Properties of Chain Ladder Models

advertisement

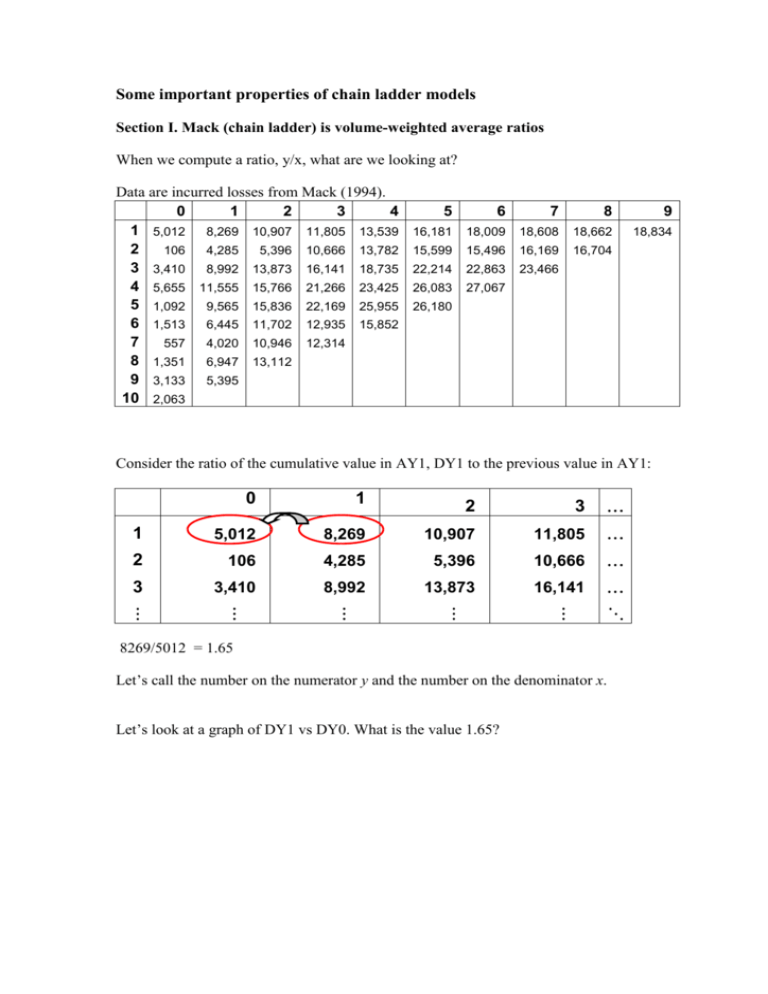

Some important properties of chain ladder models Section I. Mack (chain ladder) is volume-weighted average ratios When we compute a ratio, y/x, what are we looking at? Data are incurred losses from Mack (1994). 0 1 2 3 4 1 5,012 8,269 10,907 11,805 13,539 2 106 4,285 5,396 10,666 13,782 3 3,410 8,992 13,873 16,141 18,735 4 5,655 11,555 15,766 21,266 23,425 5 1,092 9,565 15,836 22,169 25,955 6 1,513 6,445 11,702 12,935 15,852 7 557 4,020 10,946 12,314 8 1,351 6,947 13,112 9 3,133 5,395 10 2,063 5 6 7 8 9 16,181 18,009 18,608 18,662 18,834 15,599 15,496 16,169 16,704 22,214 22,863 23,466 26,083 27,067 26,180 Consider the ratio of the cumulative value in AY1, DY1 to the previous value in AY1: 0 1 1 5,012 2 2 3 8,269 10,907 11,805 106 4,285 5,396 10,666 3 3,410 8,992 13,873 16,141 8269/5012 = 1.65 Let’s call the number on the numerator y and the number on the denominator x. Let’s look at a graph of DY1 vs DY0. What is the value 1.65? Cum DY 1 vs DY 0 12,000 10,000 (5012, 8269) 8,000 6,000 Slope = 1.65 4,000 2,000 0 0 1,000 2,000 3,000 4,000 5,000 6,000 If you plot x and y as a point on a plot, the ratio y/x is the slope of the line through the origin that passes through that point. When we think of there being a “typical” ratio (which we may want to use for prediction), we are also talking about a “typical” slope through the origin on that (x,y) plot. If our measure of “typical” is some kind of average (such as a weighted average, a geometric mean, an average of the most recent values, or whatever), we are talking about both an “average” ratio and at the same time, an “average” slope. Table of ratios 0-1 1-2 1 1.6498 1.3190 2 40.4245 1.2593 3 2.6370 1.5428 4 2.0433 1.3644 5 8.7592 1.6556 6 4.2597 1.8157 7 7.2172 2.7229 8 5.1421 1.8874 9 1.7220 2-3 3-4 4-5 1.0823 1.9766 1.1635 1.3489 1.3999 1.1054 1.1250 1.1469 1.2921 1.1607 1.1015 1.1708 1.2255 1.1951 1.1318 1.1857 1.1135 1.0087 5-6 6-7 7-8 8-9 1.1130 1.0333 1.0029 1.0092 0.9934 1.0434 1.0331 1.0292 1.0264 1.0377 In statistical terms, we’re using sample ratios to estimate the underlying ratio, since the observed ratios are “noisy”. We are also saying that, given the previous cumulative, we expect that on average the next cumulative is a multiple of the previous one. That is: E(y/x |x) = r ≡ E(y | x ) = rx. “E()” stands for “expected” (underlying average) value of whatever is in parentheses, and “|” means “given”. So E(y|x) means “the expected value of y, given the value of x”. The left side is a ratio, r, the right side is a line through the origin with slope r. They both describe the same relationship between one cumulative or incurred and the next. So if there’s an underlying "ratio", it’s also an underlying slope. Here’s one such “average” line, an ordinary regression line through the origin: Cum DY 1 vs DY 0 12,000 10,000 8,000 6,000 4,000 2,000 0 0 1,000 2,000 3,000 4,000 5,000 6,000 The slope of this line is around 2.217, which is an estimate of the underlying ratio. Residuals The residuals from this fit are the differences between the points and the line. Residual = data – fit of method ; Residual trend = data trend – method trend We use residuals to assess ways in which the model assumptions don’t apply. Let’s calculate the residual for the point with y = 8992 and x = 3410, and for the point with y = 9565, x = 1092 (these are from AYs 3 and 5 respectively). The observed value for DY1 for the point circled in red below is 8992. The fitted value (the height of the line at the x-value 3410) is 3410 2.217 = 7560. Cum DY 1 vs DY 0 12,000 10,000 (3410, 8992) 1432 8,000 6,000 4,000 2,000 0 0 1,000 2,000 3,000 4,000 5,000 6,000 The residual, 1432 is 8992 – 3410 2.217; the observed value in DY 1 minus the prediction from the ratio times the previous value (residual = data – fit). The observation with the largest residual is circled in blue. Its observed (y) value is 9565, while the x value is 1092. Consequently, its residual is 9565 – 1092 2.217, which gives 7144. Residuals vs DY0 8,000 6,000 4,000 2,000 0 -2,000 -4,000 0 1,000 2,000 3,000 4,000 5,000 6,000 Above are residuals from the fitted line (ratio). Notice the downward trend! Something is clearly amiss; the line through the origin doesn’t describe the relationship well. In fact, the residuals are getting smaller as the previous cumulative gets larger. Look at the fitted line again, and see how the points on the left are above it and the points on the right are mostly below it. The relationship is not a line through the origin: Cum.