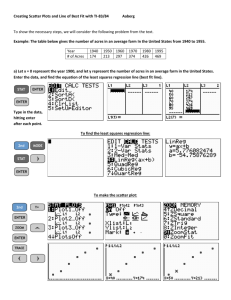

2009 Farm & Ranch Management Test Questions

advertisement

2010 Farm & Ranch Management Test Part 1 Please use the GradeMaster Card to fill in your answers 1. ________ ________ is the daily accumulation of interest on a loan. a. Cruel interest b. Interest buy down c. Annual interest Accrued interest d. 2. Joel paid the interest on 12-31-09 on a loan balance of $150,000. The interest rate is 5.5%. How much interest is due on the next payment due on April 15, 2010. a. $ 150 b.$3510 c.$ 683 d. $2351 3. If a farmer makes his payment on time once per year in question #2 and his payment is $15,000, how much interest will he pay on his next payment? a. $1,504 b. $3510 c. $8250 d. $9000 4. In question #3, how much principle will he pay? a. $13,496 b. $11,490 c. $8,000 d. $6,750 5. Farmer John Smith grows durum and needs to apply 90 lbs. of actual nitrogen in order to reach his yield goal of 40 bushels per acre. How many lbs. of NH3 would he need to apply per acre? a. 80.75 lbs. b. 120.43 lbs. c. 160.53 lbs. d. 109.76 lbs. 6. In question # 5 how much will it cost per acre if NH3 is selling for $500 per ton? a. $48.12/acre b. $27.44/acre c. $24.34/acre d. $29.27/acre 7. What will his total cost be to fertilize 1000 acres with NH3? a. $48,124 b. $36,599 c. $27,440 d. $29,270 8. Rancher Betty Spine has a herd of 200 Angus cows. 180 of her cows gave birth during 2009. What is her calving %? a. 90% b. 89% c. 97% d. 95% 9. In question #8 Betty weaned 175 calves at 574 lbs. per calf. What is her weaning wt. per exposed female? a. 502 lbs. b. 525 lbs. c. 550 lbs. d. 509 lbs. 10. If Betty grazes her cows for six months and her pasture will support .85 AUMs per acre, how many acres does she need for her 200 cows? a. 875 acres b. 1053 acres c. 1412 acres d. 1625 acres 11. The acronym LDP stands for? a. Lend Dollars Please c. Loan Deficiency Payment b. Loan Deficiency Program d. Loan Demand Payment 12. Farmer Olson harvests his spring wheat during the first week in August, feeling the markets will be going up, decides to store his wheat until the first week in April. What price would farmer Olson need on April 1st to break even with an August 1st price of $3.00? He has a one time in and out charge of $.10/bu and has operating loan interest at 9.5%. Spring wheat in December is $3.10. a. $3.25 b. $3.30 c. $3.35 d. $3.29 13. The first step in developing a crop marketing plan is: a. Establish a margin account. 1 b. Select a commodity broker. c. Determine the cost of production d. Check prices at the local elevator. 14. A rancher in western North Dakota wants to hedge his spring calf crop for sale in December. He would sell a ________ using the Futures Market. a. Life insurance policy b. Call option c. Long position d. Margin e. Contract 15. A “long” call option is: a. The right to buy the underlying futures contract. b. The right to sell the underlying futures contract. c. The obligation to buy the underlying futures contract. d. The obligation to sell the underlying futures contract. 16. To protect against lower prices, you could: a. Buy a call. b. Buy a put. 17. 18. An option buyer can: a. Exercise the option. above. c. Sell a margin. b. Sell the option. d. Sell a put. c. Let the option expire. d. All of the The “rate of return on assets” and the “rate of return on equity” are_________ measures. a. Liquidity b. Solvency c. Efficiency d. Profitability 19. The amount of gross production per dollar of investment is known as: a. Rate of return on assets. b. Operating profit margin c. Asset turnover rate. d. Labor and management earnings. 20. If two commodities are substitutes for each other, an increase in the price of one will: a. Decrease the demand for the other. b. Increase the demand for the other. c. Decrease the price of the other. d. Increase its demand. 