Professional Liability Insurance in Japan

advertisement

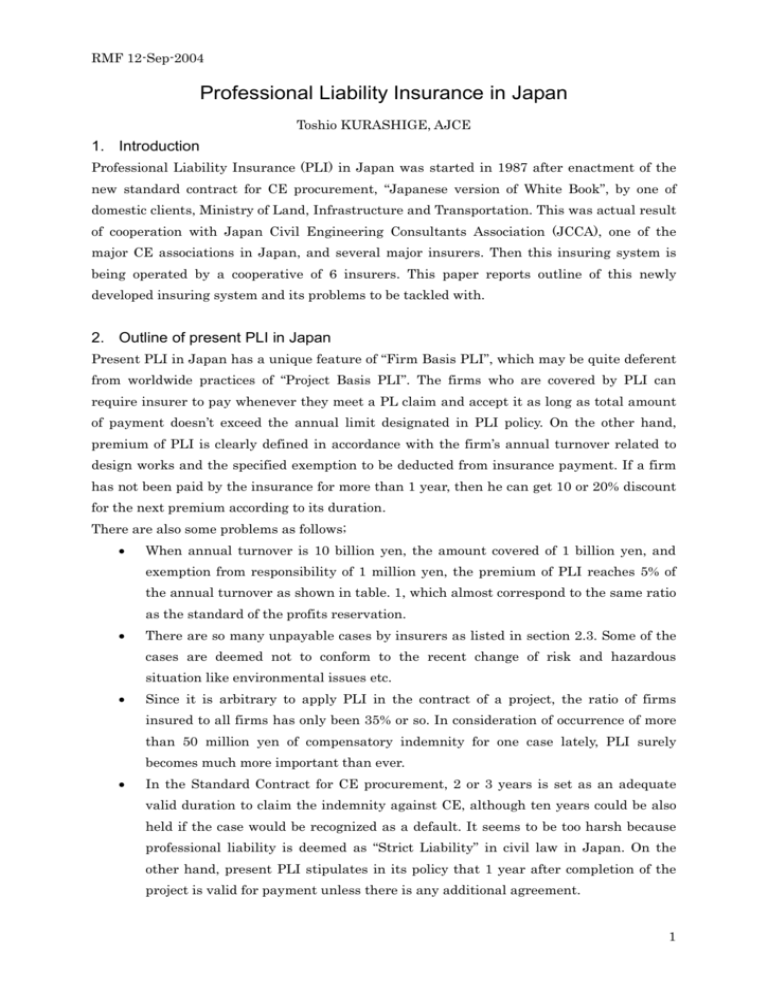

RMF 12-Sep-2004 Professional Liability Insurance in Japan Toshio KURASHIGE, AJCE 1. Introduction Professional Liability Insurance (PLI) in Japan was started in 1987 after enactment of the new standard contract for CE procurement, “Japanese version of White Book”, by one of domestic clients, Ministry of Land, Infrastructure and Transportation. This was actual result of cooperation with Japan Civil Engineering Consultants Association (JCCA), one of the major CE associations in Japan, and several major insurers. Then this insuring system is being operated by a cooperative of 6 insurers. This paper reports outline of this newly developed insuring system and its problems to be tackled with. 2. Outline of present PLI in Japan Present PLI in Japan has a unique feature of “Firm Basis PLI”, which may be quite deferent from worldwide practices of “Project Basis PLI”. The firms who are covered by PLI can require insurer to pay whenever they meet a PL claim and accept it as long as total amount of payment doesn’t exceed the annual limit designated in PLI policy. On the other hand, premium of PLI is clearly defined in accordance with the firm’s annual turnover related to design works and the specified exemption to be deducted from insurance payment. If a firm has not been paid by the insurance for more than 1 year, then he can get 10 or 20% discount for the next premium according to its duration. There are also some problems as follows; When annual turnover is 10 billion yen, the amount covered of 1 billion yen, and exemption from responsibility of 1 million yen, the premium of PLI reaches 5% of the annual turnover as shown in table. 1, which almost correspond to the same ratio as the standard of the profits reservation. There are so many unpayable cases by insurers as listed in section 2.3. Some of the cases are deemed not to conform to the recent change of risk and hazardous situation like environmental issues etc. Since it is arbitrary to apply PLI in the contract of a project, the ratio of firms insured to all firms has only been 35% or so. In consideration of occurrence of more than 50 million yen of compensatory indemnity for one case lately, PLI surely becomes much more important than ever. In the Standard Contract for CE procurement, 2 or 3 years is set as an adequate valid duration to claim the indemnity against CE, although ten years could be also held if the case would be recognized as a default. It seems to be too harsh because professional liability is deemed as “Strict Liability” in civil law in Japan. On the other hand, present PLI stipulates in its policy that 1 year after completion of the project is valid for payment unless there is any additional agreement. 1 RMF 12-Sep-2004 2.1. Projects insured by PLI Design works for public works in Japan. Not covering supervisory services. Not covering for private buildings. Optionally applicable to geological survey 2.2. Payable Indemnity by Insurer Indemnity on design flaw to pay clients who duly claim the compensation for remedy of structure and re-design in and after construction Indemnity on design flaw to pay third party who are injured clearly by structural collapse in and after construction 2.3. Typical unpayable cases Damage caused by facilities or devices etc. at project site Damage caused by transportation vehicle like airplane, elevator or car etc. Damage by criminal acts Damage of intangible property which is not actual or is spiritual property like fishery or intake right in river etc. Damage caused by noise, vibration or dust Damage to the value of environment Damage to the value of landscape Damage caused by miss-measurement when survey is the only responsible work in the project. (But it’s payable if survey is one component of responsible works and damage is caused by design based on defective result of the survey) 2.4. Remedial cost for design works itself Damage caused by default or delay of project Damage caused by war, uprising, riot, social turbulence, labor strike etc. Damage caused by earthquake, eruption or tsunami etc. Damage caused by drainage, ventilation or smoke etc. Excessive cost caused by overestimation in design Insurance and Exemption from Responsibility Insurance is limited within the range from maximum 1 billion yen (approximately US$ 9 million) to 30 million yen (approximately US$ 273 thousand). An exemption from responsibility can be arbitrarily set within the amount covered. 