At the end of the war in 1975, Vietnam was a country completely

advertisement

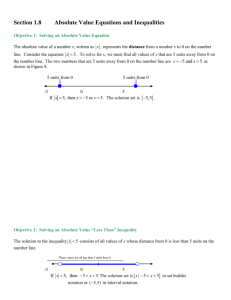

Discovering Sources of Inequality in Transition Economies: A Case Study of Rural Vietnam Vasco Molini PhD Candidate, University of Florence, Italy Guanghua Wan Senior Research Fellow, WIDER-UNU, Finland 1. Introduction In the last 20 years, the debate about income distribution has come back to the agenda of developing countries. In particular, for those who are fighting against poverty, sustaining economic growth without substantial increase in income inequality has become an extremely important issue. The automatic trickle-down, a keystone of the “Washington Consensus”, has demonstrated to be rather inconsistent. Increasing average income without redistribution may well affect the long run performance of an economy and marginalise the lower percentile of the population. This, consequently, creates a negative impact on poverty reduction. Polarised countries like Brazil seem to perform poorly in poverty reduction. On the other hand, Vietnam is considered as one of the best performing countries in terms of poverty reduction, largely owing to little increases in inequality. Given the importance of inequality in its own right and in the context of poverty eradication, it is of utmost importance to analyse determinants of inequality. Traditionally, this is accomplished by inequality decomposition by income sources or by population subgroups. These traditional approaches can only provide limited information on the fundamental determinants of income or income inequality. In the 1970s, Oaxaca (1973) and Blinder (1973) initiated a literature on inequality analysis that uses sophisticated tools like micro-simulation and regression based decomposition. Their frameworks are largely employed to analyse the determinant of discrimination in labour market. The present paper represents an attempt to explore the sources of income inequality in rural Vietnam during a period of stable growth and progressive transition to market economy. We are interested in determining in a quantitative way the contributions of variables to inequality in order to understand the role and significance of different elements. The analytical method used is a combination of regression-based decomposition with the Shapley value technique of Shorrocks (1999). Advantages of this approach include flexibility in the specification of the underlying income generation function and in the choice of inequality measures. 1 2. Economic growth and poverty reduction, 1975-2000 After the reunification in 1975, Vietnam was a country destroyed, with a strong need for infrastructures and with a population that had faced 30 years of war and deprivation. According to many indicators, at the beginning of ’80, the country was among the poorest in the world in terms of GDP per capita although it had, like many other socialist countries, high levels of school enrolments and life expectancy. Given these pre-conditions, the political leaders of the country, after many attempts to improve the economic performance through a rigid planning and agriculture collectivisation, embarked on a gradual program of liberalisation and openness called Doi Moi (renovation). To some extent, the experiment is comparable to the Chinese “market socialism”, a progressive transformation of the economy from a socialist planned to a capitalist market economy, keeping some distributive elements of the previous system. In the rural areas, collective farms were replaced by a “household responsibility system”. Plots of commune land were allocated (with longterm contracts and the right to sell) to individual households according to their characteristics in an efficient and fair way (Ravallion 2001). Price controls were gradually removed for agricultural goods and households are no longer forced to sell their products to the government. Farmer are free to supply goods to the newly established open market. At the same time, changes in the enterprise law allowed the creation of private farm and non-farm enterprises. Further, reductions in tariff barriers and FDI controls encouraged the inflow of capitals and technology. The reforms have resulted in robust economic growth (averaged 7, 9 % over 1990-2000, see WB 2002). By now, Vietnam has become the largest exporter of pepper and second largest exporter of rice and coffee in the world. The first part of 90s is characterised by a sustained growth and a strong reduction of poverty rates from 58, 1% in 1993 to 37,4% in 1998. The outbreak of Asian crisis in 1997 affected marginally Vietnamese economy compared to other East Asian countries. Nevertheless the pace of sustained growth relented and capital inflows reduced (mostly Asian FDI). The