M/s. Raintech Industrial X-Ray Services

advertisement

2

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

BRIEF FACTS OF THE CASE

Intelligence was gathered that M/s. Raintech Industrial X-Ray Services situated at 1, D.K.

Complex, Below Dena Bank, Maninagar (E), Ahmedabad {also hereby referred to as the

noticee/firm} is engaged in business of providing Industrial X-Ray Services viz. Gamma Radiography

Testing and Inspection and having Service Tax Registration No. AALFR8453MSD001 under category

of “Technical Inspection and Certification Services” defined under section 65(105) (zzi) read with

65(108) and (109) of the Finance Act, 1994 and collecting applicable service tax from their client

but not depositing in government account.

2.

During the course of investigation, it was revealed that M/s. Raintech Industrial X-Ray

Services was previously registered under Service Tax Registration No. AOZPP5346MST001 under

taxable category of “Technical Inspection and Certification Agency Service” being a proprietor-ship

firm and Shri Jayantibhai Tejabhai Patel was the Proprietor of M/s. Raintech Industrial X-Ray

Services with a registered premises addressed at A/2/3, Lalbhai Centre, Opp. Aden Park Society,

Laxminarayan Char Rasta, Maninagar (E), Ahmedabad 380 008. Thereafter, the above Proprietor,

Shri Jayantibhai Tejabhai Patel converted M/s. Raintech Industrial X-Ray Services as partnership

firm with 5 other partners viz. Shri Riteshbhai J. Patel, Shri Vijaykumar Shantilal Nagar, Shri Shantilal

Pithabhai Nagar, Shri Jaydev Shantilal Nagar and Shri Durgaprasad Shamro Bagde from February,

2010 and got their new service tax registration No. AALFR8453MSD001 under taxable service

category of “Technical Inspection and Certification Agency Service” on 10.05.2010. M/s. Raintech

Industrial X-Ray Services (Proprietorship) vide their letter dated 27.03.2010 has applied for

surrender of Service Tax Registration No. AOZPP5346MST001.

3.

Letters were issued to M/s. Raintech Industrial X-Ray Services on 29.03.2011, 21.04.2011,

07.06.2011 and 10.06.2011. As no reply had been received, letter dated 20.07.2011 was issued to

all the partners of M/s. Raintech Industrial X-Ray Services requesting them to submit records /

documents related to service tax. Shri Shantilal Pethabhai Nagar, Shri Vijaykumar Shantilal Nagar

and Shri Jaydev Shantilal Nagar vide letter dated 01.08.2011 have jointly submitted documents

relating to M/s. Raintech Industrial X-Ray Services for both Proprietor-ship firm and Partnership

firm. Vide the letter dated 01.08.2011, the other partners of M/s. Raintech Industrial X-Ray

Services have informed that the partnership firm has been dissolved with effect from 30.11.2010

vide dissolution deed dated 08.12.2010 and all the service tax liabilities have to be borne by Shri

Jayantibhai T. Patel as per para 3 of dissolution deed dated 08.12.2010.

4.

In view of the above, letters dated 12.07.2012 and summons dated 19.07.2012, 31.07.2012,

27.09.2012, 22.10.2012, 08.01.2013, 05.03.2013 and 17.04.2013 had been issued to Shri

Jayantibhai T. Patel, Proprietor of M/s. Raintech Industrial X-Ray Services, Ahmedabad with a

request to submit relevant documents / information and directed to appear for recording of a

statement. However, the summons issued were returned back from the postal authorities

indicating remark as “REFUSED”.

5.

As the correspondences made with Shri Jayantibhai Tejabhai Patel, Proprietor of M/s.

Raintech Industrial X-Ray Services, Ahmedabad had been returned from postal authorities

indicating “REFUSED”, searches were conducted at 3 different premises viz. (i) A/2/3, Lalbhai

Centre, Opp. Aiden Park Society, Laxminarayan Char Rasta, Maninagar (East), Ahmedabad (ii) No. 9,

Matru Bunglow, Express Highway, C.T.M., Ahmedabad and (iii) No. 1, Matrubhumi Apartment, Near

Jaitul Park Society, Bhaipura Road, Maninagar (East), Ahmedabad. During the course of search,

documents/records pertaining to service tax were found at No. 9, Matru Bunglow, Express

2

3

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

Highway, C.T.M., Ahmedabad and the same were seized / recovered under panchnama dated

11.09.2013.

