Payroll Processing Manual

advertisement

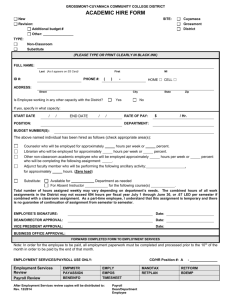

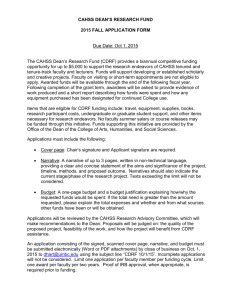

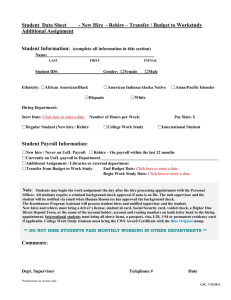

PAYROLL PROCESSING MANUAL FOR CAMPUS DEPARTMENTS TABLE OF CONTENTS PAGE INTRODUCTION Purpose of Payroll Manual History of Payroll Process Synopsis of PS Payroll Implementation Business Process Flow (New Hires) Business Process Flow (Changes) UMBC NEW HIRE AND PAYROLL CHANGE PROCESSES UMBC Personnel Action Request (PAR) Form Instructions for Completing the New Hire PAR Form Instructions for Completing the Change PAR Report/Form Instructions for Printing the Change PAR Report SUPPORTING DOCUMENTATION W-4 Instructions I-9 Instructions Substance Abuse Acknowledgement Retirement Selection Requirements Social Security Verification Payroll Adjustment Form Instructions ADDENDUM #1 - W-4 Form I-9 Form Substance Abuse Acknowledgement Form Retirement Selection Form ADDENDUM #2 - 2/12/2016 Exempt and Non-Exempt New Hire Checklist Faculty/PT Faculty New Hire Checklist Contingent I/II New Hire Checklist Graduate Assistant and Student New Hire Checklist 2 UMBC PROPRIETARY AND CONFIDENTIAL PURPOSE The purpose of this manual is to provide each departmental Payroll Preparer with the proper knowledge and comprehensive resources necessary to perform the tasks involved with processing payroll information and changes for departmental employees. SYNOPSIS As a result of changes to the payroll system mandated by Central Payroll Bureau and USM Payroll Office, each USM Institution will be responsible for the processing and maintenance of personnel and payroll information for their respective campus. Specifically, the data entry, processing and transmittal of ALL payroll documents and information will be the responsibility of the UMBC Human Resources Department. These new processes will also allow for the on-line completion of payroll forms, eliminate the manual calculation of exception time, overtime and shift differential. These new processes will entail the following: New Hire Personnel Action Request Form (PAR Form): This form will replace the Payroll Entry document. The PAR form is an on-line form that has been developed for departments to complete in order to place an employee on payroll. The completion and submission of the New Hire PAR Form with supporting documentation must remain in conjunction with deadlines for the payroll schedule. The HR Payroll Staff will enter the new employee information into PS to finalize the hiring process and forward appropriate supporting documentation (W-4, supporting Tax Treaty information, etc.) to USM/CPB for processing. UMBC Change PAR Process: Departments will be able to go on-line to make changes to existing employee information. The department Payroll Preparer will access PS Administer Workforce to make changes to employee information. Once changes are made, the payroll preparer will print the PS Change PAR Report which will outline all changes requested. The Payroll Preparer will sign the form, obtain the Department Head’s signature and forward the Change PAR form to the HR Department (with supporting documentation) for processing. Supporting Documentation: Based on State and Federal mandates, it will still be necessary to submit W-4 forms and forms required for a Non-Resident Alien, I-9 forms and supporting documents, State of Maryland Substance Abuse Policy, and Social Security Verification. In addition, the approved Contract for Contingent I and II employees is required with the submission of the New Hire PAR and/or Change PAR (for contract renewals). 2/12/2016 3 UMBC PROPRIETARY AND CONFIDENTIAL Reporting: Departments will have the ability to access PS to generate reports with position, payroll and other job information. Access to employee information will depend upon PS Security authorization. There will also be certain on-line inquiry access granted to departments to view information for individual staff. Access will depend upon PS Security authorization. The following pages outline the business process flow for the New Hire and Change PAR Process. 2/12/2016 4 UMBC PROPRIETARY AND CONFIDENTIAL UMBC PAYROLL PROCESS NEW HIRES \ 1. Department Payroll Preparer completes appropriate documents to hire an employee (New Hire PAR, W-4, I-9, etc.). 1. Upon receipt of new hire packet from department, HR Payroll Staff review required documents for accuracy and completeness. 2. Once approval signatures are obtained, Payroll Preparer forwards completed packet to HR Payroll Office for processing. 2. Once review of documents has occurred, HR Payroll Staff complete bottom gray section of New Hire PAR form and place packet in designated bins for data entry. 1. Time Entry opens for departments to enter time Worked, leave used, and pay adjustment updates (see the Time & Leave Processing Manual for business process flow of Time Entry). 1. Data Entry Staff enters new employee information into PS for placement on the Personnel Information (PI) file. ** 2. PS Payroll processes run to generate required file to submit UMBC Payroll to USM Consolidation Site for PI File. 2. Once time entry closes, HR Payroll Staff run processes to load time to PS Paysheets and make requested manual adjustments or corrections to pay not captured in Time Entry or regular pay calculation. 3. File forwarded from USM to Central Payroll Bureau (CPB) to create Master File. 1. HR Payroll Staff run final calculation processes to transmit UMBC Gross Pay (ZT/RK) File to CPB. 1. UMBC receives net pay file from CPB and loads into PS. 2. HR Payroll runs appropriate processes to close out the HR Pay Cycle, and alerts FS Accounting Staff that they may begin close-out of the pay cycle (pay distribution, GL, Projects., etc.). 2. CPB creates paychecks and loads Pay Run File to server for retrieval by UMBC OIT Staff. **In order for new hires to receive a paycheck, payroll information must be on the Payroll Master File (PI). If not, employee will receive a paycheck on the next cycle. Coordination of effort between HR and hiring department during this process is critical. 2/12/2016 5 UMBC PROPRIETARY AND CONFIDENTIAL UMBC PAYROLL PROCESS EXISTING\ EMPLOYEES (ADDITIONS, CHANGES, TERMINATIONS) 1. Department Payroll Preparer completes on-line Change PAR process and report to make specific payroll action/change (add a job, change a pay rate, terminate an employee, etc.). 