Fall 1999-EMBA

advertisement

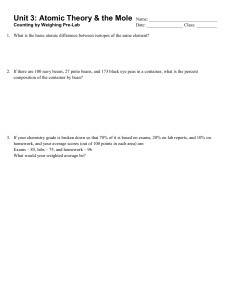

Economics 5315 Managerial Economics Fall 1999 Test No. 1 1. Hanna Corporation markets a compact microwave oven. In 1998 they sold 23,000 units at $375 each. Per capita disposable income in 1998 was $6,650. Hanna economists have determined that the price elasticity of demand for this microwave oven is –1.2. a. In 1999 Hanna is planning to lower the price of the microwave oven to $325. Forecast sales volume for 1999 assuming all other things stay the same. b. However, in checking with government economists, Hanna finds that per capita disposable income is expected to rise to $7,000 in 1999. In the past the company has observed an income elasticity of +2.5 for microwave ovens. Forecast 1999 sales given that price is reduced to $325 and that per capita income increases to $7,000. Assume that price and income effects are independent and additive. 2. Suppose nominal interest rates in the U.S. rise from 4.6% to 5.0% and decline in Britain from 6.0% to 5.5%, while U.S. consumer inflation remains unchanged at 1.9% and British inflation declines from 4.0% to 3.0%. In addition, suppose real growth in the U.S. next year at 4.0% and in Britain it is forecasted at 5.0%. Finally, suppose producer price inflation in the U.S. is declining from 2.0% to 1.0% and is expected to rise in Britain from 2.0% to 3.2%. Explain what each of these factors will have on the long-term trend exchange rate (pounds per dollar) and why. 3.A certain production process employs two inputs—labor (L) and raw materials (R). Output (Q) is a function of these two inputs and is given by the following relationship: Q = 6L2R2 – 0.1L3R3. Assume that raw materials (R) are fixed at 10 units. a. Determine the total product function for input L. b. Determine the marginal product function for input L. c. Determine the average product function for input L. d. Find the number of units of input L that maximizes total product. e. Find the number of units of input L that maximizes marginal product. f. Find the number of units of input L that maximizes average product. g. Determine the boundaries for the three stages of production. 4. One physician who treated patients who belonged to a large health maintenance organization was heard to say: “One day I was listening to a patient’s heart and realized there was an abnormal rhythm. My first thought was that I hoped that I did not have to refer the patient to a specialist.” What sort of financial arrangement do you think the physician had with the HMO? Explain. 5. The Value-Pack Canning Company buys fresh fruits and vegetables from farmers, processes and cans them, and sells the output to various supermarket chains. The company is trying to determine the optimal mix of peas and green beans to process during the forthcoming period at its Fresno plant. Output is limited by the capacity of the plant and the form’s financial resources. The plant can process 4 million pounds of peas or green beans (or linear combination of the two) during the forthcoming period. The company buys peas and green beans for $0.10 and $0.20 per pound respectively. Purchases must be paid for at the time of delivery and the firm’s current cash reserves limits purchases to $600,000. As part of the long-term contracts with several supermarket chains, the firm is required to process at least 800,000 pounds of peas and 1.2 million pounds of green beans during the period. The profit contribution for peas and green beans are $0.015 and $0.025 respectively. The firm desires to find the mix of peas and green beans to produce in order to maximize the total profit contribution of the plant during the forthcoming period. a. Formulate the problem algebraically in the linear programming framework. b. Determine the optimal mix of vegetables to process. c. How much would the relative profit contribution have to change for the mix to change? Bonus: Suppose a firm’s profit function is given by the following relationship: = -25 + 100X + 95Y – 10X2 – 5Y2 – 5XY where X and Y are the respective quantities of the two products the firm manufactures and sells. Each unit of the two products requires 10 and 5 units respectively of a certain raw material, call it A. During the forthcoming period, the firm only has 50 units of A available to produce X and Y. The firm desires to maximize profits subject to the raw materials constraint. a. Formulate the problem in a programming framework. b. Solve the problem using the Lagrangian multiplier technique. What are the optimal quantities of X and Y?