisations, says Brown, are good at collecting and analysing behavioural data. But past behaviour doesn’t drive future behaviour. New segmentation models and understanding of audiences can help drive more effective marketing approaches. 4 Coming to Concurrence: Addressable Attitudes and the New Model for Marketing Productivity is a book by consumer trend experts from marketing firm Yankelovich Partners, in which they explain how “concurrence marketing” must replace traditional marketing models. It is based on the premise that attitudes, beliefs, self-perceptions and values drive purchase behaviours. 2. A new Arts Council England segmentation model summarises indepth research that breaks down the English adult population in terms of their engagement with the arts, in the context of how the arts fit into people’s everyday lives. It provides insight into patterns of arts consumption and attitudes towards the arts, how people spend their leisure time and what competes with the arts for people’s attention. It also considers sociodemographic factors, media consumption and lifestyles and contains insights that organisations might find useful in the development of an arts activity itself. 3. Classical Music Segmentation Study. In 2001, Brown undertook a segmentation study that covered 15 orchestras in the Philadelphia area. The research segmented the public on two criteria: their relationship with the art form, and their relationship to any of the orchestras (past attendance). The researchers then collated data from the two studies to expose latent demand. The first series of questions, to develop a prospect model, were put to anyone who answered positively to the question “If you were offered free tickets and someone took you, would you go?” Approximately 60% of all people questioned said yes, indicating huge audience potential, says Brown. It asked questions around number and type of concerts attended, consumption of classical music via radio/recordings, knowledge of the art form, and resulted in 10 distinct prospect segments, from the “educated classical audience” to “family occasion” attenders, “aspiring classical enthusiasts”, “classical lite” and the plain “disinclined”. The second part of the study looked at the relationship people had with their local orchestra, and identified segments that ranged from subscribers, through to high frequency single ticket buyers, lapsed subscribers, and infrequent but interested attenders. The final stage of the study cross referenced the two models. This revealed a relatively low number (1.7%) of sophisticated, active audience members. A larger number were infrequent, social-occasion attenders. And a large number of people who were interested had not attended concerts at all. This begs the question, says Brown – why aren’t they coming? 4. Arts audience values and motivations In 2007 Brown researched the values and motivations of arts audience members. An in-depth interview examined participants’ core values, preference levels for 27 types of performances, appetite for educational content, price sensitivity, social context of attendance, political and religious beliefs, innate intelligences. Somewhat surprisingly, the research revealed a correlation between religious beliefs and the type of cultural programmes attended, and (less surprisingly) that a person’s preferred art type matched their identified innate intelligence. More importantly, for arts managers and artistic directors, was that purchase behaviour painted an incomplete picture 5 of arts preference. Many people (from two to four times as many people as had purchased a ticket) were interested but had had not purchased. “We need to move beyond purchase data,” says Brown, “and consider preference.” 5. Institution-specific orchestral audience If you undertake a segmentation study – be prepared for the results. When Brown undertook a study for the Philadelphia Orchestra, they already had a clear internally-developed view of audience preferences – but demographics and purchase behaviours were used as descriptors. The segmentation study revealed a quite different perspective. A foursegment customer model divided audiences into casual followers, warhorses, adventurous intellectuals and old-school connoisseurs. More importantly, it revealed additional insights such as which segments were hungriest for educational formats, or short introductions, and which were most open to high doses of contemporary music. As a result, the Philadelphia Orchestra re-shaped its subscription series – not in terms of content, but in how the information was organised and communicated to the audience. The new subscription season had “collections” targeted at each segment, with audience-friendly communications that reflected segment preferences expressed through the research. 