Assets - Log English (File Size: 83,63Kb)

advertisement

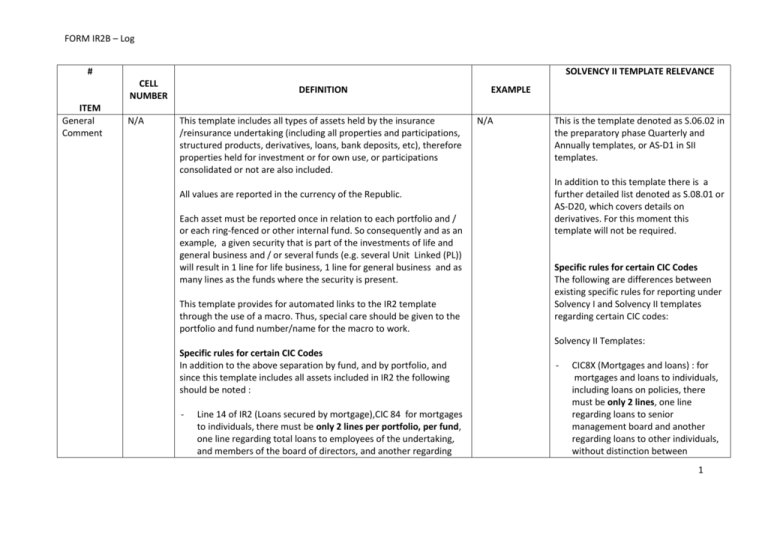

FORM IR2B – Log # SOLVENCY II TEMPLATE RELEVANCE CELL NUMBER ITEM General Comment N/A DEFINITION This template includes all types of assets held by the insurance /reinsurance undertaking (including all properties and participations, structured products, derivatives, loans, bank deposits, etc), therefore properties held for investment or for own use, or participations consolidated or not are also included. All values are reported in the currency of the Republic. Each asset must be reported once in relation to each portfolio and / or each ring-fenced or other internal fund. So consequently and as an example, a given security that is part of the investments of life and general business and / or several funds (e.g. several Unit Linked (PL)) will result in 1 line for life business, 1 line for general business and as many lines as the funds where the security is present. This template provides for automated links to the IR2 template through the use of a macro. Thus, special care should be given to the portfolio and fund number/name for the macro to work. EXAMPLE N/A This is the template denoted as S.06.02 in the preparatory phase Quarterly and Annually templates, or AS-D1 in SII templates. In addition to this template there is a further detailed list denoted as S.08.01 or AS-D20, which covers details on derivatives. For this moment this template will not be required. Specific rules for certain CIC Codes The following are differences between existing specific rules for reporting under Solvency I and Solvency II templates regarding certain CIC codes: Solvency II Templates: Specific rules for certain CIC Codes In addition to the above separation by fund, and by portfolio, and since this template includes all assets included in IR2 the following should be noted : - Line 14 of IR2 (Loans secured by mortgage),CIC 84 for mortgages to individuals, there must be only 2 lines per portfolio, per fund, one line regarding total loans to employees of the undertaking, and members of the board of directors, and another regarding - CIC8X (Mortgages and loans) : for mortgages and loans to individuals, including loans on policies, there must be only 2 lines, one line regarding loans to senior management board and another regarding loans to other individuals, without distinction between 1 FORM IR2B – Log - - - - - - - Portfolio A1 loans to other individuals, without distinction between individuals; Line 15 of IR2 (loans secured on policies of insurance), CIC 85, only one line per portfolio, per fund, for total of policy loans, without distinction between individuals; Lines 16 of IR2 (Other Loans - Secured), CIC 85, only one line per portfolio, per fund, for total of other secured loans, without distinction between individuals; Line 17 of IR2 (Other Loans - Unsecured), CIC 81, only one line per portfolio, per fund, for total of loans, without distinction between individuals; Line 31 of IR2, (Owed by intermediaries), CIC G9, only two lines per portfolio per fund, separating amount owed by more than 3 months to those owed for three months or less; Line 29 of IR2 (equipment), only two lines per portfolio per fund, separating equipment held for own use and others, CIC code 95 and 99; Lines 28,30,32,33,34,35,36,37,38,and 40,of IR2A, CIC G9, only one line per portfolio per fund; Line 39 of IR2 (Accrued interest and rent), the amount of any accrued interest should be shown in column A30 for each interest bearing certificate; any accrued rent should be shown in a separate line, only one line per portfolio per fund. This would mean that form IR2, does not include accrued interest in line 39, as this will be included in the total asset value for securities, etc. Line 41 of IR2, CIC71, CIC72, CIC73, only one line per portfolio per fund. Distinction between Life Business (L) General Business (GB) Shareholders (SH) - - - L / GB / SH/ OL individuals CIC95 (Plant and equipment (for own use), only one line aggregating all plant and equipment CIC71 (Cash) Only one line per currency CIC72 (Transferable deposits (cash equivalents)), only one line per pair (bank, currency) CIC73 (Other deposits short term (less than one year), only one line per pair Distinction between Life Business (L) Non-Life (NL) Shareholders’ fund (SF) 2 FORM IR2B – Log Fund Name A2 Asset held in unit linked and index linked funds (Y/N) Line Number to be transferred to IR2 ID Code A3 ID Code Type A5 Asset pledged as A6 Other Life assets not covering technical reserves (OL). Applicable to Unit Linked(PL)/ Index Linked (IL)/ Group Pension plan (GPP), assets held in ring-fenced or other internal funds (NL). The fund name should be preceded by the prefix PL, IL, GPP, NL, whichever applicable and space, as per the orders for completion of the annual returns. Identify assets that are part of the fund which determines the benefits of the contract . Undertakingspecific: PL Star A50 Identify the line number that should be given for the immediate transfer to IR2 form, for the particular fund, portfolio, through the use of a macro. 