6.

On scrutiny of the documents recovered under panchnama dated 11.09.2013 from the

premises of No. 9, Matru Bunglow, Express Highway, C.T.M., Ahmedabad, it was revealed that Shri

Jayantibhai T. Patel was the Proprietor of M/s. Raintech Industrial X-Ray Services, Ahmedabad and

holding service tax registration No. AOZPP5346MST001 and engaged in providing Industrial X-Ray

Services under category of “Technical Inspection and Certification Services” as defined under

section 65(108) of the Finance Act, 1994. It was further revealed that M/s. Raintech Industrial XRay Services, Ahmedabad had filed their Service Tax Returns for the Financial year 2007-08 to

2009-10. In the ST-3 Return for the year 2008-09 (April – September and October – March) and

2009-10 (April – September and October – March), he had shown his taxable income as NIL in the

relevant rows and column of the said ST-3 Returns. However, the Financial Records i.e. Profit and

Loss Account / Balance Sheet and IT returns for the financial year 2008-09 and 2009-10 apparently

showed that M/s. Raintech Industrial X-Ray Services had earned income of Rs. 24,05,150/- and Rs.

47,94,469/- respectively.

7.

Further, it was revealed that Shri Jayantibahi T. Patel, Proprietor of M/s. Raintech Industrial

X-Ray Services, Ahmedabad had converted his firm into partnership firm alongwith with 5 other

partners w.e.f. 01.02.2010. And, M/s. Raintech Industrial X-Ray Services, Ahmedabad had got its

Service Tax registration No. AALFR8453MSD001 w.e.f. 10.05.2010 and had not filed any service tax

return. M/s. Raintech Industrial X-Ray Services (Partnership firm) had been dissolved w.e.f.

30.11.2010 vide dissolution deed dated 08.12.2010. In para 3 of the dissolution deed dated

08.12.2010, service tax liability was to be borne by Shri Jayantibhai T. Patel. The financial records

seized/recovered vide panachama dated 11.09.2013, revealed that the income was Rs. 6,50,016/and Rs. 22,62,503/- for the period 2009-10 (February and March) and 2010-11 (upto November,

2010) respectively for the above partnership firm. It was further revealed that during the period

they had continuously collected service tax and paid service tax of Rs. 28,746/- vide challan No.

00001 dated 02.08.2010 but not filed any ST-3 return.

8.

Further, it was revealed that after dissolution of partnership firm of M/s. Raintech Industrial

X-Ray Services, Shri Jayantibhai T. Patel, had continued the firm M/s. Raintech Industrial X-Ray

Services as a Proprietor – ship firm w.e.f. December, 2010 and neither deposited service tax nor

filed ST-3 Return. As per the Profit and Loss Account / Balance Sheet and Income Tax Returns, it

revealed that the income earned by M/s. Raintech Industrial X-Ray Services, Ahmedabad was Rs.

33,84,184 and Rs. 7,56,138 for the period 2010-11 (from December, 2010 and onwards) and 201112 respectively.

9.

A statement of Shri Jayantibhai T. Patel, Proprietor / Partner of M/s. Raintech Industrial XRay Services, Ahmedabad was recorded on 15.10.2013 under Section 14 of Central Excise Act, 1944

read with Section 83 of the Finance Act, 1944 wherein he interalia stated that he was proprietor of

M/s. Raintech industrial X-ray Service, A-2/3, LAL BHAI CENTRE, OPP. EDEN PARK SOCIETY,

MANINAGAR, Ahmedabad upto January 2010 and thereafter, they have formed a Partnership

company in February, 2010 consisting of six partners namely Shri Riteshbhai J. Patel, Shri

Jayantibhai T. Patel, Shri Vijaykumar Shantilal Nagar, Shri Shantilal Pithabhai Nagar, Shri Jaydev

Shantilal Nagar and Shri Durgaprasad Shamro Bagde; that both the proprietorship & partnership

company were registered with the Service Tax department having registration no. AOZPP 5346M

ST001 & AALFR 8453M SD001 respectively under the category of “Test, Inspection & Certification

Service”.

3

4

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

10.