6. Theatre audience – Chicago Motivated by a desire to more deeply engage with its audience and better engage single-ticket buyers, Steppenwolf Theatre undertook a study that probed respondents’ knowledge and background in theatre, their attitudes towards risk, and how people engage with the art form before and after shows. Results showed that, contrary to expectations, many single-ticket buyers were extremely knowledgeable about the theatre – but were also very fussy about what they would attend. Results also showed a high degree of overlap between the five identified audience segments, highlighting the dangers and difficulties inherent in audience engagement research and conclusions. “Audience engagement is on the tip of everyone’s tongue,” says Brown. “But it’s an assessment challenge. We don’t know if we’ve engaged someone.” Brown’s research also found that most theatre-goers read the programme and reviews, but a huge number only engage by talking about the play on the way home. While most audience engagement efforts are focused prior to the performance, Brown suggests arts companies need to think about how to engage people after attendance – possibly even handing out discussion questions as people leave the theatre. Conclusions: Segmentation is not to subjugate the artistic vision, but to inform it. Arts companies need a mental model of their audiences and the attributes that distinguish one segment from another. You need to refine that over time so you can talk about them internally, and when selecting programmes, understand which segments you’re appealing to. 6 A focus on segments can allow more effective and relevant communication. While there is a lot of talk about micro-targeting and nano-casting (sending the right message to the right person at the right time) we are a long way from being able to do that. You need to know which segment each person on your database belongs to. Work is currently under way to design a database tool to warehouse audience segmentation information and match that with transactional data (see www.trgarts.com), to provide an ongoing and constantly updated picture of your audience. 7 Breakout Sessions Alan Brown: Building the Customer database of the Future In this interactive workshop session, Brown and conference participants teased out some additional key lessons for arts companies: 1. The first and essential step in undertaking a segmentation study is preparation. If you’re not prepared as an organsiation, it will be just another study in the graveyard of market research. Not every arts organisation is ready for segmentation; it has to be something everyone, especially artistic staff, wants. From segmentation, it’s a simple step to developing products to appeal to different audiences. Engage the artistic leadership, and bridge the gap between audience information and artists. If artists understand the audience, there is less resistance to change. In an artistically-led organisation, the data is not about telling you what to programme; it provides a tool to talk about audience preferences. 2. Arts organisations don’t have a way of assessing how people’s lives are changed by a live performance or attending an exhibition. We are good at putting on performances and selling tickets. To gain real audience insights we need to start asking people about very abstract things (“felt” outcomes, intellectual stimulation…) 3. Think carefully about what information you need about your customers to market to them or programme for them more effectively. And how you can use that information. 4. More than half the people at performances didn’t decide to go – they got asked. Essentially you are marketing to resellers, especially people who bring groups. Brown says he doesn’t know a single arts organisation that does a good job of rewarding initiators. 5. Most people go out to validate their tastes, not get dragged into a new era. Should you expect audiences to attend culturally unfamiliar works or genres? 6. The challenge in developing marketing materials is to provide messages in progressive layers of abstraction, so your communications mean something to someone who knows nothing about the piece, the performers, the theatre or the author (composer/choreographer). 7. Audience are keen to be better informed. But too often we offer lectures, not insights. There can be a lot of value in inviting people to come early for a short briefing. 8. Other useful data to collect on audiences: Do you have children at home and what are their ages? 8 Other interests (e.g. the bridge club). This helps harness the power of social networking which is truly the frontier of arts marketing. The key element in a relationship is knowing something about someone and using that to initiate a conversation. The single most useful thing to advance your organisation is to listen to why the audience comes and what they like about your work. Put yourselves on a programme to methodically start interviewing your audience. If you are not ready for a full survey, start with pre- or postperformance interviews and ask audience members just three questions. Use that information in future when you talk to them. Ask new board members to interview five audience members to gain audience insights. But beware: audiences hate being segmented because they see that as being stereotyped use segmentation data carefully as people move from one segment to another over time the power is not in the segmentation per se but in understanding that there are fundamentally different kinds of audience members. 