Abstracts of Presentations

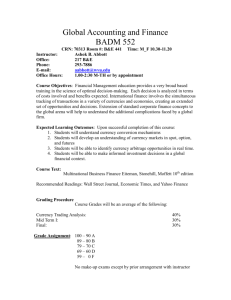

advertisement

Abstract of Presentations 1. Market Climate: Traversing the Road to Recovery Mr. Sim Khee Lau Abstract: Mr Sim, the Head of Phillip Managed Accounts (PMA), will share his experience and insights on how the global economy will traverse the path to recovery. Financial panic has subsided but the credit crunch remains largely intact. Will governments be able to spend their way out of a recession? What are the risks that threaten to throw a spanner in the works? Come and learn what you can expect of market developments in 2009. 2. The Death of Bonds or The Birth of a Bull Market? Mr. William Tan Abstract: William will be providing a market update and what are some of the opportunities that FT identify in the global credit space (government & corporate). The current recessionary environment poses duration opportunities that our FI team explores in managing the portfolio. In addition to interest rate opportunities, the FI team also identifies currency opportunities in managing the portfolio in tapping to the 3rd source of return not common among traditional plain vanilla bond funds. 3. Asian Equities: The First State Approach Mr. Alistair Thompson First State Investments is an active fund manager. First State places a strong emphasis on proprietary research and direct contact with the companies in which it invests. The objective of the research is to identify sensibly priced, high quality companies that can deliver sustainable long-term earnings per share growth. The investment process has generated consistent long term out-performance, without incurring additional portfolio volatility. First State also believes that volatile investor sentiment, which often reflects concern about non-company specific events, can create buying opportunities in companies with good prospects. By adopting an active bottom-up approach, the portfolio managers can take advantage of such opportunities when they arise, and benefit from the subsequent recovery in prices when the focus returns to company fundamentals. Alistair Thompson, Deputy Head of Asia Pacific (ex-Japan) Equities, shares with us how the First State approach has worked for the First State Asian Growth Fund and his focus in the current challenging market conditions. 4. Discretionary Managed Accounts: Building a Portfolio Mr. Alex Pang Abstract: Mr Pang will share how PMA’s active management within a disciplined investment process can deliver consistent risk-adjusted returns over time. ‘Phillip Managed Accounts’ are discretionary investment accounts suitable for retail investors, high net-worth individuals, corporations and institutions. 5. Currency as an Alternative Asset Class Ms. Grace Chan Abstract: The seminar aims to give participants who are interested in currency trading a deeper understanding to the product. The speaker will also share some useful techniques commonly used in currency trading. Understanding Currency Trading Knowledge require to start Currency trading Factors that move the Currency Market Practical techniques to formulate trading ideas Question and Answers