The House Proposals - Massachusetts Business Alliance for

advertisement

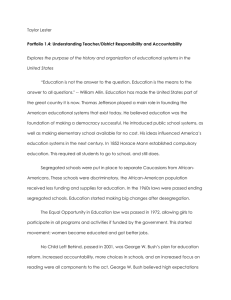

Massachusetts Business Alliance for Education Preserving Chapter 70 during the Fiscal Crisis April, 2003 A few days ago MBAE released an analysis of Governor Romney’s proposals for Chapter 70. We promised to present similar analyses for the House and Senate versions of education finance. The earlier paper begins with a summary of the basic concepts behind the funding formula; there’s no need to repeat this analysis here. The House proposals preserve the state’s commitment to funding school spending at foundation budget levels, and also preserve the structure underlying the foundation budget. The House’s ideas for Chapter 70 closely parallel our own, although there are a few differences: THE HOUSE PROPOSALS The House Ways and Means proposal maintains the current methodology for calculating Chapter 70 – the same foundation budget formula, the same inflation adjustment, the same methodology for calculating the municipal growth factor, and the same local spending requirements. Like the Governor’s budget, the House Ways and Means (HWM) proposals would mean substantial reductions next year in actual school spending. In this section, we describe what the House proposes; in the section that follows, we’ll analyze the House proposals and compare them with the Governor’s House 1 recommendations. In an ideal world, MBAE would prefer to see increases rather than decreases in state support of education. But we recognize the depth of the state’s fiscal crisis and understand that some reductions in spending are inevitable. While we disagree with some of the HWM proposals, we appreciate the fact that they have kept in place the basic aid structure that guarantees that the vast majority of funds go where they are most needed. The very heart of the Chapter 70 formula is the guarantee that the state will make up the difference between what districts need to spend (the foundation budget) and what they can reasonably be expected to raise themselves. The funds needed to meet this guarantee (we can call it “pure foundation aid”) accounted for $2.9 billion of the $3.3 billion in Chapter 70 aid in the current fiscal year (FY 03). The remaining $400 million or so is money given above and beyond pure foundation aid, largely aid based on what was distributed prior to 1993 and increased each year by the per-pupil increases guaranteed each district. There is no formula (rational or otherwise) underlying this aid, and it goes primarily, but not entirely, to wealthier districts that can afford high spending with relatively low local tax effort. Under the HWM proposals, this “extra” aid is cut to $205 million, so that the cuts are coming primarily from the districts best able to afford them. HWM would reduce overall Chapter 70 aid by $151 million from last year (a $10 million “pothole” account of $10 million means that the total reduction would actually be $141 million). The House achieves this reduction by cutting each district’s guaranteed aid from 100% of prior year aid (as has been true until now) to only 80%. HWM follows current law, requiring each town to increase its local contribution in support of its schools in proportion to the overall growth in its local revenues (including allowable property taxes Massachusetts Business Alliance for Education under Proposition 2 ½ and non-school state aid). In doing these calculations, it has taken into account the local aid reductions it proposes elsewhere in its budget. Unfortunately, the HWM proposal omits a valuable feature from last year, which reduced inequities across towns by allowing high-tax towns to decrease their local contributions while requiring low-tax towns to make larger increases. As under current law, the HWM proposal provides aid to make up the difference between the foundation budget on the one hand, and the revenues available from base aid and the required local contribution on the other. This provision is the same as under current law. While HWM appears to be cutting across the board – base aid is reduced for all districts by 20% in fact the cuts are targeted to wealthy communities. For high-poverty cities, HWM proposals work out the same as in past years – they receive full funding of the foundation budget. A smaller portion of this funding is in base aid; a larger in portion in foundation aid, but the bottom line is the same – as it should be. In dollar terms, HWM Chapter 70 proposals can be summarized as follows: Districts that need state assistance to remain at foundation receive increased funding of $34.2 million. Total aid to keep districts at foundation is $2.9 billion. Other aid above and beyond pure foundation aid is cut by almost 50 percent. Had all districts been guaranteed at least last year’s amount, this “extra” aid would have cost $390 million; instead, the house cuts it to $205 million. Bottom line: foundation increases = $34 million, “extra” aid cuts = $185 million, total Chapter 70 aid is cut by $151 million. o The House provides a $10 “pothole” fund for education spending, so the net aid cut is $141 million. What House Ways and Means Proposes – a Detailed Look Foundation Budget HWM maintains the statutory definition of the foundation budget. This calculation starts with numbers of students, applies class size and other parameters to determine numbers of teachers and other staff, applies salary values to get to wage costs, and adds in funds for books, maintenance, insurance, and other costs. Poverty Differential HWM maintains the statutory adjustment for low-income students – every 100 students generate 3 additional teachers, along with the benefits, professional development and maintenance costs associated with extra staff and extra classrooms. Inflation Adjustment The foundation budget is adjusted for inflation according to the statutory formula, increasing each year according to the increase in the U.S. Department of Commerce’s implicit price index for the