9 Not My Cup of Tea – why people don’t attend the arts. One of biggest challenges facing arts organisations is to attract new audiences. Although 9/10 New Zealanders are engaged with the arts, we know that more than 70% say they are interested but still don’t go very much. Many people find the arts remote and impenetrable, perplexing and foreign. So how do we initiate the uninitiated? How do we break this habit of nonattending? Creative New Zealand decided to see what we could find out from New Zealanders who were asked to Test Drive an arts event. We asked four New Zealanders, representing a cross section of the population, to go on a ‘shop the arts’ outing and be interviewed about their experience after. They were asked to try a performing arts event and a visual arts event in Auckland from 12 to the 19 June 2009. The results demonstrate some common attitudes and perceptions Why people don’t come Non attendance is a habit: Perception that it’s too expensive and eventually lost interest Don’t take too much notice of what’s in the paper Don’t go out of their way to find out about what’s on. The arts are perceived as a risk: Can’t find reviews/ Not sure what it will be like/ Could be really boring It’s hard to find time to go New Zealand performances not worth going to The movies are easy – you know the costs and where to go Don’t know where to go or how to find the venue Don’t know how to buy tickets The ad didn’t say when it finished Surprised at having to pay a booking fee After a “test-drive”: Motivated to attend more “There were more activities for the family than I had been aware of” It was more enjoyable than anticipated Overcame the psychological barrier about not going. “I’ll give myself permission to attend.” A DVD of the Not My Cup of Tea video is available on request for $10 plus GST. Please contact Helen Bartle, Senior Adviser Audience Development, at helen.bartle@creativenz.govt.nz to order a copy. 10 Andrew McIntyre: Silent Witness – What visitors really do in exhibitions Observing the audience Much can be learned by watching what visitors do in an exhibition. Use staff to make notes of people’s behaviour, where they stop and for how long, and what they do. (This has to be done so as not to prevent people from behaving normally.) If staff can’t be involved, use CCTV monitors to track movement, the directions the audience go; collate the material later using an exhibition diagram. People attending exhibitions display four observable audience Behavioural Modes: 1. Researcher: has prior specific interests, obsessive attention 2. Searcher: Devours everything 3. Chooser: Self directed, makes own informed decisions 4. Follower: Engages with the proposition 5. Browser: Pauses when something catches their eye. Have not accepted the proposition suggested by the curator (for variety of reasons). McIntyre also identifies four Engagement Models: 1. Immersion – extensive period of time spent in in-depth consideration (Searcher) 2. Discovery – Connection made (Chooser) 3. Exploration – has a quick look around but no connection (Follower) 4. Orientation – acknowledge, briefly consider, move on. (Browser) From a curatorial point of view, the two desirable modes for engagement are Immersion and Discovery. Browsers can be converted to Followers with correct prompting and direction. Followers can be turned into Choosers on a return visit. Prompting and direction Audiences do not always follow the narrative suggested by curator. They may start midway through an exhibit, alighting on things that catch their eye, and may not read material outlines. Viewers will often start reading text thoroughly but lose interest part way. Knowing the behaviour of foot traffic allows for better placement of material in order to encourage viewers to engage in narrative. Text can be interspersed throughout the exhibition, allowing viewers to dip in and out of narrative no matter where they have started. (Breakout report by Jennifer Buckley, Director, Auckland Art Fair) 11 Andrew McIntyre: What’s Normal? – Why there’s no such thing as a lapsed attender Research indicates that around 75% of people are interested in going to the theatre. Yet box office data from around the world shows that the most common frequency of attendance in the past 12 months is 0; that is, most people attend less than once a year. Not attending at all, if you measure it on an annual basis, is the norm. More people (collectively, over time) have been through the doors than we think – but not that many people attended in the last year. People who have attended twice or more in the last 12 months will be a small proportion of your audience. Most people who came this year probably last attended much more than a year ago. We fall into the trap of relinquishing our relationship with audience members long before they are ready to break up with us. People who have once attended but no longer do so are often more engaged than we think. In any survey of non-attenders or so-called “lapsed” attenders, people will tell you they have been when they haven’t; or they were there more recently than they actually were. They still see themselves as “belonging” to the audience. But if people haven’t attended for three years, we whip them off the database. Arts companies perceive them to be lapsed long before the audience sees themselves as disengaged. Key issues: Annualisation. We think in terms of calendar or financial years. But 12 months is a poor cycle for looking at audiences. Most