economy rapidly recovered in 1999. The crisis shed light on some unsolved aspects of the country. The main one is the unexpected low rate of growth of employment in manufacturing sector after liberalisation. According to Heckesher-Ohlin model it was expected that Vietnam would create many jobs in labour intensive sectors and was expected to see a more rapid decline of agriculture share of GDP (still 63% in 2000). While State Owned Enterprises are reducing their labour force, the new private manufacturing sector is still unable to create job opportunities (only 7% of GDP) and most of the new employment is created by low value-adding services. As pointed out by Jenkins (2002) the industrial sector is not taking advantage of the potential supply of labour and the inflow of FDI oriented to more capital-intensive production. 2 3. Inequality in Vietnam The high economic growth of Vietnam (averaging 8% during 90’s) has been accompanied only by a “tolerable” increase in inequality. The Gini index measured on consumption per capita increased from 0.329 in 1992-1993 to 0.352 in 1997-1998. The decomposition by subgroups (rural and urban) shows that the main contribution to the total is given by the enlarging difference in the average consumption between rural and urban residents. According to the Lewis model, industrialisation leads to an increase in the divergence between urban and rural sector that is offset by mass migration from countryside to towns. This, in turn, might lower the average wage rate. In the case of Vietnam, the turning point has not yet reached and the divide continued to worsen from 1993 to 1998. Within urban areas, the inequality is increasing as well. In big towns like HCM and Hanoi, most of the employment was in the public sector and wages were almost the same in 1993. After the reform and the establishment of private and foreign companies in big towns, wage gaps emerged and tend to widen. However, the increases of inequality in urban areas and between rural and urban sectors have not been accompanied by an increase of inequality in rural areas. Between 1993 and 1998, calculations using VLSS data show a stable inequality (graph 1) with some relative changes among the seven macro-regions (graph 3). To some extent, the economic division of Vietnam reflects the political division before 1975, but the pattern is oriented towards a convergence in the inequality levels (not so much in the income levels). In the Northern1 part rural inequality was low in 1993 and tended to increase in the five years considered. Before the agrarian reform of 1988, the northern agriculture was completely collectivised and the progressive liberalisation led to a redistribution of land slightly more unfair (Ravallion 2003). In the South the contrary occurred: higher levels before 1993 and a general decrease afterwards (graph 2). This is because the collectivisation had been resisted successfully by farmers and only 10% of the land became under the direct control of state in the south. Thus, the process of liberalisation led to a distribution of land close to the pre-unification level. The above facts and government efforts to reduce inequality between regions with ad hoc policies (resettlement, infrastructure provision, incentives to disadvantaged areas) represent two major causes underlying the stability of income inequality in rural Vietnam. Government plays an important role but further efforts are required. In analysing the development of non-farm economy in rural Vietnam (an extremely important determinant of income performance), Van der Walle (2003b) finds that investment in infrastructure is crucial in the creation of household income but is 1 The Northern regions are three ( Northern Uplands, Red River Delta and Northern Coastal) and they almost coincide with the former North Vietnam 3 not enough. Government should develop the labour market and land market in order for rural household to diversify activities and to better allocate productive inputs. Another major issue is the improvements of safety nets. Economic liberalisation and market development have increased the risk faced by household. Nonetheless, the tools available to deal with such drawbacks seem to be extremely ineffective. Van der Walle (2003a) provides empirical evidence on this. Public transfer helped only a few to escape poverty and even fewer to avoid to fall into poverty. In the last 15 years, most research attention has been devoted to poverty rather than inequality analysis. Vietnam is often cited as an example of poverty reduction in a context of trade liberalisation and pro-growth policies. Nevertheless, some authors raise important questions about the long run capacity of Vietnam to reduce poverty. For example, Fritzen (2003) argues that