21. Figure the per acre crop insurance guarantee on my planted acres if my actual production history is 30 bushels/acre, my level of coverage is 70%, the price is $5/bushel and my prevent plant option is 60%. a. $63 b. $105 c. $11.66 d. None of the above 22. Using the above numbers how much would I collect in crop insurance if I harvest 19 bushels per acre a. $0 b. $10 c. $25 d. $55 23. What is producers net farm income using any of the following Cash farm income – 715,000 Cash farm expenses – 575,000 Crop Inventory adjustment – increased 50,000 Accounts payable adjustment – increased 25,000 Depreciation – 25,000 Family Living – 50,000 Machinery principle payment – 25,000 a. $765,000 b. $ 400,000 c. $ 200,000 24. Calculate the projected breakeven price using the following numbers: Direct expenses – 325 Overhead expenses – 75 Crop insurance proven yield – 100 Expected yield – 133.33 2 d. $140,000 a. $4.00 b. $4.33 c. $3.00 d. $3.33 25. Net Farm Income includes a value for the operator’s labor and management. a. True b. False 26. If Return on Assets is higher than Return on Equity, then borrowed money is being used efficiently. a. True b. False 27. EBITDA is a measure of cash available for debt servicing. a. True b. False 28. Rate of Return on Assets is equal to the product of the Operating Profit Margin and Asset Turnover Rate. a. True b. False 29. Working Capital is the difference between Total Current Assets minus Total Depreciation. a. True b. False 30. Current Ratio is a good measure of profitability. a. True b. False 31. A farm business had a depreciation on equipment of $10,000. $100,000 of sales, $70,000 of paid expenses, and $10,000 of accrued expenses at end of year. What was the net cash income for the year? a. $ 30,000 b. $ 40,000 c. $ 20,000 d. $ 10,000 32. In the above problem, what is the NFI? a. $ 10,000 b. $ 20,000 c. $ 30,000 d. $ 40,000 33. If a farmer earns $50,000 net income and also earns $20,000 non-farm income, and spends $40,000 on family living . a. his/her gain in net worth is $70,000 b.has only $30,000 in his /her retirement account c. has a disposable income of $70,000 d. is able to gain $30,000 of equity e. both c& d 34. A crop produces $250 gross per acre and produces 50 bushels per acre. The cost per bu. is $4. What is the net income per acre? a.$250 b.$50 c.$ 0 d.$ 246 35. The high profit farms/ranches in Western ND for 2009 had an expense ratio of 66%, an asset turnover ratio of 47%,a depreciation expense ratio of 5%, and an interest expense ratio of 5%, What was the net income ratio for this group? a. 103% b. 113% c. 24% d. 56% 36 . In the above situation the gross farm income was approximately $1,072,800 per farm average. What was the Net Farm Income? a. $ 257,000 b. $ 107,280 c. $ 214,560 d. $ 364,472 37. A farmer has a debt to asset ratio of more than 100% . He/she will not be able to make all the scheduled payments on debt. a. True b. False 38. Non farm income should be listed on the balance sheet a. True b. False 3 39. Assume the price for hard red spring wheat with 14% protein is $5.50 per bushel. The protein percentage of a farmer’s wheat is 13.2%. If the protein discount is $.30 per 1/5 point, what price will the farmer receive per bushel if he sells the wheat? a. $4.00 b. $4.30 c. $5.20 d. $5.80 40. The costs for growing corn are normally divided into direct expenses and overhead (or fixed) expenses. Which of the following contains only direct expenses for growing corn? a. seed, fuel, professional fees, machinery depreciation b. seed, fertilizer, crop chemicals, crop insurance c. crop chemicals, crop insurance, real estate taxes, utilities d. utilities, building depreciation, operating interest, land rent 41. For growing corn which of the following contains only overhead expenses? a. machinery depreciation, liability insurance, land rent, seed b. property insurance, dry fertilizer, crop chemicals, building repairs c. building depreciation, professional fees, utilities, real estate taxes d. long term interest, anhydrous ammonia, crop insurance, real estate taxes 42. On an agricultural producer’s balance sheet, net worth is determined by: a. totaling current, intermediate, and long term assets b. subtracting current liabilities from long term assets c. subtracting intermediate and long term liabilities from total assets d. subtracting total liabilities from total assets 43. Due