1. Upon receipt of Change PAR packet from department, HR Payroll Staff review required documents for accuracy and completeness. If there is a problem with the report or supporting documentation, HR Payroll Staff will contact the department for correct information (minor updates) or return the packet to the department for correction. 2. Once approval signatures are obtained, Payroll Preparer forwards Change PAR Report and supporting documentation to HR Payroll Office for review and processing. 2. Once review of documents has occurred, HR Payroll Staff initial and date bottom of Change PAR report and place the packet in designated bins for data entry. 1. Time Entry opens for departments to enter time Worked, leave used, and pay adjustment updates (see the Time & Leave Processing Manual for business process flow of Time Entry). 1. Data Entry Staff enters change/update information into PS for placement on the Personnel Information (PI) file. ** 2. PS Payroll processes run to generate required file to submit UMBC Payroll to USM Consolidation Site for PI File. 2. Once time entry closes, HR Payroll Staff run processes to load time to PS Paysheets and make requested manual adjustments or corrections to pay not captured in Time Entry or regular pay calculation. 3. File forwarded from USM to Central Payroll Bureau (CPB) to create Master File. 1. HR Payroll Staff run final calculation processes to transmit UMBC Gross Pay (ZT/RK) File to CPB. 1. UMBC receives net pay file from CPB and loads into PS. 2. HR Payroll runs appropriate processes to close out the HR Pay Cycle, and alerts FS Accounting Staff that they may begin close-out of the pay cycle (pay distribution, GL, Projects., etc.). 2. CPB creates paychecks and loads Pay Run File to server for retrieval by UMBC OIT Staff. **Any changes affecting employee pay must appear on the Payroll Master File (PI). If not, payment based upon updated employee information will occur in the next pay cycle. Departments must adhere to established payroll deadlines. 2/12/2016 6 UMBC PROPRIETARY AND CONFIDENTIAL COMPLETING THE NEW HIRE PAR FORM: The UMBC Personnel Action Request Form (PAR) will be required to place all individuals on the University Payroll. The following steps are required for the completion and submission of the UMBC PAR form. Each field of the PAR Form contains “Help Text” to assist Payroll Preparers with the proper completion of the form. The “Help” text can be viewed in the bottom left corner of the document screen. In addition, each field of the PAR Form must be completed for first-time new hires/transfers. HIRE INFORMATION: Action (Select one of the following options) Concurrent Job: An existing active employee who is hired in a new position. Hire: New Employee- Never worked for USM. May also be used to Hire a current employee into a secondary job at UMBC. Rehire: Previously employed at UMBC within the last year (there should be an established EMPID in PeopleSoft). . Reinstatement: New hire was previously employed at UMBC/USM within the last three years; an established EMPID should exist in PeopleSoft; only applies to faculty and staff with Regular appointment at the time of termination/ resignation. Transfer within USM: Click if transfer from UMB, UMCP, UMES, UMCES, UMUC, USM, UMBI, Coppin, Bowie, Towson, U of B, Frostburg, OR Salisbury. Transfer from other State Agency: Click if transferring from any other State of Maryland agency. One Pay Appointment: Select if new hire is to receive one lump sum for services rendered. Reason: Enter reason for hire. Effective Date: Effective Date of concurrent job/new hire/rehire/reinstatement/transfer; must enter new hire/rehire date. Employee ID: If employee is a rehire or a concurrent job is being added, enter PS EMPID (if known). Prior UMS/State Service Date: Prior Agency Code: 2/12/2016 Enter the employee’s USM/State Service Date. In order to receive credit for prior service, employee must submit an official letter from the USM institution or State agency detailing the employee’s hire date, any breaks in service and leave balances. Select appropriate agency code from drop-down menu. 7 UMBC PROPRIETARY AND CONFIDENTIAL Supporting Documents: W-4 (Federal/StateTax Employee Withholding Certificate). Additional documents are required for Non-Resident aliens (Citizenship Status Form, Proof of Citizenship; and if exempt from federal taxes, the representation letter and an 8233). Social Security Verification; required to establish employee taxation and official name for payroll purposes. State of Maryland Substance Abuse Policy Acknowledgement of Receipt I-9 (Employment Eligibility verification) and Supporting Documents. List of acceptable documents are identified on the I-9 document. The I-9 must be completed within 3 days from the first day of work in order to sustain employment agreement. Retirement Selection Form (Exempt and Faculty only), Retirement Selection Form must be attached to ensure receipt of first paycheck. (See Appendix for further information regarding the completion and processing of these forms, as well as any other required documents) PERSONAL DATA: Name: (First Name/ Middle Name/ Initial and Last Name) Enter the Employee’s legal first name, middle name/initial and last the name from the employee’s Social Security Card. Do not use punctuation. Suffix: As necessary, select the employee’s appropriate suffix (e.g., Jr., Sr., II or III). Home Address: Enter the employee’s home address including the number, street name, and any supplemental information (e.g., apartment number, PO Box, etc.). Do not use punctuation. County: Select Maryland country from drop-down menu. City Enter the name of the city where the employee lives (e.g., Baltimore, Ellicott, Randallstown, etc.). Do not use punctuation. Postal (Zip) Enter the zip code from where the employee lives (e.g., 21250, 21229). State Enter the 2 character postal abbreviation of where the employees lives (e.g., MD, VA, DC, WV). Campus Phone Number Enter the employee’s campus phone number (e.g., 410-455-0000); if not available at time of appointment, enter department main number.. Home Phone Number Enter the employee’s home number (e.g., 410-111-2222). HR uses the home phone number to contact the employee for verification of information only. This number will not be published. 