(1) vs Cum.(0) 12,000 11,000 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 0 1,000 2,000 3,000 4,000 5,000 Above is a line of best fit in green. Clearly a line that doesn’t go through the origin is a better description of the relationship here. Normally residuals are divided by their (individual) standard deviation, so that they share a common scale – the result is standardized residuals. Secondly, it’s important to see whether the residuals are related to other likely predictors of the observations (in which case we will see non-random trends in the residuals plotted against those predictors). One obvious thing to do is to look at residuals against the three directions (accident year, development year and calendar year), as below. The fourth plot, residuals vs fitted values, is a standard regression diagnostic. Notice that it has exactly the same appearance as the above plot – only the scale labels are different! Wtd Std Res vs Dev. Yr Wtd Std Res vs Acc. Yr 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 0 1 2 3 4 5 6 7 8 9 81 82 Wtd Std Res vs Cal. Yr 83 84 85 86 87 88 89 90 Wtd Std Res vs Fitted 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 81 82 83 84 85 86 87 88 89 90 2,000 4,000 6,000 8,000 10,000 12,000 Residual display for a ratio model for DY1 on DY0 (first pair of years). The plot against accident and calendar years are the same because we only have a single pair of years. There’s also not a lot of information in the residuals for a single pair of years – patterns have to be quite strong for us to be able to pick anything up. Here’s the plot of y vs x for the second pair of years (DY2 vs DY1), followed by the corresponding residuals. Cum.(2) vs Cum.(1) 18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 0 5,000 10,000 Wtd Std Res vs Dev. Yr Wtd Std Res vs Acc. Yr 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 0 1 2 3 4 5 6 7 8 9 81 82 Wtd Std Res vs Cal. Yr 83 84 85 86 87 88 89 90 Wtd Std Res vs Fitted 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 81 82 83 84 85 86 87 88 89 90 8,000 10,000 12,000 14,000 16,000 18,000 Residual display for a ratio model for DY2 on DY1 (second pair of years). In the model for DY2, we can see an increasing trend against calendar (and accident) year, and a decreasing trend against fitted values – again, the relationship between DY2 (y) and DY1 (x this time) is not through the origin. Cum.(3) vs Cum.(2) 22,000 20,000 18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 0 5,000 10,000 Plot of y vs x for second pair of years (DY3 vs DY2). 15,000 Wtd Std Res vs Dev. Yr Wtd Std Res vs Acc. Yr 1.6 1.6 1.2 1.2 0.8 0.8 0.4 0.4 0 0 -0.4 -0.4 -0.8 -0.8 0 1 2 3 4 5 6 7 8 9 81 Wtd Std Res vs Cal. Yr 82 83 84 85 86 87 88 89 Wtd Std Res vs Fitted 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 -0.2 -0.4 -0.6 -0.8 1.6 1.2 0.8 0.4 0 -0.4 -0.8 81 82 83 84 85 86 87 88 89 90 8,000 10,000 12,000 14,000 16,000 18,000 Residual display for a ratio model for DY3 on DY2 (third pair of years). Cum.(4) vs Cum.(3) 24,000 22,000 20,000 18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 0 5,000 Plot of y vs x for third pair of years. 