poverty reduction is not guaranteed unless the government implement specific policies that enables it. In particular, the main concern of the author is the too slow pace of structural reforms (reform of SOE’s) that are encountering increasing resistance by conservative groups combined with a too quick rise in the urban rural gap. Baulch and Minot (2002) considered regional imbalances in Vietnam. By matching 1997-1998 household survey data with 1999 census data, they are able to present a poverty map of the country. Remote areas of northern and central Vietnam seem to be less affected by economic growth and still face poverty rates over 50%, while in Ho Chi Mihn City and Hanoi urban areas (excluding nonresident and migrant household) poverty has been reduced to below 20%. An important contribution on inequality comes from Glewwe et al (2002). Using the Oaxaca (1973) methodology, they decompose the change in per capita consumption from 1993 to 1998 into changes in characteristics and changes in the returns to the characteristics. The results show that the increasing gaps across provinces are almost completely explained by changes in the returns. Also, highly educated people and household heads with an employment in secondary or tertiary sector benefited more than others and experienced a bigger change in the return to characteristics. 3. Data and Shapley Decomposition The data used are extracted from the two waves of Vietnamese Living standard survey, 19921993 and 1997-1998. The sample contains detailed record on production and consumption activities 4 for almost 8076 households in rural Vietnam. Observations are also available on facilities and prices at the commune level. These variables will be used to capture location effects. To discover sources of inequality in income or consumption, two analytical frameworks can be employed. The first is commonly known as decomposition by population subgroups or by factor components (Shorrocks 1980, 1982). Applications of the subgroup decomposition include malefemale or white-black divide, which produces what is called within- and between-group contributions. Policy implications from this kind of decomposition are limited because the contributions cannot be attributed to the dividing variable such as sex or race when other human capital variables such as education and experience are not controlled for. The factor decomposition is often used to attribute total income inequality into components associated with wage income, investment income, and other incomes. These factor incomes are functions of more fundamental variables such as wealth holding, human capital, family characteristics, employment sector and residential location. It is desirable, particularly from the policy-maker’s point of view, to identify contributions by these more fundamental variables. The second analytical framework – regression based decomposition – is initiated by Oaxaca (1973) and Blinder (1973) and extended by Juhn et al. (1993) and Wan (2004). A major advantage of this approach is that other variables can be controlled for thus the impact of key variables can be isolated with little contamination. Early development of this framework is restricted in the sense that it only permits decomposition of income or wage difference between two population groups. Recent work of Wan (2004) relaxes this limitation and leads to an inequality accounting technique where inequality of income or consumption can be attributed to fundamental variables. When combined with the Shapley value method of Shorrocks (1999), the regression based framework of Wan (2004) can handle any inequality indicator and imposes no restriction on the parametric income or consumption function. 4. The income generating function The model, a standard semi log income generating function, has been estimated with a yeardummy (D) and some interacted time dummies in order to allow for variations in the coefficients across the two years. Log (Y) D i X i i DX i (1) The dependent variable is the household consumption deflated by regional prices rather than income because it shows less volatility and is less vulnerable to idiosyncratic shock. According to Friedman’s theory of permanent income (Friedman 1957 and Deaton 1997) this is a better measure of family well–being and as demonstrated by the long experience of household survey collection, less influenced by measurement error. Households tend to be more precise on consumption rather 5 than on income. This is particularly true for rural households. Recent contributions about land reforms in Africa (Dercon 2001) show that in transition economies consumption is less sensitive to current circumstances and better reflects household perceived return to its own assets and endowments. Different