GAO Analyzes Proposals For Holding Down SSDI

advertisement

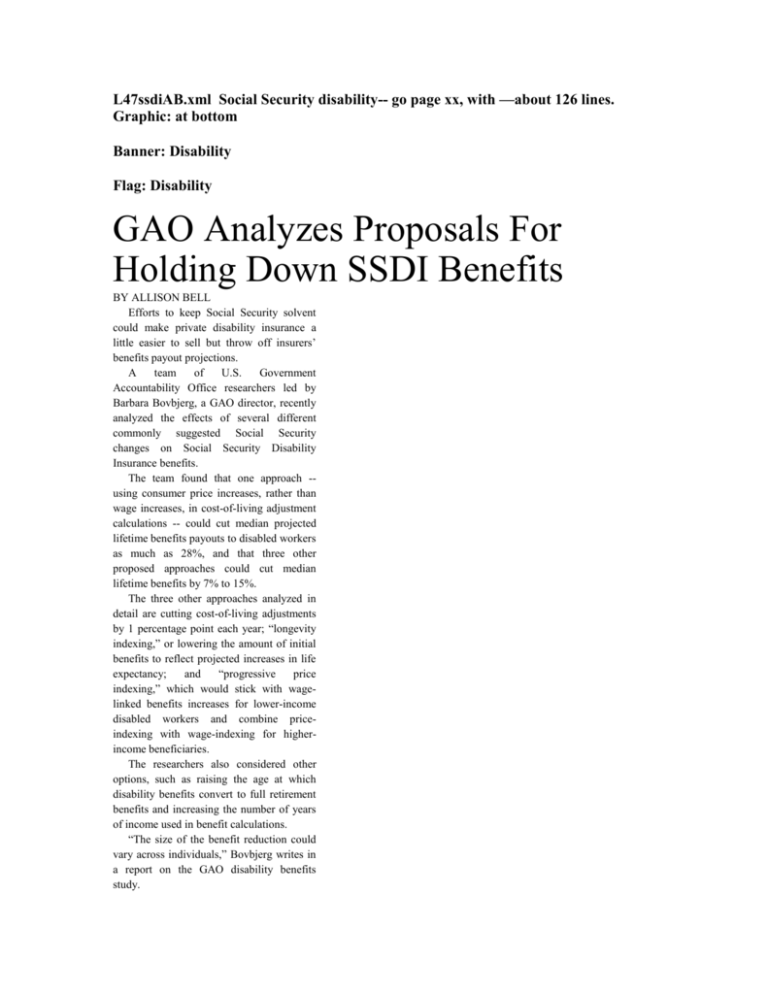

L47ssdiAB.xml Social Security disability-- go page xx, with —about 126 lines. Graphic: at bottom Banner: Disability Flag: Disability GAO Analyzes Proposals For Holding Down SSDI Benefits BY ALLISON BELL Efforts to keep Social Security solvent could make private disability insurance a little easier to sell but throw off insurers’ benefits payout projections. A team of U.S. Government Accountability Office researchers led by Barbara Bovbjerg, a GAO director, recently analyzed the effects of several different commonly suggested Social Security changes on Social Security Disability Insurance benefits. The team found that one approach -using consumer price increases, rather than wage increases, in cost-of-living adjustment calculations -- could cut median projected lifetime benefits payouts to disabled workers as much as 28%, and that three other proposed approaches could cut median lifetime benefits by 7% to 15%. The three other approaches analyzed in detail are cutting cost-of-living adjustments by 1 percentage point each year; “longevity indexing,” or lowering the amount of initial benefits to reflect projected increases in life expectancy; and “progressive price indexing,” which would stick with wagelinked benefits increases for lower-income disabled workers and combine priceindexing with wage-indexing for higherincome beneficiaries. The researchers also considered other options, such as raising the age at which disability benefits convert to full retirement benefits and increasing the number of years of income used in benefit calculations. “The size of the benefit reduction could vary across individuals,” Bovbjerg writes in a report on the GAO disability benefits study. Congress could come up with ways to protect disabled beneficiaries from the effects of any changes in benefits formulas, but, if Congress decides to save money by focusing the protection on lower-income disabled workers, the higher-income income workers -- who may be more likely to have private disability insurance --will face greater benefits cuts than other workers face. Members of Congress are looking at ways to cut all Social Security expenses because they believe the program will soon be running a deficit. Today, 6.9 million of the 49 Social Security program’s 49 million beneficiaries are disabled workers. Disabled workers collect a total of $8.1 billion in benefits per year, or an average of $979 in benefits per beneficiary per month, compared with an average of $1,051 per month for retirees. Actuaries expect the SSDI trust fund to run dry in 2026, 16 years before the OldAge and Survivors Insurance trust fund might empty out. Congressional staffers and other policy experts have focused mainly on strategies for cutting retirement income program costs, but they should think carefully about how any changes will affect disabled workers, because those workers “are least able to compensate for any reduction in benefits,” Bovbjerg writes. Bovbjerg recommends that Congress also think carefully about ways to keep any efforts to protect disabled workers from making SSDI benefits much richer than ordinary retirement benefits. If Congress decides to keep the SSDI system mostly the same but links benefits increases to increases in consumer prices, rather than to wages, then a worker born in 1985 who qualifies for disability at 62 and dies at 82 would receive $505,000 in lifetime benefits, while a similar worker born in 1985 who retires at age 62 and dies at age 84 would receive just $433,000 in benefits, Bovbjerg warns. Reforms that cut SSDI benefits could both help and hurt the private disability insurance industry. Reductions in the real, inflation-adjusted value of SSDI benefits could make private disability coverage more attractive to individuals and employers who can afford it, just as concerns about the stability of the Social Security retirement income program have increased the appeal of private retirement savings plans. Any disability insurers that offer or add inflation-adjustment features modeled on the SSDI cost-of-living adjustment method may find that applying changes in SSDI COLA formulas to their own COLA formulas will reduce their own COLA costs. But SSDI cuts could hurt the many disability insurers that coordinate their benefits with SSDI and either use no COLA riders or COLA riders that increase benefits by a set amount, such as 3% or 6% per year. Disability insurers often subtract any SSDI payments claimants receive from the checks they themselves send out, both to hold down the cost of the private coverage and to discourage malingering. Helping private disability claimants qualify for SSDI has become a big business, and many of the vendors courting disability insurers at disability insurance industry events are trying to sell them SSDI application assistance services. If a disability insurer is depending on increases in SSDI payouts to help reduce the size of its own claim expenses over time, substantial cuts in SSDI benefits could affect the accuracy of those projections, experts say. Effects Of Reform Proposals On Projected Median Lifetime SSDI Benefits For Disabled Workers Born In 1985 Type of reform proposed Percentage reduction in anticipated benefits Cutting cost-of-living adjustment 1 percentage point 10% Longevity indexing 15% Linking benefits increases to consumer prices, not 28% wages Linking benefits increases to wages for the lowest7% income beneficiaries but combining wage-indexing and price-indexing in increase calculations for higher-income beneficiaries Source: GAO analysis of data from the Genuine Microsimulation of Social Security microsimulation model