2/12/2016 8 UMBC PROPRIETARY AND CONFIDENTIAL Gender Select gender value from drop-down menu. Highest Education Level: Select highest education level completed from the drop-down menu. Martial Status Select the applicable employee martial status (e.g., Married, Single) from the drop down box. This does not relate to marital status information for taxation purposes. Military Status: Select applicable military status from drop-down menu. US Citizen Select one option (e.g., Yes or No) from the drop down box. Date of Birth Enter the employee’s date of birth in M/d/yyyy date format (e.g., 01/01/0000). Birth Country Enter country of birth (USA, China, etc.). Social Security Number Enter the employee’s 9-digit Social Security Number (SSN). If the employee is on a visa and has not been issued a permanent SSN, enter temporary SSN, and attach the affidavit of Compliance with the employee’s receipt from Social Security Administration as proof of application. Ethnic Group American Indian//Alaskan Nature Asian/Pacific Islander Black Hispanic White Visa Type Select appropriate visa type from drop-down menu. Supporting documentation must be attached. JOB DATA: Position Number Enter 8-digit position number. Department ID Enter 5-digit PS department number. Department Name Enter department name. Job Code/Title Enter PS jobcode and payroll title assigned to the position. Standard Hours/FTE Enter weekly hours and percentage of time for position (40 hrs/100%; 20 hours/.50%, etc.). Appt. End Date Enter end date of contract/appointment. Employee Class: Select appropriate employee class from drop-down menu; must correspond with position status (see employee class descriptions on instruction sheet). 2/12/2016 9 UMBC PROPRIETARY AND CONFIDENTIAL Payment Method Select method of payment from drop-down menu. Bi-weekly/Hourly Rate Enter bi-weekly (for salaried employees) or hourly (for Contingent I, Student employees) rate of pay. Annual Salary: Enter annual rate of pay for salaried employee (Regular or Contingent II Exempt/Non- Exempt Staff, Faculty, Graduate Assistant employees). EMERGENCY CONTACT INFORMATION: Name Relationship Provide first and last name of person to contact in case of emergency. Contact’s relationship to employee (mother, father, aunt, etc.). Address Enter address of emergency contact. If same as employee, check box. Phone Provide telephone/cellular phone number of emergency contact. If same as employee, check box. Comments This section provided for additional notes/comments to alert data entry or payroll staff to special circumstances for newly hired employee. APPROVALS SECTION: Completed By: Name Enter the name of the department representative who prepared the form. Signature Signature of the person who completed the form. Date Enter the date the form was completed. Use date format M/D/YYYY (e.g., 01/00/0000). Phone Number For contact information, please enter the phone number of the person completing this form. E-Mail Address Enter the E-Mail address of the person completing the form. Signature Authority: Name After reviewing the form for accuracy and completeness, the person with direct Signature Authority for this Department should print his/her name. There may be a need for multiple department representatives to review and approve the document based upon the particular practice of the department. Follow the procedures established for your department/division. Signature Signature of approving authority. Date Enter the date the form was completed. Use date format M/D/YYYY (e.g., 01/00/0000). 2/12/2016 10 UMBC PROPRIETARY AND CONFIDENTIAL Phone Number For contact information, please enter the phone number of the department representative having signature authority. E-Mail Address Enter the E-Mail address for the department representative having signature authority. Once all the appropriate signatures have been obtained, attach the UMBC New Hire PAR form to supporting documentation and forward to the HR Payroll Office for review and processing. A sample of the New Hire PAR Form is provided on the next page. 2/12/2016 11 UMBC PROPRIETARY AND CONFIDENTIAL University of Maryland Baltimore County 1000 Hilltop Circle Baltimore, MD 21250 Instructions: Please complete this form and attach all supporting Documents. Forward to Human Resources – Payroll. HELP TEXT APPEAT APPEARS IN THE BOTTOM LEFT CORNER OF THE SCREEN 1 Action Select 1 Option 2 Reason 3 Supporting Documents 4 Effective Date 5 Employee ID (If Known) 6 Prior USM/State Service Date 7 Prior Agency Code (USM Transfer only) Select 1 Option W-4 PERSONAL DATA 8 First Name Substance Abuse Retirement Selection Form Social Security Verification Non-resident Alien/ Required Docs On File Permanent Resident 9 Middle Name/Initial 10 Last Name 12 Home Address 24 Date of Birth 11 Suffix Select 1 Option 13 County of Residence Select 1 Option Other: 14 City 15 Postal (Zip) 19 Gender Select 1 Option I-9 & Supporting Documents 16 State 20 Highest Education Level Select 1 Option 25 Birth Country 26 Social Security # 17 Campus Phone Number 21 Marital Status Select 1 Option 22 Military Status Select 1 Option 27 Ethnic Group Select 1 Option 30 Department ID 31 Department Name 32 Job Code/Title / 29a 30a 31a 32a 29b 30b 31b 32b 36 Payment Method Select 1 Option EMERGENCY CONTACT INFORMATION 40 Name 41 Relationship 42 Address Employee 23 US Citizen Yes No 28 Visa Type Select 1 Option JOB DATA 29 Position Number 35 Employee Class Select 1 Option 18 Home Phone Number 33 Standard HRS / FTE / 33a 34 Appt End Date 33b 34b 38 Bi-weekly/Hourly Rate Same Address as 43 Phone Employee 39 Annual Salary Same Phone as Omments: THE APPROVALS SECTION MUST BE COMPLETED COMPLETED BY Name (Please Type or Print) Signature Date Phone Number E-mail Address SIGNATURE AUTHORITY Name (Please type or Print) Date Phone Number E-mail Address Signature HR APPROVAL/VERFICATION (HR USE ) Pay Group FICA Status Pay Frequency Data Entry Initials Employee ID /Rcd Date 34a Comments Retirement System ORP - TIAA Eligible Not Eligible ORP - Fidelity Employee’s Pension LEOPS 2% Transfers Employee’s Employee’s Only Retirement 6% 2/12/2016 Retirement 5% 12 ORP - Valic Teachers Pension 2% Employee’s Teacher’s Teacher’s Retirement 7%UMBCRetirement 5% AND CONFIDENTIAL Retirement 7% PROPRIETARY COMPLETING THE CHANGE PAR FORM/REPORT: Direct on-line access to PS will be provided to departmental Payroll Preparers to update personnel/ payroll information for existing employees. The actions provided on the Change PAR panels are those which most frequently occur as part of the payroll process. The following process outlines instructions for the completion of the Change PAR Form and generating the appropriate report to the HR Payroll Office to update the employee’s Job Data in PS. Navigation: Home > Administer Workforce > Administer Workforce (GBL) > Use > UMBC PAR Changes To access information for an existing employee in a department, one of the fields outlined in the screen shot must be entered. Emp ID: Enter the Employee Identification Number assigned to the staff member. Once the EmpID is provided, PS will display the Change PAR panels and update of the employee information can commence. Empl Rcd Nbr: If the employee holds more than one job with the University, enter the Employee Record Number which applies to the specific department where the change must occur. 