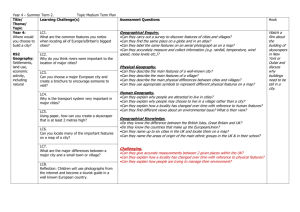

schooling mandated

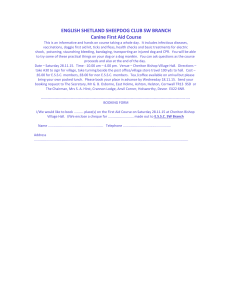

advertisement