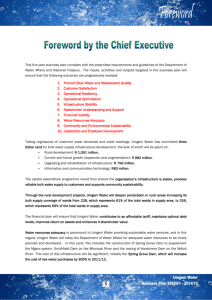

(5) Financial Plan (116 to 118)

advertisement

12.11 SELF EVALUATION STATEMENT ON FINANCIAL RESPONSIBILITY 12.11.1 Operating Performance Figure 12-11: Operating Performance indicators Operating Incom e 800 ons) (milli 600 Rand R a nd (mi l l i o ns) 642 588 619 556 400 660 614 276 200 F09 F10 F11 F12 F13 F14 F15 N et F inance C osts (milli 120 116 Rand ons) Rand (m illions) 160 108 83 117 101 82 71 80 40 F09 F10 F11 F12 F13 F14 F15 N et Profit ons) (milli R a nd (mi l l i o ns) Rand 600 526 505 503 486 559 532 400 168 200 F09 F10 F11 F12 F13 F14 F15 The forecasted decline in operating profits is due to the low volume growth in water sales combined with double digit increases in both direct and indirect costs. Net profits are projected to reduce significantly due to the following impairments: F'12: Maphumulo BWS Scheme (Phase 1) R 181m F'12: Mhlabatshane BWS Scheme R 150m F’12: Total R 331m F'15: Ozwathini BWS Scheme R 85m F'16: Richmond Pipeline R 98m The lower debt levels have however contributed to lower finance costs which has had a positive impact on net profits - 116 - Umgeni Water has three business segments namely Bulk Potable Water, Bulk Wastewater and Section 30 Activities as described below. Bulk Potable Water Table 12-33: Performance Ratios Cost per kilolitre - Bulk water Net surplus ( R millions) Umgeni Water F08 F09 F10 F11 F12 Target Actual Actual 2.235 2.020 1.900 2.090 2.330 3.712 470 381 496 485 472 157 F13 F14 F15 3.182 3.313 3.640 492 548 520 Forecast The cost per kilolitre of bulk potable water is projected to increase from F’10 onwards due to the significant increases in the direct costs of production and the impairment of rural development projects. Figure 12-13: Cost per kilolitre – Bulk Water (Cost Components) Direct Costs Indirect Costs Finance charge 4.0 0. 20 0. 23 3.5 0. 17 0. 25 3.0 0. 21 1. 37 R a nd pe r k i l o l i tr e 1. 28 1. 70 2.5 0. 99 1. 04 0. 15 2.0 0. 39 0. 18 0. 26 1.5 1. 01 0. 90 0. 83 0. 75 1.0 0.5 1. 78 0. 80 0. 89 1. 01 1. 94 2. 06 2. 19 2. 32 1. 17 F'08 Actual F'09 Actual F'10 F'11 F'12 Forecast Forecast Forecast F'13 Forecast F'14 Forecast F'15 Forecast F'16 Forecast Bulk Wastewater The bulk wastewater section of the business segment is not projected to show growth and will maintain an average net profit of around R 7 million per annum due to relatively low increases in the management fee and higher costs. - 117 - Section 30 Activities The revenue from section 30 activities is projected to increase from R 184 million in F’09 to R 206 million in F’10. This growth arises from Umgeni Water’s appointment as an implementation agent for the Department of Water Affairs, the Department of Education and District Municipalities. 12.11.2 Financial Position Table 12-34: Financial and Solvency Ratios Umgeni Water F08 F09 Target Actual Actual 1.374 Current Ratio F10 F11 F12 0.991 2.174 1.915 1.580 F13 F14 F15 1.520 1.723 1.964 Forecast Net Debt : Equity Ratio <0.7 1.116 0.482 0.554 0.312 0.341 0.380 0.298 0.214 Debt : Equity Ratio <0.7 2.040 1.283 0.741 0.647 0.596 0.458 0.377 0.289 Debt Service >1.75 3.364 5.512 7.108 7.881 2.551 5.303 6.507 7.484 Debt : Asset ratio Return on Assets <0.40 0.569 0.486 0.367 0.350 0.337 0.287 0.247 0.208 15% to 20% 21% 23% 18% 14% 7% 13% 13% 12% (income before interest & taxes divided by total assets excluding investments) Umgeni Water’s gearing, although significantly higher than the sector average, has shown a steady improvement since 2002 and is now projected to reach an acceptable level of 0.741 in F’10 after the redemption of the UG65 bond. The reduction in debt impacts positively on the debt to asset ratio which will reduce from 0.486 in F09 to 0.367 in F’10 which is within the targeted ratio of less than 0.40. Asset productivity as measured by the return on assets ratio shows a declining trend from 23 % in F’09 to 12 % in F15, due to the capital expenditure programme with lower operating profits. - 118 -