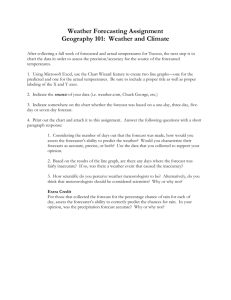

3.Financial Planning and Forecasting

advertisement

Unit 3 Financial Planning and Forecasting Overview Managers and investors need to understand how to forecast future results. Managers use pro forma, or projected, statements and use them in four ways. First, by looking at projected statements, managers can assess whether the firm’s anticipated performance is inline with the firm’s internal targets and with investors’ expectations. Second, pro forma statements can be used to estimate the impact of proposed operating changes. Third, managers use pro forma statement to anticipate the firm’s future financial needs, and then arrange the necessary financings. Finally, projected financial statements are used to estimate free cash flows, which determine the firm’s overall financial value. Managers forecast their capital requirements, and then choose the plan that maximizes shareholder value. Security analysts make the same type of projections as managers, and influence the investors, who determine the future of managers. In this chapter we explain how to create and use pro forma statements, beginning with the strategic plan, the foundation for pro forma statements. We focus on three key elements of the financial plan: (1) the sale forecast, (2) pro forma financial statements, and (3) the external financial plan. Outline Value creation is impossible unless a company has a well-articulated plan. Most companies have a mission statement, a condensed version of a firm’s strategic plan. Strategic plan and mission statements usually begin with a statement of the overall corporate purpose. The corporate scope defines a firm’s lines of business and geographic area of operations. Corporate objectives set forth specific goals for management to attain, which can be specify both in qualitative and quantitative terms. Most companies have multiple objectives, and revise theses as business conditions □. changes. Once a firm has defined its purposes, scope, and objectives, it should develop a strategy for achieving its goals. □. Corporate strategies are broad approaches rather than detailed plans. 1 □. Corporate strategies should be both attainable and compatible with the firm’s purposes, scope, and objectives. Operating plans can be developed for any time horizon, but most companies use a five year horizon. The plan is intended to provide detailed implementation guidance, based on the corporate strategy, to help meet the corporate objectives. It explains in considerable detail who is responsible for a particular function, when specific tasks are to be accomplished, sales and profit targets, and the like. Large multidivisional companies break down their operating plans by division. Each division has its own goals, mission, and plan for meeting its objectives, and theses plans are then consolidated to form the corporate plan. The financial planning process can be broken down into six steps: (1) Development of projected financial statements, (2) determination of the funds needed to support the five year plan, (3) forecast of funds availability over the next five years, (4) establishment and maintenance of a system of controls governing the allocation and use of funds within the firm, (5) development of procedures to adjust for adjusting the basic plan, and (6) establishment of a performance-based management compensation system. Although the type of financial forecasting described in this chapter can be done with a hand calculator, virtually all corporate forecasts are made using computerized forecasting models. Spreadsheets have two major advantages over pencil-and –paper calculations. □. It is much faster to construct a spreadsheet model than to make a “by-hand” forecast if the forecast period extends beyond a year or two. □. A spreadsheet model can recalculate the projected financial statements and ratios almost instantaneously when one of the input variables is changed, thus making it easy for managers to determine the effects of changes in variables such as sales. The sales forecast generally begins with a review of sales during the past five to ten years. The sales forecast is a forecast of a firm’s units and dollar sales for some future period, and is generally based on recent sales trends plus forecasts of the economic prospects for the nation, region, industry and so on. If the sales forecast is off, the consequences can be serious. Thus, an accurate sales forecast is critical to the firm’s well being. Once sales have been forecasted, future balance sheets and income statements must be forecast. The most commonly used technique is the percent of sales method, which begins 2 with the sales forecast, expressed as an