Expenses Manual-Revised Version

advertisement

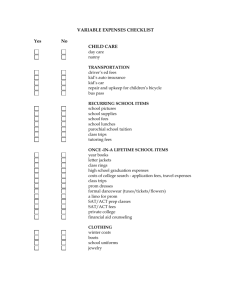

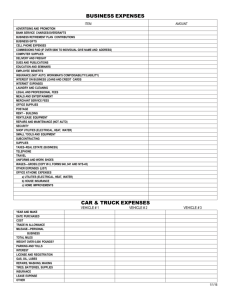

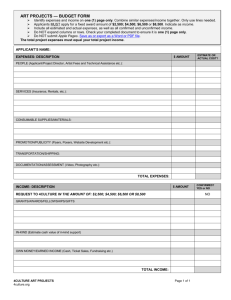

Expenses Policy 1 Contents 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Introduction ........................................................................................................................................... 3 Policy & General Claims Procedures ............................................................................................. 4 Advances against Expenses and Credit Cards ........................................................................... 6 Hospitality / Entertainment including Staff Meetings ........................................................... 7 Travel and Accommodation ............................................................................................................. 8 Subsistence (e.g. Meals/Snacks) ..................................................................................................... 9 Courses & Conferences .....................................................................................................................10 Home / Personal Mobile Telephone Expenses .......................................................................10 Mobile Phones Provided by the University ..............................................................................11 Professional Subscriptions.............................................................................................................11 Relocation and Removal Expenses ..............................................................................................11 2 1. Introduction 1.1 University Responsibilities The University is publicly accountable for all of its expenditure including reimbursement of business related expenses incurred directly by staff members and is required to comply with Glasgow Caledonian University's Financial Policies and Regulations. In processing expenses claims, the University is required by HM Revenue & Customs to demonstrate that adequate controls are in place to ensure: taxable expenses are identified where appropriate, PAYE tax and National Insurance contributions are deducted before expenses are reimbursed It is essential that the University minimises the risk of exposure to monetary penalties arising from investigations by HMRC and Department of Work and Pensions. Failure to fulfil statutory obligations to collect Tax and National Insurance contributions would result in the University (rather than individuals) becoming liable to pay back taxes together with interest and penalties. 1.2 To Whom the Manual Applies This Expenses Manual applies to all the activities of the University and its Subsidiary Companies and is for the guidance of Members of University Court, all University employees and others engaged in University business. In the interests of value for money and the appropriate use of public funds, claimants are expected to be prudent in their spending and delegated authorisers as per the Scheme of Delegation are expected to be diligent in their review and approval of expenses. 1.3 Responsibility of the Claimant This manual provides claimants with the necessary guidance to enable them to make expense claims. Following the guidance will avoid delays in re-imbursement and minimise any possibility of further enquiries by the Finance Office, Auditors or HMRC. Submitting, or attempting to submit, a fraudulent claim will be treated as gross misconduct under the terms of the University’s Conduct and Capability Policy. 1.4 Responsibility of the Authoriser Delegated authorisers as per the Scheme of Delegation must ensure that claims are fully supported by documentation. The reason for incurring the expenses must also be fully justified in iExpenses or Expenses Claim Form. 1.5 Responsibility of the Finance Office The Finance Office is responsible for ensuring re-imbursement of expenses and for monitoring compliance with expense procedures. In the event that a member of staff has any questions arising from this document, or has any queries relating to the reimbursement of expenses, they should in the first instance contact the Accounts 3 Payable section within the Finance Office. Court Members should contact the University Secretary. The University will provide employees with a statement of expenses reimbursed for their annual income tax return, where necessary. 