The Midwest hosts large pharmaceutical, including Abbott and

advertisement

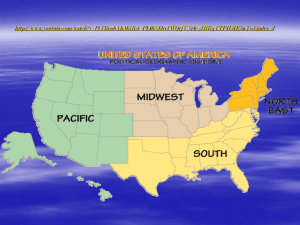

Midwest Life Sciences Overview The Midwest hosts large pharmaceutical companies, including Abbott and Baxter in Chicago, and Eli Lilly in Indiana. These large pharma companies have become the significant buyers of basic research from biotech nationwide and internationally. They are increasingly looking to smaller biotech companies as their pipeline to new and innovative products. It also boasts a strong medical devices industry. Ten of the top 20 companies have their headquarters in the Midwest with another four companies with significant operations in the Midwest. Minneapolis area is the leader in numbers of patent inventors. Minneapolis hosts Medtronic, Inc and Guidant, which was acquired by Boston Scientific.; Milwaukee hosts GE Medical Systems (high-end imaging); the area around Warsaw, Indiana hosts the prosthesis industry; and the Chicago area is home to Hospira and Takeda. Some of the nation’s largest distributors of medical equipment and drugs are situated in the region. These include number two distributor in the US, Cardinal Health, largest pharmacy benefits management, Express Scripts, and largest institutional pharmacy services provider Omnicare. These companies take advantage of the central location and advanced logistics infrastructure to ship across the nation. Five of the nation’s top hospitals are located in the Midwest • Mayo Clinic (Rochester, Minnesota) • Cleveland Clinic (Cleveland, Ohio) • Barnes-Jewish Hospital/Washington University (St. Louis, Missouri) • University of Michigan Hospitals and Health Centers (Ann Arbor, Michigan) • University of Chicago Medical Centers (Chicago, Illinois) The Midwest has long been a major player in the nation's strong Research and Development infrastructure. Many Midwest institutions number among the nations' leaders in R&D spending as well as in the metrics of technology transfer. Overall academic R&D funding in Midwest states tends to be above the U.S. average. Collectively, universities within the Midwest region accounted for $9.9 billion or 19% of total US institutional R&D expenditures in FY2007. NIH Research accounted for $4.5 billion or 21%. The metro areas of Chicago, St. Louis, and Detroit are considered some of the top research centers in the nation. Midwest health care startups received more than $1 billion in investments for 165 companies through 2008; up slightly from 2007’s record breaking $1 billion total. Ohio and Minnesota once again led all Midwestern states in health care investment, with Cleveland and Minneapolis again leading all regions. Still venture capital is scarcer in this area than on either coast. Additionally, the venture capital dollars available in Midwest must cover a greater region than the concentrated capital on the coasts. Midwest investors lack proximity, making interaction for networking and deal syndication less frequent and less efficient. In addition, the average size fund in Midwest is relatively small ($25 - $50 million) compared to the coastal funds of $100+ million. Largest Life Science Companies in the Midwest (sales) Cardinal Health $99.512 Bil Pharmaceuticals Distribution & Wholesale Abbot $29.528 Bil Pharmaceuticals Manufacturer Medtronic $14.599 Bil Medical Devices Manufacturer Baxter $12.348 Bil Biopharmaceuticals & Biotherapeutics Manufacturer St. Jude Medical $4.363 Bil Medical Devices Manufacturer Zimmer $4.121 Bil Medical Devices Manufacturer 3M Healthcare $3.790 Bil Dental, Medical supplies, Health IT Omnicare $6.311 Bil Pharmaceuticals Distribution & Wholesale Hospira $3.630 Bil Pharmaceuticals Manufacturer Eli Lilly $20.378 Bil Pharmaceuticals Manufacturer Stryker $6.718Bil Medical Devices and Supplies Manufacturer Patterson $3.094 Bil Dental Equipment Distribution Illinois Illinois is home to many of the world's leaders with total sales around $47.5 bil. These companies include Abbott Laboratories, Baxter International, TAP Pharmaceuticals, Hospira, Akzo Nobel, Medline Industries, Dade Behring, Abraxis BioScience, etc. Chicago’s Drug & Pharmaceutical industry employment concentration is 90% higher than the national average. It represents over 6.1% of total U.S. Drug & Pharma employment Indiana Indiana was identified as one of the nation's top four life sciences leaders as defined by number and concentration of life sciences-related jobs. The major sectors are health care delivery, pharma, and medical devices, they generate $14 billion a year for Indiana. The state is a home to such industry giants as Eli Lilly, Biomet, Cook Group, Inc. and Zimmer, WellPoint. Indiana boasts the second largest medical school in the U.S. (Indiana University School of Medicine) and hosts the highly successful