Ad Valorem Tax Guide

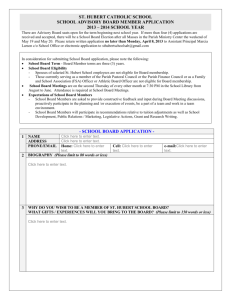

advertisement