Fact Sheet: Industry Arguments Against the Bottle Bill

advertisement

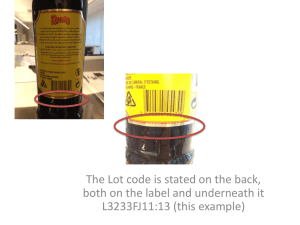

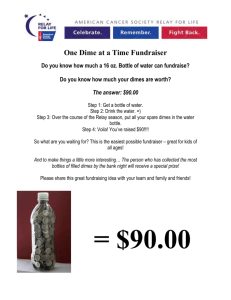

Sierra Club MA website: http://www.massbottlebill.org/ubb/ind_claims.htm Fact Sheet: Industry Arguments Against the Bottle Bill Since the Massachusetts Bottle Bill became law in 1982, dramatic changes have occurred in the beverage market. Sales of “new” beverages such as juices, iced tea, sport drinks, and bottled water have vastly increased. Because the Bottle Bill does not yet cover these drinks, millions of these containers wind up as litter or in our landfills and incinerators, costing cities and towns money in expensive disposal fees. The public benefit from the bottle bill is clear – and support for it is as strong as ever! When opponents sponsored a ballot question to repeal the Massachusetts Bottle Bill, it was rejected 93% to 7%. Despite overwhelming public support, specialinterest groups are opposed to it, and have spent enormous sums in trying to overturn or gut bottle bills throughout the USA. In Columbia, Missouri, bottlers outspent supporters at 10-to-1[i]. In Hawaii, the industry created a so-called “consumers” groups, entirely funded by the bottling industry. CLAIM: The bottle bill is a tax on consumers. FACT: The bottle bill is not a tax since deposits are 100% refundable. Those who do not redeem their containers make a voluntary choice not to do so, and therefore unclaimed deposits cannot be considered a tax. CLAIM: We don’t need a bottle bill now that communities have curbside recycling programs. FACT 1: States without bottle bills have only ~ 25% recycling rate of beverage containers, while states with a bottle bill typically have an 70+% rate.[ii] FACT 2: The bottling industry perpetuates an incorrect assumption that states must choose between curbside programs and deposit laws. Recycling data proves that both systems are necessary. Beverages are purchased and consumed both at home – where curbside recycling can be effective – and also away-from-home for immediate consumption. Beverages consumed away from home can be captured with deposits, but are beyond the reach of curbside programs. Despite a tripling in the number of curbside programs in the U.S. from 1990-2000, the quantity of aluminum cans wasted increased from 554,000 to 691,000 tons a year, and the amount of PET beverage bottles landfilled and incinerated rose from 359,000 to 943,000 tons per year.[iii] CLAIM: A Bottle Bill Update will hurt our economy FACT: Updating the bottle bill will be good for the Massachusetts economy. Collecting the unclaimed deposits on the updated items will generate up to $20 million[iv] annually to ensure funding for essential environmental programs – without imposing any new taxes. The updated bottle bill will save municipalities the cost of collecting and either recycling or disposing of these materials. Reductions in litter will reduce property damage and personal injury from broken glass and sharp metal cans. In addition, updating the bottle bill will create new jobs in the recycling and retail industries. CLAIM: Updated bottle bill will increase the price of bottled beverages FACT: Although 5¢ is added to the cost of a bottle or can when you buy the beverage, it is fully refunded when you return it! If you choose not to return it, the unclaimed deposit is used to fund litter reduction and recycling programs. Donald Dowd, Vice President of Coca Cola of New England, stated "our prices pre-bottle bill and post-bottle bill are virtually the same."[v] A study funded by the National Food Processors Association found that soda in Massachusetts “costs roughly the same as soda in New Hampshire …,” and concluded, “One could argue that . . . having a bottle bill does not increase beverage prices.”[vi] CLAIM: Updating the bottle bill will create problems for shopkeepers FACT: Massachusetts retailers and redemption centers already have well-established systems to handle deposit containers. Reverse Vending Machine (RVM) technology has already greatly reduced the amount of space retailers must use to satisfy their obligations under the bottle bill and this technology can easily adapt to any changes in the bottle deposit law. RVMs 1 read container bar codes and electronically record the type of beverage containers returned. The machines can be reprogrammed to deal with new containers under an updated bottle bill. CLAIM: Updating the bottle bill harm municipal curbside recycling programs by removing valuable aluminum FACT: The vast majority of the items included in the update are plastic and glass. It costs municipalities money to collect, process, and market recyclables. The savings to municipalities from removing these cumbersome, low-value materials from their recycling programs far exceeds the loss of revenue from sales of scrap aluminum. The purpose of municipal recycling programs is not to generate revenue but to provide an environmentally sound, cost-effective alternative to land filling and incineration. CLAIM: There’s got to be a better way. FACT: The most effective recycling programs in the world are comprised of curbside PLUS deposit. Systems that eliminate one or the other component are ineffective. CLAIM: Sen. O'Leary's NJ-Style Litter Tax is more fair and will be more effective. FACT 1: The bottlers' newest claim is that New Jersey's Litter Tax is better than the bottle bill. In reality, NJ environmentalists see this as a complete fabrication. The meager proceeds the proposed Litter Tax would barely amount to $25,000 per year for each city and town. This amount can not even begin to pay for cleanup, education, and other litter control programs. In New Jersey, litter is at an all-time high, and environmentalists are working to implement a Massachusetts-style Bottle Bill. Click here to read NJ Sierra Club's comments on Sen. O'Leary's proposal. FACT 2: Until three years ago, the Clean Environment Fund (CEF) was the recipient of forfeited deposits. This fund - as well as hundreds of other dedicated funds - were dissolved by the State Legislature. Although still on the books, the CEF and all other dedicated funds like it cannot be reinstated without specific legislation to allow them. The O'Leary Litter Taxes "set aside" cannot be established. CLAIM: Fraud will cause the bottlers to lose millions FACT: Buying a beverage in another bottle-bill state - or a non bottle bill state like New Hampshire - and returning it in Massachusetts, is considered "fraud". While some bottlers are unwilling to specify just how many containers are fraudulently returned, others like Coca-Cola are beginning to use the most obvious method to eliminate it: different barcodes in bottle bill states. This low-cost method virtually eliminates fraud. [i] Container Recycling Institute [ii] Ibid. [iii] Ibid. [iv] Container Recycling Institute [v] Boston Globe Nov. 22, 1989 An Economic and Waste Management Analysis of Maine’s Bottle Deposit Legislation, by Dr. George Criner, Commissioned by the National Food Processors Association, University of Maine, 1991. [vi] 2