UNIVERSITY RISK MANAGEMENT INITIATIVE An Initiative to

advertisement

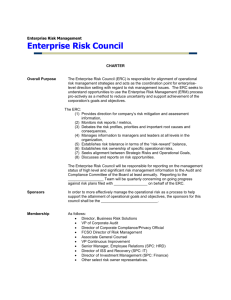

UNIVERSITY RISK MANAGEMENT INITIATIVE An Initiative to Implement an Improved University Risk Management System By George Wendt Title of This Identifying, assessing and negating the risks that threaten the objectives of Ohio University should be facilitated based upon strategic considerations. The traditional approach to risk management focuses upon operational risks addressed through insurance; it is not an all-encompassing approach. Conventional risk management, utilizing a sole department to recognize and address a limited category of threats to the organization, must be given the opportunity to adopt a more robust method. All types of risk should be evaluated and controlled. The Enterprise Risk Management model should be adopted. Enterprise Risk Management involves the elimination or mitigation of threats which could adversely impact its strategic objectives. An on-going formal process must be used to identify, assess, prioritize and manage exposures to loss. Enterprise Risk Management affords the University the opportunity to optimize the attaining of its vision. History of the Discipline A short review of the history of risk management puts the matter into proper context. The insurance industry originated in England in 1688 with the creation of Lloyd’s of London. The insurance buyer bought coverage for their organization. Typically, this was the approach to handling governmental risk in North America until the 1970s. In the 1960s and 70s new legal theories challenged the notion that government should not be sued. State legislatures and courts changed the law so that legal action could be taken against governmental entities as a result of their negligence. During the same time, organizations bought coverage out of convenience and frequently paid too much for it. Attempting to transfer all risks to insurance companies was too costly. It is cheaper to insure risks with high deductibles and to apply loss prevention tools to keep costs down. During the 1990s, risk management experienced another major change. Organizations began to marshal a greater share of their resources in order to counter more kinds of risks. The result was Enterprise Risk Management. Framework What basic guidelines govern the operation of a well-functioning Enterprise Risk Management program? ERM assumes that when something is done in one area of the University, there can be reactions elsewhere. It addresses the question, If a decision leads to a diminution of Ohio University’s reputation, for instance, it may cause an economic or financial loss. Higher education is faced with communication problems as a result of risk silos. ERM core groups would break down these silos and sets an example for all of the staff under its direction. ERM, with its various components, works to build bridges of communication so that risks can be better managed. 2 Enterprise Risk Management enhances risk identification. All types of risk would be evaluated. ERM builds upon the work already being done by the Department of Risk Management and Safety by expanding its scope in addressing all types of losses. More categories of risk are evaluated than in the past. Even the consideration of the traditional operational risks can be expanded. Significant potential losses were always an important consideration under conventional risk management; they are emphasized even more with Enterprise Risk Management. One of the major tasks of an ERM core group is the prevention of potentially debilitating losses, especially those with a high probability of occurrence. With Enterprise Risk Management, there is more of an emphasis on what might bring down the house. As a result, Enterprise Risk Management enhances the organization’s ability to visualize a greater population of major threats before they occur. These efforts put the University on a much better footing. Furthermore, Executive Staff’s heavy involvement in this initiative is a key factor in ensuring its success. When individual members of the senior administration take ownership of the process it not only makes transformational change possible through their use of line authority, but it also creates a culture where the proper treatment of risk is appreciated. As it is with quality, so it must also be with risk; risk management must not be confined to a single department, but deeply embedded in the culture. All of those participating should seek to isolate risks leading to severe losses that have a high probability of occurrence. Department heads should address the risks created by their operations and be willing to manage them. In addition, Enterprise Risk Management should be integrated with the development of strategic objectives. ERM works in conjunction with the organization’s strategic objectives. Enterprise Risk Management is a strategic tool. The risk associated with an objective should be evaluated as it is being developed and should become a part of the implementation decision. Finally, monitoring the results of the Enterprise Risk Management process should be handled by the audit function of the University. Internal Audit’s interest in and familiarity with ERM would greatly enhance its potential for success. The Enterprise Risk Management Process Enterprise Risk Management, as mentioned, expands the opportunity to identify and counter risks before they become disasters by utilizing the authority of the members of