10,000 15,000 20,000 90 Wtd Std Res vs Dev. Yr Wtd Std Res vs Acc. Yr 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 0 1 2 3 4 5 6 7 8 9 81 82 Wtd Std Res vs Cal. Yr 83 84 85 86 87 88 89 90 Wtd Std Res vs Fitted 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 81 82 83 84 85 86 87 88 89 90 14,000 16,000 18,000 20,000 22,000 24,000 Residual display for a ratio model for DY4 on DY3 (fourth pair of years). By now it’s getting hard to see much of anything going on, there are only 7 and 6 points respectively in the most recent two sets of residual plots above. We can combine the residuals together into a display against each direction. The plots against accident and calendar years will no longer be redundant, and we will be able to pick up trends in those directions. Note that the plot against development years will not show lack of fit in general, since the fitted line will go through a “weighted average” value of y at each development, but it will allow us to see what’s going on with the spread around the line. The fitted value will more clearly show (by having an overall trend) whether there’s a tendency to need an intercept. Wtd Std Res vs Dev. Yr Wtd Std Res vs Acc. Yr 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 0 1 2 3 4 5 6 7 8 9 81 82 Wtd Std Res vs Cal. Yr 83 84 85 86 87 88 89 Wtd Std Res vs Fitted 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 81 82 83 84 85 86 87 88 89 90 5,000 10,000 15,000 20,000 25,000 We can see a strong overall downward trend against fitted values. This strongly suggests a need for an intercept term! 90 The standard chain ladder ratio (Mack) The standard chain ladder ratio (Mack ratio) is a kind of weighted average of the ratios, where the weight is the previous cumulative – it’s sometimes called a “volume weighted average”. An ordinary average of a set of y values (y1, y2, … yn) is (y1 + y2 + … + yn)/n. We can write that in short form as: (i yi )/n. A weighted average has a weight for each observation, so that an observation with more weight “affects” the average more than one with less weight. It “pulls” the average toward it. A weighted average looks like this: [wi · yi ] / [wi]. A weighted average ratio is written like this: r = [wi (yi /xi)] / [wi]. The chain ladder/Mack model has wi = xi . That is, r = [xi (yi /xi)] / [xi] = [yi xi /xi] / [xi] = yi / xi . In other words, if we add up the two columns and take the ratio to get the chain ladder ratio, 8269 + 4285 + 8992 + … 5012 + 106 + 3410 + … it’s the same as weighting the individual ratios by the first column and taking the average: 5012 · 1.6498 + 106 · 40.4245 + 3410 · 2.6370 + … 5012 + 106 + 3410 + … There are three entirely equivalent ways of looking at the same thing – as a ratio of sums, and a weighted average ratio, and as a weighted average slope (weighted regression line through the origin). Because the weights applied to the ratios are the previous value (incurred or cumulative), this kind of weighted average is often called a volume-weighted average ratio. Mack (chain ladder) is volume-weighted average ratios 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 0 1,000 2,000 3,000 4,000 5,000 6,000 Individual ratios and the standard chain ladder (Mack) ratio (red) for DY1 vs DY0. The arithmetic average of the ratios is in gray. Below are the residuals for the Mack model applied to all pairs of years. Wtd Std Res vs Dev. Yr Wtd Std Res vs Acc. Yr 2 2 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 -1.5 -1.5 0 1 2 3 4 5 6 7 8 9 81 82 Wtd Std Res vs Cal. Yr 83 84 85 86 87 88 89 Wtd Std Res vs Fitted 2 2 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 -1.5 -1.5 81 82 83 84 85 86 87 88 89 90 5,000 10,000 15,000 20,000 25,000 Again, we see a strong downward trend. Note that if a line through the origin is inadequate because the actual relationship needs an intercept, then no other line through the origin will fit. That is, no ratio, no matter how you choose it, will adequately describe the development. 