people come once and then miss a year, or two, or three – and still perceive themselves as part of our audience. It’s just that they are sharing their favours between a vast repertoire of places they can go. The behavioural trap. Beware of using past behaviour as a marker as to who you should communicate with. For example, those most likely to attend a performance of Shakespeare may be those who haven’t attended Shakespeare recently, NOT those who attended last year. If we are using behavioural data as indicators of attendance, we should also look at the audience member’s cycle of attendance. And then mail or email with the frequency of communication based on that. The danger of brochures. People read our booklets – and find reasons or excuses not to go. Our communications are often dysfunctional from the audience’s perspective. Only 15-20% of people buy from the brochure. A focus on short-term sales. Consider the whole database. We need to cultivate and keep the audience we have, not foist tickets and messages on those who attend most frequently. Shared favours. You core audience is most likely to be someone else’s core audience as well; they are likely to be active cultural consumers who attend a number of different genres and performances in any given year. Accept that lots of people like you and will come every three-four years. Embrace that. Fortunately there are a vast number of latent attenders: 12 The core versus the periphery. In general, the arts obey Pareto’s law with regard to ticket sales – approximately 20% of people buy 80% of tickets. A sales-driven mentality says just target the 20%. An audience development approach says “Who are the 80% and what do we need to do to get them along?”. To reach the latent attenders we need to reach into the periphery. Communications challenges and solutions: Analyse the data you have and what people have seen; tailor your communications to them based on what you know about them If nothing else, segment your database on frequency. Give people a choice of frequency and type of communication to be received Don’t give up on “lapsed” attenders e.g. a service to call people who hadn’t attended for more than two years in advance of the next season showed a return of $5 for every $1 spent on the initiative. Electronic communication should allow us to be data-driven and communicate relevantly – yet most arts organisations send the same newsletter to everyone on their e-list. Recognise when they attend after a long period and communicate with them immediately after attendance. 13 James Austin, Fundraising Institute of New Zealand and Louise Parkin, Saints Information Ltd: How research pays – building a case for support Arts organisations need to move towards greater independence, as sponsorship becomes increasingly challenging, there is less central and local government support to go around and audiences feel the economic pressure. Austin and Parkin urged participants to: Be positive Despite the current economic crisis, there are still fantastic opportunities and diverse funding streams to further your financial independence. Be prepared Fundraising requires discipline, proactivity and planning. It requires a strategic approach, but you also need to be well organised and take care of the details. A fundraising plan: helps you to focus and prioritise what is most important for your organisation helps you to establish and track progress toward your goals. As part of your plan, identify and mitigate potential risks (e.g. spread risk across a range of projects or productions) Build and nurture relationships Fundraising is all about relationship building – relationships are paramount because your best fundraising prospects are likely to be the donors you already have. Individual donors are your best prospects and they may well introduce you to other donors. 90% of your money will come from 10% of your supporters. Communicate clearly what you’re trying to achieve. Make sure everyone in your organisation understands your vision, your brand and what your fundraising needs are because everyone is a potential fundraiser. Make the most of your contacts and connections. If board members or your CEO aren’t helping, ask them to set up a meeting with some of their contacts. If they’re not interested, set up a dedicated fundraising board or committee. (Leadership is critical in fundraising.) Know your prospective audience. Marketing and fundraising go hand in hand –– identify the appropriate person or organisation and research, research, research. Find out what donors want and expect and work with them on it. Choose the right person to talk to a potential donor – people who are passionate about what you do can be the best people to make the approach (e.g. the curator, an actor, director etc). Whenever possible meet people face-to-face – it always works best. Don’t forget to follow up and build on your relationships – e.g. showing your thanks. Treat your donors as valued stakeholders – invite them to special events and make them feel involved. Links: 14 Funding Institute of New Zealand Saints Information Cultural Funding Guide on NZLive.com Donations Toolkit on CNZ.govt.nz Fundraiseonline.co.nz Givealittle.co.nz Donate.co.nz (Breakout report by Jackie Hay, Manager, NZLive.com) 15