The Impact of a Novella on Accounting Students` Perception of

advertisement

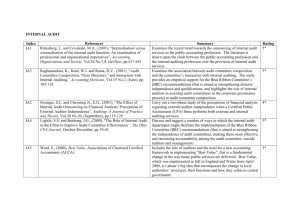

Accounting Students’ Perceptions of The Audit Profession: Can We Impact? Steven R. Jackson The University of Southern Mississippi and K. W. VanVuren The University of Tennessee at Martin Abstract The purpose of this study was to measure the impact of an instructional novella, “The Auditor”, on the perceptions that auditing students have concerning the auditing profession. Students in two different auditing classes were presented a questionnaire on the first day of class. The questionnaire elicited their opinions on various aspects of auditors, their actions, and the auditing process. Studying the novella increased students’ confidence in the value of an audit and the ability of the audit profession to self-regulate itself. After studying the novella, students increased their perception that the auditor has a responsibility to ensure that client financial statements are consistent with conventional accounting practices and that the future viability of the client company is not in doubt. Furthermore, student’s perception’s of the effectiveness of auditors at prescribing remedies to problems, coping with risk and uncertainty, and providing useful service to clients became more positive. In summary, students had an increased confidence in the effectiveness of auditors and the auditing process. Introduction and Literature Review At no other time in the history of the accounting profession has there been such an impact to the financial reporting function within the capital market structure. In the past the profession has experienced scandals and faced questions about the auditing profession, but the media coverage of these events was less intense than the coverage today. Potential and current accounting students and their parents have greater access to information concerning the current accounting scandals which increases the potential impact on decisions concerning careers. Student decisions pertaining to majoring in accounting are impacted by the perceptions these students have of the accounting profession. Students may choose accounting as a major right out of high school or may make the choice after starting college. A number of factors such as job availability, starting pay, potential for advancement and the impressions of what the career will provide, impact the decisions of students to become or remain accounting majors. Many accounting programs have faced declining enrollments in the last few years even while those same accounting programs have updated curricula and increased efforts to recruit students. Barsky, et al. (2003) points out that accounting programs cannot control important external issues that arise in today’s dynamic business marketplace. This study looks at one aspect of this business marketplace, specifically the impact of recent accounting scandals and the impact of those scandals on the perceptions of the students about the profession. Barsky, et al. (2003) states that many students and their parents simply do not understand how dramatically the role of accountants and their education has changed during the past decade (Barsky and Catanach 2001). Few realize that the accountant’s role has evolved from that of financial accounting and tax advisor to one of consultant who offers advice on a variety of management issues, including performance improvement, human resource systems, and other financial matters (IMA 1999). In fact, a recent Harris poll (2001) on the “prestige of professions” rated accountants 16th out of 17 listed professions. The accounting scandals project the image that accounting may no longer be such a stable profession. The related risk of legal liability, criminal prosecution and pressure for unethical behavior also may dampen student interest in accounting (Barsky, et al. 2003). In a 1996 study, Gramling, et al. presented results of a survey questionnaire used to ascertain whether the perceptions of undergraduate business students about audit expectation issues would be changed after completion of an undergraduate auditing course. They also compared the perceptions of students subsequent to completion of an auditing course to the perceptions of professional auditors. The issues addressed in their study include: the appropriate role for auditors; the specific parties to whom auditors should be responsible; the prohibitions and regulations that should be placed on audit firms; and the decisions that auditors would likely make in a series of specific case studies. The survey results were also used to provide evidence as to the perceptions of these three groups regarding key performance attributes of auditing. The remainder of this paper is outlined as follows. The second section describes the survey instrument used to obtain the empirical evidence and provides information on the survey respondents. The third section presents the analysis of the survey responses. The fourth section concludes with summary comments; and