2. Policy & General Claims Procedures 2.1 General Expenses Claim Policy An expenses claim should be used to reimburse incidental expenses only. Items such as books, periodicals software and computer equipment should be purchased through departmental purchasing procedures. Accommodation and Travel must be internally approved and then booked through our appointed travel agent, Key Travel. Reimbursements will always be made in £ sterling even when expenses were incurred in a foreign currency. Where expenses are incurred in foreign currencies, the rate of exchange can be found using http://markets.ft.com/research/Markets/Currencies 2.2 Claim Procedure Expenses claims for university staff must be made using iExpenses. Non-staff expense claims should continue to be made using the latest version of the Expenses Claim Form. All expense reimbursements will be made by the Finance Office. Reimbursement will be made providing receipts support the claim unless otherwise directed by iExpenses. For non-staff claims, the Expenses Claim Form must be signed by the individual claiming the expenses and countersigned in accordance with the standard delegated authority limits contained within the Delegated Authority Policy. Claims should be submitted as soon as possible and those over 3 months old will not be paid unless a reasonable explanation can be provided for the delay. An incomplete or incorrect claim will be returned with an explanation as to why it cannot be processed. The claim should be amended as required and then resubmitted to Accounts Payable for processing. In circumstances where VAT has been incurred the expenses claim should clearly identify this in the justification field. All expense claims and supporting receipts are subject of regular review by the Auditors. 2.3 Completing an Expenses Claim Form (Non Staff) An expenses claim form should be completed, either electronically or otherwise in block capitals, as follows: Complete the Claimant Information section. Complete the Expense Details section – claims cannot be reimbursed without ‘reason for expense’. If the expenses were incurred for entertaining purposes, complete the Hospitality Details section. Use Mileage Details section to record details of private car mileage claimed. Complete Receipted Expenditure section. Receipts to accompany the form should be numbered and it is this number that must be entered in the Receipt Number column of this section. If there is insufficient space on the form attach and number additional forms. Include Value Added Tax (VAT) where applicable. Total amount claimed and budget codes to which the claim is to be charged must be entered on 4 the Summary section. The Declaration section must have the signature of the Claimant. The Authorisation section must have the signature of an authorised signatory. A Claimant cannot both sign and authorise the form and the Authoriser must be independent of the Claimant. 2.4 Submitting Claims via iExpenses (Staff only) Expense claims are submitted through Oracle iExpenses. Following submission of your claim, all receipts should be attached to the confirmation page and sent to Finance in the pre-printed iExpenses envelopes. Further information on iExpenses and a comprehensive guide on how to enter expense claims can be found on the Finance Office pages of GCUYou. 2.5 Claims when Travelling with Spouses/Partners Where the claimant is accompanied by a Partner/Spouse or other non-University connected persons, the claimant must only claim the appropriate share of each item of expenditure, consistent with that which would have been incurred if travelling unaccompanied. Under no circumstances must the University incur additional costs on account of the claimant's travelling companion(s). 2.6 Claims with Extended Visits Extended Visits are those which include time spent on non-University Business such as earlier arrival or later departure. Extended visits may be permitted provided there is no additional cost to the University and it is not a regular occurrence. Prior approval should be obtained from Line Manager. 2.7 Receipts Receipts should always be provided where possible to account for each item of expenditure however, unreceipted expenditure up to the value of £20 will be reimbursed provided suitable justification has been provided. 2.8 Authorisation Limits For staff below Executive level, the standard delegated authority limits contained within the Delegated Authority Policy, should be referred to. Otherwise expense claims must be approved as follows: Claimant Authoriser of Expenses Claim Authoriser Limits Executive Any other member of the Executive Up to £1,000 Principal Up to £10,000 If <£1,000, Executive Board Member Up to £1,000 Principal If >£1,000, Chair of Court or Chair of No Limit Finance & General Purposes Committee 5 Members of Court University Secretary Up to £1,000 University Secretary countersigned by No limit the Principal Where a single overseas visit (for an individual or group) costs in excess of £30,000, or an individual’s expenses exceed £10,000, approval must be obtained from the Finance & General Purposes Committee. Student visits are exempt from this requirement and are subject to normal authorisation controls. Members of staff who are authorised to approve expenditure should ensure: 1. They do not approve expenditure where the claimant is a connected person. A connected person is defined as spouse/partner, family member or other closely related person and 2. Are a more senior authority when providing authorisation in all circumstances. Failure to follow these instructions will render the expenses claim invalid. 