Conclusion - Californians for Renewable Energy

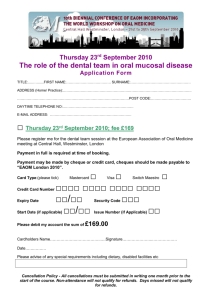

advertisement

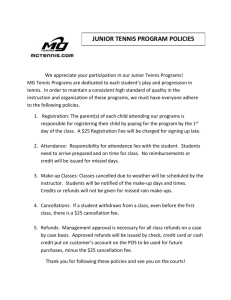

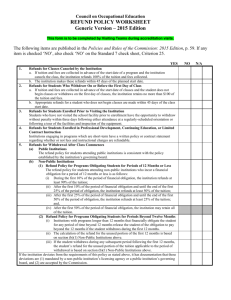

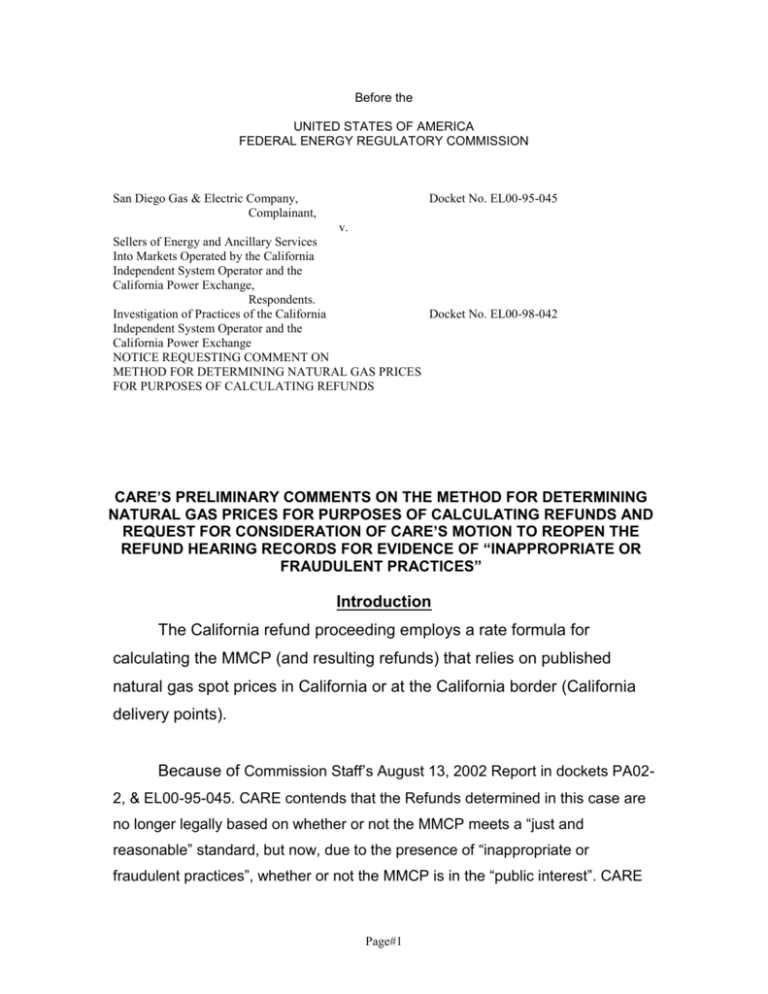

Before the UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION San Diego Gas & Electric Company, Complainant, Docket No. EL00-95-045 v. Sellers of Energy and Ancillary Services Into Markets Operated by the California Independent System Operator and the California Power Exchange, Respondents. Investigation of Practices of the California Docket No. EL00-98-042 Independent System Operator and the California Power Exchange NOTICE REQUESTING COMMENT ON METHOD FOR DETERMINING NATURAL GAS PRICES FOR PURPOSES OF CALCULATING REFUNDS CARE’S PRELIMINARY COMMENTS ON THE METHOD FOR DETERMINING NATURAL GAS PRICES FOR PURPOSES OF CALCULATING REFUNDS AND REQUEST FOR CONSIDERATION OF CARE’S MOTION TO REOPEN THE REFUND HEARING RECORDS FOR EVIDENCE OF “INAPPROPRIATE OR FRAUDULENT PRACTICES” Introduction The California refund proceeding employs a rate formula for calculating the MMCP (and resulting refunds) that relies on published natural gas spot prices in California or at the California border (California delivery points). Because of Commission Staff’s August 13, 2002 Report in dockets PA022, & EL00-95-045. CARE contends that the Refunds determined in this case are no longer legally based on whether or not the MMCP meets a “just and reasonable” standard, but now, due to the presence of “inappropriate or fraudulent practices”, whether or not the MMCP is in the “public interest”. CARE Page#1 therefore, requests consideration of CARE’s motion to reopen the refund hearing records for evidence of “inappropriate or fraudulent practices”. Staff’s Position In its August 13, 2002 report, Commission Staff concluded, among other things, that historically, the spot prices for natural gas at the California delivery points highly correlate with prices at producing basins and Henry Hub. During the months of October 2000 to July 2001 -the refund period in the California refund proceeding – staff found the correlation was abnormally low. Since that time, staff found the high correlation has resumed. Given this abnormal correlation for this isolated period, Staff attempted to independently verify the price data. Staff concluded that the data cannot be independently verified by the Commission to assure that they are statistically valid, reliable and free from the effects of price manipulation. Staff has therefore concluded that the reported prices are not appropriate for the Commission to use in computing the MMCP in the California refund proceedings. Staff indicates that, while there may be other alternatives, it examined two substitute gas mechanisms in detail and has recommended that the Commission use a substitute based on the spot price for natural gas in certain production basins plus the regulated cost of transportation. An uplift would be permitted for unaffiliated gas costs that exceed the input used for MMCP. This uplift will also capture some measure of scarcity. In light of Staff's conclusions on the cost of natural gas for purposes of determining refunds, and the extent to which implementation of these conclusions could affect the amount of refunds ultimately required in this proceeding, the Commission made findings on August 13, 2002 that it is appropriate to allow comment by parties on this issue before the Commission takes further action. Specifically, seeking comments on whether the Commission should change the method that is used to determine the cost of natural gas for purposes of calculating refunds in this proceeding, and, if so, what method should be used. Is Staff's recommended substitute method appropriate? If not, Page#2 what method should be used instead? And, what is an appropriate way to account for scarcity? CARE position and the nexus with “inappropriate or fraudulent practices” New information made available by the