costs faced by state and local governments. Massachusetts Business Alliance for Education Local Contribution HWM maintains the current framework for calculating required local effort – towns’ contributions to education rise in proportion to their Proposition 2 ½ levy limit (excluding any local overrides) and their unrestricted state aid. The calculations take into account the fact that unrestricted non-school aid will fall. HWM omits last year’s provision which required additional local effort (above and beyond the local growth factor) of towns with very low contribution rates and which allowed decreases in contributions for towns that currently make a very high contribution in support of schools. Foundation Aid The HWM budget maintains the existing framework. Each district is first guaranteed a certain amount of aid. This “base aid” is set at 80% of prior year aid, instead of 100% as in past years. The revenues available from the required local contribution and base aid are then compared to the foundation budget. If there is a shortfall, it is made up by additional foundation aid from the state. Thus, all districts are maintained at foundation budget levels. Aid to the neediest districts actually rises. It is easier to understand what is happening if we calculate “true” foundation aid – the difference between the foundation budget and required local contribution, paying no attention to prior year aid amounts. This aid actually rises by $34 million in the HWM proposal, as the foundation budgets of low-income districts grow more rapidly than their expected local contributions. Aid for Wealthy Towns The remaining aid can be thought of as “extra” aid – aid given to districts above and beyond what’s needed to reach foundation. This aid has helped to preserve existing spending levels in so-called “above foundation” communities. HWM guarantees every district at least 80% of last year’s aid level. The cost of this “extra” aid, above and beyond what’s needed to bring all districts to foundation, is $185 million. This compares to the $390 million that would have been necessary to keep all districts at FY 03 spending levels. Spending Requirement The current spending requirement is retained; education spending must equal Chapter 70 aid plus the required local contribution. Total required spending statewide remains essentially constant, as increases in required local contribution are approximately equal to the decrease in Chapter 70 assistance. House Ways and Means Education Proposals – Other than Chapter 70 Special Education Funding HWM provides $130 million for the so-called special-education “circuit breaker”, an increase of $59 million above the FY 03 budget. Intervention, Literacy HWM reduces remediation funds for districts with low MCAS results by 80%, from $50 million to $10 million, and requires that these remaining funds be used only with high school students. Massachusetts Business Alliance for Education HWM maintains $7.7 million in literacy funds, down from $18.3 million appropriated for the current year but up from the $6.5 million actually spent before these programs were eliminated by the Governor’s 9C cuts. School Building Construction HWM omits the $22 million in first-year school building assistance grants. Since the program operates with a one-year lag, these represent funds to districts that have already received construction approval. Charter School Reimbursement HWM would restore the program to reimburse districts for a portion of the state revenues lost when students leave for charter schools; this would add $46.5 million to the budget above last year’s level and above the Governor’s House 1 recommendations. Full-day Kindergarten HWM continues the full-day kindergarten grants, at $23 million – down slightly from the $24.6 million available in FY 03. Class-Size Reduction, Low-Income Districts HWM would eliminate this $18 million program (as would the Governor). It provides additional funds to low-income districts; in effect, it increases the foundation budget for the high-poverty school districts. School Transportation In the current year, the state is paying $94 million in school transportation assistance - $52 million to town school districts and $42 million to regional school districts. The governor and HWM propose to eliminate all aid to city and town districts (like Belmont or Boston), and cut the regional transportation aid dramatically – the Governor to $21 million and the House to $26 million. Under the school reform law, net school spending – spending on teachers, books, and other operating costs – is calculated separately from school transportation, which can in this sense be thought of as part of the municipal budget. There is no direct impact on school operating costs of cutting transportation aid, any more than there’s an impact from cutting lottery or other non-school aid. But in the real world, dramatic cuts in school transportation, additional assistance, lottery, and other non-school aid make it very unlikely that cities and towns will be able to maintain the $700 million of current-year net school spending levels above and beyond what is required under the reform law. Analysis, House Ways and Means Proposals Other than the reduction in base aid from 100% of prior year levels to 80%, HWM makes no changes in the existing Chapter 70 formula. The structural definition of the Foundation budget, the statutory inflation adjustment, and the requirement that additional education aid in fact be spent on education, have served the state well; MBAE supports the HWM approach. Massachusetts Business Alliance for Education Reducing Tax Inequities While the Governor’s proposal to move all districts to a uniform local tax rate does not work well with Proposition 2 ½, MBAE is supportive of the Governor’s general desire to reduce inequities in required tax effort across districts. Last year, Governor Swift proposed that districts with a tax effort greater than 170% of the state average receive additional state aid (thereby allowing them to maintain foundation spending with a reduced tax effort). She also recommended that districts taxing themselves at less than 70% of the state average close some of the gap between 70% and their existing tax effort. MBAE supports this approach; HWM proposals would be improved by continuing these provisions. Indeed, the cap at 170% of the state average is quite high; MBAE would prefer to see it lowered. The requirement that towns currently taxing at only 70% of the state average increase their contribution above and beyond what is required by the municipal revenue growth factor is a fair one, but very difficult for towns to accomplish in the absence of Proposition 2 ½ overrides. Class-Size Reduction Grants Like the Governor, HWM would eliminate the $18 million in class-size reduction grants currently given to high-poverty districts. This $18 million can be thought of as a de-facto increase in the foundation budget for the very poorest districts. While MBAE does not support an increase in the foundation budget at this time, we strongly oppose this reduction in spending in the neediest districts. Additional School Aid The HWM budget proposes some $205 million in what we might call “additional school aid” – aid in excess of the “pure” foundation aid needed to bring all districts to foundation. This represents a cut of 47% from the $390 million of additional aid implied by guaranteeing every district at least 100% of last year’s aid amount. MBAE would have preferred to avoid reductions in school aid, but we recognize that, absent new tax revenues, cuts are inevitable, and we agree with HWM that cuts are appropriately made in this additional aid. Ideally, however, we’d have made the cuts in a different way. HWM first reduces all aid by 20%, and then adds back whatever is needed to bring each district to foundation. This means that both very wealthy districts, like Chatham, and some districts of average wealth, like Quincy, receive aid reductions of 20%. Since Chatham receives no “true” foundation aid, all of its aid is additional aid, and this represents a cut of 20% of its extra aid. But most of Quincy’s aid is needed to bring it to foundation; the 20% cut in its total aid represents a cut of 54% in its additional aid. We would prefer that HWM did the calculations in the other order – first calculate foundation aid, as the difference between what the district needs to spend (the foundation budget) and its required local contribution. What is left is additional aid; any cuts should be made across the board in this additional aid. This would have meant 47% cuts for both Quincy and Chatham, which seems fairer than the HWM calculation. This course has the advantage of making explicit the extent to which each district’s aid is needed to bring it to foundation. Eventually, MBAE would like to see some rational basis for distributing this additional assistance. One possibility would be to guarantee each town a certain percent of foundation budget, with the percent varying inversely with per-capita income. The transition from the current additional aid payments (which have no underlying formula) to a new system could be made gradually, by Massachusetts Business Alliance for Education reducing extra assistance each year by 40% or so (or base aid each year by 20% or so) while gradually building up the aid amounts under the new formula. In 2 or 3 years, all towns would be receiving more from the new formula than the old, and the transition would be complete. Unfortunately, the HWM budget would preclude such a transition. The HWM specifies that, absent a rewrite of the formula as a whole, that base aid be set at 100% of prior year amounts in FY 05, and be raised to 101% of prior year in the subsequent two budget years. School Building Construction The governor honors school building construction commitments made to districts in the past year. HWM does not. These districts have received assurance from the state that they will receive school construction aid. MBAE strongly supports the Governor’s position that commitments already made must be honored. Given that these districts have signed contracts and begun construction, it’s hard to see how they can make ends meet if the promised state aid does not materialize. MCAS Remediation HWM recommends cutting the MCAS remediation funding by 80%, from $50 million this year to only $10 million in FY 04. MBAE is a strong supporter of additional funding for the districts with large numbers of at risk students. Intervention MBAE has argued strongly that the state needs to increase the Department of Education’s capability to work with struggling districts. The current MCAS remediation funding brings with it, as it should, additional oversight and assistance from the Department of Education. The HWM cut in remediation funds, along with recommended cuts in the Department’s operating budget, are steps in the wrong direction and undercut the chances for long-term education improvement. MBAE believes the state should increase, not decrease, the role it plays with struggling districts. While the people who work with schools at DoE are very capable, there simply aren’t enough of them. Any serious effort to make major educational gains requires that at least 10 to 15% of the state’s schools receive educational assistance each year. This assistance needs to be more prescriptive, and ongoing increases in state aid, as well as restored remediation funds, should be tied to the development of effective implementation plans. MBAE is pleased that HWM has retained the state’s literacy grants. Teaching reading is central to all learning, and the state’s experience with the Bay State Readers program, eliminated at least temporarily by the Governor’s 9C cuts, showed that major gains could be made by training whole faculties – and promoting exchange of ideas and techniques across districts – in all of the elements of a complete reading program. The governor’s elimination of these programs was penny-wise and