the final section discusses possible limitations of the paper and makes suggestions for future research in this area. Methodology and Survey Instrument The subjects for the study were students in an undergraduate auditing class. There were 51 students in total, 26 females and 25 males. On the first day of class, the students were asked to complete an eight page survey. The survey was based on an instrument developed, tested, and used in a study of the audit expectations gap in Britain (Humphrey, et. al., 1993). Modifications were made by Grambling, et. al (1996), in recognition of differences in auditing and accounting issues between Britain and the United States, and this was the instrument used in the present study. The survey instrument consists of four primary sections: 1) a set of questions designed to elicit opinions on the role and nature of auditing; 2) a set of questions used to identify the attributes that subjects associate with aspects of auditor performance; 3) a series of short case studies used to determine actions that participants perceive auditors would take in a variety of circumstances; and 4) a set of questions designed to obtain biographical information and personality variables about the respondents. The set of questions on the role and nature of auditing consists primarily of statements regarding existing and possible audit roles, prohibitions and regulations in the audit environment, and parties to whom auditors should be responsible. For each of the statements in this set, respondents were asked to indicate the extent of their agreement or disagreement with the statement on a seven-point Likert scale (1= Strongly disagree; 4=Neutral; 7=Strongly agree). For the set of questions concerning potential prohibitions and regulations on an audit firm, respondents were asked to reply to various statements on the same Likert scale. Respondents were also asked to respond as to how successful they perceive auditors are at various activities (1=Extremely unsuccessful; 4=Neither successful or unsuccessful; 7=Extremely successful). For this set of questions, respondents could also indicate that the activity was not applicable to auditors. The short cases provide a total of nine responses. Two responses refer to possible audit report qualifications; two refer to potential whistle-blowing situations; one refers to a potential resignation situation; and four refer to the level of work that an auditor would be expected to complete. The initial stage of the course consisted of reading and studying The Auditor, a fictional account of an accounting student and his progress from student to partner in a large CPA firm, (The Auditor: An Instructional Novella, James K. Loebbecke, Prentice Hall, 1999) and then discussing it in class. The questionnaire was administered a second time after classroom discussion of the Novella. Discussion of Results The results of the first section of the questionnaire dealing with views about auditors and the auditing process are shown in Table One. The focus in this section is on auditors, as individuals, and the audit process. Out of thirteen questions in this section, four showed statistically significant movement in terms of average response pre-reading of the novella versus post-reading of the novella. One question elicited expression of opinion to the phrase “the auditing process is seriously weakened by imprecise accounting standards.” The pre-reading average score on this question was 3.73. The post-reading average score was a statistically significant decline to 3.22 (p=.044). This result indicates that after reading The Auditor students changed their opinion to have a greater confidence in the efficacy of the audit process regardless of the precision of accounting standards. Table One Views about Auditors and the Auditing Process Statements Students Students T Value Pre-Reading Post-Reading (p-value) The auditing process is seriously 3.73 weakened by imprecise acctg. standards 3.22 1.733 (.044) An audit is of very little use to a company 2.04 1.65 1.710 (.047) The quality of audit work is adequately regulated by the audit profession 4.59 4.86 -1.345 (.092) Audit committees comprising nonexecutive directors should improve auditor independence 4.41 4.96 -2.945 (.002) 1=Strongly disagree, 4=Neutral, 7=Strongly Agree Another question in this section of the questionnaire that showed a statistically significant change (p=.047) was, “Do you agree/disagree with the statement: An audit is of very little benefit to a company?” The pre-reading average score was 2.04; the postreading score was 1.65. Again, this is evidence that one impact of The Novella was to give students a greater appreciation of the importance of the audit and the effectiveness of the audit process. The students were also asked whether they think that the quality of audit work is adequately regulated by the audit profession. Before reading The Auditor the average response was 4.59; after reading The Auditor the average response went up to 4.86. This is a