Commission Staff in its August 13, 2002 Report on Potential Manipulation of Short-Term Electric and Natural Gas Prices in the West, compels CARE to utilize such, to establish good cause, to seek a motion to reopen the refund hearing records for evidence of “inappropriate or fraudulent practices” which where specifically identified in the Commission Staff’s August 13, 2002 Report. This report finds that such “inappropriate or fraudulent practices” have a direct effect on the purported Mitigated Market Clearing Price (MMCP) identified as issue (1) in the proceedings in docket EL00-95-045. CARE contends the failure to include this vital, and timely information, which is already part of the administrative record, in this case, in the deliberations under hearing, makes such hearings a farce. CARE contends what has actual occurred in these so-called “public hearings” is to perpetrate a fraud on the public, that there now exists a legal and evidentiary basis for inducing the public’s reliance on implied and express claims and assurances that all the evidence was properly considered necessary to assure true and full disclosure of the facts in this case, when the facts in this proceeding’s Administrative Records evince the failure to do so. On August 2, 2002 the FERC Administrative Law Judge Birchman issued an order denying CARE’s request to reopen the evidentiary hearing records and request to sponsor witness testimony and evidence at the August hearing on mmcp issues that is said to concern alleged inappropriate or fraudulent practices, as part of the August 19th to August 23rd hearings to be located in San Francisco California (August 2, 2002 Order at 1). On July 29, 2002, CARE filed a motion for reconsideration of my Order issued on July 23, 2002. The July 23 Order granted its motion filed on July 19, 2002 for inclusion on the restricted service list and denied the request to sponsor witness testimony and Page#3 evidence at the August hearing on mmcp issues that is said to concern alleged inappropriate or fraudulent practices. My July 23 Order noted that I had adopted a Restricted Service list on August 31, 2001, that my rulings of record prior to the August 31, 2001, Order established procedures for inclusion on a Restricted Service List, and that CARE had not complied with those procedures and had not filed a motion seeking inclusion on the Restricted Service list prior to July 29, 2002. My July 23 Order also explained why the evidence which CARE denominated as mmcp evidence was beyond the scope of the issues set for hearing, including the mmcp issues set for hearing which have been adjudicated under the governing trial schedule. This Order was in response to CARE’s July 29, 2002, motion for reconsideration, before the ALJ. CARE identified it’s prior October 24, 2001 filings on the mmcp in our July 29, 2002 Motion at page 9. On October 24, 2001 (FERC Submittal 20011024-5001) we filed, CARE’s [Californians], Case Against Independent Energy Producers Association (“IEPA”), and California Parties including evidence of violations of law and requests for appropriate relief. This is where we first raised our assertions regarding “inappropriate or fraudulent practices” purportedly “not before [you], which are not among the issues set for hearing”(July 23, 2002 Order at 8). Are our assertions of “inappropriate or fraudulent practices” not before you because it was not raised timely, because you never deliberated on it, or because the “inappropriate or fraudulent practices” sited should have no relevance or bearing on the MMCP issues? We have consistently maintained our position that any transaction subsequent to exercise of market power have a direct bearing on the MMCP and any refunds owed to California are required to be based on the difference between the price charged and the cost of production, not the FERC’s “so-called” Mitigated Market Clearing Price (MMCP), because FERC’s issuance of market-based rate authority to all market participation are conditioned