Northern Pacific Fixtures Company sells a single product for $28 per

advertisement

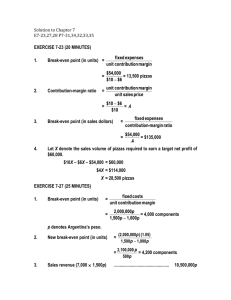

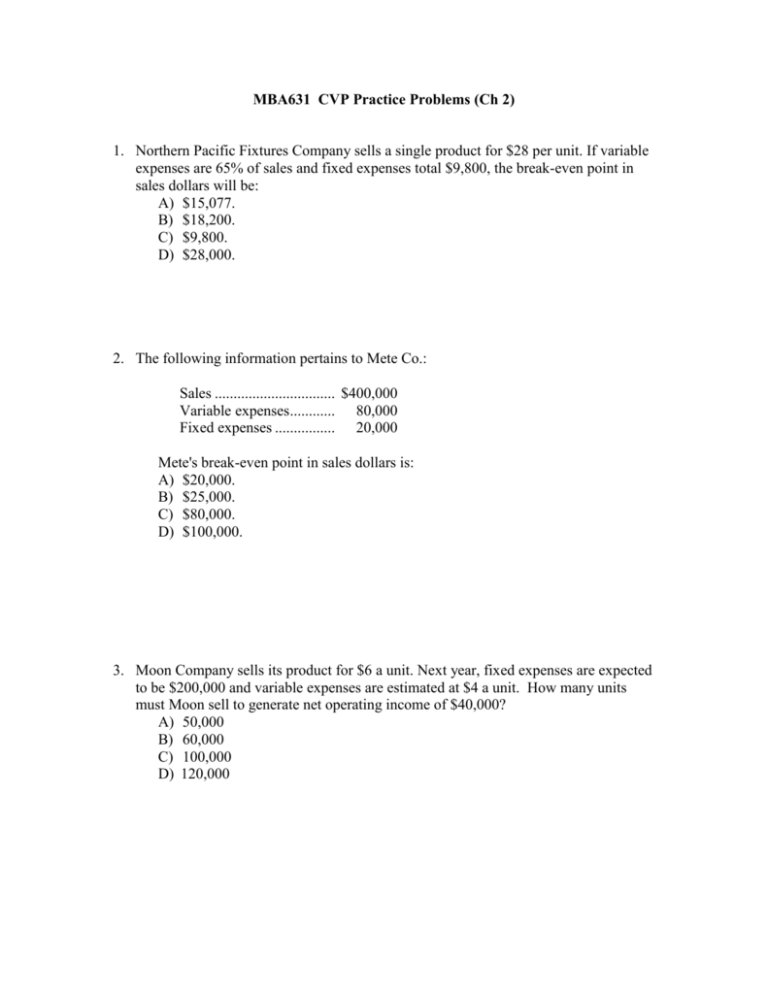

MBA631 CVP Practice Problems (Ch 2) 1. Northern Pacific Fixtures Company sells a single product for $28 per unit. If variable expenses are 65% of sales and fixed expenses total $9,800, the break-even point in sales dollars will be: A) $15,077. B) $18,200. C) $9,800. D) $28,000. 2. The following information pertains to Mete Co.: Sales .............................................................. $400,000 Variable expenses.......................................... 80,000 Fixed expenses .............................................. 20,000 Mete's break-even point in sales dollars is: A) $20,000. B) $25,000. C) $80,000. D) $100,000. 3. Moon Company sells its product for $6 a unit. Next year, fixed expenses are expected to be $200,000 and variable expenses are estimated at $4 a unit. How many units must Moon sell to generate net operating income of $40,000? A) 50,000 B) 60,000 C) 100,000 D) 120,000 4. Rider Company sells a single product. The product has a selling price of $40 per unit and variable expenses of $15 per unit. The company's fixed expenses total $30,000 per year. The company's break-even point in terms of total dollar sales is: A) $100,000. B) $80,000. C) $60,000. D) $48,000. 5. Street Company's fixed expenses total $150,000, its variable expense ratio is 60% and its variable expenses are $4.50 per unit. Based on this information, the break-even point in units is: A) 50,000. B) 37,500. C) 33,333. D) 100,000. 6. The contribution margin ratio is 30% for the Honeyville Company and the break-even point in sales is $150,000. If the company's target net operating income is $60,000, sales would have to be: A) $700,000. B) $650,000. C) $300,000. D) $210,000. 7. Last year, Flynn Company reported a profit of $70,000 when sales totaled $520,000 and the contribution margin ratio was 40%. If fixed expenses increase by $10,000 next year, what will sales have to be for the company to earn a profit of $80,000? A) $600,000 B) $570,000 C) $562,500 D) $625,000 8. Rothe Company manufactures and sells a single product that it sells for $90 per unit and has a contribution margin ratio of 35%. The company's fixed expenses are $46,800. If Rothe desires a monthly target net operating income equal to 15% of sales, sales in units will have to be: A) 1,486 units. B) 3,467 units. C) 1,040 units. D) 2,600 units. 9. The following monthly data in contribution format are available for the MN Company and its only product, Product SD: Total Per Unit Sales .............................................................................................................. $83,700 $279 Variable expenses.......................................................................................... 32,700 109 Contribution margin ...................................................................................... 51,000 $170 Fixed expenses .............................................................................................. 40,000 Net operating income .................................................................................... $11,000 The company produced and sold 300 units during the month and had no beginning or ending inventories. Required: a. Without resorting to calculations, what is the total contribution margin at the break-even point? b. Management is contemplating the use of plastic gearing rather than metal gearing in Product SD. This change would reduce variable expenses by $18 per unit. The company's sales manager predicts that this would reduce the overall quality of the product and thus would result in a decline in sales to a level of 250 units per month. Should this change be made? c. Assume that MN Company is currently selling 300 units of Product SD per month. Management wants to increase sales and feels this can be done by cutting the selling price by $22 per unit and increasing the advertising budget by $20,000 per month. Management believes that these actions will increase unit sales by 50 percent. Should these changes be made? d. Assume that MN Company is currently selling 300 units of Product SD. Management wants to automate a portion of the production process for Product SD. The new equipment would reduce direct labor costs by $20 per unit but would result in a monthly rental cost for the new robotic equipment of $10,000. Management believes that the new equipment will increase the reliability of Product SD thus resulting in an increase in monthly sales of 12%. Should these changes be made?