90 Section II. Chain ladder does not distinguish between accident and calendar years It is a property of the chain ladder that, when applied to an incremental triangle. the incremental forecasts identical to those for the equivalent procedure where accident years and development years are interchanged. Equivalently, you get the same incremental forecasts whether cumulation, calculation of ratios and projection runs to the right, across development years or down, across accident years. This applies to any model whose forecasts reproduce those of the standard chain ladder, so Mack’s model and the two-way cross-classification quasi-Poisson GLM both have this property in respect of the mean forecasts. Consider 5he following (toy) triangle, which represents incremental paid losses. 20 10 30 It turns out that the value to be forecast (in gray) = 30 10 / 20 = 15 Usual calculation (working across to the right) Equivalent cumulatives: 20 30 30 Ratio: 30/20 = 1.5 Cumulative forecast = 30 1.5 = 45 Incremental forecast = 45 – 30 = 15. Working down rather than across Cumulating down: 20 10 50 Ratio running down: 50/20 = 2.5 “Cumulative” forecast = 10 2.5 = 25 Incremental forecast = 25 – 10 = 15. In the first case, writing everything in terms of the incrementals, the ratio is (20+10)/20 = 1 + 10/20 . The cumulative forecast is 30 (1 + 10/20) = 30 + 30 10/20 . The incremental forecast is 30 + 30 10/20 – 30 = 30 10 / 20 . In the second case, again writing in terms of incrementals, the ratio is (20+30)/20 = 1 + 30/20 . The cumulative forecast is 10 (1 + 30/20) = 10 + 10 30/20 . The incremental forecast is 10 + 10 30/20 – 10 = 10 30 / 20 . In the general case, the incremental forecast (calculated in either direction) if b denotes the sum of incrementals in the same development year, and c denotes the sum of incrementals in the same accident year, and a denotes the sum of all values that are both above and to the left (in earlier accident and development years), then the incremental predicted (forecast) value is (bc)/a . a c b p ˆij p̂ ij = b.c/a Note that if the forecast value is further into the future than the next diagonal (calendar year), that (unknown) future incremental values required for the formula are replaced with their own forecasts. An algebraic proof that the incremental forecasts are of the form (bc)/a is given in Barnett, Zehnwirth and Dubossarsky (2005). This formula is symmetric (the formula is the same if we interchange accident and development periods – i.e. transpose the incremental array, since bc/a = cb/a. Consequently, it is always the case that the chain ladder works the same if we treat the accident years as if they were the development years and vice-versa. This is a worrisome property, because we know that the accident and development year directions are different. It appears to make no sense to cumulate downward and take ratios running down, but in fact the usual across version makes just as much sense. Some of the consequences are discussed in detail in Barnett et al (2005). Example The data in the following example are from the triangle ABC in Barnett and Zehnwirth (2000). Note that we do not use the exposures in this example. Firstly, let’s see what the residuals from a Mack model tell us about the suitability of a ratio model. We clearly see below strong changes in trend in the calendar year direction; neither Mack nor the quasi-Poisson GLM (#link to other page#) version of the chain ladder can deal with this. This is not an unusual circumstance. Wtd Std Res vs Dev. Yr Wtd Std Res vs Acc. Yr 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 0 1 2 3 4 5 6 7 8 9 10 77 78 79 Wtd Std Res vs Cal. Yr 80 81 82 83 84 85 86 87 Wtd Std Res vs Fitted 1.5 1.5 1 1 0.5 0.5 0 0 -0.5 -0.5 -1 -1 77 78 79 80 81 82 83 84 85 86 87 400,000 600,000 800,000 1,000,000 Let’s now examine standard chain ladder forecasts for this data. These forecasts are the same for Mack and the quasi-Poisson GLM. Incremental chain ladder forecasts for the ABC data (not exposure adjusted): 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 0 1 2 3 4 5 6 7 8 9 10 153638 188412 134534 87456 60348 42404 31238 21252 16622 14440 12200 178536 226412 158894 104686 71448 47990 35576 24818 22662 18000 14455 210172 259168 188388 123074 83380 