3. Advances against Expenses and Credit Cards The cost of a business expense should normally be met by the individual and reimbursement should subsequently be sought from the University. Foreign currency advances are available to staff members who are in receipt of a University VISA card travelling overseas on University business. Provided there is prior agreement to obtain an advance against expenses, the following conditions will apply: An advance must be accounted for via iExpenses duly authorised and supported by receipts as soon as possible and not later than 14 days after the date when the original expenditure was incurred. Any exchange differences will be charged to the School/Department/Project to which the overall expenditure relates to. Unused foreign currency must be converted back to GBP and returned in person to the Santander branch located in the George Moore Building and reconciled as appropriate in iExpenses. Should the staff member fail to account for the advance within 14 days of the return from business, the Finance Office reserves the right to withhold the provision of further advances or reimbursements of expenses until the matter is resolved, or make a direct deduction from payroll of the outstanding sum. Further information can be found in the Staff Advances Policy. Any requests for a University VISA card for staff members must be approved by the Head of Department or Dean of School and sent to Accounts Payable along with a justification and intended usage and estimated amounts per month in support of the application. Further information is available from the Finance Office pages of GCUYou. 6 4. Hospitality / Entertainment including Staff Meetings 4.1 Business Entertainment/Corporate Hospitality The University recognises that there may be occasions when, for legitimate business reasons, it is appropriate to provide hospitality to external customers or other supporters of the University. On those occasions it is expected that the purpose of entertaining is to foster new business or to continue existing business contacts. Entertainment will not be considered to be legitimate business entertainment if: There are no external guests present or the ratio of University employees to externals exceeds 4:1. In terms of qualifying as business entertainment, anyone who is employed in any capacity by the University does not count as an external guest. The purpose of the meeting is primarily social, even though business topics may have been discussed. Any entertaining should be approved in advance. Hospitality taking place in GCU should be ordered from the in-house catering facility using departmental purchasing procedures, therefore does not form part of the Expense Policy. The University will only pay costs which are judged to be reasonable. Where costs are considered to be unreasonable the University may reject claims or exclude items. In those cases, if a University credit card has been used, the card holder may be required to reimburse the excessive costs. Unreasonable claims will include those where the food and drink ratio in terms of cost and proportion are not considered to be appropriate to the occasion. Twhe provision of any alcoholic drinks must be moderate and be complemented by a selection of nonalcoholic alternatives. The University also expect that staff who consume alcohol for the purpose of hospitality must have already finished work for the day or not be required to return to work. Expenses relating to legitimate business expenses are generally not taxable however this may be subject to review by HMRC with the ratio of University staff to external guests being a critical factor. Any business entertainment costs should be authorised in accordance with the Delegated Authority Policy by an approver independent of the event. Where the approver is in attendance, the costs should be authorised by a more senior authority. 4.2 Non-Business Entertaining Non-business entertaining is considered as events which take place primarily for the benefit of members of staff and which may, exceptionally, be paid for from University funds. The University recognises that there may be some circumstances, such as a retirement celebration or Christmas lunch, when hospitality may be provided for University employees without the presence of any external guests. Expenses incurred in this way are normally taxable, although HMRC do allow dispensation in some circumstances up to a limit of £150 per head per year. Any entertaining should be approved in advance. Hospitality taking place in GCU should be ordered from the in-house catering facility using departmental purchasing procedures, therefore does not form part of the Expense Policy. 7 Staff choosing to attend University social functions such as the Graduation Ball shall meet the costs of these personally. This also applies to all items where an employee of the University would normally have been expected to pay personally for the cost of goods or services. However, where a member of staff is specifically required to attend a social function as part of their duties, reimbursement of reasonable costs may be claimed. Prior approval must be obtained from their Line Manager. 