to a winter storm, a farm was without electricity for seven (7) days. The farmer used a tractor driven generator to produce electricity while without normally supplied electricity. He ran the generator 23 hours a day for seven (7) days, shutting down about an hour a day for fueling, maintenance, checking oil, etc. He determines that the tractor burns 2.5 gallons of diesel fuel per hour to operate the generator. The diesel fuel cost him $2.899 per gallon. How much was his fuel expense for the year increased because electricity was not available from his local rural electric cooperative for this week? (to nearest dollar) a. $1,118 b. $1,167 c. $1,218 d. $1,267 44. Rollie, the rancher, rented a 240 acre pasture for $14 per acre for the year. He had 55 cow/calf pairs in the pasture for 105 days. Rollie had artificially inseminated the cows, and all cows appeared bred, so no bull was in the pasture with the cows. What was his cost per aum (animal unit month)? Use one (1) aum equals one (1) cow/calf pair on pasture for 30 days. a. $16.69 b. $17.14 c. $17.45 d. $18.20 45. In economics when more and more of a variable resource is added to a given amount of a fixed resource, the resulting changes in output will eventually diminish. This is known as the: a. Law of demand b. Law of diminishing marginal utility c. Law of diminishing marginal returns d. Marginal cost 46. Any production cost that increases as output increases is known as a: a. Fixed cost b. Overhead cost c. Variable cost d. Discretionary cost 4 47. The total value of all final goods and services produced in an economy during a given year is known as: a. Gross national product b. Disposable income c. Economic profit d. Marginal revenue 48. The focusing of an individual’s efforts on the production of a single good or service is known as: a. Social regulation b Pure capitalism c. Rational expectations d. Specialization 49. The expansion of a firm into stages of production earlier or later than those in which it has specialized is known as: a. Horizontal integration b. Vertical integration c. Substitution effect d. Market socialism 50. A sustained and continuous increase in the price level is known as: a. Liquidity b. Negative income c. Deflation 5 d. Inflation 2010 STATE FFA FARM BUSINESS MANAGEMENT TEST PART 2 Financial Statements (FINPACK Balance Sheets found in the resource information) Please use the Market Value when making the calculations for the Anderson Farm. Also round the number to the nearest hundredth. 1/1/2008 1/1/2009 1/1/2010 Current Ratio 2.54 1.70 1.65 Ownership Equity 0.75 0.77 0.75 Leverage Ratio 0.26 0.26 0.33 Current Debt Ratio 0.30 0.35 0.37 Debt to Asset Ratio 0.44 0.23 0.25 51. The change in Net Worth from 1/1/2008 to 1/1/2010 was: a. $62,453 b. $42,953 c. $95,070 d. $32,617 52. The ratio that is the Weakest on 01/01/10 is the: a. Current Ratio b. Current Debt Ratio c. Leverage Ratio d. Debt to Asset Ratio 53. On which date was the Anderson’s current ratio the strongest? a. 1/1/2008 b. 1/1/2009 c. 1/1/2010 54. Based on the interest that the Anderson Farm paid in 2009 ($24,628), what was the actual interest rate paid on The Anderson’s Farm average farm asset for 2009. Use the 01/01/09 and 01/01/10 to calculate the average farm assets (Market Value). a. 1.7% b. 2.1% c. 2.4% d. 3.0% 55. The decreasing current ratio for the Anderson’s could indicate: a. Poor Farm Profits b. Decreasing Working Capital c. Family draw is too high 6 d. All of the Above 56. Which ratios have shown the worst trends? a. Current and Debt to Asset b. Current and Ownership Equity c. Current and Leverage d. None of the Above 57. The Debt to Asset Ratio in the year it was the strongest would be considered: a. Strong b. Satisfactory c. Vulnerable 58. The Current Ratio in the year that it was the weakest would be considered. a. Strong b. Satisfactory c. Vulnerable 59. The 1/1/2010 Leverage Ratio would be considered: a. Strong b. Satisfactory c. Vulnerable 60. The ratios from 1/1/2009 to 1/1/2010: a. remained relatively strong b. show the farm has taken on a vulnerable position c. changed drastically d. none