2/12/2016 13 UMBC PROPRIETARY AND CONFIDENTIAL Name: In instances where the Emp ID is unknown, enter the employee’s name as it appears in PS. Click the Search key. PS will display the Change PAR panels and data entry can begin. Last Name: If the full name of the employee is unknown, simply enter the individual’s last name. In instances where the spelling is uncertain, enter the first two letters of the individual’s name and click the Search key. PS will display all variations of letters entered. Click the Search key for the desired employee name and empl record and PS will display the Change PAR panels for data entry. Personnel Status: When none of the above information is known, click on the translate arrow and select the status of “Employee” and PS will display all individuals currently employed within the department (based on PS Security set-up). Click the Search key once the name of the employee is located and PS will display the Change PAR panels. Data entry can begin. Once the Search has been completed, the Change PAR panels will appear. The personnel/payroll information for the employee selected will appear at the top of the panel. The following panels will be displayed for update of employee information: 2/12/2016 14 UMBC PROPRIETARY AND CONFIDENTIAL A Change PAR panel is provided for each of the changes listed above. To begin data entry, click the yellow “+” symbol to add a row. Change Date: Enter the date the change is to take effect. This is a required field. If no new date is entered, the date will default to the current date. Sequence #: If multiple actions have the same effective date, enter the sequence or order you wish the actions to take place (i.e., 0, 1, 2, etc.) PAR Change: Click the translate arrow to display the PAR Change you wish to make. The PAR Changes listed are among the most common utilized to update employee personnel/payroll information. The changes are: - Change in Compensation Change in Department Change in Employee Class Change in Retirement Plan Change in Standard Hours Change in Visa status Change in Pay Group Name Change New Contract SSN Change New Action/Reason Termination Depending upon the PAR Change selected, complete the panels as follows: 2/12/2016 15 UMBC PROPRIETARY AND CONFIDENTIAL Change in Compensation: Click on the Comp. Rate Panel (either click on yellow directional arrow at the top to expand the panel views,; or click on the hyperlink displayed at the bottom of the screen to access the panel) Employee Type: Enter the pay type of the employee: hourly or salaried (other two items are PS delivered). Comp Rate: Enter the new salary or hourly rate for the employee. Payment: Enter whether the compensation is for annual, hourly, or biweekly (if annual is not provided). Click the “Save” button. 2/12/2016 16 UMBC PROPRIETARY AND CONFIDENTIAL Change in Department: This action is generally accompanied by a Position Action Request. Contact the HR Classification/Compensation Office if request is not accompanied by appropriate approvals. Department: Enter the new Department Number. In instances where the Department Number is not known, click the look-up (magnifying glass) to conduct a Search for the appropriate department. 2/12/2016 17 UMBC PROPRIETARY AND CONFIDENTIAL Click on the appropriate Department. PS will automatically update the Department field. Click the “Save” button. 2/12/2016 18 UMBC PROPRIETARY AND CONFIDENTIAL Change in Empl Class: Employee Classification: 2/12/2016 Note that this action is generally made in conjunction with a Position Action Request. Contact HR Classification/Compensation if change in empl class is not accompanied by the appropriate Classification Action Form. Enter the new employee class. In instances where the employee class is Not known, click on the “look-up” glass to obtain the appropriate value. 19 UMBC PROPRIETARY AND CONFIDENTIAL Click on the desired value and PS will automatically update the Employee Classification Field on the panel. Click the “Save” button. 2/12/2016 20 UMBC PROPRIETARY AND CONFIDENTIAL Change in Retirement Plan: Click on the “Retirement” panel at the top of the page, or click the hyperlink at the bottom. Plan Type: Enter the new retirement plan the employee has selected. If plan is Unknown, click on the “looking glass” to conduct a search for the Plan types. Available values are Employer Only (for ORP plans) and Pension Plan US 1 (for MSRA plans). This panel will only be updated for Exempt Staff and Faculty based on their eligibility to switch from the MSRP to an ORP (if employee switches from MSRP to an ORP, they must remain in the ORP); or between ORP plans. Benefit Plan: Enter the new retirement plan the employee has selected. Please note that a Retirement Selection Form must accompany the Change PAR Report when submitted to the HR Payroll Office. If the employee is Switching from the MSRP to an ORP, an “Election Not to Participate In the MSRP” must be submitted to the HR Benefits Unit. Click “Save” button. 2/12/2016 21 UMBC PROPRIETARY AND CONFIDENTIAL Change in Std Hours: Click on the “Std Hours” panel at the top of the page, or the hyperlink at the bottom. Standard Hours: Enter the new Standard Hours for the employee. For example, if Standard hours is changing from 40 to 20, enter the new value of 20. Click “Save” button. 2/12/2016 22 UMBC PROPRIETARY AND CONFIDENTIAL Change in Visa: Select the “Visa” panel at the top of the page or click on the hyperlink at the bottom of the page to begin data entry. Country: Enter the country of USA (country approving Visa). Visa/Permit Type: Enter the visa type of F1, J1, etc. Click “Save” button. *Please note that any Visa Status Changes/Updates must be accompanied by the appropriate supporting documentation (I-94 card, I-20, IAP-66, etc.) 2/12/2016 23 UMBC PROPRIETARY AND CONFIDENTIAL Change of Paygroup: Select the “Paygroup” panel at the top, or click on the hyperlink at the bottom of the page. Pay Group: Enter the new paygroup (Hourly, Salaried or Contract Pay) Compensation Rate: Enter the new compensation rate based on new pay group. Payment: Enter payment type associated with the paygroup (i.e., 22 pay, Annual, Hourly, or Bi-Weekly) Click “Save” button. 