1 – 42 A4 ISIN if available, other "recognized" code otherwise (CUSIP, Bloomberq Ticker,Reuters RIC), bank account number (if deposit), registration number from land registry (for land), registration number from registrar of companies (for subsidiaries), or undertaking-specific if nothing else is available (e.g.: company accounts number for loans ) The code must be consistent over time. Type of ID Code used for the “ID Code” item. FR0010456764 (for ISIN) Identify assets in the balance sheet that are collateral pledged (CP), collateral for reinsurance accepted (CR), collateral for securities General (G) Ring fenced funds (RF) Fund Number in SII templates, instead of name. The relevant numbering process of funds procedure will be provided by the Service for the SII preparatory templates. Y/N ISIN, CUSIP, Bloomberq, account number, registration number, Undertaking CP / CR / CB / R This column is not included in SII templates. Identify assets that are in the scope of the template AS-D6. 3 FORM IR2B – Log collateral Item Title A7 borrowed (CB) and repos (R). For partially pledge assets two lines for each asset can be reported, one for the pledged amount and another for the remaining part. The above codes should be used only for the pledged amount. For that part of the assets or if the whole asset is not pledged then leave blank. Name of the security, bank name for deposits, subsidiary name, address for property. Not applicable for categories where assets are not required to be individualized. Issuer Name A8 Issuer Sector A9 Name of the issuer. An issuer is defined as the entity that offers securities representing part of its capital, part of its debt, derivatives, etc., for sale to investors. For investment funds, the issuer name is the name of the funds’ manager. Not applicable for categories where assets are not required to be individualized. Identify the economic sector of issuer based on NACE code. The letter reference of the NACE code must be used for identifying sectors (e.g. A:Agriculture, hunting and forestry; Section B: Fishing, etc) except for the NACE relating to Section J: Financial Intermediation, for which the 4 digits code should be used. For investment funds the NACE code would be 6712 (Security broking and fund management). “BNP PARIBAS SA TF/TV 5,019% 13/04/2049 CALL 2017”, “SCHRODER INT. SELEC. FUND US LARGE CAP”, “Westhafen Tower 13th Floor, Frankfurt, DE” BNP Paribas, Volkswagen, Cyprus Government After the issuer name, SII templates have two more columns Issuer Code and Type of Code which relate to legal Entity Identifier. For the current phase these were not included. 6511 (NACE for Life insurance) 4 FORM IR2B – Log Not applicable for categories where assets are not required to be individualized. Issuer Group A10 Issuer Country A11 Country of custody A12 Currency A13 CIC A15 For the initial phase this is not a required field. The Company may opt to leave it blank. Name of the ultimate parent undertaking of issuer. For investment funds the group relation is relative to the fund manager. Not applicable for categories where assets are not required to be individualized. Country where the legal seat of issuer is located. For investment funds, the country is relative to the fund manager. The legal seat, for this purpose, should be understood as the place where the issuer head office is officially registered, at a specific address, according to the commercial register (or equivalent). One of the options in the following closed list shall be used: ISA 3166-1 alpha-2 code Supernational issuers: XA European Union Institutions : EU Not applicable for categories where assets are not required to be individualized. ISO code of the country where undertaking assets are held in custody. For identifying international custodians (e.g. Euroclear), the country of custody will be the one corresponding to the legal establishment where the custody service was contractually defined. Not applicable for categories where assets are not required to be individualized. Currency