incubator, Indiana University's Emerging Technologies Center. Iowa More than 1,100 companies are engaged in Iowa’s biosciences industry, ranging from large international companies, to small start-ups. According to the Battelle Memorial Institute's Technology Partnership Practice Report, Iowa's strengths are in animal and plant sciences, bioeconomy, biomedical imaging, drug discovery, development piloting and production, advanced food products, biosecurity/biodefense, post-genomic medicine, and animal systems. Thanks to legislation encouraging equity investments, the establishment of several venture capital community funds and a growing network of local investors, capital is readily available for companies in the biosciences. Kansas More than 20,000 jobs in Kansas are associated with the state’s bioscience companies and research universities. Kansas is home to more than 160 bioscience companies employing 11,000 to 13,000 people Kentucky Kentucky is home to hundreds of bioscience and biotechnology-related companies, working in areas from nutrigenomics and pharmaceuticals to natural products and medical devices. Kentucky has established Commonwealth Seed Capital, LLC, to invest state funds in support of early-stage technology companies in Kentucky. The state also maintains a series of funds that promote and provide capital for early-stage technology commercialization. The Kentucky Enterprise Fund has invested over $7.7 million in 151 companies throughout the state. Michigan Michigan is home to such companies as Stryker, Amway, Perrigo, Autocam, etc.With over $2 billion invested in R&D each year and nearly 100 new companies since 2000, Michigan leads the nation as one of the fastest growing life sciences states. Michigan's life sciences industry focuses on the following areas: Pharmaceuticals, Medical devices, Instrumentation, Diagnostics, Biotechnology research and ancillary services Minnesota Minnesota ranked 14th among states in biotech growth leadership. There are 585 FDA approved medical device establishments currently in Minnesota. The state’s companies are particularly strong in medical devices. Some of the US’s leading companies operate in the state including, Medtronic, 3M, Boston Scientific Scimed, St. Jude Medical, Patterson Companies, American Medical Systems, the Mayo Clinic, Amplifon USA, MGI Pharma, and others. Between 2002 and 2006, Minnesota registered 2,333 patents in medical decides, ranking second in the nation. Missouri This is a growing industry in the state with focus on chemical and medical device manufacturing. Pharmaceutical manufacturing is significant in Missouri with companies such as Pfizer, K-V pharmaceuticals and Aventis operating facilities in the sate. In the medical equipment the focus is on microbial detection, molecular diagnostics, immunoassay, clinical software, pathogen detection, refractive laser, surgery devices, and weighing systems. The companies active in these sectors are Bausch & Lomb Surgical, and Cardinal Scale. Nebraska -$24 million Chemical Engineering complex is largely dedicated to bioprocessing, including a planned GMP pilot fermentation plant for Phase I/II clinical materials. -In Lincoln, the George W. Beadle Center for Genetics and Biomaterials Research, is a $32 million, 140,000 sq. ft. facility located on UNL’s main campus. The center also houses the UNL Center for Biotechnology, the Nebraska Center for Virology, the Redox Biology Center, and the UNL Plant Science Institute. Ohio The state was ranked 4th nationally in the Biotech strength by the Business Facilities Magazine. There are around 818 bioscience-related entities operating in the state, and from 2004 to 2007, an average of 55 new bioscience companies began operation in Ohio each year. Ohio’s strength in the biological sciences has led to a concentration in the fields of cancer and cardiovascular research and treatment, genomics, genetics, and neurology. As mentioned above Ohio life science’s startup lead the Midwest in attracting venture capital investments. Wisconsin Bioscience in Wisconsin contributes over $6.9 billion to the state's economy. Wisconsin bioscience industry, comprised of 338 companies throughout the state, had revenues of $6.4 billion in 2005. Wisconsin's companies are active in medical imaging, diagnostics and medical devices - and food and agricultural biosciences. Wisconsin's bioscience company revenue has seen an annualized growth rate of 15 percent since 2003.Wisconsin bioscience industry is young and growing. Half of the companies in the sector are less than 10 years old. Two-thirds are less than 15 years old and employ 22,372 people in the state. Most of the bioscience companies in Wisconsin developed from scientific discoveries made in Wisconsin's academic research laboratories.