2/12/2016 24 UMBC PROPRIETARY AND CONFIDENTIAL Name Change: Click on “Name” panel at the top or the hyperlink at the bottom of the page. First Name: Enter employee’s new first name. If first name is not changing, enter current name as it appears in PS. Middle Name: Enter employee’s new middle name or initial. If middle name/initial Is not changing, enter current name as it appears in PS. Last Name: Enter employee’s new last name. If last name is not changing, enter current name as it appears in PS. Click “Save” to store change(s). *For all name changes, employee must submit updated W-4 form, updated Social Security Card, and legal documentation authorizing name change. In instances where a data entry error occurred (either in HR Payroll or USM/CPB) documentation is not required to correct employee name. 2/12/2016 25 UMBC PROPRIETARY AND CONFIDENTIAL New Contract: Click on the “Contract” panel at the top of the page, or the hyperlink at the bottom. This panel applies to 9 month Faculty and Graduate Assistants (22 equal pays), Contingent II employees, and Contingent I Employees (If and When Needed and Temporary Staff). Start Date: Enter start date of new contract for employee. End Date: Enter end date of the new contract. Employee Type: Enter whether new contract is for Hourly or Salaried employee. Comp Rate: Enter compensation rate for new contract. Click “Save” to store changes. 2/12/2016 26 UMBC PROPRIETARY AND CONFIDENTIAL SSN Changes: Click the “SSN” panel at the top, or the hyperlink at the bottom of the page to begin data entry. Social Security #: Enter the new or corrected SSN for the employee. Please note that SSN changes must be accompanied by a new Social Security Card. Click “Save” to store change. Proceed to the next section for instructions on printing PAR Changes. 2/12/2016 27 UMBC PROPRIETARY AND CONFIDENTIAL New Action/Reason Changes: Click the “New Action/Reason” panel at the top, or the hyperlink at the bottom of the page to begin data entry. A table outlining the new action/reasons that apply to UMBC employees follows panel instructions. Action: Click on the drop-down to select the appropriate action. Actions pertaining to UMBC employees are outlined on the following chart. Reason: Click on the “looking glass” to select reason that corresponds to the elected action. Job Code: Enter the employee’s 5 or 6 digit job code; if job code is changing as a result of the action selected, click on “looking glass” to obtain appropriate job code. Position Number: Enter the position number associated with the selected action (if applicable). HR Account Code: Enter HR Account that will be charged for the funding of the position. Comp Rate: 2/12/2016 Enter the new compensation rate (if applicable). 28 UMBC PROPRIETARY AND CONFIDENTIAL ACTION/REASON TABLE, APPLICABLE TO UMBC EMPLOYEES, ON THE FOLLOWING PAGES: DEFINITION Employee hired into an additional position outside of home department Non-Exempt employee has completed 6 month probation period Employee has had a data change (i.e., contractual conversion, extension of temporary REASON ACTION Add’l Job LONG DESCRIPTION Additional Job Comp Prob Completion of Probation Data Chg Data Change Demotion Demotion Employee demoted to lower level FAC Lack of terminal Degree STF Lack of Certification/License USP Unsatisfactory Performance LOA Leave of Absence Employee granted leave of absence APR DIS EDU FML HEA MAT MIL PER RES SPC UNA USU Layoff Layoff Employee Laid Off RED Staff Reduction SEA Seasonal Closure TMP Temporary Closure 2/12/2016 29 ADL PRC CON EXT FIC PER PJC PRE STC TEM Contractual Conversion Extension of Temporary Appt. FICA Tax Change Temporary to Permanent Appt Primary Job Change PrePay Deduction Status Change Permanent to Temporary Appt Approved Leave Without Pay Disciplinary Suspension Education Family and Medical Leave Act Health Reasons Maternity/Paternity Military Service Personal Research Suspension Unpaid Unauthorized Absence-Unpaid Suspension Pending Chrgs-Unpd UMBC PROPRIETARY AND CONFIDENTIAL Pay Rt Chg Pay Rate Change Change in Employee Pay Rate ADJ Adjustment ATB Across-The-Board COL Cost-of Living Adjustment EQU Equity LYP Leap Year Pay Rate Change MER Merit Posn Chg Position Change Change in the title and/or status of an employee’s position SI1 Salary Increase(By Step) SI2 Salary Increase(By Percent) SI3 Salary Increase(By Amount) INA Position Inactivated JRC Job Re-Classification NE W New Position REO Re-Organization/Restructure STA Position Status Change TTL Title Change UPD Position Data Update XFR Transfer Probation Probation Status Places employee on probation at beginning of employment EX Extended T PR B Original Probation PSC Status Change Transfer 2/12/2016 Transfer Transfer from BOR School Transfer to Department on Campus Supervisor Level Advance 30 BOR Transfer from BOR School CDT Transfer to dept on Campus SLA Supervisor Level Advance UMBC PROPRIETARY AND CONFIDENTIAL Terminations: Once the action of Termination is selected, click the panel to begin data entry. Action: The action of Termination will default from the Selection menu. Reason Code: Click on the “looking glass” to select the appropriate reason for the termination. Reasons which apply to UMBC employees are outlined in the table following Section. Compensation: Enter the employee’s compensation at the time of termination. 2/12/2016 31 UMBC PROPRIETARY AND CONFIDENTIAL REASONS FOR TERMINATION OF UMBC EMPLOYEE: Termination Termination Employee termination/ resignation from University service ATT Attendance COM Commuting Problems CRC Criminal Conviction DEA Death EFT End of Fixed-Term Contract ELI Elimination of Position ERT Early Retirement FAM Family Reasons GMI Gross Misconduct GRD Graduation (Student/GA) HEA Health Reasons INS Insubordination JOB Job Abandonment LVE Failure to Return from Leave MIL Military Service OPP More Opportunities OTP Resignation-Other Position PAY Dissatisfied with Pay PER Personal Reasons RED Staff Reduction REJ Rejection On Probation REL Relocation RES Resignation RET Return to School RJC Rejection on Probation RTR Retirement TMP End Temporary Employment UNS Unsatisfactory Performance VIO Violation of Rules WOR Dissatisfied w/Work Conditions Proceed to the next section for instructions on printing PAR Changes. 