4.3 Entertainment relating to Graduations and School / Departmental Events Any entertaining, outwith that provided by the University before/ after the Graduation Ceremony, should normally be restricted to the Honorary Graduate, two external guests and two members of University staff. Entertainment provided at School / Departmental events must be reasonable taking into account the number of staff members attending. The provision of any alcoholic drinks in relation to entertainment provided in 4.3 must be moderate and be complemented by a selection of non-alcoholic alternatives. The University also expect staff who consume alcohol for the purpose of hospitality, do so at a reasonable level, and should normally have already finished work for the day or not be required to return to work. 4.4 Refreshments Supplied During the Course of a Meeting It is permitted to provide refreshments (e.g. sandwiches, biscuits, hot or cold non-alcoholic drinks) where this is considered to be necessary due to the length or nature of the meeting. This should be ordered from the in-house catering facility using departmental purchasing procedures, therefore does not form part of the Expenses Policy. 5. Travel and Accommodation 5.1 General Travel and accommodation must be booked through the University’s appointed agent before travelling and the Travel and Accommodation Policy applies. 5.2 Travel to be reimbursed through an expense claim The University has an appointed travel agent responsible for booking all travel on behalf of University staff. On occasions, staff may need to be reimbursed for travel which cannot be booked through our travel agent, for example a taxi to and from an airport. Such incidental travel expenses should be reimbursed through an expenses claim. 5.3 Use of a Private Car Use of a private car is allowed if there are a number of passengers, heavy equipment has to be carried, or the destination is not well served by public transport (requirement to make multiple connections or remoteness of destination). For mileage claims in excess of 100 miles per round trip, the claimant will be restricted to economy class rail fare. Employees must ensure that they are licensed and insured to permit their vehicle to be used on University business. The University will not accept liability for any consequences arising from failure to 8 do so. The University reserves the right to request copies of insurance certificates or alternative evidence of insurance cover and a system of random checks will be carried out. No discretion exists to pay higher mileage rates than those currently in force, or to pay for fuel, except where a hired vehicle has been used on University business. The current HMRC mileage allowance rate is 45p per mile. No income tax liability should arise on those claiming mileage whilst using private cars for business journeys as the rates paid by the University are within HMRC guidelines. Where total mileage claimed in the tax year exceeds 10,000 miles, an assessable benefit may arise. Full details of the journey, including date, reason for journey, starting points and destinations, should be shown in the appropriate columns of the mileage section in iExpenses or on the Expenses Claim Form. Parking costs incurred in the course of travelling away from home or (where applicable) the normal place of work in the performance of the duties of employment may be claimed. A Department may not pay the cost of any individual University Employee's parking permit. The University will not reimburse parking fines and other fines for road traffic offences incurred by University employees whilst on University business. This rule applies both to University employees driving University vehicles and University employees using their own/hire vehicles on University business. 5.4 Hired Vehicle Expense Claims Expenses claims arising from the use of University and Hired vehicles must be confined to the reimbursement of business expenses only. If the employee is required to pay for fuel then reimbursement of fuel costs on production of receipts should not give rise to any tax liability. This is provided that no private mileage is covered. No liability will fall on the employee if the cost of any fuel used is included in the contract hire - as this will be met by way of a University Purchase Order. Where a cost has been incurred that can be attributed to an element of private motoring, these costs should not be claimed. 