from other papers (Heltberg 2003), we control for location by not only including location dummies, but also adding a variable indicating presence of manufacturing plants within 10 km to the households. This later location variable also captures the effect of rural industrialisation (like Chinese TVE’s) in raising incomes. The distance from the closest health centre is used to control for health provision facilities. Finally included is a dummy for the presence of asphalted or tarmac roads (having or not having electricity or potable water were significant but highly collinear) in the commune. The construction of roads is the typical infrastructure intervention of government and it is extremely important for income generation. Having access to road, still usable during the rain period, allows rural household to have a greater mobility and to have access to markets eve if they are not located close to the commune. Conventional regressors are considered and they include household size, average education and age of household head (plus their squares), dummy for ethnic minority, the dependency rate, the percentage of wage earners, and percentage of members working outside in the primary sector (generally seasonally labourers). Conventional capital and livestock capital are separately considered as they may have different impacts on income. To avoid simultaneity and capture capital depreciation or appreciation we use the stock of capital at the beginning of the year (at the beginning of income generating process) valuated at year-end prices. During model estimation, the livestock variable was dropped as it was insignificant. It is important to control for land productivity in the model, which is calculated as the total harvest divided by the acres of land (or trees in case of fruit crops). This variable helps capture many effects: the quality of land, climatic conditions etc. Also, crops productivity is related to government policy. The success of coffee exports is the outcome of an intentional policy of the government to develop some economically marginal areas of the country. Central Highlands were the most favourable places to start the cultivation of coffee and government encouraged the resettlement of peasants from land–poor areas of Red River Delta. In this way government “killed three birds with one stone”. A depressed area has been developed, reducing between-region inequality (but the drawback was an increase in within inequality), a surplus labour force found high remunerating activity and eventually the resettlement increased the quota of Khin population in the area at the expense of ethnic minority who fought against Vietcong and with Americans during the war. To some extent, the same story can be told about fruit cropping, but in this case, the 6 cultivation is less regionally located. Government supported this activity, combining it with a plan of reforestation and hydro geological preservation. We also consider the role of crop diversification on income. Our insight is that households trying to increase tradable crops tend to be better off than households that limit themselves to rice or other food production (grains, etc.). 5. Estimation and decomposition results The income generation function was estimated with heteroskedasticity corrected (White correction for variance estimation). The regression shows a high R square (table1). This result is extremely important for the following decomposition as the model is able to explain more than half of the income generation process. All the linear variables are significant and show proper signs. Education and age of the head contribute positively to income while household size; dependency rate and ethnicity possess negative coefficients. The ethnicity, consistent with Baulch (2002) is still a negative predictor of income. Ethnic minority households –non-Chinese- seem to be more disadvantaged and tend to be poorer (Baulch and Minot 2002). The coefficient for wage earners rate is positive while that for employment in the primary sector is negative. The latter confirms that agricultural wages are low and those landless or with little land are worse-off. Due to low labour mobility and small land per capita (there exist only few big farms) the agricultural labour market is rather underdeveloped. The percentage of wage earners is very important in income generation and might become a major source of inequality as in China (Wan 2004). Rural residents in eastern China have benefited from spill-over from coastal cities and big towns while inland areas, due to long distance from major economic centres lagged behind. The capital is positive confirming that households with more modern means of production or the possibility to buy them perform better than others. In