He further stated that he had started a firm viz. M/s. Rain-Tech Industrial X-Ray Service in

2007 and the same was converted into partnership firm in February, 2010; that the partnership

firm was dissolved vide dissolution deed dated 08.12.2010 and thereafter he continued his

business in Proprietorship for some period. Thereafter, the same business was continued with all

the equipments in the name of M/s. Sun Industrial Radiography Services which has been started by

his son and he is authorised for all the day-to-day matter including its service tax related matters;

that the Inspection certification can be given by a person with license given by BARC (Bhabha

Atomic Research Centre), Mumbai and he had the license from BARC; that his son is not holding

any license from BARC which is mandatory for rendering the above services.

11.

He further stated that as a proprietor, he had filed ST-3 Returns regularly for the year 200809 and 2009-10, wherein the taxable value had been shown as NIL; that he had filed the ST-3 return

for the first and second half of 2008-09 on 23rd April, 2009; that he had intentionally shown such

wrong information in his ST-3 returns with malafide intention of evasion of service tax; that he had

collected the service tax from the customers continuously since inception of his firm but he had not

deposited the service tax amount to the Government account; that their firm was also making

agreement/ contracts with some of the customers for rendering the above services. He stated that

he had not correctly mentioned his income against the value of taxable service in my ST-3 returns

filed but he agreed with the fact that income shown in income tax return/P&L and Balance Sheet, is

the consideration received against the above taxable service rendered to his customers; that he

had short paid/ not paid the service tax on the income received against the service rendered by

both the firms; that the income against service rendered and service tax liability in respect of the

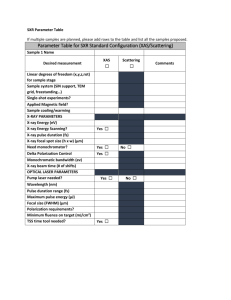

above firms is as under:(1) M/s. Raintech Industrial X-Ray Services - Proprietor – Shri Jayantibhai Tejabhai Patel

Year

Value of

taxable

Services

provided

Basic

Service tax payable

Ed. Cess S. & H.S.

Ed. Cess

2008-09

24,05,150

2,88,618

5,772

2,886

2009-10

47,94,469

4,79,447

9,589

4,795

2010-11 (from 33,84,184

3,38,418

6,768

3,384

December,

2010)

2011-12

7,56,138

75,614

1,512

756

(2) M/s Raintech Industrial X-Ray Services - Partnership firm

Year

2009-10

01.02.2010 to

31.03.2010

2010-11 (upto

30.11.2010)

2,97,276

4,93,831

3,48,570

0

0

0

Differenti

al service

tax

required

to pay

2,97,276

4,93,831

3,48,570

77,882

0

77,882

Total

Service

tax paid

Value of

taxable

Services

provided

6,50,016

65,002

1,300

650

66,952

28,746

Differential

service tax

required to

pay

38,206

22,62,503

2,26,250

4,525

2,262

2,33,037

0

2,33,037

Basic

Service tax payable

Ed. Cess S. & H.S.

Ed. Cess

Total

Service

tax paid

12.

Regarding above tabulated figure, he stated that the same was arrived from the total of the

summary of the invoices raised for the taxable services rendered by their firms wherein an element

of service tax separately mentioned and also appropriately charged on the consideration, already

4

5

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

received. He further confirmed that the amounts shown above are true and correct; that all the

income earned by him was from the taxable services rendered in the category of “Test, Inspection

& Certification Service”; that he had not rendered any other taxable service and not earned any

income thereof; that he is fully aware of the provisions regarding becoming an offence under

Service tax Law i.e. Service tax collected from the customer but not deposited in the government

exchequer. He agreed to pay Rs. 12,17,558/- as a liability of M/s. Raintech Industrial X-Ray Services

(Proprietorship firm) for the financial year 2008-09 to 2011-12 (excluding income received during

partnership firm) and Rs. 2,71,243/- as a liability of M/s. Raintech Industrial X-Ray Services

(Partnership firm) for the financial year 2009-10 (February and March) and 2010-11 (upto

November, 2010) and in confirmation of his service tax liability, he had made payment willingly for

Rs. 1 Lakhs vide Challan No. 00001 dated 11.10.2013; that he had not rendered any taxable service

during 2012-13 in M/s. Raintech Industrial X-Ray Services (both Proprietor and Partnership) and not

earned any income thereof.

13.

