Intro: Organizational Economics & Strategic Alliances

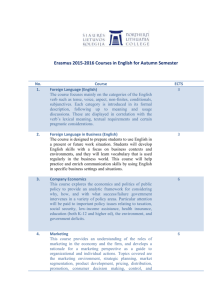

advertisement

Ao. Univ.-Prof. Dr. Josef Windsperger E-mail: josef.windsperger@univie.ac.at Homepage: www.univie.ac.at/IM Office hours: Wednesday 11.00 – 12.30 PhD-DK: Theory of Networks The course provides a general discussion of the theoretical foundation of networks (strategic alliances, joint ventures, franchising, licensing, consortia, clusters, virtual networks). It emphasizes the relationships between different theories and networks. The sessions provide a overview of a number of the major theoretical and methodological approaches adopted in network research as it evolved into a specific research field. The course incorporates sessions on essential aspects of network research including transaction cost economics, property rights theory, information economics, resource-based theory, real options reasoning and the relational view of networks. In particular, the course highlights current research challenges and methodological issues facing the research in economics and management of networks and encourages a discussion among the participants to determine what constitutes an appropriate future research strategy, especially applied to your PhD-project. Objectives The course aims to: 1. Confront students with the theoretical approaches applied to networks; 2. Share insights on contributions made to the field and discuss relevance to students’ own PhD research project. Sessions: SER 3, BWZ, University of Vienna, Brünner Str. 72, A-1210 Vienna Monday: 15.00 – 18.00 10. 11., (Intoductory Session), 24. 11. (Topic 1 and 2), 1. 12. (Topic 3 and 4), 15. 12. (Topic 5 and 6), 12. 1. (Topic 7), 19. 1. 2009 (Topics 8) REQUIREMENTS The goal of this course is to familiarize students with a broad range of theoretical approaches that explain networks. The requirements are twofold: (a) Class preparation and participation: I) You have to prepare the discussion question for the Introductory Session (3 pages). Page 1 II) You will be required to write a. Four summaries of the assigned texts (see Guidelines below). These summaries are due at the start of each seminar session and have to be submitted to josef.windsperger@univie.ac.at. b. You have to present one summary of a discussion paper in January (20 minutes presentation). Please send me your presentation one day before your presentation. OR Instead of four summaries and the presentation of the discussion paper, you can submit your own research paper on strategy and governance of networks. Choose a research topic for a paper that can be submitted to a peer-reviewed journal; the paper must be presented in January and submitted by February 15. (b) Research paper: Each group has to complete a research paper (see Guidelines below). The paper should present the most important research results based on the relevant literature (see www.elearning.univie.ac.at). First, you should use the papers listed below. Second, you should include further important papers if they go beyond the indicated literature. The final grade will be based on the summaries including presentation) (40 %) and the final paper (including presentation) (60 %). The research paper must be submitted on Friday before the presentation to Josef.windsperger@univie.ac.at. (c) Presentations in the class: I) Research Paper (Topic 1 – 6): The presentation time for the research paper is not more than 40 minutes. II) Presentation of assigned discussion paper (Presentation time: 20 minutes) in January 2009. The Power Point presentations have to be submitted - at the latest - at the day of presentations to josef.windsperger@univie.ac.at. GUIDELINES (a) Discussion papers: Summaries of articles (3 – 4 pages) Here are some rules for the structure of summaries: 1. Summarize the reading’s argument: Recapitulate the key steps in the author’s argument. Page 2 2. Do an ‘internal’ critique: Accepting the author’s starting assumption, identify the strengths and weaknesses of this study. 3. Do an ‘external’ critique: Examine critically the author’s assumptions, and identify how they might question the author’s argument. Criticize and compare the author’s approach with others. 4. Finally, you should think about how this research helps us in trying to explain the real world. (b) Research Papers (20 – 25 pages) Here are some rules for the structure of the paper: The heart of your paper should be (1) to summarize and criticize the relevant literature and method and (2) to discuss ways how to improve the existing research results. Outline a research strategy: Describe how you think you could improve the theoretical arguments and/or the methods. What kind of empirical methodology could be use? In preparing the paper, you should read somewhat beyond the list of the required articles indicated in the course outline. Relevant Literature All papers can be downloaded from the elearning platform Blackboard Vista (http://elearning.univie.ac.at). Introductory Session - Lecture In this introductory session, the different theoretical perspectives as well as concepts will be introduced. Attention will also be paid to fundamental questions related to the existence and the motives of forming alliances for firms. References: Combs JG, Ketchen DJ jr. 1999. Explaining