annual growth rate in dollar sales revenue. The percent of sales method is a method of forecasting future financial statements that expresses each account as a percentage of sales. These percentages can be constant or they can change overtime. □. The period in which the forecasted sales hold is called the explicit forecast period, with the last year being the forecast horizon. □. Population growth and inflation determine the long-term growth rate for most companies. □. Companies often have a competitive advantage period, during which they can grow at rates higher than the long-term growth rate. □. Many items on the income statement and balance sheet are often assumed to increase proporti0nately with sales. Items are not tied directly to sales depend on the company’s policies and the managers’ decisions. The constant ratio method of forecasting is a forecasting approach in which the forecasted percentage sales for each item is the same as the actual percentage for the year preceding the forecast period. The first step in using the percent of sales method is to forecast the next year’s income statement to estimate income and the addition to retained earnings. □. A sales forecast is needed. □. The percent of sales method assumes initially that all costs except depreciation are a specified percentage of sales. □. In the simplest case, costs are assumed to increase at the same rate as sales; in more complicated situations, specific casts are forecasted separately. □. Interest and preferred dividend amounts are simply prior year amounts carried over to the forecast period. These amounts are changed when external financing requirements are analyzed in a later step. The second step is to forecast next year’s balance sheet. □. All asset accounts can be assumed to increase directly as percentage of sales unless the firm is operating at less than full capacity. If the firm is not operating at full capacity, then fixed assets will not vary with directly sales, but the cash, receivable, and inventory accounts will increase as a percentage of sales. □. Liabilities, equity, or both must also increase if assets increase---assets expansions 3 must be financed in some manner. □. Certain liability accounts, such as accounts payable and accruals, can be expected to increase spontaneously with sales. These are spontaneously generated funds, obtained automatically from routine business transactions. □. Retained earnings will increase, but not proportionally with sales. The new retained earnings will be determined from the projected income statement. □. Other financial accounts, such as short-term debt, long-term debt, preferred stock, and common stock, are not directly related to sales. Changes in theses accounts result from managerial financing decisions; they do not increase spontaneously as sales increase. □. The difference between projected total assets and projected liabilities and capital is the amount of additional funds needed (AFN). AFN are funds that a firm must raise externally through borrowing or by selling new common or preferred stock. The third step is the decision on how to finance the additional funds required. Sometimes contractual agreements, such as a limit on the debt ratio, will restrict the firm’s financing decisions. Other factors that the financial staff must consider are3 the firm’s target capital structure, the effect of short-term borrowing on its current ratio, and conditions in the debt and equity market. One complexity arises in financial forecasting relates to financing feedbacks, which are the effects on the income statement and balance sheet of actions taken to finance asset increases. In view of the fact that all of the data are based on forecasts, and since the adjustments add substantially to the work but relatively little to the accuracy of the forecast, we leave them to later finance courses. Once the pro forma financial statements have been developed, the key ratios can be analyzed to determine whether the forecast meets the firm’s financial targets as set forth in its financial plan. If the statements do not meet the target, then elements of the forecast must be changed. □. A spreadsheet model can e run using different sales growth rates, with the results analyzed to see how the ratios would change under different growth scenarios □. A spreadsheet model can also be used to evaluate dividend policy, financing alternatives, and alternative working capital policies. Forecasting is an iterative process, both in the way the financial statements are generated and the way the financial plan I developed. 