Further, he stated that he had intentionally refused to receive numerous letters/ summons

sent by the service tax department to avoid submission of documents/ records of his firms, to

present himself before the investigating officer and to evade service tax liability; that their

partnership firm has been formed on 01.02.2010 which has been dissolved vide partnership

dissolution deed dated 08.12.2010 and as per condition no. 10 mentioned at page 8 of the

dissolution deed, all the liabilities as regards to service tax payment has to be borne by him; that he

is only responsible person for payment of service tax liability in respect of partnership firm.

14.

Letter was issued to M/s. Welspun Corp. Ltd., Bharuch, a major service recipient of M/s.

Raintech Industrial X-Ray Services, Ahmedabad requesting them to furnish details of service

received. M/s. Welspun Corp. Ltd., Bharuch vide their letter dated 17.10.2013 have submitted

summary of invoices raised by M/s. Raintech Industrial X-Ray Services, Ahmedabad and payment

made by them. And, also submitted copies of Invoices raised by M/s. Raintech Industrial X-Ray

Services. The invoices received from M/s. Welspun Corp. Ltd., Bharuch showed that M/s. Raintech

Industrial X-Ray Services, Ahmedabad had shown specifically and collected amount as Service Tax.

15.

As per the provision of Section 65 (108) of the Finance Act, 1994 the term

“Technical Inspection and Certification” means :

“ inspection or examination of goods or process or material or information technology

software or any immovable property to certify that such goods or process or material or

information technology software or immovable property qualifies or maintains the specified

standards, including functionality or utility or quality or safety or any other characteristic or

parameters, but does not include any service in relation to inspection and certification of

pollution levels”.

Further, Technical Inspection and Certification Agency as defined in Section 65(109) means

“any agency or person engaged in providing service in relation to technical inspection and

certification”

16.

Whereas it appeared that M/s. Raintech Industrial X-Ray Services, Ahmedabad was started

from 2007 as a proprietorship firm, Shri Jayantibhai T. Patel was the Proprietor of the said firm.

M/s. Raintech Industrial X-Ray Services, Ahmedabad was holding service tax registration No. AOZPP

5346M ST001 and filed service tax returns upto 2009-10. For the year 2008-09 and 2009-10 M/s.

Raintech Industrial X-Ray Services (Proprietorship firm) has filed ST-3 Return showing their taxable

income as NIL and he had not deposited any service tax. Further, M/s. Raintech Industrial X-Ray

Services, Ahmedabad was converted into partnership firm since from February, 2010. During May,

5

6

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

2010, M/s. Raintech Industrial X-Ray Services, Ahmedabad (Partnership firm) got their service tax

registration No. AALFR 8453M SD001. However, they had only paid service tax of Rs. 28,746/- and

not filed any ST-3 Return. M/s. Raintech Industrial X-Ray Services (Partnership firm) had been

dissolved w.e.f. 30.11.2010 vide dissolution deed dated 08.12.2010 and in para 3 at Page 4 of the

said dissolution deed dated 08.12.2010, Shri Jayantibhai T. Patel has to borne all tax liability of M/s.

Raintech Industrial X-Ray Services (Partnership firm) on it’s dissolution.

17.

Whereas it appeared that Shri Jayantibhai T. Patel had continued his firm M/s. Raintech

Industrial X-Ray Services, Ahmedabad as a Proprietorship firm after dissolution of M/s. Raintech

Industrial X-Ray Services (Partnership firm). M/s. Raintech Industrial X-Ray Service had neither

deposited any service tax nor filed ST-3 return after 2009-10. Upon reconciliation of Balance

Sheet, Profit and Loss Account and Income Tax Return, it appeared that M/s. Raintech Industrial XRay Services, Ahmedabad had failed to pay appropriate service tax to the government account.

The amount not paid / short paid by M/s. Raintech Industrial X-Ray Service, Ahmedabad is as under

:Year

Proprietor

Value of

Service tax payable

Service Different

/

taxable

tax paid

ial

Basic

Ed.