on market participants’ agreements not to exercise market power1. CARE has repeatedly raised the issue of the legality of spot-market and forward market transactions, which we contend have been contaminated by fraud. Figure 1 of PG&E’s market sales provides empirical evidence that its Page#4 market sales in the PX’s day-ahead markets had also been contaminated by fraudulent market practices prior to the refund effective period under hearing. This is a significant oversight that needs to be included here and in the ISO’s proposed Market Design proposed in docket ER02-1656. As currently proposed ER02-1656 is predicated on the assumption that sales into the new Day-Ahead markets will be disinfected from market power abuse and manipulation. How can such presumption be made, when P.G.&E. made 80% of its excess profit from its power sales for twelve months in the Day-Ahead markets, and no mitigation or refunds have been considered or proposed? Since, this was deemed outside the scope of the August hearings by the ALJ, neither this empirical evidence nor our October 24, 2001 Motion to establish a May 22, 2000 through June 19, 2001 refund effective date (FERC Submittal 20011024-5001) was allowed to be litigated. The ALJ failed to even discuss the fact that based on the August 13, 2002 Staff Report on Potential Manipulation of Short-Term Electric and Natural Gas Prices in the West, that the time period of January 1st, 2000 through April 1st, 2000 is the appropriate time interval to determine the appropriate pre- mitigation data to use as a baseline for applying the Mitigated Market Clearing Prices (MMCPs) litigated as Issue (1) in this proceeding in order to calculate refunds. The data from Figure 1 is derived by manually2 transposing hard copy data provided by P.G.&E. under docket EL02-71 covering its sales into three distinct energy markets. These are the Real-Time Market (or Spot Market), Real-Time and Hour Ahead markets, or Day-Ahead (Forward Market). 1 Pursuant to the FERC regulations and Orders approving power marketer’s market-based rates “the Commission allows sales at market-based rates if the seller (and each of affiliates) does not have, or has adequately mitigated, market power in generation and transmission and cannot erect barriers to entry.” 2 CARE wishes to acknowledge the work of its UCSC interns for spending approximately 40 hours transcribing hard copy data to MS Excel. CARE will provide this Excel format data via e-mail by request. Page#5 ISO Real Time Energy data covers the period 1/1/00 through 12/31/01, with a Mean Real Time Price of $31.43/MWh during the time interval 1/1/00 through 4/1/00. Utilizing this as the baseline Mitigated Market Clearing Price for the Utility’s sales in the spot market, P.G.&E. made a miniscule $54,261,339 excess profit on its spot market sales reported in the time interval 1/1/00 through 12/31/01. ISO Real Time and Hour Ahead energy sales data covers the period 1/1/00 through 12/31/01, with a Mean Real Time and Hour Ahead price of $32.36/MWh during the time interval 1/1/00 through 4/1/00. Utilizing this as the baseline Mitigated Market Clearing Price for the Utility’s sales in the Real Time and Hour Ahead markets, P.G.&E. made $807,101,088 excess profit on its a Real Time and Hour Ahead sales reported in the time interval 1/1/00 through 12/31/01. PX Day Ahead Energy data covers the period 1/1/00 through 12/27/00, with a Mean Day Ahead Price of $30.08/MWh during the time interval 1/1/00 through 4/1/00. Utilizing this as the baseline Mitigated Market Clearing Price for the Utility’s sales in the Day Ahead market, P.G.