4 □. For planning purposes, the financial staff develops a preliminary forecast based on a continuation of past policies and trends. This provides a starting point, or “baseline” forecast. □. Projections are modified to see what effects alternative operating plans would have on the firm’s earnings and financial conditions. This results in a revised forecast. □. Alternative operating plans are examined under different sales growth scenarios, and the model is used to evaluate both dividend policy and capital structure decisions. Free cash flow is calculated as follows: FCF = Operating cash flow — Gross investment in operating capital Alternatively, free cash flow can be calculated as : FCF = NOPAT —Net investment in operating capital. □. Free cash flow represents the amounts of cash generated in a given year minus the amount of cash needed to finance the additional capital expenditures and working cpital needed to support the firm’s growth. □. Forecasts of free cash flows are used by investors and financial managers to estimate the firm’s stock price. Although forecasts of capital requirements are always made by constructing pro forma financial statements as described above, if the ratios are expected to remain constant an approximation can be obtained by using a simple forecasting formula. The formula is as follows: Additional funds needs = Required increase in assets — Spontaneous increase in liabilities — Increase in retained earning Or AFN = (A*/S0)△S — (L*/S0)△S — MS1(RR) □. A*/S0 = assets that must increase if sales are to increase, assets that are tied directly to sales. □. L*/S0 = liabilities that increase spontaneously as percentage of sales, or spontaneously generated financing per $1 increase3 in sales. □. S1 = total expected sales for the year in question. S0 = last year’s sales. □. △S = change in sales = S1 — S0. □. M = profit margin, or profit per $1 of sales. □. RR is the retention ratio, which is the percentage of net income that is retained. • RR is also equal to 1—payout ratio. • the retention ratio and payout ratio must total to 100%. 5 The equation shows that external financing requirements depend on five factors: □. Rapidly growing companies require large increase in assets, other things held constant, so sales growth is an important factor. □. The amount of assets required per dollar of sales, or capital intensity ratio, has a major effect on capital requirements. Companies with a high ratio of assets-to-sales ratios require more assets for a given increase in sales, hence a greater need for external financing. □. Companies that spontaneously generate a large amount of liabilities from account payable and accruals will have a relatively small need for external financing. □. The higher the profit margin, the larger net income available to support the increases in assets, hence the low need for external financing. □. Companies that retain more of their earnings as opposed to paying them out as dividends will generate more retained earnings and hence have less need for external financing. The AFN formula provides an accurate forecast only for companies whose ratios are all expected remain constant, and may be used to provide a quick estimate of external financing requirements. But in planning process the actual additional funds needed should be calculated by projected financial statements. Both the AFN formula and the projected financial statement method assume that the ratios of assets and liabilities to sales remain constant over time. This, in turn, requires the assumption that each “spontaneous” asset and liability item increases at the same rate as sales. The assumption of constant ratios and identical growth rates in appropriate at times, but there are times when it is incorrect. Where economies of scale occur in asset use, the ratio of that asset to sales will change as the size of the firm increases. Technological considerations sometimes dictate that fixed assets be added in large, discrete units, often referred to as lumpy assets. This automatically creates excess capacity immediately after a plant expansion. Forecast errors can cause the actual assets/sales ratio for a given period to be quite different from the planned ratio, resulting in excess capacity. If any of the above conditions apply (economies of scales, lumpy assets, or excess capacity), the A*/S0 ratio will not be constant, and the constant growth forecasting methods should not be used. Rather techniques must be used to forecast asset levels to determine additional 6 financing requirements. Two of these methods include linear regression and excess capacity adjustment. If one assumes that the relationship between a certain type of asset and sales is linear, then one can use simple linear regression techniques to estimate the requirements for that type of assets for any given sales