2.5. Insurance Premium Insurance premium can be estimated by clearly defined formula once a firm decides maximum insurance and exemption. Firm’s annual turnover and past claim records are main parameters in the formula. 2 RMF 12-Sep-2004 AP PR (a ATO b) (1 DR ) where AP = Annual Premium PR = Premium Rate specified for each combination of maximum insurance and exemption ATO = Annual Turnover a & b = Specified Constants varying in accordance with ATO DR = Discount Rate of 20%, 10% and 0%, which is determined from past claim records as follows; 1) 0% for new member firm to PLI or firm who was paid of insurance more than one time in the last one year after holding 10% discount 2) 10% for a firm who was not paid of any insurance in the last one year after holding 0% discount and a firm who was paid more than one time in the last one year after holding 20% discount 3) 20% for a firm who was not paid of any insurance in the last one year after holding 10% discount. Based on the above formula, insurance premiums in the case of without discount are calculated as shown in Table 1. Table 1. Example of Insurance Premium Annual Turnover Insurance Exemption million yen/year 1 billion 500 million 100 million 1million 3million 1million 3million 1million 3million 100 million 1.78 1.72 1.33 1.26 0.66 0.59 1billion 8.36 8.04 6.24 5.92 3.08 2.77 10 billion 23.98 23.08 17.90 16.99 8.85 7.94 50 billion 46.01 44.27 34.54 32.59 16.98 15.24 3. Some issues on Standard Contract 3.1. Valid duration to claim by client (VDC) VDC has been understood to be 1 year by Civil Law in case of the deal under contract. But Standard Contract for CE procurement shows 2 or 3 years should be appropriate because design flaw would be usually identified mainly in a construction stage which is generally completed in a couple of years after design stage. In addition to that, maximum 10 years could be valid if the flaw must be serious default or intentional. As mentioned before, does this kind of long term liability make sense? 3 RMF 12-Sep-2004 3.2. Maximum Indemnity There is no description about maximum indemnity on Standard Contract for CE Procurement. Accordingly extremely large amount of indemnity could be claimed to CE even if the flaw was slight and design fee was small. On the other hand, PLI policy doesn’t cover more than 1 billion yen as shown in chapter 2. It is obvious that this situation must be improved. But we have to provide clear answers to the following questions prior to putting forward requirement to client to set up adequate limitation of indemnity on the Contract. Should we take higher liability in accordance with increase of design fee? If so, we can say “lower the design fee is, lower the indemnity should be”. But if not, what should we say then? Who should compensate for residual amount of damage other than our payment? The attitude of keeping this issue unresolved maybe makes the entire responsibility attributed to CE after all. 3.3. Client’s Inspection of Design Products at Delivery In-house engineers of clients inspect design output carefully by due date after completion of the design work to evaluate whether the output could be acceptable or not. Then CE sometimes remedies their output within the agreed duration. Does this lead to share the liability between clients and CE? 4. Concluding Remarks AJCE would like RMF and FIDIC to provide information like maximum indemnity and valid duration to claim on agreement, and above mentioned PLI scheme worldwide etc. Also it is highly appreciated if opinions on Japanese PL situation could be heard from experienced persons on risk management. What is an ideal and practical PLI policy? It seems to be a critical issue for not only developed countries but developing countries where CE firms are suffering from enormous indemnity. Are there any criteria for CE to reject or accept a claim from clients to pay an indemnity? Examples on such criteria for worldwide cases would be helpful. (Drafted on 7-Sep-04) 4