2/12/2016 32 UMBC PROPRIETARY AND CONFIDENTIAL PRINTING PAR CHANGES: The previous section outlined the different types of changes that can be made to employee personnel/ payroll information utilizing the Change PAR pages. This section outlines instructions for printing the Change PAR form(s) that will be submitted to the HR Payroll Office for the update of PS. Navigation: Home > Administer Workforce > Administer Workforce (GBL) > Report > UMBC Change PAR Report After following the appropriate navigation, the above-cited page in PS will appear. Run Control ID: 2/12/2016 A Run Control ID will be created for your use, or a run control can be created specific to the using department. 33 UMBC PROPRIETARY AND CONFIDENTIAL Once Run Control ID has been entered the Change PAR Report page will appear for processing. Language: Enter the language required for the report. English will be the default. PAR Selector: Enter whether the report should be based on: Department: if changes were made for numerous employees in a single department and all changes have the SAME effective date, select this option. Reports will print by Empl ID. EmpID: choose this option if change(s) were made to only one employee in the department. As of Date: Enter effective date of change (from original Change PAR update screen). EmpID: If PAR Selector for EmpID was selected, enter EmpID. If EmpID is Not known, follow “look-up” instructions from previous pages. Department: If PAR Selector for Department was chosen, enter Department #. Follow “look-up” instructions from previous pages. Once fields are completed, click on the yellow “RUN” button to initiate Compilation of the Change PAR Report. 2/12/2016 34 UMBC PROPRIETARY AND CONFIDENTIAL Before the report is compiled the following PS Report page will appear: This page is displayed to notify the user of the server the report will be sent to in the Process Scheduler. Since this is a custom UMBC Report, the server information will default. Simply click on the “OK” button to begin compilation of the report. Upon clicking the “OK” button, PS will return to the Change PAR Report page. 2/12/2016 35 UMBC PROPRIETARY AND CONFIDENTIAL PRINTING THE CHANGE PAR REPORT: To view the results of the report, click on the Report Manager hyperlink. The “Status” column of the Report Manager Report List should display “Posted.” This lets the user know that the report has been compiled and is ready for viewing.* Simply click on the “View” link and PS will take the user into the Adobe screens to view the Change PAR Report. The top half of the page will display all current employee information. The bottom half of the report will outline all the changes made to the employee’s personnel/payroll information via the Change PAR pages. 1. The Payroll Preparer will print the report(s), review the change(s) and sign. 2. The report is forwarded (with applicable back-up documentation) to the individual with signature authority for the department. 3. The report is signed by the department official and then forwarded to the HR Department wiith attached documentation) for review and update of PS. If change involves the update to position data, a copy of the Change PAR Report goes to the HR Classification/Compensation Unit. *See sample of completed Change PAR Report on the following page. 2/12/2016 36 UMBC PROPRIETARY AND CONFIDENTIAL SUPPORTING DOCUMENTATION: W-4 Form: All new employees must complete a W-4 form. The form must be completed in black (or dark blue) ink. All information must be printed (except the signature). Faxed or Xeroxed copies of W-4 forms, signed and initialed by someone are not acceptable. In addition, there cannot be any corrections, strike-outs, or white-out on the W-4 form. Failure to correctly complete a W-4 form will result in the delay placing the employee on the University payroll, thus creating a delay in the receipt of a paycheck. Sample W-4 form is attached as an addendum to this document. Individuals who do not have a Social Security Number must complete and submit an Affadavit of Compliance in order to be placed on payroll. W-4 for a Non-Resident Alien: There are countries that have tax treaties with the United States. These treaties entitle the non-resident alien to be exempt from paying Federal taxes. The W-4 must be completed as follows: The employee must pay State taxes. A non-resident alien may only claim 0 or I exemption on line 5 for State taxes. If the individual is totally or partially exempt from Federal taxes, please write, 1 or 0 on line 5 for Federal taxes. On line 6, include additional withholding of $15.30 for all non-resident aliens who claim 1". (The additional withholding is necessary to prevent under-withholding. The tax tables in the payroll system include the standard deduction which is appropriate for citizens and resident aliens who file a 1040, but non-resident aliens are not allowed to use standard deduction. The $15.30 will be taken if there is any income in excess of the tax treaty provision.) FORMS REQUIRED FOR NON-RESIDENT/RESIDENT ALIENS CITIZENSHIP STATUS FORMS When Filed W-4 Can Be Completed: Resident Alien for tax Purposes W-4 CSF W-9 Every Calendar Year Originals Sent To Payroll As a United States Citizen NRA for tax purposes, no Tax Treaty applies: Researcher, Teacher, Student, Grad Assist W-4 CSF Every Calendar Year Originals Sent To Payroll Must file single Federal is 0 or 1 & $15.30. State is 0 or 1. Can not use line 7 2/12/2016 37 UMBC PROPRIETARY AND CONFIDENTIAL NRA for tax purposes, Tax Treaty applies: Researcher, Teacher, Student, Grad Assist FYI: W-4 CSF 8233 (Oct, 1996) Rep. Letter Every Calendar Year Originals Sent To Payroll Must file single Federal is 0 or 1 & $15.30. State is 0 or 1. Can not use line 7 NONRESIDENT ALIENS WITH A TEMPORARY SOCIAL SECURITY NUMBER CAN NOT USE A TAX TREATY. TAX TREATY FORMS MUST BE FILED CORRECTLY BY NOVEMBER 26 OF THE CURRENT CALENDAR YEAR TO BE EXEMPT FROM FEDERAL TAXES ON JANUARY 1 OF THE NEW YEAR Key: NRA= W4= CSF= 2/12/2016 Nonresident Alien Employee withholding allowance certificate Citizenship status form 38 UMBC PROPRIETARY AND CONFIDENTIAL I-9 Form: All new employees must complete and submit an I-9 form in order to be placed on the University payroll. This form verifies the employee’s eligibility to work in the United States (in accordance with the US Department of Justice Immigration and Naturalization