increase. An estimated regression equation is determined that provides an estimated relationship between a given asset account and sales. If a firm’s fixed assets are not operating at full capacity, then the calculation for required level of fixed assets will need to be adjusted. □. Full capacity sales are actual sales divided by the percentage of capacity at which the fixed assets were operated to achieve these sales: FullCapacityScale ActualSales PercentageOfCapacityOperated □. The target fixed assets to sales ratio is equal to the current year’s fixed assets divided by full capacity sales: T arg etFixedAssetToSalesRatio ActualFixedAssets FullCapacitySales □. The required level of fixed assets is equal to the target fixed assets to sales ratio times projected sales: Required level of fixed assets = (Target fixed assets to sales ratio)(Projected dales) Question 1. Those asset items that typically increase proportionally with higher sales are _______ , ______, and _______. ________ assets are frequently not used to full capacity, when that occurs, do not increase as percentage of sales. 2. Short-term and long-term _______, _______ stock, ________ stock, and ________ earnings are examples of accounts that do not increase proportionately with higher level of sales. 3. The amount of assets that are tied directly to sales, A*/S0, is often called the _______ ________ ratio. 4. The _______ _____ _______ method involves projecting the asset requirements for the coming period, then projecting the liabilities and equity will be generated under normal operations, and subtracting the projected liabilities and capital from the required assets to 7 estimate the _________ _______ _______. 5. _______ _______ ________ is defined as actual sales divided by the percentage of capacity at which fixed assets were to operated to achieve those sales. 6. If the capital intensity ratio of a firm actually decreases as sales increase, use of formula method will typically overstate the amount of additional funds required, other thing held constant. a. True b. False 7. Which of the following would reduce the additional funds required if all other things held constant? a. An increase in the dividend payout ratio. b. A decrease in the profit margin. c. An increase in the capital intensity ratio. d. An increase in the expected sales growth rate. e. A decrease in the firm’s tax rate. 8. Which of the following statements is most correct? a. Suppose economies of scale exist in a firm’s use of assets. Under this condition, the firm should use regression method of forecasting asset requirements rather than the percent of sale method. b. If a firm must acquire assets in lumpy units, it can avoid errors in forecasts of its need for funds by using the linear regression method of forecasting asset requirements because all the points will lie on the regression line. c. If the economies of scale in the use of assets exist, then the AFN formula rather than the percent of sales method should be used to forecast additional funds requirements. d. Notes payable to banks are included in the AFN formula, along with a projection of retained earnings. e. One problem with AFN formula is that it does not take account of the firm’s dividend policy. Questions 1. United Products Inc.’s business has been slow; therefore, fixed assets are vastly underutilized. Management believes it can double sales nest year with the introduction of a new product. No new fixed assets will be required, and management expected that there will be no earnings retained next year. Under the following conditions, what is the next 8 year’s additional financing requirement? Current assets $5,000 Accounts payable $1,000 Notes payable 1,000 5,000 Long-term debt 4,000 _______ Common equity 4,000 Net fixed assets Total assets a. $0 $10,000 b. $4,000 Total liabilities and equity $10,000 c. $6,000 d. $13,000 e. $19,000 2. The 2000 balance sheet for American Pulp and Paper is shown below (in million dollars) Cash $ 3.0 Account receivable 3.0 Inventory 5.0 Accounts payable Notes payable Total current assets $11.0 Fixed assets Total assets $ 2.0 1.5 Total current liabilities $ 3.5 3.0 Long-term debt 3.0 ______ Common equity 7.5 $ 14.0 Total liabilities and equity $ 14.0 In 2000, sales were $60 million. In 2001 management believes that sales will increase 20 percent to the total of $72 million. The profit margin is expected to 5 percent, and the dividend payout ratio is targeted at 40%. No excess capacity exists. What is the additional funds needed (in millions) for 2001 using the formula method? 