of the issue (e.g.: bond labeled in USD) ISO 4217 Code EIOPA Code used to classify securities (description in the CIC table Allianz SE After the issuer group, SII templates have two more columns Issuer Group Code and Type of Code which relate to legal Entity Identifier. For the current phase these were not included. DE, IT, EE (ISO 3166-1 alpha-2 Code) PT, UK EUR, GBP, SEK, USD (ISO 4217 Code) PT22 5 FORM IR2B – Log file). If an investment is not included in the CIC categories, please use for third and fourth position G9 (Other) Participation A16 When classifying an asset using the CIC table, undertakings shall take into consideration the most representative risk to which the asset is exposed to. Indicates whether or not the investment is a participation as defined in article 2 of the Law on Insurance Services and other Related Issues of 2002-2013. (Convertible corporate bond listed in Portugal) N/Y Identify if an equity and other share or subordinated liability is a participation by using the following criteria: included in group supervision except if deducted under art. 212 and /or strategic. For solo reporting or group reporting where the Deduction and aggregation method is used, the following options shall be used: Not a participation : N Is a participation, but not consolidated at group level and not strategic : YNGNS Is a participation not consolidated at group level but strategic : YNGS Is a participation, consolidated at group level and not strategic : YGNS Is consolidated at group level and is strategic : YGS External rating A17 Rating Agency A18 Rating given by external rating agency. Only applicable to CIC categories 1, 2, 5 and 6. Undertakings must report the external rating which in their perspective is best representative. Rating agency giving the external rating. For example the rating agencies Moody’s, Fitch, Standard & Poor’s. AAA, Aa Moody’s, Fitch,…, Other 6 FORM IR2B – Log Duration A20 Definition=Original duration in years. Only applies to CIC categories 1, 2, 4 (when applicable, e.g. for investment funds mainly invested in bonds), 5 and 6. For assets without fixed maturity the first call date should be used. 10,5,3 Quantity A22 1000 Unit price A23 Valuation method A24 Number of securities or invested amount measured at par amount, depending on the type of assets. For assets categories 3 and 4, report the number of shares. For asset categories 1,2,5 and 6 report the invested amount measured at par amount. For CIC categories 7, 8, 9 and G, this should equal A26. Amount in reporting currency for asset categories 3 and 4, the percentage of par value (clean price consistent with IFRS definition), for asset categories 1,2,5 and 6. Accrued interest is recognized in items A30 (Accrued interest). For CIC categories 7, 8, 9 and G, this should equal to 1. Identify the valuation method used when valuing assets. One of the options in the following list shall be used: Quoted market price in active markets for same assets : QMP Quoted market price in active markets for similar assets : QMPS Other alternative valuation method : AVM Adjusted equity methods (applicable for the valuation of participations) : AEM IFRS equity methods (applicable for the valuation of participations) : IEM Acquisition cost A25 The company should provide in writing any other method it used, if other is used Acquisition price of each asset. When there are different acquisition prices due to acquisitions made at different dates, an average acquisition price must be used and consequently only one line is completed for one single asset, independently of having more than one acquisition. Asset duration, defined as the ‘residual modified duration’. For assets without fixed maturity the first call date shall be used. The duration shall be calculated on economic value. 35,56 (€, etc.) for shares; 98,52 for bonds QMP/QMPS/ AVM/ AEM/ IEM 13,10 (€, etc.) 7 FORM IR2B – Log Total amount A26 Maturity date A28 Accrued interest A30 Not applicable to CIC categories 7, 8 and G. Formula, corresponding to the multiplication of “Quantity” by “Unit price” plus accrued interest for bonds and other interest bearing security. For CIC categories 7, 8, 9 and G, this should indicate the Total value of the line. Only applicable for CIC categories 1, 2, 5, 6 and 8. Corresponds always to the maturity date, even for callable securities. For perpetual securities use “31/12/9999”. Quantify the amount of accrued interest for interest bearing securities. Note that this value is also part of A26 – Total amount. 3.556.890 (€, etc.) 31/10/2012 2.589 (€, etc.) 8