Capital in the 21st Century by Thomas Piketty A Brief Book Review

advertisement

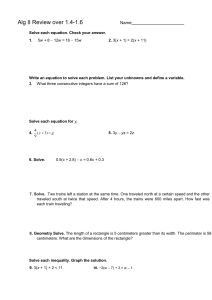

Capital in the 21st Century by Thomas Piketty A Brief Book Review The book is massive, 577 pages plus notes. I consider it a landmark work. Extensive criticism has appeared (including one group of economists which question the data in one of his Excel spreadsheets). So massive is the work that a paperback summary is now available on Amazon. Here are 10 things you ought to know about the book: 1. Uses the concept of the ratio of capital to income 2. Theory: income from jobs grows with increases in productivity, e.g. productivity gains are shared with workers (Smartt comment: not necessarily so, depends on worker power (or lack of it) as well as the supply of workers.) 3. From the beginning of WWI, though the Depression, and through WWII, much personal capital was destroyed. After WWII productivity gains increased at a high rate (in part due to the stimulus to the economy from rebuilding destroyed cities/homes/businesses). This has led thinkers to the assumption that economic inequality was declining. Author: this is a one-time occurrence. The long term annual rate of return on capital is 4-5%. GNP/productivity gains are at 1-2% annually, long term, therefore the rich get richer faster than average each year than do those working (at a job) for a living. 4. Personal capital includes home equity. The 20th Century saw the beginnings of a propertied (home-owning) middle class; he deems this a good result as it lowers inequality. 5. Declines in income tax rates (from 1930’s to 1980, 50 years, US federal income tax top rate averaged 81%). Lower rates led to exploding executive compensation, both in US and in many other economies. Since CEOs could keep much more of their pay/bonuses, they pushed much harder for higher compensation. High, progressive federal income tax rates do not collect much tax, they are more effective in restraining high executive pay. 6. Solution to inequality, worldwide, is a coordinated end to bank secrecy (which allows tax evasion largely by the rich) combined with a worldwide progressive tax on capital (including homes, net of mortgage balance). He acknowledges that such solution is almost impossible to implement. 7. He presents extensive data (plurality of data is French, since they have had the most lengthy, comprehensive taxes (hence reporting) on inheritances and on gifts. In the 18th century and prior, inequality was based on unequal ownership of land (rural economy throughout the world). Early 19th century industrialization did not help workers, generally, to become more equal or even improve living standards very much. 8. Many of our “capitalism is good” economic theories, he says, proceed from either economists who are entranced with theoretical models or politicians who, he says, are practiced at justifying the status quo and batting down changes which might adversely affect their constituents. 9. Education helps but the escalating cost of superior quality higher education in the US in the last approximately 30 years in the US and in the UK (more recently) is reinforcing inequality. (The average Harvard University parent has an annual income of $450,000.) Conclusion: worth the read, consider the paperback summary, seldom too technical and dense for the layman.