3. Refer to Problem 2, how much can sales grow above the 2000 level of sales of $60 million without requiring any additional funds? a. 12.28% b. 14.63% c. 15.75% d. 17.65% e. 18.45% 4. Smith Machines Inc. has a net income this year of $500 on sales of $2,000 and is operating its fixed assets at full capacity. Management expects sales to increase at 25 percent nest year and is forecast a dividend payout ratio of 30 percent. The profit margin is not expected to change. If spontaneous liabilities are $500 this year and no excess funds are expected next year, what are Smith’s total assets this year? a. $1,000 b. $1,500 c. $2,250 d. $3,000 e. $3,250 (The following data apply to the next three problems) Crossley Products Company Balance Sheet as of December 31, 2000 (Thousands of dollars) 9 Cash $ 600 Accounts payable Receivable 3,600 Notes payable Inventory 4,200 Accruals Total current assets $ 8,400 Net fixed assets 1,157 840 Total current liabilities $ 4,397 Mortgage bonds 1,667 Common stock 667 7,200 Total assets $ 2,400 Retained earnings $ 15,600 8,869 Total liabilities and equity $ 15,600 Crossley Products Company Income Statements for December 31, 2000 (Thousands of dollars) Sales $12,000 Operating costs 10,261 Earnings $ 1,739 Interest 339 Earnings before taxes $ 1,400 Taxes (40%) 560 Net income $ 840 Dividends (60%) $ 504 Additional retained earnings $ 336 5. Assume that the company was operating at full capacity in 2000 with regard to all items except fixed assets; fixed assets in 2000 were utilized to only 75 percent of capacity. By what percentage could 2001 sales increase over 2000 sales without the need for an increase in fixed assets? a. 33% b. 25% c. 20% d. 44% e. 50% 6. Now suppose 2001 sales increase by 25 percent over 2000 sales. Assume that Crossley cannot see any fixed assets. Use the percent of sales method to develop a pro forma balance sheet and income statement. Assume that any required financing is borrowed as notes payable. Use a pro forma income statement to determine the additional external capital (in thousands) will be required. a. $825 b. $925 c. $750 d. $900 e. $850 7. Refer to problem 6. After the required financing is borrowed as notes payable, what is is 10 the firm’s current and debt ratio? a. 1.73; 38.84% b. 2.02; 38.84% c. 1.73; 44.06% d. 1.73; 43.64% e. 2.02; 44.06% (The following data apply to the next two problems) Taylor Technologies Inc. Balance Sheet as of December 31,2000 Cash $ 90,000 Accounts payable $ 180,000 Receivables 180,000 Notes payable 78,000 Inventory 360,000 Accruals 90,000 Total CA $ 630,000 Net fixed assets 720,000 Total assets $ 1,350,000 Total CL $ 348,000 Common stock 900,000 Retained earnings 102,000 Total L$E $ 1.350,000 Taylor Technologies Inc. Income Statement for December 31,2000 Sales $ $1,800,000 Operation costs 1,639,860 EBIT $ $ 160,140 Interest 10,140 EBT $ $ 150,000 Taxes (40%) 60,000 Net income $ $ 90,000 Dividends (60%) $ 54000 Addition to retained earnings $ 36,000 8. Suppose that in 2001,sales increase by 10 percent over 2000 sales. Construct the pro forma financial statements using the percent sales method. Assume the firm operated at full capacity in 2000. how much additional capital will be required? a. $72,459 b. $70,211 c. $68,157 d. $66,445 e. $63,989 9. Refer to problem 8. Assume now that fixed assets are only being operated at 95 percent of capacity. Construct the pro forma financial statements using the percent of sales method. How much additional capital will be required? a. $28,557 b. $32,400 c. $39,843 d. $45,400 e. $50,000 11 10. Answers for questions (Financial Planning and Forecast) 1. cash; receivable; inventory; Fixed 2. debt; preferred; common; retained 3. capital intensity 4. percent of sales; additional funds needed 5. Full capacity sales 6. a. A decreasing capital intensity ratio, A*/S0, means that fewer assets are required, proportionately, as sales increase. Thus, the external funding requirement is overstated. Always keep in mind that the formula method assumes that the asset/sales ratio is constant regardless of the level of sales. 7. e. Answer a through d would increase the additional funds required, but an decrease in the tax rate would raise the profit margin and thus increase the amount of available retained earnings. 8. a. Statement a is correct; economies of scale cause the ratios to change over time, which violates the assumption of the percent of scales method. Statement b is false; the points will not all lie on the regression line. Statement c is false; the AFN formula requires percentage of sales over time. Statement d is false; the AFN formula includes only spontaneous liabilities, and notes payable do not spontaneously increase with sales. Statement e is false; the AFN formula includes the dividend payout, so dividend policy is included. Answers for problems (Financial Planning and Forecast) 1. b. Look at next year’s balance sheet: Current assets $10,000 Accounts payable Notes payable Current liabilities Net fixed assets $2,000 1,000 $3,000 5,000 Long-term debt 4,000 _______ Common equity 4,000 $11,000 AFN Total assets $15,000 4,000 Total liabilities and equity $15,000 With no retained earning next year, the common equity account remains at $4,000. thus, the additional financing requirement is $15,000 - $1,000 = $4,000. 