general, we can say that agriculture was a profit-making business in 90s, differently from China (Wan 2004). In particular, diversification has a good pay-off as it takes advantage of the long territory layout, the climate (semi-tropical, equatorial) variations and the land morphology that varies ( big planes). Location variables show the correct signs. The distance from a health centre, which is a good proxy for government’s lack of investment in rural health creates produces negative effects on income. The same can be said about roads (positive sign of the dummy for asphalted roads). The presence of Vietnamese Town and Village enterprises is a good predictor of income as well. As the Chinese experience has shown, the creation of local (in rural areas) opportunities of job raises income and reduces mass migration and demographic pressure on towns. 7 The coefficients for the productivity variable demonstrate the importance of coffee production. However, all interactive variables are negative except coffee, indicating declining importance of agricultural productivity on household income over time. Also, land scarcity and over-exploitation may become worse over time, causing decreased productivity over time. This is particularly true in the two rice-rich areas, the Mekong Delta and the Red river Delta. The only exception is coffee. Due to the increasing export starting from 1995, the revenues for coffee producers grow substantially. Looking at the coefficients for capital and credit access, they all have positive coefficients although their marginal impacts on income dropped somehow in 1998. Rural Vietnam was under-capitalised with limited access to credit due to market and credit repression. The negative signs for the capital and credit access dummies seem to indicate that the growth of income has been accompanied by an inefficient allocation and concentration of capital and credit in some areas of the country. Turning to the decomposition results, the main determinant of inequality is location that accounts for about 30% in both periods and this contribution tends to increase over time. This result is not surprising as geography is a very important factor causing income inequality. To some extend, this contribution correspond to the between component in the traditional approach. Unlike the traditional approach, however, our approach controls for other income determinants. Our results shows a smaller contribution of geography than that documented in Heltberg (2003) and we believe 30% contribution is intuitively more reasonable than the higher value given by Heltberg. The other main contributors to inequality are household characteristics and the human capital of household head. This increasing importance of household characteristics and human capital is a consequence of the transition process. With the progressive removal of the constraints that limited individual ability, the importance of education and experience of the household manager (the household head) increases dramatically. At the national level, paradoxically, this change might have played an equalising role. Household heads from Northern Vietnam (that is poorer than South) are, on average, better educated. An increase in the returns to education might have increased the income of Northern households relatively to Southern, reducing the north-south gap. There is a decline in the importance of land in inequality composition. This is consistent with the findings in the literature that confirm a fair distribution of this factor. The declining contribution might be the consequence of the increased diversification in some very backward areas of the country. Finally, job opportunities outside the households increased their importance in inequality determination and the same can be said for infrastructure. The unequal distribution of these factors seems to become more important as the rural economy opens up more. Clearly, these increased 8 contributions to total inequality must come at the expense of other contributions, particularly land, as discussed earlier. As the Vietnamese economy continues fundamental reforms and transformation, inequality is less driven by land endowment but the access to secondary and tertiary sectors. Areas with embryonic industrialisation and close to towns tend to grow more than purely rural areas, and this confirms the prediction of the Lewis model. Vietnam is slowly moving towards an industrialised economy from a predominantly agriculture-based economy. This transition inevitably brings about an increasing divide between rural and urban areas as well as an increase in the gap between semi rural areas (areas close to big and medium size towns) and other rural areas. In the present situation, the divides are kept under control but in the long- run, without any correction or redistributive intervention they might lead to extremely non-homogeneous growth. 