5.5 Taxi Hire Taxis are hired from within the University through the Facilities Management agreement with the Taxi Owners Association (TOA). A member of staff requiring a Taxi for University business asks the nominated contact in their department to order the Taxi, or if outside office hours, the receptionist at the George Moore Building. The use of Taxis to take employees home after working late after 9pm is only allowed in exceptional circumstances, and not as a regular arrangement. Heads of Department/Division are required to approve these exceptions. Note these costs may be considered to be Taxable Benefits in Kind by HMRC unless stringent conditions are met. 6. Subsistence (e.g. Meals/Snacks) Employees, who are required to travel in the UK on University Business in the course of their work, are entitled to a meal allowance for each day whilst away from both home & their normal place of work. 9 The UK daily rates are: Conditions More than 10 miles from home & normal place of work and absent from each for between 5-8 hours spanning a normal meal time. More than 10 miles from home & normal place of work and absent from each for more than 8 hours spanning two normal meal times. Maximum Daily Rate £20 £40 For New York, the daily rates are: Conditions For each 24 hours Over 5 hours but less than 10 hours Over 10 hours but less than 24 hours Maximum Daily Rate $102.50 $31 $76.50 Subsistence payments in relation to travel overseas (outside New York) are paid at the HMRC worldwide rates. Subsistence rates for all destinations can be obtained from the ‘Policies & Guidelines’ section on the Finance Office pages of GCUYou. All claims must be supported by vouchers/receipts. Cash is not advanced to employees prior to the expenses being incurred. Reimbursement of the cost of any alcohol included will only be considered where it is appropriate to the setting of the occasion e.g. a glass of wine or a beer consumed with a meal or snack. Tips and service charges will be reimbursed provided they are commensurate with the cost of the meal and the cultural environment incurred. 7. Courses & Conferences Courses and Conferences will only be approved where these are relevant to the performance of the employee's duty. In the following cases there may be a tax liability on the employee where attendance was: Given as a reward For personal education The costs of Department training and seminar days need to be approved by the relevant member of Executive if the costs are expected to exceed £200 per attendee or £1,000 in total. Any expenses incurred as a result of "away day" training and "team building" events must have prior approval of the Executive Member. 8. Home / Personal Mobile Telephone Expenses Only in exceptional circumstances and with the approval of the Principal, are employees allowed to seek reimbursement of business calls made using their home and mobile telephones. Claimants must attach itemised statements in support of claims for business calls. Business calls must be identified on the itemised statements. The cost of personal calls must be deducted from the total amount of each bill and only the net amount, representing business calls (and the VAT thereon), should be included on the expenses claim. Where the University has agreed to pay a proportion of the employee’s rental costs, the expenses claim 10 should comprise business calls plus the agreed proportion of rental, plus the proportionate amount of VAT. The amount of rental reimbursed will be subject to tax and national insurance contributions deductions as the amount reimbursed is regarded as a taxable benefit. 9. Mobile Phones Provided by the University 9.1 Principles A business case can be made for mobile phones where the following, but not exclusive, operational needs exist: ‘on-call’ duties out with normal working hours dealing with emergencies specific operational needs 9.2 Procedures A written case must be submitted to the Budget Holder stating the requirement of a mobile phone and those individuals who will be authorised to use it. If approval is given, the member of staff should contact the Information Services Department, who will advise on appropriate technical and services specifications. Staff who have mobile phones will be required to make a contribution for any personal calls. The cost of personal calls should be estimated by the mobile user and a reimbursement made to Finance. It is acceptable to expand the estimate to cover a 3 or 12 month period and make the contribution on this basis. 10. Professional Subscriptions The University does not normally pay professional membership fees /subscriptions for individual staff members. The only instances in which prior approval will be given by the PVC, Executive Dean or the Head of Department as appropriate is when either it is a legal requirement of the post holder or where the claimant is paying for an institutional membership i.e. as the University’s representative to that body. Full details, including the name of the relevant professional body to which payment has been made, and the exceptional circumstances supporting the claim, are both required to be entered in iExpenses or on the Expenses Claim Form. Departmental records must be kept for such memberships to enable value for money appraisals to be carried out on this type of expense. 11. Relocation and Removal Expenses Where the appointment of a new member of staff necessitates a move of home, the expenses associated with the relocation and the removal of the personal effects of that member of staff may be paid by the University. The reimbursement will be in accordance with such schemes as may be approved by the University Court. The scheme is administered by the Human Resources Department. 11