2006 - Iowa State University

advertisement

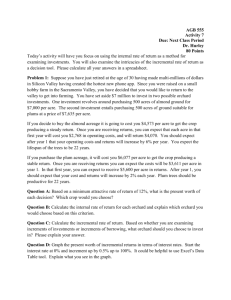

Economics 330 Fall 2006 Exam 3 KEY Land, Labor and Capital A. Circle all correct answers. Each question has one or more correct answers. (1 pt. per answer) 1. Which of the following lenders will provide loans for short-term operating expenses? a. Farm Credit Services b. insurance companies c. rural commercial banks d. Iowa Agricultural Development Authority e. Farm Service Agency (USDA) 2. Which of the following would tend to cause farmland values to increase, all else equal? Use the income capitalization relationship. a. increasing long-term interest rates b. elimination of USDA commodity programs c. increasing demand for corn for ethanol d. increasing cost of nitrogen fertilizer e. higher yielding seed varieties 3. Compared to a fixed cash lease, a crop-share lease: a. is riskier for the tenant b. requires the tenant to provide more operating capital c. requires the tenant to keep more records d. gives the tenant more management freedom e. is more common in the state of Iowa 4. Which of the following financial measures is an indicator of solvency? a. working capital b. total farm debt-to-asset ratio c. current asset-to-debt ratio d. net worth (market value) e. % return on assets (ROA) 5. When a farm machinery lease ends, the farmer can: a. keep the machine, for no extra payment b. purchase the machine for a price close to its fair market price c. return the machine to the leasing company d. exchange the machine for a new model under a new lease e. sell the machine and split the money with the lease company 6. Which of the following would tend to increase a farm’s net cash flow in the short run? a. carrying over an operating loan balance for another year b. paying off a machinery loan in 6 years instead of 3 years c. doubling the size of a dairy operation d. buying land with a loan equal to 75% of the purchase price instead of cash renting it e. amortizing a 10-year loan with an equal total payment repayment schedule instead of an equal principal payment repayment schedule. B. 7. Answer as indicated. List five items that should be included in a farm employee agreement. (5 pts.) a. _____________________________________________________________________ b. _____________________________________________________________________ c. _____________________________________________________________________ d. _____________________________________________________________________ e. _____________________________________________________________________ 8. If a farm has a 5-year average return on assets (ROA) of 6% and is paying an average interest rate of 10% on borrowed funds, what is the maximum total debt-to-asset ratio it could support? (4 pts.) ________% 9. A farmer couple has a chance to purchase 80 acres of farmland for $4,000 per acre or rent it for $160 per acre. It has a CSR rating of 81, and 70 acres of it are tillable. They put together the following budget (per acre). (4 pts. each) Show your work. Expected annual gross income from crops and USDA $530 Expected input costs (seed, fertilizer, pesticides, drying) Machinery and labor costs Cash rent Property taxes $200 $120 $160 $ 25 a. How much is their expected profit per acre if they cash rent the farm? $________/tillable acre b. How much is their expected profit per acre under a traditional 50-50 crop share lease? $________/tillable acre c. How much would their expected profit per acre be if they owned the land, before taking into account their loan payment? $________/ tillable acre d. Using the income capitalization approach and a discount rate of 4%, what is the estimated value of the land, per tillable acre? $________/tillable acre e. Several land sales have taken place in the same county: Sale Price Acres Tillable Acres CSR $ per Tillable Acre $ per CSR on Tillable Acres $420,000 120 100 84 ___________ _____________ $212,520 65 60 77 ___________ _____________ What was the selling price per tillable acre for each sale? Fill in the blanks above. What was the selling price per CSR point on the tillable acres for each sale? Fill in the blanks above. f. Based on the average of the two sales in the previous question, what value per acre would you put on the 80 acres in question? Take into account the CSR rating (81) and the number of acres tillable (70). Assume no value for the nontillable acres. $_________/acre g. If the couple pays the asking price of $4,000 per acre, pays $1,000 down and borrows the rest at 6% interest for 25 years, how much will their total annual payment be on 80 acres? The amortization factor for a 25-year, 6% loan is $.07823 per $ borrowed, for an even total payment loan. $ ___________/year. h. What effect do you think this land purchase would have on their farm business with respect to: (9 pts.) 1) liquidity 2) solvency 3) profitability 10. A large cash grain farm wants to hire a good mechanic and truck driver. They are wondering if they should utilize an Internet agricultural employment company like the one cited in Lab 11. Discuss some advantages and disadvantages for them of doing this. (6 pts.) Advantages: Disadvantages: 11. List three ways that a small, part-time crop farmer could reduce total machinery costs. (6 pts.) a. _________________________________________________________________ b. _________________________________________________________________ c. _________________________________________________________________ 12. Explain how the Farm Service Agency of the U.S. Department of Agriculture helps farmers reduce financial risk through: (6 pts.) a. guaranteed loans b. marketing loans 13. Describe how marketing and production risk are shared, and how expenses are shared (who pays or contributes what?) under each of the following agreements. (6 pts.) a. flexible cash rent lease b. custom farming contract Economics 330 Fall 2006 Exam 3 K E Y 1. 2. 3. 4. 5. 6. a, c, e c, e c b, d b, c, d a, b, e 7. a. b. c. d. 8. Maximum D/A = 9. a. $530 – 200 – 120 – 160 = $50/tillable acre b. $530 2 $45/tillable acre c. $530 – 200 – 120 – 25 = d. V= e. Sale Price $ Per Tillable Acre $420,000 $420,000 $4,200 100 $4,200 $50 84 $212,520 $212,520 $3,542 60 $3,542 $46 77 duties, working days and hours wages, benefits supervisor, evaluation termination, holidays ROA i 6% = .60 60% 10% 200 120 2 $185 = .04 $185/tillable acre $4,625/tillable acre f. 70 50 46 = $48 x 81 = $3,888 x = $3402/acre 80 2 g. $4,000 – $1,000 = $3,000 $ Per CSR on Tillable Acres $3000 x 80 a. = $240,000 $240,000 x .07823 = h. 10. $18,775.20/year or $234.69/acre Decrease – land payment $235/acre payment // $185/acre net return Decrease Increase D/A ratio, but increases in land values may help in the long run. Profitability: Should increase net income, on average. Liquidity: Solvency: Advantages: Wider distribution, applicants would have Internet skills, Company may screen Disadvantages: Cost, no control over location, may have to pay employee to relocate, may miss good applicants 11. a. b. c. d. e. custom hire, rent used machinery smaller machinery joint ownership trade labor 12. a. b. Guaranteed Loans: Pay of 90% of loan to private lender if farmer can’t pay. Reduced interest rate. Marketing Loans: Farmers can obtain loan on crop at county USDA loan rate. Pays back the lower of the loan + interest, or the county cash price (PCP) on that day. 13. a. Flexible cash rent lease: Tenant pays all costs, price and/or production risk shared. Rent based on actual yield and/or price. Custom farming contract: Landowner pays all costs except labor and machinery, takes all risk. b.