6. Conclusions This paper attempts to analyse empirically inequality composition in Vietnam using the Shapley’s decomposition (Shorrocks 1999) and explore its changes over time. Although inequality in rural Vietnam did not increase, important changes occurred with regard to the contributions of different inequality determinants. Our results confirm that growth, even in rural areas, is unevenly distributed. Some households and areas benefited from openness and modernisation while others lagged behind. Related to this finding is the increasing role of job opportunities outside the household. Those closer to towns or to industrial clusters perform better. The more household rely on agriculture the more they are vulnerable to agriculture prices shocks. As expected, household characteristics increased their importance in inequality determination. This is so despite the fact that access to education, at least to primary schools, is guaranteed to all in Vietnam. Contrary to many developing countries, characterised by unfair land distribution, Vietnam undertook a well implemented land reform and the role of land quality and quantity in inequality determination has thus declined. This partially has something to do with the loss of importance of the primary sector and the increase in the role of more modern sources of inequality, such as outside job opportunities. The experience of rural Vietnam, according to most of the studies, confirms that some important targets have been reached, including increase in average income, development of poor areas and poverty reduction. All of these important results occurred in a country where equalising forces (endogenous and exogenous) limited the common side effects of transition processes. Generalising the results of Ravallion (2003), the situation of rural Vietnam in 1998 might be considered a second best outcome: a combination of some elements of efficiency with some elements of redistribution. Clearly, the time span is too limited to forecast how long these positive conditions will persist in the 9 future. Nevertheless, the experience of rural Vietnam in the decade after the initial reforms is an interesting example of growth without inequality and of well-targeted pro-poor policies. References Blinder, Alan S., 1973. Wage discrimination: Reduced form and structural estimates. Journal of Human Resources 8, 436–455. Baulch B. Truong Thi Kim Chuyen Haughton D., Haughton J.(2001): Ethnic Minority Development in Vietnam: A socio economic perspective, mimeo Baulch B. Truong T. K Chuyen D., Haughton J.: Ethnic Minority Development in Vietnam: A socio economic perspective July 2001 mimeo Dercon S (2001). Economic Reform, Growth and the poor: evidence from rural Ethiopia, WPS /2001-8 De Mauny A. Vu Thu Hong (1998) Landlessness in the Mekong Delta: the situation in Duyen Hai District, Tra Vihn Province Vietnam” Report prepared for Oxfam Great Britain, Hanoi Vietnam Fritzen S. (2003) Growth inequality and the future of poverty reduction in Vietnam. Journal of Asian Economics 13 635- 657 Glewwe P. Gragnolati M. Zaman H. (2002): Who gained from Vietnam’s Boom in the 1990’s? An analysis of Poverty and Inequalities trends Economic Development and Cultural Change pg 773- 782 Glewwe P. Phong N (2001): Economic Mobility in Vietnam in the 1990’s, mimeo Gallup J. (2002): The wage Labor market and Inequality in Vietnam in 1990s, Wb working paper 2896 Heltberg R. (2003) Spatial Inequality in Vietnam: A regression-based decomposition, Paper prepared for the UNU/WIDER Project Conference on Spatial Inequality in Asia, Tokyo, 28-29 March 2003 Juhn, Chinhui, Murphy, Kevin M., Pierce, Brooks, (1993). Wage inequality and the rise in returns to skill. Journal of Political Economy 101, 410–442 Oaxaca, Ronald L., 1973. Male-female wage differences in urban labour markets. International Economic Review 14, 693–709. Ravallion M., van der Walle D (2001).: “Breaking up the collective Farm: welfare outcomes of Vietnam’s mass privatization World Bank Policy Research Paper no 2951, Ravallion M., van der Walle D (2003): “Land Allocation in Vietnam’s Agrarian Transition” World Bank Policy Research Paper no 2710 Shorrocks, Anthony F., 1980. The class of additively decomposable inequality measures. Econometrica 48, 613–625. 