interfirm cooperation and performance: toward a reconciliation of predictions from the resource-based view and organizational economics. Strategic Management Journal 20: 867-888. De Rond M, Bouchikhi H. 2004. On the dialectics of strategic alliances. Organization Science 15: 56-69. Ireland RD, Hitt MA, Vaidyanath D. 2002. Alliance management as a source of competitive advantage. Page 3 Journal of Management 28: 413-446. Kogut B. 1988. Joint ventures: theoretical and empirical perspectives. Strategic Management Journal 9: 319332. Park SO, Ungson GR. 2001. Interfirm rivalry and managerial complexity: a conceptual framework of alliance failure. Organization Science 12: 37-53. Shenkar O, Reuer JJ. 2005. The alliance puzzle: known terrain, black boxes, and the road ahead. In Handbook of Strategic Alliances, Shenkar O, Reuer JJ (eds.). Sage Publications: Newburry Park, CA. Discussion: On basis of these introductory articles, please identify the different theoretical perspectives applied to networks and argue why firms increasingly turn to networks. Topic 1: Transaction Cost Economics & Networks References: Williamson OE. 1991. Comparative economic organization: the analysis of discrete structural alternatives. Administrative Science Quarterly 36: 269-296. Hennart JF. 1988. A transaction cost theory of equity joint ventures. Strategic Management Journal 9: 361374. Hennart J-F, Reddy S. 1997. The choice between mergers/acquisitions and joint ventures: The case of Japanese investors in the United States. Strategic Management Journal 18: 1-12. Oxley JE. 1997. Appropriability hazards and governance in strategic alliances: a transaction cost approach. Journal of Law, Economics, and Organization 13: 387-409. Leiblein MJ, Reuer JJ, Dalsace F. 2002. Do make or buy decisions matter? The influence of organizational governance on technological performance. Strategic Management Journal 23: 817-833. David, R. J., S.-K. Han (2004), A Systematical Assessment of the Empirical Support for the Transaction Cost Economics, Strategic Management Journal, 25, 39 – 58. Discussion: On the basis of these articles, please identify key findings or insights and also identify research questions deserving attention. Topic 2: Resource-based and Organizational Capability Theory & Networks References: Grant RM. 1991. The resource-based theory of competitive advantage: implications for strategy formulation. California Management Review 33: 114-135 Page 4 Eisenhardt KM. and Martin JA. 2000. Dynamic capabilities: What are they? Strategic Management Journal 21: 1105-1121 Griffith DA. and Harvey MG. 2001. A resource perspective of global dynamic capabilities. Journal of International Business Studies 32 (3): 597-606. Teece DJ., Pisano G. and Shuen A. 1997. Dynamic capabilities and strategic management. Strategic Management Journal 18: 509-533 Foss, N. J. (2005), Scientific Progress in Strategic Management: The Case of Resource-Based View, Journal of Learning and Intellectual Capital (in print). Newbert, S. L. (2006), Empirical Research on the Resource-based view of the firm, Strategic Management Journal, 28, 121 – 146. Gulati, R. (1999), Network Location and Learning:The Influence of Network Resources and Learning on Alliance Formation, Strategic Management Journal, 20, 397 – 420. Lorenzi, G., A. Lipparini (1999), The Leveraging of Interfirm Relationships as distinctive organizational capability, Strategic Management Journal, 20, 317 – 338. Jacobides, G. (2005), Architecture and Design of Organizational Capabilities, Working paper, London Business School. On the basis of the readings, please compare and contrast resource-based with the transaction cost theories used in strategy and international business. Topic 3: Information Economics & Networks In this session, we will cover theory from information economics (signalling and screening theory) and discuss opportunities to apply this research to the network literature. References: Akerlof GA. 1970. The market for 'lemons': quality uncertainty and the market mechanism. Quarterly Journal of Economics 84: 488-500. Reuer JJ, Koza MP. 2000a. Asymmetric information and joint venture performance: theory and evidence for domestic and international joint ventures. Strategic Management Journal 21: 81-88. Royer JJ, Koza MP 2000b. On lemons and indigestibility: Resource assembly through joint ventures, Strategic Management Journal, 21, 1995 – 1997. Reuer JJ. 2005. Avoiding lemons in M&A deals. Sloan Management Review 46: 15-17. Spence M. 1973. Job market signaling. Quarterly Journal of Economics 87: 355-374. Stiglitz JE. 2000. The contributions of the economics of information to twentieth century economics. Quarterly Journal of Economics 115: 1441-1478. Reuer JJ, Ragozzino R. 2006. Initial public offerings and organizational governance: evidence from joint ventures and acquisitions. Working paper. Discussion: On the basis of the readings, please compare and contrast information economics with the transaction cost theories used in strategy and international business. Page 5 Topic 4: Property Rights Theory & Networks References: Hart, O., J. Moore (1990), Property Rights and the Nature of the Firm, Journal of Political Economy, 98, 1119 – 1158. Brynjolfsson, E. (1994), Information Assets, Technology, and