statistically significant change (p=.092), and again, can be interpreted as the students having a favorably enhanced opinion as to the effectiveness of the auditing profession after studying the novella. It appears that the changing responses to the three questions mentioned above all point to a growing positive attitude that accounting students seem to have about their chosen profession. Furthermore, it is interesting to note another question in this section of the questionnaire that had to do with the need for outside directors on a company’s audit committee. After studying the novella, students more strongly felt (before=4.41, after=4.96, p=.002) that audit committees comprised of non-executive directors should improve auditor independence. The most reasonable interpretation of this result is that while the general affect of The Auditor was to increase students’ confidence in and respect for auditing, students also developed a heightened belief that the auditor can’t “go it alone”. Auditor independence needs to be bolstered by more independence from management (i.e., more outside directors on audit committees of clients). Table two presents significant results in the section of the questionnaire addressing the role of auditors with respect to the audited company and their financial statements. The results of this section of the survey provide evidence that students developed a heightened conviction that the auditor should take on a high level of responsibility for the quality of clients’ financial statements. For example, one question asked for agreement/disagreement to the notion that it is part of the role of the auditor to ensure that companies’ financial statements are consistent with conventional accounting practices. The average pre-reading response on this issue was 5.90; the average postreading response increased to 6.35 (p=.002). Table Two Views about the Role of Auditors With Respect to the Audited Company and Their Financial Statements Students Students T Value Pre-Reading Post-Reading (p-value) Statements The auditors’ role with respect to audited financial statements of companies should be to ensure that: they are consistent with conventional 5.90 accounting practices The auditors’ role with respect to the audited company should be to ensure that: the future viability of the company 4.96 is not in doubt 6.35 -3.081 (.002) 5.29 -1.279 (.10) the balance sheet provides a fair valuation of the company 6.00 6.27 -1.371 (.088) all significant fraud is detected 5.94 5.31 2.995 (.002) 1=Strongly disagree, 4=Neutral, 7=Strongly Agree Another question posited the statement: “The auditors’ role with respect to the audited company should be to ensure that the future viability of the company is not in doubt.” The average response to this question increased from 4.96 to 5.29 (p=.10). Another question asked for agreement/disagreement with the notion that part of the auditors’ role with respect to the audited company is to ensure that the balance sheet provides a fair valuation of the company. Before studying The Novella an average score of 6.0 indicates relatively strong agreement with this statement, but after studying the novella the average response increased to 6.27 (p=.088). The changes in all three of the above mentioned questions indicate an increased perception on the part of students to “raise the bar” as to the level of responsibility that should be assigned to the auditor with respect to the informative quality of clients’ financial statements. However, students apparently think that this intensified level of responsibility can only be taken so far. On the question exploring whether auditors should be responsible for the detection of all significant fraud, the pre-reading average response was 5.94. After studying The Auditor the average score was 5.31. This represents a very strong (p=.002) change of perception regarding the culpability of the auditor in fraudulent financial reporting situations. Table three presents the results of the group of questions dealing with propositions relating to prohibitions and regulations on an audit firm. Table Three Views about Possible Prohibitions and Regulations on an Audit Firm Statements An audit firm should: not act primarily to make a profit Students Students T Value Pre-Reading Post-Reading (p-value) 4.43 have limited liability determined 4.39 by statute 1=Strongly disagree, 4=Neutral, 7=Strongly Agree 4.84 -1.394 (.085) 4.76 -1.704 (.047) In this section of the questionnaire, two questions were statistically significantly different. In response to the statement that an audit firm should “not act primarily to make a profit”, the pre score was 4.43. After studying The Auditor the average response increased to 4.84 (p=.085). Another question elicited reaction to the notion that audit firms should have limited liability determined by statute. The pre score was 4.39; the post score was significantly higher at 4.76 (p=.047). These seemingly contrary results (a de-emphasis on profits is arguably to the detriment of the audit