Service). This form must be completed by the third (3rd) day of employment. A sample of this form and instructions for completion are attached as an addendum to this document. Substance Abuse Policy and Acknowledgement of Receipt Form: This receipt is required in accordance with the Governor’s Executive Order 01.01.1991.16 all employees are required to read the policy and sign and submit the Acknowledgement of Receipt form stating that they are aware of the State/University policy regarding substance and alcohol abuse. A sample of this form is attached as an addendum to this document. Social Security Card Verification: A copy of the employee’s social security card depicting official name to be used on UMBC payroll for the purpose of ensuring appropriate taxation (or exemption to taxation) of employee. Retirement Selection Plan Form: This form is required for Regular Exempt and Faculty employees for the selection of a retirement plan. This form does not take the place of the actual retirement application. However, it serves to expedite the processing of employee payroll (where a plan selection must be designated). 2/12/2016 39 UMBC PROPRIETARY AND CONFIDENTIAL COMPLETION OF PAYROLL ADJUSTMENT FORM: This form is to be used to submit payment adjustments for specific types of earnings that require authorization and/or verification by the HR Payroll Staff. Employee Name: Enter employee first and last name as it appears in the PS System. EMPID/Record: Provide the PS Employee Identification Number and Job Record for which the payroll adjustment will be made. Department ID/: Name Enter 5-digit PS Department number and name. Bi-Weekly Salary: Provide employee’s bi-weekly salary. Pay Period: Enter pay period in which the payroll adjustment will occur (e.g., PR-10). Service Dates: Enter date service(s) were rendered and payment/adjustment is owed. Payroll Contact: Provide name of individual completing the form. Contact Phone: Telephone number of contact person completing the form. Tax Period: Segmentation: Number of pay periods for taxation (regular b/w salary + adjustment = total; divide total into b/w salary to obtain number of pay periods for tax segmentation). HR Payroll Office will verify number of pay periods for segmentation. Update remaining check boxes, hours, amounts, etc. where appropriate. Explanations for each earnings code are provided. A sample of the Payroll Adjustment Form is provided on the following page. 2/12/2016 40 UMBC PROPRIETARY AND CONFIDENTIAL Payroll Adjustment Form University of Maryland, Baltimore County This form should be used to submit payment adjustments for specific types of earnings that require authorization and/or verification by HR- Payroll. Employee Name Empl ID/Record # Department ID/Name Bi-weekly Salary Tax Period Segmentation Pay Period Service Dates Payroll Contact / Contact Phone Adjustments to Pay Check Type of Pay Description Regular Pay Adjustment Regular Position adjustment (retro increase, new hire, contract payout for retirement eligible earnings) Employee is terminating or changing status Employee on work related injury for less than 6 months Employee on work related injury for greater than 6 months Additional pay (Benefit eligible position) ex. Faculty Special Pay Final Leave Payout Accident Pay Accident Pay Additional Pay Check Type of Pay Description Prior Pay Period Adjustments Adjustment to Regular Pay New hire/Pay not entered in Time Entry (Hrly or contingent employee) Positive Adjustment to Pay (nonbenefit eligible position) ex. Summer, winter, flat pay Earnings Code RAJ Amount Hours LV1 ACC ACE ADL Earnings Code REG * Amount ADJ * Description: Department Preparer: _______________________________ Print ___________________________ Sign ______ Date Department Approver: _______________________________ Print ___________________________ Sign ______ Date * These actions should be done in Time Entry unless Pay Segmentation is required. Refer to Pay Segmentation Practice for details. 2/12/2016 41 UMBC PROPRIETARY AND CONFIDENTIAL ADDENDUM 1: - 2/12/2016 New Hire PAR Instructions W-4 Form I-9 Form Substance Abuse Acknowledgement of Receipt Form Retirement Selection Form (for Exempt and Faculty Only) 42 UMBC PROPRIETARY AND CONFIDENTIAL Payroll Service Center New Hire Payroll Action Request Instructions Introduction Complete the Personnel Action Request Form for the addition of Concurrent Jobs, New Hires, Rehires, and Transfers. Use the chart to determine the required fields, appropriate actions/reason codes, and required documents to submit. The forms will be reviewed based on the guidelines below. If these requirements are not satisfied, payroll processing could be delayed. 2.0 Action/Reason Table 2.1 Description: Hire Hire a new employee that is not currently employed by UMBC, USM or another State Agency Hire, Additional Job ADD Reason Codes INI Initial Employment XST Other State Agency Transfer from USM XUM Fields 1-4 and 8-42 must be complete for all new hires. (Fields 6, 7 must be completed for USM and State transfers) New Hire PAR W4 Completed I-9 with supporting documents Social Security Number Verification State of Maryland Substance Abuse Policy See Additional Documentation Requirements Section requirements based on employee category Fields to Complete Required Documents 2.2 Description: Hire, One Pay Appointment Hire a new employee who is to receive one lump payment only ONP One Pay Appointment Reason Code Fields to Complete Fields 1-4, 8-16, 19, 23-28, and 29-36 must be completed for all one pay appointments. Required Documents 2/12/2016 43 New Hire PAR W4 Completed I-9 with supporting documents Social Security Number Verification UMBC PROPRIETARY AND CONFIDENTIAL 2.3 Description: Concurrent Job An existing active employee gets hired in a new position regardless of the department ADD – Hire, Additional Job Action (1) Reason (2) Supporting Documentation (3) Effective Date (4) Empl ID -if known (5) First Name (8) Middle Name/Initial (9) Last Name (10) Position Number (29) o Department ID (30) o Department Name (31) o Job Code/Title (32) o Std Hours/FTE (33) Appointment End Date (34) Employee Class (35) Payment Method (36) Bi-weekly/Hourly Rate (37) Annual Salary (38) See Additional Documentation Requirements Section for requirements based on employee category Reason Codes Fields to Complete Fields to Complete (continued) Required Documents 2.4 Description: Rehire Employee is returning to UMBC, previously terminated in PeopleSoft Rehire REH Reason