&E. made an astronomical $3,967,597,716 excess profit on its PX Day Ahead market sales reported in the time interval 1/1/00 through 12/27/00. Starting around May 22, 2000, the wholesale price of electricity dramatically increased in comparison to previous years and was far above the cost of producing electricity. Generators, marketers, their brokers, and the IOUs were able to charge these unreasonably high prices because of increased demand and tight electricity supply contrived by these same parties in concert with the producer controlled California Independent System Operator (ISO) board, through the with holding of generation, round-trip trading, and other fraudulent market practices. This is the time period that CARE alleges fraudulent Page#6 PG&E Daily Energy Sales for Real Time, Real Time & Hour Ahead, and Day Ahead Markets $120,000,000 $110,000,000 Total Daily Energy Sales ($) $100,000,000 $90,000,000 $80,000,000 $70,000,000 $60,000,000 $50,000,000 $40,000,000 $30,000,000 Real Time Energy Sales 1/1/00-4/1/00 Mean Price=$31.42637 Excess Profit=$54,261,339 Real Time & Hour Ahead Energy Sales 1/1/00-4/1/00 Mean Price=$32.36396 Excess Profit=$807,101,088 Day Ahead Energy Sales 1/1/00-4/1/00 Mean Price=$30.08143 Excess Profit=$3,967,597,716 $87,638,892 $85,642,305 $82,749,968 $80,298,629 $79,504,124 $72,425,808 $57,298,978 $50,586,620 $48,872,984 $42,913,377 $37,803,140 $33,480,990 $32,838,090 $26,197,391 $20,000,000 $10,000,000 $9,179,033 $7,407,261 $6,852,289 $2,526,337 $1,977,054 $5,503,002 $0 08/28/1999 12/06/1999 03/15/2000 06/23/2000 10/01/2000 01/09/2001 04/19/2001 07/28/2001 11/05/2001 02/13/2002 Delivery Date Figure 1 P.G.&E. ISO Real Time, ISO Real Time & Hour Ahead, and PX Day Ahead Energy Market Sales Page#7 market transactions first took place that contaminated subsequent market-based transactions by involved Generators, marketers, their brokers, and the IOUs, which where contrived by these parties in concert with the producer controlled ISO board. CARE provides the graph of IOU PG&E’s market –based sales into the PX Day-ahead, ISO Real Time, and Real Time and Hour Ahead Energy Markets. PG&E made forty million dollars in windfall profit on May 23, 2000 in its Day-ahead Market Sales into the PX, with a normal load sales price of about four million dollars per day (or $30.08/MWh) as the price for all the power sold in the PX day ahead market by PG&E. On June 13,14, & 15, 2000 PG&E made fifty five million, seventy million, and fifty three million excess profits respectively. This is the time period that CARE, in our FERC complaint in docket EL01-2, alleges fraudulent market transactions took place that contaminated subsequent market-based transactions by involved Generators, marketers, their brokers, and the IOUs which where contrived by these parties in concert with the producer controlled ISO board, to create a blackout in the San Francisco bay area contrived through the with holding of generation capacity, round-trip trading, and other fraudulent market practices. June 22, 23, & 24 witnessed a sharp price spike as a result of manipulation by El Paso Gas, who followed suit with generators by constraining capacity to raise the price of natural gas. PG&E made eighty two million on the 22nd, seventy-eight million on the23rd, and sixty-eight million on the 24th profits respectively in the PX Day-ahead markets. Did the spot prices for natural gas at the California delivery points correlate with prices at producing basins and Henry Hub for the time interval May 22, 2000 through October 2000?Is this the appropriate time interval for determining the appropriate pre-mitigation data to use as a baseline for applying the Mitigated Market Clearing Prices (MMCPs) Page#8 litigated as Issue 1 in this proceeding in order to calculate refunds? Can Staff conclude or certify that the data for the time interval May 22, 2000 through October 2000 can be independently verified by the Commission to assure that they are statistically valid, reliable and free from the effects of price manipulation? PG&E made eighty three million dollars profits on its Day-ahead market sales on December 12, 2000. Wholesale electricity prices soared, peaking at $1400 per megawatt hour on December 14th 2000, apparently because sellers had inside information prior to FERC’s December 15, 2000 Order implementing the so-called “soft” price cap. The utilities filed emergency