10 Shorrocks, Anthony F., 1982. Inequality decomposition by factor components. Econometrica 50, 193–211. Shorrocks, Anthony F., 1999. Decomposition procedures for distributional analysis: A unified framework based on the Shaply value. Unpublished manuscript. Department of Economics, University of Essex. Van der Walle D. (2003a): “The static and dynamic incidence of Vietnam’ Public Safety Nets” Social Safety Net Primer Series n 0319, Van der Walle D. (2003b) Is the emerging Non farm Market Economy the route out of poverty in Vietnam? World Bank Policy Research Paper no 2950 Vietnamese Living Standard Surveys (VLSS) 1992/1993-1997/1998 Wan, Guanghua, 2004. Accounting for Income Inequality in Rural China: A Regression Based Approach, Journal of Comparative Economics (in print). 11 Graph 1: Variation of rural log consumption per capita by percentiles: difference between 1993 and 1998 .75 .7 .65 .6 diff9398 Variation of log consumption per capita 1993-1998 0 20 40 60 80 100 centile Source: VLSS 1993-1998 Graph 2: Variation of log consumption per capita by percentiles in Northern and Southern rural Vietnam: difference between 1993 and 1998 Variation in the log of real consumption per capita .65 .7 Source: VLSS 1993-1998 .6 Variation .75 .8 North and South Vietnam 1993-1998 0 20 40 60 80 100 Percentiles sdiff 9398 ndiff 9398 Source: VLSS 1993-1998 12 Graph 3: Distribution of log consumption per capita by seven rural regions: Kernel density in 1993 and 1998 2 3 4 5 6 0 .5 1 0 .5 1 1 4 8 6 10 4 6 8 10 0 .5 1 7 4 6 8 10 x 93 98 Graphs by Code by 7 regions Source: VLSS 1993-1998 1=Northern Uplands, 2=Hanoi Region, 3=Northern Coastal, Southern Coastal, 5=Central Highlands, 6 Ho Chi Mihn Region, Mekong Delta 13 Table 1: regression results Dependent variable = logarithm of household consumption per capita Household Size -0.061 (23.45)** Distance From Health Centre or Family Planning Centre Proportion Of Male In Household 0.165 (6.24)** Number Of Manufacturing Opportunities In 10 Km 0.109 (7.38)** Years Of Education Of Hh Head 0.033 (24.25)** Dummy For Credit Access 0.099 (7.80)** -0.003 (5.08)** Presence Of Road Practicable During Rain Season 1998 Number Of Manufacturin g opportunities In 10 Km 1998 Productivity Of Rice Kg/Sqmeter 1998 Productivity Industrial crops Kg/Sqmeter 1998 Productivity Of Coffee Kg/Sqmeter 1998 0.055 (2.62)** -0.092 (5.98)** -0.305 (5.47)** Househol Head Age 0.006 (17.79)** Land for annual crop per worker 0.037 (8.27)** Dummy For Ethnic Minority -0.182 (10.64)** Productivity Of Rice Kg/Sqmeter 0.371 (6.99)** Dependency Rate -0.201 (9.95)** Productivity Food Crops Kg/Sqmeter 0.013 (5.54)** Dummy For Credit Access 1998 -0.069 (4.07)** Proportion Of Wage Earners In Lab Force Household 0.201 (11.05)** Productivity Industrial crops Kg/Sqmeter 0.024 (4.31)** Annual Crop Land Per Worker 1998 -0.023 (4.04)** Proportion of employment in agriculture outside, in lab force household -0.345 (11.32)** Productivity Of Coconut Kg/ Tree 0.001 (4.00)** Capital Per Capita 1998 -0.042 (2.03)* Presence Of Road Practicable During Rain Season 0.052 (3.13)** Productivity Of Coffe Kg/Sqmeter 0.17 -1.39 Yeardummy 0.699 (31.74)** Capital Per Capita 0.094 (4.99)** Productivity Of Fruit Kg/Sqmeter 0.002 (3.65)** Constant 6.447 (172.21)** -0.013 (2.02)* 0.569 (2.87)** Observations 8076 R-Squared 0.63 * Significant At 5%; ** Significant At 1% Table 2 : Decomposition results 1993 14 GINI % ATKINSON (e=0) % Household size Human capital Ethnic Household composition Labour opportunity Capital Credit Land Infrastructure Location TOTAL THEIL-L (a=0) % THEIL-T (a=1) % CV2 0.0238 0.0273 0.0117 12.96 14.85 6.34 0.007 0.008 0.004 12.12 14.40 7.47 0.007 0.008 0.004 12.08 14.38 7.50 0.006 0.008 0.004 % 11.16 13.55 6.64 % 0.0132 10.13 0.0161 12.36 0.0075 5.77 0.0132 0.0210 0.0059 0.0063 0.0203 0.0044 0.0498 0.1838 7.20 11.44 3.18 3.43 11.07 2.41 27.11 100 0.003 0.006 0.003 0.001 0.006 0.001 0.015 0.054 6.46 11.08 4.94 2.44 11.20 1.53 28.37 100 0.004 0.006 0.003 0.001 0.006 0.001 0.016 0.055 6.48 11.09 4.96 2.44 11.20 1.54 28.33 100 0.004 0.006 0.004 0.001 0.007 0.001 0.017 0.057 6.39 10.54 6.46 2.30 12.37 1.41 29.18 100 0.0081 0.0128 0.0118 0.0028 0.0183 0.0017 0.0381 0.1303 Table 3 : Decomposition results 1998 GINI % Household size Human capital Ethnic Household composition Labour opportunity Capital Credit Land Infrastructure Location TOTAL 0.0240 0.0288 0.0141 0.0153 0.0162 0.0091 0.0013 0.0088 0.0093 0.0573 0.1841 ATKINSON (e=0) % 13.04 15.65 7.65 8.32 8.80 4.92 0.70 4.75 5.06 31.11 100 THEIL-L (a=0) % 0.0065 0.0084 0.0050 0.0040 0.0044 0.0041 0.0002 0.0020 0.0025 0.0179 0.0550 THEIL-T (a=1) % 11.80 15.21 9.09 7.32 8.06 7.36 0.30 3.57 4.63 32.65 100 0.0067 0.0086 0.0052 0.0042 0.0046 0.0042 0.0002 0.0020 0.0026 0.0184 0.0565 CV2 % 11.77 15.18 9.13 7.35 8.09 7.38 0.30 3.57 4.64 32.60 100 0.0063 0.0083 0.0047 0.0040 0.0043 0.0062 0.0002 0.0020 0.0025 0.0196 0.0580 % 10.85 14.22 8.11 6.95 7.40 10.62 0.33 3.49 4.30 33.73 100 0.0125 0.0174 0.0095 0.0074 0.0072 0.0254 0.0007 0.0037 0.0057 0.0474 0.1369 9.14 12.74 6.90 5.43 5.26 18.57 0.48 2.68 4.18 34.62 100 15 6.21 9.78 9.02 2.18 14.06 1.28 29.19 100