56086 38496 33768 27400 20590 16918 211448 253482 183370 131040 78994 60232 45568 38000 26102 20758 17056 219810 266304 194650 120098 87582 62750 51000 34286 26997 21469 17640 205654 252746 177506 129522 96786 82400 44925 33853 26656 21198 17418 197716 255408 194648 142328 105600 65149 45697 34435 27114 21562 17717 239784 329242 264802 190400 116193 82949 58182 43843 34522 27453 22558 326304 471744 375400 234612 159737 114035 79986 60273 47459 37742 31011 420778 590400 425805 287301 195611 139645 97950 73809 58118 46218 37976 496200 649327 482379 325473 221600 158199 110964 83616 65840 52359 43021 Incremental chain ladder forecasts for the transpose of the ABC data: 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 0 1 2 3 4 5 6 7 8 9 10 153638 178536 210172 211448 219810 205654 197716 239784 326304 420778 496200 188412 226412 259168 253482 266304 252746 255408 329242 471744 590400 649327 134534 158894 188388 183370 194650 177506 194648 264802 375400 425805 482379 87456 104686 123074 131040 120098 129522 142328 190400 234612 287301 325473 60348 71448 83380 78994 87582 96786 105600 116193 159737 195611 221600 42404 47990 56086 60232 62750 82400 65149 82949 114035 139645 158199 31238 35576 38496 45568 51000 44925 45697 58182 79986 97950 110964 21252 24818 33768 38000 34286 33853 34435 43843 60273 73809 83616 16622 22662 27400 26102 26997 26656 27114 34522 47459 58118 65840 14440 18000 20590 20758 21469 21198 21562 27453 37742 46218 52359 12200 14455 16918 17056 17640 17418 17717 22558 31011 37976 43021 It should be noted, however, that the Mack standard deviations of forecasts (or outstandings or ultimates) and their coefficients of variation do not have the transpose property; because of the way the conditioning is set up; when transposed, the conditioning in the variance is not symmetric. The symmetry in the forecasts (specifically, that the transpose of the forecast and the forecast of the transpose of the triangle are equal) is not a desirable property. It is not an indication of “robustness” – forecasts from ratio models are highly sensitive to particular observations, and completely insensitive to other observations. It is not an indication of suitability of ratio models in general or of the chain ladder in particular, nor of either the Mack or quasi-Poisson GLM versions of it. If we run a structurally similar symmetric model from PTF (a two-way crossclassification model with log-link), of course the model won’t be suitable either: Wtd Std Res vs Cal. Yr 2.5 2 1.5 1 0.5 0 -0.5 -1 77 78 79 80 81 82 83 84 85 86 87 - however, a more suitable model can be obtained by allowing for some CY trend changes (though it would still be overparameterized and suffer from some of the other deficiences mentioned in Barnett et al, 2005) This model does have symmetry in forecast standard errors and CVs. For example, the following table is the same for both the original and transposed array. Calendar Year 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 Total Mean Reserve 1,619,407 1,145,583 787,890 549,715 390,448 279,534 203,820 145,476 92,444 44,221 5,258,538 Standard Dev. 87,010 64,074 44,277 31,161 22,714 16,870 13,195 10,766 8,594 6,252 240,539 CV Reserve 0.05 0.06 0.06 0.06 0.06 0.06 0.06 0.07 0.09 0.14 0.05 The same would be true for the quasi-Poisson GLM version of the chain ladder. As already mentioned, symmetry is not of itself a desirable property, but if you want to impose that symmetry it would be interesting to ask why we should expect it to hold for the mean but not the standard deviation. An article on the Mack method and bootstrapping is available here. References Barnett, G. and B. Zehnwirth (2000) Best Estimates for Reserves, PCAS No 87, p245303. Barnett G., B. Zehnwirth and E. Dubossarsky (2005) When Can Accident Years Be Regarded As Development Years?, PCAS No 92, p249-256. Mack, Th. (1994), "Which stochastic model is underlying the chain ladder method?" Insurance Mathematics and Economics, Vol 15 No. 2/3, 1994, pp. 133-138.