pound-foolish; MBAE supports HWM’s restoration of these funds. Overall Education Spending – House vs Governor At first glance, the governor provides more education spending than HWM. His Chapter 70 proposal is $214 million above what House Ways and Means recommends. Massachusetts Business Alliance for Education in Millions of Dollars Chapter 70 (with Foundation reserve) Other non-Const Education Aid School Construction Aid Subtotal, Education Aid 2002 3,213 267 361 3,842 Other General-Purpose Aid Total 1,271 5,113 Required School Spending 2003 Initial After Budget Cuts 3,259 3,259 260 257 382 382 3,901 3,898 1,235 5,136 7,435 1,120 5,018 House 1 Change from 2004 Initial 03 3,332 73 189 -71 410 29 3,931 30 House W&M Change from Initial 2004 03 H 1 3,118 -141 -214 235 -25 46 388 7 -22 3,742 -159 -189 885 4,817 -349 -319 1,049 4,791 -186 -344 164 -25 7,156 -349 7,432 -186 164 However, because of the major differences between what HWM proposes and what the Governor proposes, this simple comparison is misleading. The governor proposes to “fold in” to Chapter 70 some categorical aid amounts that HWM would continue. These aid amounts total $46 million. On the other hand, the governor funds the new school construction commitments made in the past year; HWM does not. These total $22 million. On balance, HWM education aid is $189 million less than what the governor recommends. But this does not tell the whole story. The governor proposes to limit overall aid increases to any given city or town. In cases where the education aid increases to a town push the town’s total aid above the target, the Governor proposes dollar-for-dollar reductions in other aid categories. In this sense, the Governor’s proposals are misleading; what appear to be increases in education aid are in fact funded by the town, not the Commonwealth. HWM, on the other hand, calculates each aid formula independently. For this reason, a fair comparison has to include all general-purpose aid. Since HWM makes smaller cuts in general-purpose aid than the governor, overall funding is essentially the same. In the end, education and unrestricted local aid in The HWM budget are $25 million less than under House 1. HWM also differs from the governor in required school spending. The governor requires only that districts spend at foundation. Since the total of required school spending and state aid exceeds foundation budget in most districts, the governor’s proposals would allow a reduction in required school spending of $349 million from current-year levels. It is highly likely, then, that the higher aid amounts the governor nominally assigns to education will in fact be diverted to non-school purposes. HWM retains the current framework, which requires that increases in the required contribution and in state education aid in fact be spent on education. Since HWM cuts education aid, it would also allow a reduction in required school spending. But, at $186 million, the cut allowed by HWM is substantially less than that allowed by the Governor. Overall, HWM would maintain required school spending at a level $164 million above what is envisioned in House 1. In the current year, cities and towns spend $700 million above and beyond what is required under the current law (and $1.2 billion above foundation). Since cities and towns have raised these funds with the assurance that they would not later be included in state spending requirements, neither the HWM budget nor the Governor’s require that this spending continue. Given the large cuts both budgets envision in overall local aid, it seems highly likely that much of this extra spending will be eliminated. Massachusetts Business Alliance for Education Paradoxically, the Governor recommends a higher Chapter 70 amount than HWM, but recommends lower required net school spending. Overall, the two proposals provide about the same amount of total school and non-school aid. Because the Chapter 70 totals are higher, many individual districts may be tempted to support the governor’s education proposals over those put forward by HWM. But the lion’s share of this extra Chapter 70 aid is likely to be used to free funds for other municipal purposes, since it is not tied to school spending. Since this is, in effect, all-purpose local aid, a fair comparison of HWM with the Governor’s proposals has to look at other major forms of state aid. When higher HWM non-school aid is balanced against lower HWM Chapter 70, the two come out about the same statewide. MBAE prefers the House version because it maintains the current foundation budget structure and because it has a substantially higher level of required school spending. CONCLUSIONS: On the whole, MBAE is supportive of the HWM approach to education funding. It assures (as does the Governor) that districts will continue to receive the funding necessary to maintain foundation level budgets. Beyond this, HWM retains many critically important elements of the current formula, including the structural definition of the foundation budget, the statutory definition of the annual inflation adjustment, and the requirement that state and local funds raised for education in fact be spent on the schools. MBAE also supports HWM’s decision to restore the state’s literacy initiative. MBAE has three criticisms of the HWM proposals: 1. The 80% reduction in MCAS remediation funds and the overall cut in the DoE budget leave the department with a diminished capability to work with struggling districts; MBAE believes the department’s capabilities to help these districts should be increased rather than cut. 2. MBAE would retain the class-size reduction grants to the big-city districts. These are an important source of badly needed funding for these schools. 3. HWM’s failure to honor school building construction contracts made in good faith with districts during the past year is grossly unfair to the districts involved – districts that have proceeded with construction contracts on the basis of state assurances of funding assistance.