S. &

Total

Partnershi Services/

service

Cess

H.S.

p

Income

tax

Ed.

shown in

required

Cess

Balance

to pay

Sheet

2008-09

Proprietor 24,05,150 2,88,618 5,772 2,886 2,97,276

0

2,97,276

2009-10

Proprietor 47,94,469 4,79,447 9,589 4,795 4,93,831

0

4,93,831

2009-10

Partnershi 6,50,016

65,002

1,300

650

66,952

28,746

38,206

(01.02.2010

p

to

31.03.2010)

2010-11

Partnershi 22,62,503 2,26,250 4,525 2,262 2,33,037

0

2,33,037

(upto

p

30.11.2010)

2010-11

Proprietor 33,84,184 3,38,418 6,768 3,384 3,48,570

0

3,48,570

(from

December,

2010)

2011-12

Proprietor 7,56,138

75,614

1,512

756

77,882

0

77,882

2011-12

Closing

Balance of

1,38,547

13,855

277

139

14,271

0

14,271

Debtor

Total

1,43,91,00 14,87,20 29,74 14,87 15,31,81

15,03,07

7

4

3

2

9 28,746

3

18.

According to section 67 of the Finance Act, 1994 as amended from time to time where

service tax was chargeable on any taxable service with reference to its value, then such value shall

be the gross amount charged by the service provider for such service provided or to be provided by

him. The gross amount charged for the taxable service shall include any amount received towards

the taxable service before, during or after provision of such service. Thus, the value to be

considered for calculation of service tax was the gross amount charged for providing the taxable

services. The noticee was not paying the service tax on the gross amount charged for the taxable

services rendered. In other words, they had short paid on the gross amount charged / received for

6

7

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

the taxable services and thereby contravened the provisions of Section 67 of the Finance Act, 1994

read with Rule 6 of the Service Tax Rules, 1994.

19.

As per the provisions of the Finance Act, 1994 and rules made there under, the service

provider was required to assess correct value for the service provided by them as well as to pay

service tax on the actual amount of income received by them for services rendered in due course

as prescribed and to follow all the procedure laid down in the Act and Rules. In this case, the

service provider had short paid the Service Tax leviable on the taxable value though they had taken

service tax registration under the services provided as Technical Inspection and Certification

Services. The service provider had failed to file to file correct ST-3 returns for the taxable services

rendered by them and suppressed the facts of the services rendered and actual amount of Service

Tax collected by them for the period from 2008-09 to 2011-12. It also appeared that the service

provider had charged and collected Service Tax from the service recipients on invoice value in

respect of services rendered to their clients but short paid the same in government Account in

contravention of the provisions of Section 68 of the Act. It, therefore, clear that the service

provider had failed to make timely payment of the Service Tax as provided in Section 68 of the Act

read with Rule 6 of the Rules.

20.

It is provided under section 68 (1) of the act that ‘every person providing taxable

service to any person shall pay service tax at the rate specified in section 66 in such a manner and

within such period which is prescribed under Rule 6 of the Service Tax Rules, 1994. In the instant

case M/s. Raintech Industrial X-Ray Services had not paid service tax amounting to Rs. 15,31,819/(Rupees Fifteen Lacs Thirty One Thousand Eight Hundred and Nineteen Only) (Service Tax of Rs.

14,87,204/- plus Education Cess and Secondary & Higher Secondary Education Cess of Rs.44,615/-)

towards their service provided as Technical Inspection and Certification Agency for the taxable

amount of Rs. 1,43,91,007/- and thereby violated the provision of Section 68(1) of the Act read

with Rule 6 of the Service Tax Rule, 1994.

21.

Whereas, as per section 70 of the Finance Act 1994, every person liable to pay service tax is

required to himself assess the tax due on the services provided by him and thereafter furnish a

return to the jurisdictional Superintendent of Service Tax by disclosing wholly & truly all material

facts in their service tax returns (ST-3 returns). The form, manner and frequency of return are

prescribed under Rule 7 of the Service Tax Rules, 1994. In this case, it appeared that the noticee

had not assessed the tax due, properly, on the services provided by him, as discussed above, and

failed to file correct ST-3 Returns in time thereby violated the provisions of Section 70(1) of the act

read with Rule 7 of the Service Tax Rules, 1994.

22.