motions with the California Public Utilities Commission to modify Rate Stabilization Plans (RSPs) to provide for 30 percent rate increases on December 14, 2000. FERC issued an order on December 15, 2000 requiring the dissolution of the producer controlled ISO board effective January 29, 2001. The December 15, 2000 Order allowed the IOUs to provide their generation capacity to support their native load requirements. Prior to the FERC’s December 15, 2000 Order in docket EL00-95 the IOUs where required by FERC regulations to sell their generation into the California Power Exchange (PX). PG&E ending its Day-ahead sales into the PX markets on December 27, 2000. The ALJ denied CARE an opportunity to allow cross-examination and production of witnesses nor did he accept our document as pre-filed hearing testimony in his Order (August 2, 2002 Order at 15). CARE’s July 19 motion requested the opportunity at the August 2002 hearing to sponsor expert testimony and evidence on “mmcp issues”. The “mmcp issues” which CARE belatedly seeks to address and to have adjudicated at the August hearing do not involve implementation of the Commission’s mitigated market clearing pricing methodology that have been stipulated by the participants and adjudicated earlier this year. Instead, CARE’s selfstyled “mmcp issues” are said to concern alleged inappropriate or Page#9 fraudulent utility practices. CARE’s motion for reconsideration elaborates that it wishes to sponsor witness testimony in support of a document styled “How Deregulation Let the Power Industry Steal $71 Billion From California. CARE claims that this report “shows that California was not a victim of the laws of supply and demand, as it has been widely portrayed. The California energy crisis, instead, was a public relations hoax—orchestrated by the power industry that will cost $2,200 for every Californian.” August 13, 2002, the FERC Staff issued a press release confirming beyond any reasonable doubt that the so-called “inappropriate and fraudulent market practices” CARE cited are highly likely to have occurred during the refund period under hearing in the August 19th to August 23rd 2002 hearings in San Francisco California. Today's Commission actions stem from findings in an interim FERC Staff Report, also issued today, on potential manipulation of shortterm electric and natural gas prices in the West. Key findings and recommendations in the staff fact-finding investigation are: • there exists sufficient evidence to warrant formal investigations of possible violations of the Federal Power Act by Portland General Electric Company, Enron Power Marketing, Inc., Enron Capital Trade Resources Corporation, El Paso Electric Company and Avista Corporation and Avista Energy. • historically, the spot prices for natural gas at the California delivery points highly correlate with prices at producing basins and Henry Hub. During the months of October 2000 to July 2001 – the refund period in the California refund proceeding – the correlation was abnormally low. Since that time, the high correlation has resumed. • given the abnormal correlation for this isolated period, staff attempted to independently verify the price data to assure that it is statistically valid, reliable and free from the effects of price manipulation. • the published natural gas spot prices at the California border–California delivery points–used as a basis for refunds in the pending California refund proceedings (Docket Nos. EL00-95-045 and EL00-98-042) cannot be independently verified and may have been manipulated. • Enron's trading strategies, described in the previously released Enron memos, used false information in an attempt to manipulate prices. Page#10 • staff recommends that the Commission require that all marketbased rate tariffs include language specifically prohibiting misleading or false misinformation. This will allow refunds for any revenues obtained in violation of the tariff. • staff recommends that the Commission reevaluate the "simultaneous offer" rule that it uses to discipline affiliate transactions to ensure that it is effective and verifiable. • staff endorses expanded civil penalty authority applicable to jurisdictional companies that violate Commission orders and regulations. CARE’s answers to specific questions before the Commission 1. Should the Commission change the method that is used to determine the cost of natural gas for purposes of calculating refunds in this proceeding? To answer this question the Commission staff must answer the following data requests. a. Did the spot prices for natural gas at the California delivery points correlate with prices at producing basins and Henry Hub for the time interval May 22, 2000 through October 2000? b. Is this the appropriate time interval for determining the appropriate premitigation data to use as a baseline for applying the Mitigated Market Clearing Prices (MMCPs) litigated as Issue 1 in this proceeding in order to calculate refunds? c. Can Staff conclude or certify that the data for the time interval May 22, 2000 through October 2000 can be independently verified by the Commission to assure that they are statistically valid, reliable and free from the effects of price manipulation? We have consistently maintained our position that any transaction subsequent to exercise of market power have a direct bearing on the MMCP and any refunds owed to California are required to be based on the difference between the price charged and the cost of production, not the FERC’s “socalled” Mitigated Market Clearing Price (MMCP), because FERC’s issuance Page#11 of market-based rate authority to all market participation are conditioned on market participants’ agreements not to exercise market power3. This is a matter in the “public interest”; therefore the “just and reasonable” standard need not be applied. 2. What method should be used? Based on the August 13, 2002 Staff Report on Potential Manipulation of Short-Term Electric and Natural Gas Prices in the West, and PG&E’s market – based sales into the PX Day-ahead, ISO Real Time, and Real Time and Hour Ahead Energy Markets, the time period of January 1st, 2000 through April 1st, 2000 is the appropriate time interval to determine the appropriate pre-mitigation data to use as a baseline for applying the Mitigated Market Clearing Prices (MMCPs) litigated as Issue (1) in this proceeding in order to calculate refunds. 3. Is Staff's recommended substitute method appropriate? If not, what method should be used instead? No, Staff’s recommended use of a substitute based on the spot price for natural gas in certain production basins plus the regulated cost of transportation, does not address or mitigate the effects of “inappropriate or fraudulent practices” by sellers of natural gas and/or energy during the time interval May 22, 2000 through October 2000. CARE’s position is that January 1st, 2000 through April 1st, 2000 is the appropriate time interval to determine the appropriate pre-mitigation data to use as a baseline for applying the Mitigated Market Clearing Prices (MMCPs) litigated as Issue (1) in this proceeding in order to calculate refunds. Refunds should include all markets contaminated by exercise of market power and other “inappropriate or fraudulent practices” by sellers, including the PX Day-Ahead and forward markets including CERS contracts. Refunds must cover the refund effective 3 Pursuant to the FERC regulations and Orders approving power marketer’s market-based rates “the Commission allows sales at market-based rates if the seller (and each of affiliates) does not have, or has Page#12 period May 22, 2000 through June 19, 2001, to mitigate all market power abuses by all sellers, and to do so in the “public interest”. 