Organization, Management Science, 40, 164 -1662. Baker, G. P., R. N. Hubbard (2001), Empirical Strategies in Contract Economics: Information and the Boundaries of the Firm, American Economic Review, 91, 189 – 194. Windsperger, J., R. P. Dant (2006), Contractibility and Ownership Redirection in Franchising: A Property Rights View, Journal of Retailing 82, 259 – 272. Kim, J., J. T. Mahoney (2005), How property rights economics furthers resource-based view: Resources, transaction costs and entrepreneurial discovery, Working paper. Elfenbein, D.W., J. Lerner (2003), Ownership and Control Rights in Internet Portal Alliances 1995 – 1999, RAND Journal of Economics, 34, 356 – 369. Discussion: On the basis of these readings, please compare and contrast the property rights theory with the resource-based and organizational capabilities theories to explain networks. Topic 5: Real Options & Networks References: Bowman EH, Hurry D. 1993. Strategy through the options lens: an integrated view of resource investments and the incremental-choice process. Academy of Management Review 18: 760-782. Chi T. 2000. Option to acquire or divest a joint venture. Strategic Management Journal 21: 665687. Folta TB. 1998. Governance and uncertainty: The tradeoff between administrative control and commitment. Strategic Management Journal 19: 1007-1028. Kogut B. 1991. Joint ventures and the option to expand and acquire. Management Science 37: 1933. Reuer JJ, Leiblein MJ. 2000. Downside risk implications of multinationality and international joint ventures. Academy of Management Journal 43: 203-214. Kogut B. and Kulatilaka N. 2001. Capabilities as Real Options. Organization Science 12 (6): 744-758 Discussion: On the basis of these readings, please compare and contrast the real options view with other theories of networks. What are the key challenges and opportunities associated with using real options to study networks? Topic 6: Relational View & Networks Page 6 Many firms have difficulties managing strategic alliances successfully. Partly this is due to issues such as trust and commitment, which allow the alliance to successfully evolve. References: Gulati, R. 1995. Does Familarity Breed Trust? The Implication of Repeated Ties for Contractual Choice in Alliances, Academy of Management Journal, 38, 85 – 112. Dyer JH, Singh H. 1998. The relational view: cooperative strategy and sources of interorganizational competitive advantage. Academy of Management Review 23: 660-679. Molina J. 1999. On the relational view. The Academy of Management Review 24 (2): 184-185. Dyer J. 1999. Response to Relational View Commentary. The Academy of Management Review 24 (2): 185-186. Gulati R., Nohria N. and Zaheer A. 2000. Strategic Networks. Strategic Management Journal 21: 203-215. Anderson, E., S. D. Jap (2006), The dark side of close relationships, Sloan Management Review, Spring, 75 – 82. Dyer, J., W. Chu (2000), The Determinants of Trust in the Supplier-Automaker Relationships in US, Japan and Korea, Journal of International Business Studies, 31, 259 – 285. Gulati, R., J. Nickerson (2006), Interorganizational Trust, Governance Choice and Exchange Performance, Organization Science (accepted). Discussion: Based on your interpretation of the different readings, please discuss the most important contributions of the relational view and discuss how these issues contributes to other theoretical approaches. Topic 7 and 8: New Developments in the Theory of Networks– (A) Discussion Paper Sessions and (B) Presentation of Own Research Paper Ad (A): Topic 7: Organizational Boundaries and Networks Reuer JJ, Arino A. 2006. Contractual complexity in strategic alliances. Working paper. Elfenbein, D.W., J. Lerner (2003), Ownership and Control Rights in Internet Portal Alliances 1995 – 1999, RAND Journal of Economics, 34, 356 – 369. Gulati, R., P. R. Lawrence, P. Puranam (2006), Adaptation in Vertical Relationships: Beyond Incentive Conflict, Strategic Management Journal, 26, 415 – 440. Jacobides, M. G., S. Billinger (2006), Designing the Boundaries of the Firm: From “Make, Buy or Ally” to the Dynamic Benefits of Vertical Architecture, Organization Science, 17, 249 – 261. Santos, F. M., K. M. Eisenhardt (2005), Organizational Boundaries and Theories of Organization, Organization Science, 16, 491 – 508. Topic 8: New Research Developments on Networks Gulati, R. P. Puranam (2007), Complementarity & Constraints: Why both firms make and buy the same thing? Working Paper, Northwestern University, Kellogg School of Management. Page 7 Parmigiani A. (2007), Why do Firms both Make and Buy? An Investigation of Concurrent Sourcing, Strategic Management Journal, 28, 285 – 311. Nickerson, J., D. He (2006), Why do firms make and buy: Efficiency, Appropriability, and Competition in the Trucking Industry, Strategic Organization, 4, 43 – 77 Lazzarini, S. G., G. J. Miller, T. R. Zenger (2006), Dealing with the Paradox of Embeddedness: The Role of Contract and Trust in Facilitating Movement out of Committed Relationship, Working Paper, Olin School of Business. Tong T, Reuer JJ, Peng M. 2006. International joint ventures and the value of growth options. Academy of Management Journal forthcoming. Ad (B) Presentation of the own reseach paper that applies concepts based on theories of networks. Page 8