of the above 61. What was the Anderson’s Net Worth on Jan. 1, 2010? a. $1,071,376 b. $1,061,570 c. $1,486,544 d. $1,118,477 62. If the Andersons have $190,000 worth of current assets on January 1, 2011, what is the maximum amount of current liabilities they can have if they want their current ratio to be the same or better than it was on Jan. 1, 2010? a. $115,152 b. $111,765 c. $ 74,803 d. None of the Above 7 63. Based on the Anderson’s Farm Balance Sheet for 01/01/10, the total retained earnings/contributed capital is: a. $ 47,101 b. $1,071,376 c. $1,118,477 d. None of the above 64. Using the information from the Average Farms from the Farm Income Statement (Region 3), which group of enterprise’s contributed the most to gross cash farm income: a. All Livestock Income b. All Crop Income c. Custom Work Income d. Government Payments and Insurance Projected Budget Joel Anderson has decided on the following crop and livestock program. The total bases for this farm in 2010 are 500 acres for wheat with a 30 bushel yield and 45 bushel counter cyclical yield. Joel also has a corn base of 500 acres with a 43 bushel program yield and a 59 counter cyclical yield and a Soybean base of 425 acres with a 24 bushel program yield and a 28 Bushel counter cyclical yield. The Food, Conservation, and Energy Act of 2008 rates for this year are $.52 for wheat, $.30 Soybeans and $.28 for corn. The 2008 Farm Bill changed direct payments to 83.3% for 2010. Use the Average Farm from Region 3 to determine cost. Crop Spring Wheat Owned Soybeans, Cash Rent Corn, Owned Corn, Cash Rent Mixed alfalfa grass, owned Pasture Owned Cows ACRES Yield Price 160 35 bu. $ 5.50 950 28 bu. $ 8.50 200 100 bu. $ 3.25 540 116 bu. $ 3.25 280 1.25 ton $ 40.00 480 1.01 AUM $ 18.89/aum 50 head Gross return/cow $610 65. Would the rented Soybean acres cover the direct cost per acre if the rent cost was $60/acre and not considering government payments. a. Yes b. No 66. Calculate the projected return over total direct and overhead costs using the Anderson’s projected crop and livestock plan. Use the prices that are projected and do not include any projected government payments. (Use Region 3 Average Profit Farms for all farms for the crop and livestock analysis from your resource unit. Also assume the pasture costs on the livestock enterprise analysis are correct, and that all crop expenses are correct, including land rent, but use the projected prices and yields for both livestock and crops.) 8 d. a. $23,156 b. $20,548 c. $14,048 $ 4,604 67. Based on the Anderson’s Projected Budget, which crop listed below has the highest return over direct costs per acre (use the average farm on the enterprise budgets)? a. Corn b. Pasture c. Wheat d. Mixed Hay 68. Based on the Anderson’s Projected Budget, what should they do to increase their profit assuming overhead expenses to be fixed? a. Raise More Corn b. Raise No Wheat c. Increase Soybean Acres d. All of the Above 69. Using 1.5 AUM’s per cow and grazing his herd for 6.0 months, it would be wise for Joel Anderson to: a. Do nothing b. Rent additional pasture acres c. Increase the size of their cow herd d. All of the above 70. What would be the net return for Joel Anderson’s Cowherd if the income per cow increased by $25/head and his feed cost decreased by 5%? Use the “Average” Farm for feed expense. a. $1478 b. $8500 c. $8750 d. $9000 71. If the discounts for wheat at 13% protein remain at their current levels, it will be worth $3.50/bushel. What will the return per acre be on Joel Anderson’s wheat crop be if he only produces 13% protein wheat? a. -$23.34 b. -$93.34 c. $23.34 d. $93.34 72. Based on the Projected Budget Data what you recommend to the producer? a. Increase Cow Herd b. Decrease Wheat Acres c. Forward Contract at high price levels than budgeted 9 d. All of the Above Income Statement (Page 1 of Resource Unit) 73. The Anderson's net operating profit (Net farm income from page 1 of the resource unit. a. $258,090 b. $170,141 c. $ 96,293 d. $134,415 74. Net operating profit 2008 a. $252,476 b. $225,468 c. $521,883 d. $ 56,222 75. Net operating profit 2007 