firm while limited liability is to its advantage) are actually consistent with those found in the preceding section. On the one hand, after reading The Auditor, students had a greater awareness of the auditors’ responsibility to society (that the auditor should not primarily be interested in profit); while on the other hand, they also seemed to have a greater appreciation of the need for establishing reasonable limits to expectations of auditor performance (that there is a need for limited liability statutes). Table four presents the results of the series of questions having to do with how successful auditors are at performing various audit-related activities. The scale ranged from 1=extremely unsuccessful to 7=extremely successful. The first two questions that showed statistically significant changes in perceptions had to do with problem-solving skills. The first question addressed auditors’ ability to diagnose problems. Before studying The Auditor students’ average response was 5.59; after studying The Auditor the average response was 5.92 (p=.023). Relatedly, students were asked how they feel about auditors’ facility at prescribing remedies to problems. The average response for this question went from a pre score of 5.25 to a post score of 5.53 (p=.059). Another question dealt with risk/uncertainty coping ability. For this question the average response also increased after reading The Auditor (pre=5.39, post=5.73, p=.047). The last question solicited an opinion as to the degree the auditors’ work provides a useful service to clients. Again, the average response increased after studying The Auditor, going from a pre-score of 6.27 to post score of 6.53 (p=.029). It is interesting to note the impact of The Auditor on the perceptions of students about the effectiveness of auditors and the auditing process. Table Four Views About How Successful Auditors Are At Particular Activities Statements diagnosing problems Students Students T Value Pre-Reading Post-Reading (p-value) 5.59 5.92 -2.051 (.023) prescribing remedies to problems 5.25 5.53 -1.588 (.059) coping with risk & uncertainty 5.39 5.73 -1.706 (.047) providing a useful service to clients 6.27 6.53 -1.947 (.029) 1=Strongly disagree, 4=Neutral, 7=Strongly Agree There was a section of the questionnaire that presented a series of small problematic situations that might possibly come up in the course of an audit. The point of the vignettes was to elicit from students their judgment as to how the typical auditor would react in the various situations. Table five presents the results of the three situations where the average response changed significantly after reading The Auditor. The first scenario involved an insider trading situation The question posed to the students was their perception of the likelihood the auditor, upon discovery, would refer to the matter in the audit report (assessed on a seven-point Likert-scale ranging from never=1 to always=7). Students’ initial judgment was on average 4.9. After studying The Auditor the average response went to 5.2 (p=.091). Another situation involved the auditors discovering a major defective product problem with significant contingent liability implications and the likelihood the auditors would report such a matter in the client’s audit report. On this question the change in the students’ perception as to the probable auditor action was even more pronounced. The average response went from 4.98 before studying The Auditor to 5.58 after (p=.008). The last scenario involved collection of audit evidence. The scenario dealt with a physical inventory involving a chain of warehouses. Students were asked their opinion of the number of warehouse inventory counts the auditors would choose to observe. The response scale of counts to be observed ranged from zero to six. Before studying the novella the students’ average response was 3.20; the after response was 3.54. This .34 point increase in the average response was statistically significant with a p-value =.098 Table Five Judgments as to How Auditors Would React in Various Situations Students Students T Value Statements Pre-Reading Post-Reading (p-value) Re: an “insider dealing” situation – How likely is it that the auditor will refer 4.90 5.20 -1.353 to the matter in the audit report? (p=.091) Re: contingent liability situation – How likely is it that the auditor will refer 4.98 to the matter in the audit report? Re: physical inventory-taking scenario – What is the most likely number of 3.20 warehouse inventory counts that you think the auditors will attend? 