2. b. None of the items on the right side of the balance sheet rises spontaneously with sales 12 except account payable. Therefore, AFN = (A*/S0)△S — (L*/S0)△S — MS1(RR) = ($14/$60)($12) — ($2/$60)($12) — (0.05)($72)(0.6) = $2.8 — $0.4 — $2.16 = $0.24 million. 3. d. Note that g = Sales growth = △S/S0 and S1 = S0 (1+g). Then, AFN = A*g — L*g — M[(S0) (1+g)](RR) = 0, $14g — $2g — 0.05[60 (1+g)](0.60) = 0 g = 0.1765 = 17.65%. 4. c. 0 = (A*/S0)△S — (L*/S0)△S — MS1(RR) 0 = (A*/2,000)(2,000×0.25) — (500/2,000) (500) — (500/2,000) (2,500×0.7) 0 = (500A*/2,000) — 125 — 437.5 5. a. FullCapaci tySales PercentIncrease A* = $2,250 12,000 16,000 0.75 16,000 12,000 0.33 33% 12,000 6. e. Cross Products Company Pro Forma Income Statement December 31,2001 (Thousands of dollars) ___2000 Sales Operating costs EBIT Interest EBT $12,000 Forecast 2001 Basisa Forecast 1.25 $15,000 __ 10,261 12,826 $ 1,739 $ 2,174 339 339 $ 1,400 $ 1,835 560 _____734 Net income $ 840 $ 1,101 Dividends (60%) $ 504 $ 601 Additional to RE $ 336 $ 440 Taxes (40%) Cross Products Company Pro Forma Balance Sheet 13 December 31,2001 (Thousands of dollars) 2000 Cash $ 600 Forecast 2001 Basisa Forecast 1.25 $ 2002 After AFN 750 AFN $ 750 Receivables 3,600 4,500 4,500 Inventory 4,200 5,250 5,250 $ 8,400 $ 10,500 $ 10,500 Total CA 7,200b $ 7,200 $15,600 $17,700 $ 17,700 Accts. Payable $ 2,400 $ 3,000 $ 3,000 Net fixed assets $ 7,200 Total assets Notes payable 1,157 Accruals 1,157 +850 2,007 840 $ 1,050 1,050 $ 4,397 $5,207 $ 6,057 Mortgage Bon. 1,667 1,667 1,667 Common Sto. 667 667 667 9,309 9,309 Total CL RE 440c 8,869 Total L&E $15,600 $ 16,850 $ 17,700 AFN = $ 850 Notes: a Sales are increased by 25%. Operating costs, all assets except fixed assets, accruals, and accounts payable are adjusted to determine the appropriate ratios to apply to 2001 sales to calculate 2001 account balances. b From problem 5 we know that sales can increase by 33% before additions to fixed assets are needed. c See income statement. 7. d. Current ratio = CA/CL = 10,500/6,057 =1,73. Debt / Asset 6,057 1,667 43.64% 17,700 8. c. The projected balance sheet indicated that the AFN = $68157 Taylor Technologies Inc. Pro Forma Income Statement 14 December 31, 2001 Sales Forecast 2001 2000 Basisa Forecst $1,800,000 1.10 Operating costs EBIT 1,639860 $1,980,000 0.9110 1,803,846 $ 160,140 $ 176,154 10,140 10,140 $ 150,000 $ 166,014 60,000 66,406 Net income $ 90,000 99,608 Dividends (60%) $ 54,000 $ 59,765 Addition to RE $ 36,000 $ 39,843 Interest EBT Taxes (40%) Taylor Technologies Inc. Pro Forma Balance Sheet December 31, 2001 Forecast 2001 2000 Basisa Forecast 90,000 0.05 Receivables 180,000 0.10 198,000 Inventory 360,000 0.20 396,000 Cash Total current assets $ $ Fixed assets Total assets Accounts payable 630,000 Accruals 90,000 $ 0.10 $ 900,000 Retained earnings 102,000 198,000 78,000 0.05 99,000 348,000 Common stock Total L&E 792,000 $ 1,485,000 180,000 78,000 693,000 0.40 $ 1,350,000 $ 99,000 $ 720,000 Notes payable Total CL $ $ 375,000 900,000 39,843b $ 1,350,000 141,483 $ 1,416,843 AFN = $ Notes: 15 68,157 a Sales are increase by 10 %. Operating costs, all assets, accruals, and accounts payable are divided by 2000 sales to determine the appropriate ratios to apply to 2001 sales to calculate 2001 account balances. b See income statement. 9. a. The projected balance sheet indicates that the AFN = $28,557 (The Pro Forma Income Statement is just the same as that constructed in problem 8.) Taylor Technologies Inc. Pro Forma Balance Sheet December 31, 2001 Forecast 2001 2000 Basisa Forecast 90,000 0.05 Receivables 180,000 0.10 198,000 Inventory 360,000 0.20 396,000 Cash Total current assets $ $ Fixed assets Total assets Accounts payable 630,000 Accruals 90,000 $ 0.10 $ 900,000 Retained earnings 102,000 198,000 78,000 0.05 99,000 348,000 Common stock Total L&E 752,400 $ 1,445,400 180,000 78,000 693,000 32,400b $ 1,350,000 $ 99,000 $ 720,000 Notes payable Total CL $ $ 375,000 900,000 39,843c 141,483 $ 1,350,000 $ 1,416,843 AFN = $ b Full Capacity Sales = 1,800,000/0.95= 1,897,737 Target fixed assets/Sales ratio = 720,000 /1,894,737 = 38% Required level of fixed assets = (0.38) (1,980,000) = 752,400 Necessary FA increase = 752,400 — 720,000 =32,400. c See income statement. 16 28,557