a. -$106,076 b. c. $279,931 d. $230,922 before depreciation) for 2009 $258,090 76. Which year had the highest Net Farm Income after depreciation? a. 2007 b. 2008 c. 2009 77. For 2009 The Anderson’s Total Cash Family Living, Investments, and Non-Farm Capital Purchases was $52,555. Based on the Region 3 Household and Personal Expenses Statement, which category do they fall closest to? a. Average b. Low 20% c. 40 – 60% d. High 20% 78. Based on the information in the Region 3 Farm Income Statement, the Anderson’s are closest to which category for their 2009 Net Farm Income after depreciation? a. Low Farms b. 40-60% farms c. High Farms 10 d. Average Farm Investment Analysis The Andersons have the opportunity to purchase 160 acres of crop land for $125,000. The taxes on the land are $4.00 per acre. They have the required down payment of $25,000 and expect no immediate return on those dollars. They can borrow the money for 5.5% for 30 years. 79. What will the Annual Payment be on the Land not including taxes? a. $6,881 b. $9,076 c. $5,378 d. $7,823 80. Would Joel Anderson be cheaper on a cash flow basis to rent an additional 160 acres for $45/acre, if you don’t take into consideration any equity that might be gained? a. Yes b. No 81. Using the Average of All Farms Corn on Owned Land Total Direct Expenses, if Joel Anderson produces 100 bushels of corn per acre and gets $3.30/bushel, will there be enough money left over after covering all direct expenses to make his land payment? a. Yes b. No 82. Would this land purchase be generally consider a good investment based on Question 81? a. Yes b. No 83. The total payment per acre including taxes would be: a.$43 b.$52 c.$47 d.$54 84. If your answer to question 81 was no, what is the minimum price of corn Joel would need for a 100 bushel yield to make it a good investment? a. $3.20 b. $3.40 c. $3.60 d. My answer was yes Joel is looking at purchasing a new Sprayer for $80,000 to boot. Joel has three different financing options. One is to finance the total amount at 4.5% interest for four years. The second option is to take an interest waiver and make a principal only payment of 20,000 the first year and finance the rest for 3 years at 5%. The last option would be to pay cash and receive a discount of 7% on the boot price and finance through a different financial institution @ 5.5% making 4 equal annual payments. The Sprayer that was traded will be the down payment. 85. If the Anderson’s finance the Sprayer using the 4.5% interest option, the annual payments would be: a. $22,299 11 b. c. d. 86. $22,561 $16,724 $22,039 Total costs including interest for the Sprayer using the cash discount option would be: a. $90,504 b. $74,400 c. $84,904 d. $81,900 87. c. Which option has the least total cost including interest? a. Finance the whole price b. Interest Waiver Cash Discount d. They are all equally expensive 88. Joel is looking to purchase an additional, more fuel efficient vehicle for his family. If he purchases a slightly used car for $17,500 and can finance at 7.0% interest for 60 months with no money down, what would his monthly payments be on the new car? a. $338.28 b. $346.50 c. $419.13 d. $363.13 89. Another option Joel could use for financing the car is to put 10% down and finance the remainder for 60 months at 6.0%. How much less total dollars will Joel end up paying for the vehicle with this option by the time it is paid off? a. $773.00 b. $973.00 C. $2523.00 d. $1750.00 90. Projected Cash Flow In Resource Unit Does Joel Anderson’s Farm Cash Flow for 2010: a. Yes b. No 91. What month ends with the highest Operating Loan Balance: a. December b. November c. October d. September 92. If there is a 10% decrease in commodity prices over the year, how would it impact 12 Joel’s projected Net Farm Income for 2010 a. -$56,056 b. -$44,841 c. -$13,092 d. $72,722 93. What is the Anderson’s projected Net Cash Flow for 2010? a. $72,722 b. $11,947 c. $26,045 d -$13,092 94. Using this cash flow plan, Joel increases his working a. $82,807 b. 1.8% c. $5,120 d. $10,120 capital by: 95. If Joel purchases a new baler and adds payments of $7,250/year to this plan, will it still cash flow? a. Yes b. No c. This payment wouldn’t change the projected cash flow 96. With a term debt coverage ratio of 1.05 would this cash flow plan raise red flags at the local bank: a. Yes b. No Family Living Use the information in the resource information section to answer the questions. 