Codes Required Documents 2/12/2016 44 REI New Hire PAR W4 Completed I-9 with supporting documents Social Security Number Verification State of Maryland Substance Abuse Policy See Additional Documentation Requirements Section for requirements based on employee category Reinstatement UMBC PROPRIETARY AND CONFIDENTIAL 3.0 Additional Documentation Requirements by Employee Type In addition to the required documentation listed above for each Action/Reason, there are specific documents required for new employees based on their category of employee. It is imperative that these documents be submitted to payroll by the scheduled deadline. Failure to submit all the required paperwork may result in delayed payment. Employee Category Contingent I Additional Documents Required Copy of Contingent I Requisition and Agreement Graduate Assistant Non-Exempt Part-time Faculty Student Contingent II Exempt Faculty Copy of Personnel Requisition Form Original Contract Copy of Personnel Requisition Form Retirement Plan Selection Form Copy of Approved Appointment Letter Retirement Plan Selection Form Faculty Supplemental Form Graduate Assistant Acceptance Letter (signed by the student & Graduate School) Student FICA Exemption Form Copy of Personnel Requisition Form Copy of Part-time Supplemental Faculty Appointment Faculty Supplemental Form Student FICA Exemption Form 4.0 Guideline for Coding Employee Classification (Box 35) Employee Class Determined by Description Exempt, Contingent I Title, requisition and Contingent I agreement Exempt, Contingent II Title, requisition and contract Exempt, Regular Title, personnel requisition and benefit forms Faculty NonTenure Continuing Contract Faculty, Not Tenured Not on Track Title code An exempt employee that is on an if and when needed or temporary contract Any exempt employee on a contractual basis. These employees may be eligible for leave benefits (refer to departmental guidelines for leave eligibility). Any exempt employee that is hired on a regular position and is benefit eligible (health, retirement, etc.) Only faculty Librarians Faculty, Not Tenured on Track Appointment Letter, Faculty Data Form Faculty, Tenured Appointment Letter, Faculty Data Form 2/12/2016 Appointment Letter, Faculty Data Form 45 Faculty members who are on a contract for a specified period of time and are not seeking tenure Permanent faculty members who are working towards becoming tenured. Permanent faculty granted tenure. UMBC PROPRIETARY AND CONFIDENTIAL Faculty, Contractual Appointment Letter, Faculty Data Form Graduate Assistant, Bi-weekly Title code Non-exempt, Contingent I Title code (begins with 02 through 15) and Contingent I agreement Non-exempt, Contingent II Title code (begins with 02 through 15) and contract Non-exempt, Regular Title code (begins with 02 through 15) 2/12/2016 46 All non-benefit eligible, primarily part-time faculty or visiting faculty that are not on a regular line All graduate research/teaching assistants An non-exempt employee that is on an if and when needed or temporary contract Any non-exempt employee on a contractual basis. These employees may be eligible for leave benefits (refer to departmental guidelines for leave eligibility). Any non-exempt employee that is hired on a regular position and is benefit eligible (health, retirement, etc.) UMBC PROPRIETARY AND CONFIDENTIAL 2/12/2016 47 UMBC PROPRIETARY AND CONFIDENTIAL 2/12/2016 48 UMBC PROPRIETARY AND CONFIDENTIAL 2/12/2016 49 UMBC PROPRIETARY AND CONFIDENTIAL ADDENDUM 2: CHECKLIST FOR APPOINTMENTS Non-Exempt New Hire Checklist UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) Copy of Approved Personnel Requisition form W -4 (and supporting documents if employee is non-resident alien) Completed I-9 and Copies of Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form Exempt New Hire Checklist UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) Copy of Approved Personnel Requisition form W -4 (and supporting documents if employee is non-resident alien) Completed I-9 and Copies of Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form Retirement Plan Selection Form 2/12/2016 50 UMBC PROPRIETARY AND CONFIDENTIAL Faculty New Hire Checklist UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) Copy of Approved Faculty Appointment Letter Faculty Supplemental Form (completed by Office of the Provost for all Regular Faculty) W -4 (and supporting documents if employee is non-resident alien) Completed I-9 and Copies of Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form Retirement Plan Selection Form Part-time Faculty New Hire Checklist UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) Copy of Approved Faculty Appointment Letter Faculty Supplemental Form (completed by hiring department for non-regular faculty) W -4 (and supporting documents if employee is non-resident alien) Completed I-9 and Copies of Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form 2/12/2016 51 UMBC PROPRIETARY AND CONFIDENTIAL Contingent II (Contractual) New Hire Checklist UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) Copy of Approved Personnel Requisition form Copy of Personal Services Contract W -4 (and supporting documents if employee is non-resident alien) Completed I-9 and Copies of Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form Contingent I New Hire Checklist (Intermittent/ If & When Needed and Temporary) UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) Photocopy of Contingent Category I Requisition and Agreement with appropriate signatures W-4 (and supporting documents if employee is non-resident alien) I-9 and Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form 2/12/2016 52 UMBC PROPRIETARY AND CONFIDENTIAL Graduate Assistant New Hire Checklist UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) W-4 (and supporting documents if employee is non-resident alien) Completed I-9 and Copies of Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form Supplemental Personnel Data Information Form Student FICA Exemption Form Student New Hire Checklist UMBC Personnel Action Request Form (Hire, Hire/Concurrent Job, Hire/One Pay Appointment Rehire, Reinstatement, and Transfer) W-4 (and supporting documents if employee is non-resident alien) Completed I-9 and Copies of Supporting Documents Social Security Number Verification Signed Substance Abuse Acknowledgement of Receipt form Student FICA Exemption Form Work Permit (Students 17 and under) 2/12/2016 53 UMBC PROPRIETARY AND CONFIDENTIAL