The government has from the very beginning placed full trust on the service provider so far

service tax is concerned and accordingly measures like Self-assessments etc., based on mutual trust

and confidence are in place. Further, a taxable service provider is not required to maintain any

statutory or separate records under the provisions of Service Tax Rules as considerable amount of

trust is placed on the service provider and private records maintained by him for normal business

purposes are accepted, practically for all the purpose of Service tax. All these operate on the basis

of honesty of the service provider; therefore, the governing statutory provisions create an absolute

liability when any provision is contravened or there is a breach of trust placed on the service

provider, no matter how innocently. From the evidence, it appears that the service provider has

not taken into account the incomes received by them for rendering taxable services for the

purpose of payment of service tax and thereby, service tax liabilities are not properly discharged by

them. The non filing of ST-3 returns thereby non-declaration of the value of taxable service

correctly in ST-3 returns and not paying the amount of service tax is utter disregard to the

requirements of law and breach of trust deposed on them such outright act in defiance of law

7

8

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

appears to have rendered them liable for stringent penal action as per the provisions of Section 78

of Finance Act 1994 for suppression, and concealment or non furnishing value of taxable service

with intent to evade payment of service tax .

23.

In view of above discussion, it clearly comes out that all these material information and

value of taxable services had been concealed from the department deliberately and consciously to

evade payment of service tax purposefully by not declaring the amount received against the

services rendered. From all the above acts of contravention on the part of the noticee have been

committed with an intention to evade the payment of service tax by suppressing the facts and to

commit fraud. Therefore, service tax was required to be demanded and recovered from them

under Section 73 (1) of Finance Act, 1994 by invoking extended period of five years under the

proviso to Section 73(1) of the Finance Act, 1994 (32 of 1994) as the service provider had

suppressed/not declared the nature and value of the taxable services. Thus, the amount of Service

Tax Rs.15,31,819/- was required to be recovered from the noticee by applying the extended period

of five years.

24.

Whereas, from the foregoing paras and discussion made herein above, it appeared that the

noticee had contravened the provisions of

(i)

Section 67 of the Finance Act, 1994 in as much as they had failed to assess and

determine the correct value of taxable services provided by them, as explained in

foregoing paras for the period 2008-09 to 2011-12;

(ii)

Section 68 of the Finance Act, 1994 read with Rule 6 of the Service Tax Rules, 1994 in

as-much-as they failed to make payment of service tax amounting to Rs. 15,31,819/(Rupees Fifteen Lacs Thirty One Thousand Eight Hundred and Nineteen Only) (Service Tax

of Rs. 14,87,204/- plus Education Cess and Secondary & Higher Secondary Education

Cess of Rs.44,615/-) during the period 2008-09 to 2011-12, to the credit of the

Government account within the stipulated time lime;

(iii)

Section 70 of the Finance Act 1994 as amended read with Rule 7 of the Service Tax

Rules, 1994 in as much as they have failed to self-assess the Service Tax on the taxable

value and to file ST-3 returns properly for their service provided as Technical Inspection

and Certification Agency Services during 2008-09 to 2011-12.

25.

In view of the foregoing paras, it appeared that the noticee had contravened provisions of

Finance Act, 1994 and the rules made there under with intent to evade payment of Service Tax and

therefore the amount of Service Tax Rs.15,31,819/- was required to be recovered along with

interest under sections 73 and 75 of the Finance Act, 1994 by invoking the extended period of five

years as per the proviso to Section 73(1) of the Finance Act, 1994.

26.

Further, as per Section 75 ibid, every person liable to pay the tax in accordance with the

provisions of Section 68, or rules made there under, who fails to credit the tax or any part thereof

to the account of the Central Government within the prescribed period is liable to pay the interest

at the applicable rate of interest. Since the service provider has failed to pay their Service Tax

liabilities in the prescribed time limit, they are liable to pay the said amount along with interest.

Thus, the said Service Tax was required to be recovered from the noticee along with interest under

Section 75 of the Finance Act, 1994.

27.

Whereas, the value of taxable service in respect of aforesaid services rendered by them

had not been subjected to assessment. Eventually, they had willfully made the mis-statement and

not paid Service Tax. Thus, the noticee had failed to self-assess the Service Tax payable on the

8

9

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

taxable value received correctly; failed to file S.T-3 returns correctly as per provisions of the

Finance Act, 1994, and also failed to pay the Service Tax at the applicable rate on the taxable value.

Thus, on going through the facts and circumstances of the instant case, it appeared to lead towards

a conclusion that the noticee had deliberately and also willfully evade payment of service tax on

commission income received as discussed above.

28.