senior administration. In addition, risks are evaluated and are prioritized so that scarce resources can be properly applied. If the total elimination of a potential risk is not possible, its minimization is pursued. Building inspections in residence halls conducted to find flammable materials, for example, are an essential tool in our efforts to ensure life safety. Furthermore, controls may be necessary in order to effectively diminish the potential for loss. A sprinkler system in the same building, for instance, may be installed in order to reduce the loss potential of a fire. Decisions made as a result of Enterprise 3 Risk Management should be communicated to all who have need of the information. In addition, ERM’s methods should be utilized consistently across all departments. Department heads, for example, should consider all of their risks and be vigilant to the possible occurrence of major losses. Finally, all decisions made in the process should be monitored for results. Enterprise Risk Management Techniques Every important choice involves at least some degree of risk. The risk associated with Ohio University’s strategic objectives should be carefully assessed in order to better ensure their proper implementation. Culture, the integrated pattern of human knowledge, belief, and behavior, is a key consideration. Barriers to necessary change which are deeply ingrained in the institution need to be overcome as the opportunities arise. An Enterprise Risk Management program at the University would need to carefully assess the various aspects of its culture in order to ensure success. A risk evaluation would examine the environment that we exist in, taking into account risks that are both inside and outside of the institution and any barriers that may stand in the way of results. The University faces four types of strategic risk: compliance, operational, reputational and economic. At times, these core risks interrelate and this linkage should be tracked. An event causing reputational problems, for instance, could lead to a financial loss. An NCAA violation, for example, might not only raise concerns on the part of future students and their parents about Ohio University’s athletics, but could also lead to a fine. There is heightened interest with ERM to identify and negate major losses, especially those that have a reasonable likelihood of occurring. Formal Risk Assessment ERM should commence with a formal risk assessment. Such an assessment would begin even before the creation of a group to sustain the effort over the long term. A risk assessment drills down to bedrock. Data is collected through individual interviews, surveys or workshops. Key questions are asked: “What are the recent changes in your operations?” or “What are the challenges to your educational mission?” or “Do you know of any unhandled risks within your department?” A list of risks is established from this work. They are then evaluated and prioritized. Root cause analysis is then implemented. A root cause is a basic source of risk; its existence can bring about losses. A root cause is generated by people, processes or technology. The question “why” is asked until the root cause is determined. Consider the economic question, for example, “Why was there high unemployment during the Great Depression?” A less than penetrating response might be “Because people were out of work.” More is needed. “Why were people out of work?” “Because there were not enough jobs.” “Why was this?” Because there was not enough economic growth. “Why was that?” “Because the supply of money, which must grow to accommodate an expanding economy, was insufficient.” Now, a root cause has been determined. 4 As a result of the formal risk assessment, strategies will need to be generated in order to properly manage the risk which is identified. One approach is to avoid the activity or operation, along with the associated risk altogether. If the University were contemplating opening an additional regional campus, it might decide to forego this expansion out of concern for the attendant risk. Another strategy is to minimize the risk. Supervisor safety training, for instance, can diminish the incidence of industrial losses. Risks can also be transferred from the University to other entities. Our property and liability insurance program, including our membership in the Inter-University Council Insurance Consortium along with commercial insurance, permits us to share risk with other universities and the insurance industry. When we experience a major loss, for example, a portion of the cost of such an event is assumed by these other organizations as well. Finally, a risk can simply be accepted as an unavoidable reality. The Enterprise Risk Management Advisory Group Under the leadership of the Vice President for Finance and Administration, the Enterprise Risk Management Advisory Group would become the centerpiece of the ERM Program. The Group would function in an advisory capacity, reporting its findings to the President of the University. Additionally, it would act to mitigate risk. Risk-related information evaluated by its diverse membership, listed later in this paper, is utilized to develop countermeasures which are then presented to senior administration. Risks identified by individuals or other units of the University are also assessed. Group members regularly report to the membership on significant dangers that have come to their attention. One of the Group’s essential duties is holding each other