Invoicing Protocol to be issued at Project Start Up

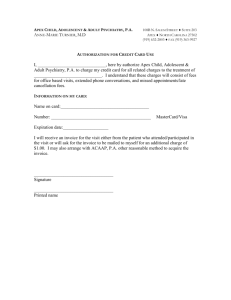

advertisement

Defence Contamination Projects Invoicing Protocol Monthly Invoicing Schedule Monthly Invoices Email to Defence Project Manager will supply mandatory details/requirements to be included in invoices. The format for invoicing schedule is to be agreed at start up. Email to the Defence finance area in format below – Do not provide hard copy. (can include DPM as a copy recipient if agreed with DPM). Defence Project Manager. Should include task breakdown and phasing to track project. Defence Project Manager. Separate invoices are required by the 19th of each month for work performed/delivered only. A signed statement is to be attached with each invoice outlining the delivered work and a % for work progressing. Invoice information upon engagement of Company regarding invoice protocol: A correctly rendered tax invoice includes: • Tax invoice details as required by the Australian Taxation Office A New Tax System (Goods and Services Tax) Act 1999 (we conform generally - but come and ask me if you are worried) • Defence Purchase Order number - XXXXX • Invoice number and date • Defence point of contact name, telephone number and email address • Description and value of goods and/or services supplied Additional Contamination Recommendation for project finance monitoring - a statement of deliverable completion i.e. an attachment with their Schedule 1 table with a % of completion e.g. 30% of Project Management completed. What’s not appropriate? • A handwritten tax invoice • Suppliers issuing invoices before the goods and/or services have been supplied • Defence paying the invoice before the goods and/or services have been supplied Document Control: Issued: Version 2.0 NCRP, 21 May 2012 1