4. What is an appropriate way to account for scarcity? CARE’s position on the appropriate way to account for scarcity rents is as follows: a. Determine (for both electricity and natural gas) on a regional basis the native generation capacity and available contractually obligated import capacity for a given delivery area. b. Determine the historic maximum load requirements (constrained market) for the delivery area, (for both electricity and natural gas) and the historical Market Price for energy or gas sold. Such historic load maximum, and associated Market Price, must be based on data Certified by the Commission to be free from contamination from market power abuse by the Commission in order to establish this benchmarked Market Price and maximum load (i.e., the time interval May 22, 2000 through June 19, 2001 does not apply). Such must include the Commission’s Certification that there now exists a legal and evidentiary basis for inducing the public’s reliance on implied and express claims and assurances that all the evidence was properly considered necessary to assure true and full disclosure of the facts in determining the historic load maximum, and associated Market Price. c. Determine (for both electricity and natural gas) those generation sources that are with holding generation capacity due to planned or unplanned outages. Such determination must determine whether or not the source in question is contractually obligated to deliver under Reliable Must Run, other contractual agreements, and/or the Commission’s “Must Offer” requirements. Those sources found to be with holding capacity in violation of the Commission’s Orders, their contractual obligations, or dispatch adequately mitigated, market power in generation and transmission and cannot erect barriers to entry.” Page#13 orders from ISO, must be assessed a with holding penalty against all such sales, which must be passed onto the buyer and/or consumers. d. Those Sellers (both electricity and natural gas) whose sales are required because of load demand in excess of the historic native generation capacity and available contractually obligated import capacity for a given delivery area, whose sale price does not exceed the associated maximum Market Price as Certified by the Commission, and sources found not to be with holding generation capacity in violation of the Commission’s Orders, their contractual obligation, or dispatch orders from ISO, may be allocated scarcity rent, on a prorated basis as determined by the ISO subject to the Commission’s Order on such. Conclusion CARE respectfully submits our comments on the method for determining natural gas prices for purposes of calculating refunds along with a Request for Consideration of CARE’s motion to reopen the refund hearing records for evidence of “inappropriate or fraudulent practices”. CARE contends that the Refunds determined in this case are no longer legally based on whether or not the MMCP meets a “just and reasonable” standard, but now, due to the presence of “inappropriate or fraudulent practices”, whether or not the MMCP is in the “public interest”. Respectfully submitted, President, CARE dated this 10th day of September 2002. (831) 465-9809 5439 Soquel Drive Soquel, CA 95073 E-mail: michaelboyd@sbcglobal.net Certificate of Services Page#14 I hereby certify that I have this day served the foregoing document upon each person designated on the official restricted service list, via electronic mail, compiled by the Secretary in this proceeding in Docket EL00-95 et.al. Rule 2010(f)(3) provides that you may serve pleadings by email. I further certify that those parties without electronic mail have been served this day via US mail or via ListServ. Verification I am an officer of the complaining corporation herein, and am authorized to make this verification on its behalf. The statements in the foregoing document are true of my own knowledge, except matters, which are therein stated on information and belief, and as to those matters I believe them to be true. I declare under penalty of perjury that the foregoing is true and correct. Dated this 10th day of September 2002. Respectfully submitted, President, CARE (831) 465-9809 5439 Soquel Drive Soquel, CA 95073 E-mail: michaelboyd@sbcglobal.net Page#15