1=Strongly disagree, 4=Neutral, 7=Strongly Agree 5.58 -2.475 (p=.008) 3.54 -1.309 (p=.098) Once again it can be seen that in all three instances of change, the average response increased. In all three instances a higher number indicates a more ethical judgment on the part of the auditor. In that the questions were posed in terms of what the respondent thinks the auditor would do, this section of the questionnaire presents additional evidence that the impact of The Auditor was to enhance the students’ confidence in the ethical behavior of auditors. Summary The purpose of this study was to observe evidence of the impact of studying an instructional novella on auditing. The novella inspired in students a more positive feeling about auditors and the auditing process. After studying the novella, students expressed greater agreement with the notion that the audit is effective in spite of imprecise standards. The novella also inspired in students a greater confidence in the usefulness of an audit and the ability of the audit profession to self-regulate itself. However, after studying the novella, students felt more strongly the need for truly independent outsidemember audit committees to enhance the ability of auditors to adequately do their jobs. Concerning the role of auditors with respect to the audited company and its financial statements, after studying the novella, students felt more strongly that the auditor has a responsibility to ensure that financial statements are consistent with conventional accounting practices. Students also felt that auditors have a responsibility for financial statements to ensure that the future viability of the client company is not in doubt. Furthermore, students also came away from studying The Auditor with a stronger feeling that the auditor has a responsibility for the financial statements to provide a fair valuation of the client company. About the only slack that the students grant the individual auditor is that they increasingly warn that it is unreasonable to hold the auditor responsible for the discovery of all significant fraud that an unscrupulous client might perpetrate. In regard to views about possible prohibitions and regulations on an audit firm, students more strongly felt that an audit firm should not act primarily to make a profit. However, they also felt that increased statutory limited liability be made available to audit firms. The Auditor also affected students’ opinions about how successful auditors are at performing several audit related activities. Studying the novella enhanced students’ opinions of the auditor as a problem-identifier, problem-solver, and manager of risk and uncertainty. Finally, a reading of the novella had an impact on students’ judgments as to how auditors would react in various audit-related situations. The questionnaire results indicated that students anticipate auditors taking ethically strong actions in such areas as reporting insider trading activity and contingent liability exposure due to faulty product. Discussion More research needs to be done in this area to measure the impact of the auditing course on these perceptions and how we as accounting educators might overcome the negative perception of the profession to attract the best and brightest students to major in accounting. This study looks at a very small sample of students and may not have validity outside those groups studied. The students were in two different regions of the country which may have an impact on the perceptions of the students. The impact of the audit professor and textbook should have no impact on the responses because the questionnaire was administered at the beginning of each semester however; the other accounting coursework taken preceding the audit class may have impacted the responses. These threats aside these results indicate a change in perception of accounting students in today’s environment that should be considered when recruiting and retaining accounting majors. References AICPA. 1993. The expectations gap standards: Progress, implementation issues, research opportunities. Proceedings of the Expectations Gap Roundtable in Charleston, SC (May 11-12, 1993). New York: AICPA Barsky, N.P., and A.H. Catanach, Jr. 2001. Perception is Reality: Managing Student and Parental Expectations is Critical to Increasing Accounting Enrollments. Management Accounting Quarterly (Fall): 22-32. Barsky, N.P., Catanach, A.H., and B. M. Kozlowski. Creating Strategic Responses to Critical Risks Facing Accounting Education. Workpaper presented at the AAA annual meeting, 2003. Gramling, A.A., J.W. Schatzberg, and W.A. Wallace, 1996. The role of undergraduate auditing coursework in reducing the expectations gap. Issues in Accounting Education 11 (1): 131-161. Guy, D.M., and J.D. Sullivan. 1988. The expectations gap auditing standards. Journal of Accountancy (April): 36-46. Harris Poll. 2001. Number 50: Doctors Seen As Most Prestigious of Seventeen Professions and Occupations, Followed by Scientists (#2), Teacher (#3), Clergy (#4), and Military Officers (#5). Harris Interactive (October 10). Humphrey, C., P. Moizer, and S. Turley. 1993. The audit expectations gap in Britain: An empirical investigation. Accounting and Business Research (Winter): 395-411. Institute of Management Accountants (IMA). 1999. Counting More, Counting Less: Transformations in the Management Accounting Profession. Montvale, NJ. Sutton. M.H. 2002. Financial Reporting at a Crossroads. Accounting Horizons (December): 319-328.