97. Based on the total family living excluding Other non-farm expenditures for region 3, does the Anderson’s cash flow for family living fall closest to? a. Low 20% b. High 20% c. The average Farm d. 40-60% 98. Total cash family living and investments for the High 20% of all farms in region 3 was: a. $152,669 b. $ 50,302 c. $ 43,273 d. $ 82,457 13 99. If the Smith’s were just to raise soybeans, how many acres would he need to pay for the average of all farms total cash family living. Use the data from region 3 and use the 40 – 60% data for soybeans on rented land. Use net return per acre. a. 1223 b. 947 c. 1832 d. 1433 MARKETING Use the information in the Resource Information Section. Assume a negative $0.40 per bushel nearby basis and a negative $.60 new crop basis for wheat, a $0.02 per bushel/trade commission for options and futures, and a $0.03 per bushel per month carrying charge. Carrying charge would start on September 1. Commission on feeder cattle is $2.50/cwt for options and futures and a positive $7/cwt basis for the feeder cattle. The commission for selling the calves at the local auction is $14.00/head. On April 1, 2010, the Andersons had 2500 bu. of 09 Corn in the bin. Their projected soybean production for 2010 will give them 26,600 bushels to sell. Joel will raise 50 calves that will be weaned on November 1 and will average 575 lbs, and he will background his calves, taking them to 750lbs before they are sold at the local auction. 100. Joel’s break even price on his weaned calves in September is 112.00/cwt, is it possible to lock this price in after all fees? a. yes b. no c. maybe d. can’t tell from the information given 101. How many Soybean Contracts would Joel need to purchase to cover his projected production yields if he is insured at 70%? 2 b. 3 c. 4 d. 5 a. 102. Joel wants to price some of his 2010 soybean crop at Country Grain Cooperative in Cleveland. With today’s price and a -70 cent basis, what can he have his soybean sold for? a. $9.04 b. $8.94 c. $9.14 d. $9.09 103. Considering that it costs 1 cent per bushel per mile to haul, where should Joel sell his remaining 2009 corn? a. Cleveland b. Eldridge c. Napoleon d. Marion 14 104. Joel decides to sell a Jan ’11 soybean contract today, and at harvest time in October, that contract price has dropped to $9.50. How much money could he make if he buys that contract to make a full turn and get out of the market? a. $1850 b. $1950 c. $1750 d. $1600 105. In August at harvest time, the price of wheat is $5.25/bushel at the elevator. Joel delivers his grain, but decided to wait to price it. If he sells it in February, what does the price need to be for him to make the same as he would have in August using 5.5% interest? a. $5.70 b. $5.58 c. $5.40 d. $5.28 106. At weaning time Joel could sell his cattle directly to a feedlot for 115/cwt delivered. If it costs him $1.80/head per day to background them, what price will he need to get at the local sales barn to gross the same amount 60 days later when they weigh 750 lbs.? a. $95 b. $99 c. $101 d. $105 INCOME TAX Based on the Anderson’s Federal Tax Schedule found in the resource packet: 107. What is their total farm expenses? a. $456,925 b. $523,083 c. $66,158 d. Cannot tell from the schedule F 108. a. b. How much will Joel Anderson have pay in self employment tax for 2009? $66,158 $ 5,061 c. $10,122 d. You can’t tell by looking only at the Schedule F 109. What was the Anderson’s Gross Accrual Farm Income for 2009 a. $523083 b. $456925 c. $110,225 d. You can’t tell by looking only at the Schedule F 110. Joel could have decreased his 2009 tax liability by: a. Sold more of their crop at harvest time b. Spent less on custom hire c. Raised their own feed d. Paid off their operating loan interest in December 15