accountable for tasks associated with these risks. Integrating the consideration of risk into high-level decision making is also one of the responsibilities of the Group. Potential Risks What are the risks that the Enterprise Risk Management Group seeks to negate? First of all, compliance issues are among the most significant risks that the University faces. The failure to adhere to applicable laws, whether they are federal, state or local, could result in sanctions relating to accreditation, athletic participation, or other adverse consequences. In addition, operational risks of the institution, those conventional exposures that arise in connection with an institution of higher education being in business, continue to be an essential work of the Group. Furthermore, reputational risk, if not properly addressed, can impact how major stakeholders perceive Ohio University. The image of the University as it interacts with students and their parents, alumni, taxpayers, contributors, and granting agencies is vital to the fulfillment of its strategic objectives. Reputational risk has staying power; if a reputation is damaged due to an event, it could take considerable time and the expenditure of scarce resources to undo the damage. Finally, economic and financial exposures pose a major threat to the University’s strategic objectives. Group evaluation of the stewardship and accountability of Ohio University’s financial resources and the impact of the economy on these funds is an essential duty. Given the weighty responsibilities of the Enterprise Risk Management 5 Group, each member must be committed to countering these core risks. The Group must work on its own initiative to recognize and counter all strategic risk facing the University. Group Tasks What are the tasks of the Enterprise Risk Management Advisory Group? One of the first duties of the Group is to generate a risk register from the data collected as a result of the initial risk assessment. Listing potentially devastating perils by utilizing considerations of both the likelihood and the potential severity of loss provides the Group with a baseline to work from in the pursuit of a safer campus. Regular meetings would address emerging issues as they present themselves. Individual members would be assigned the task of evaluating risks for later presentation to the Group. Risk remediation plans would be developed for each identified peril and assigned to the appropriate individuals. Membership Members will be selected based upon the risk creation potential of their divisions and their familiarity with University activities. Membership should include at least the following persons: Associate Vice-President for Risk Management and Safety Chief Audit Executive Executive Director for University Communications and Marketing Executive Vice-President and Provost (or designee) A Faculty Member Economist General Counsel Risk Manager Vice-President for Finance and Administration (Group chair) Benefits of Enterprise Risk Management The benefits of Enterprise Risk Management are considerable. ERM makes it possible for better decisions to be made. It advances our strategic objectives by creating an environment where the proper management of risk is appreciated. Also, improved management consensus is developed along with increased management accountability. Enterprise Risk Management improves communications and provides the opportunity for everyone to assist in fulfilling the University’s educational mission. Everyone wants to be able to sleep at night; any manager at Ohio University who is concerned about achieving results could benefit from ERM in this way. Implementation Steps The following is a summary of implementation steps: Make a deliberate decision to pursue or not to pursue ERM. Appointment of a project leader to coordinate the ERM implementation. Select a consultant to conduct a risk assessment. 6 Conduct risk assessment. Identify the desired membership of the ERM Group. Gain approval of the Bylaws. Group meets to refine and prioritize risks in order to form a risk register. Group reports to President regarding risks monthly or more frequently, if needed. Group executives direct remediation of risks that can be immediately negated. Group evaluates the remainder of the items on the risk register. Group assigns a champion to each risk to ensure its proper handling. Each risk champion develops a remediation plan for all assigned risks. Champions periodically report progress on each risk until the work is concluded. New items are placed on the register as they come to the attention of the Group. Internal Audit periodically evaluates the performance of the Group. Enterprise Risk Management Proposal Ohio University would greatly benefit from the implementation of Enterprise Risk Management. Risk identification would be bolstered by addressing categories of risk not previously considered. Frequently, risk identification is the most difficult aspect of the Risk Management process, but ERM seeks to remedy this by enlarging its scope. Risk assessment would be accentuated through the efforts of the Enterprise Risk Management Group, whose members would possess high levels of expertise. Risk communication would be greatly aided by the interaction between the members of the Group. For all of these reasons, the Department of Risk Management and Safety requests that, upon due deliberation, a risk assessment be conducted leading to the creation of an Enterprise Risk Management Advisory Group. 7