Law on the state budget

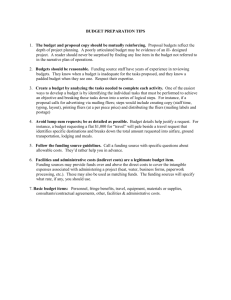

advertisement