It further appeared that on account of all the above narrated acts of commission and

omissions on the part of the noticee, they had rendered themselves liable to penalty under the

following provisions of the Finance Act, 1994, as amended:

(i) Section 76 of the Finance Act, 1994, in as much as they failed to classify their services

under proper and correct taxable service and failed to pay the appropriate Service Tax on due

dates within the stipulated time;

(ii) Section 77 of the Finance Act, 1994, in as much as they failed to furnish the correct details

in their returns;

(iii)

Section 78 of the Finance Act, 1944, in as much as they have mis-stated the taxable

value of the services provided by them to the service recipients and they have, knowingly and

willfully, not paid the correct amount of Service Tax leviable on such amount.

29.

All the above acts of contravention of the various provisions of the Finance Act, 1994, as

amended from time to time, and Rules framed there under, on the part the noticee had been

committed by way of suppression of facts with an intent to evade payment of service tax and,

therefore, the said service tax not paid is required to be demanded and recovered from them

under the proviso to Section 73 (1) of the Finance Act, 1994, as amended from time to time, by

invoking extended period of five years. All these acts of contravention of the provisions of Section

65, 67, 68 & 70 of the Finance Act, 1994, as amended from time to time read with Rules 6 and 7 of

the Service Tax Rules, 1994 appears to be punishable under the provisions of Section 78 of the

Finance Act, 1994 as amended from time to time.

30.

Now, therefore, M/s. Raintech Industrial X-Ray Services situated at A/2/3, Lalbhai

Centre, Opp. Aiden Park Society, Maninagar (East), Ahmedabad – 380 008 was issued a show cause

notice no. STC/4-39/O&A/2013-14 dated 22.10.2013 by the Additional Commissioner of Service

Tax, Ahmedabad as to :(i)

why the amount of Rs. 1,43,91,007/- collected from various clients should not be

considered as “taxable value” under the category of “Technical Inspection and

Certification Services” as specified in clause (zzi) of Section 65(105) read with Section 65

(108) and (109) of the Finance Act, 1994 as amended.

(ii)

why service tax amounting to Rs. 15,31,819/- (Rupees Fifteen Lacs Thirty One Thousand

Eight Hundred and Nineteen Only) (Service Tax of Rs. 14,87,204/- plus Education Cess

and Secondary & Higher Secondary Education Cess of Rs.44,615/-) on the taxable value

referred in above para should not be charged and recovered from them under the

provision of section 73(1) read with section 68 of the Finance Act, 1994, as amended by

invoking larger period of five years as discussed hereinabove. They also required to show

case as to why the service tax paid vide Challan No. 00001 dated 02.08.2010 for Rs.

28,746/- and Challan No. 00001 dated 11.10.2013 for Rs. 1,00,000/- should not be

appropriated against the said demand.

9

10

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

(iii)

why interest on such service tax at the appropriate rate prescribed under the provisions

of Section 75 of the Finance Act, 1994, as amended should not be demanded and

recovered from them;

(iv)

why penalty may not be imposed upon them under section 76 of the Finance Act, 1994

as amended for contravention of section 68(1) of the Finance Act read with Rule 6 of the

Service Tax Rules, 1994 for the failure to make the payment of service tax payable by

them within stipulated time.

(v)

Penalty should not be imposed upon them under section 77 of the Finance Act, 1994, as

amended, for contravention of Section 70 of the Finance Act, 1994; and

(vi)

why penalty under section 78 of the Finance Act, 1994, as amended, should not be

imposed on them for suppressing the taxable value received under Technical Inspection

and Certification Service and material facts before the department resulting into nonpayment of Service Tax, Education Cess and Secondary & High Secondary Education cess

as mentioned hereinabove.

DEFENCE REPLY

31.

The noticee filed their defence reply vide letter dated nil received by this office on

19.02.2014, in which they submitted as under:

That M/s. Raintech Industrial X-Ray Services proprietorship (the Assessee) is situated at A2/3, Lalbhai Center, Aiden Park Society, Maninagar (EAST), Ahmedabad-380008, and is

engaged in rendering service falling under category of Technical Inspection and Certification

Services.

That the department during investigation noticed that they were registered as a

proprietorship firm having registration no. AOZZPP5346MST001 and Shri Jayantibhai T.

Patel was proprietor.

That they continued to provide service as proprietorship firm up to January-2010 and

surrendered Service Tax Registration Number on 27-03-2010.

That in February, 2010 proprietor Shri Jayantibhai Tejabhai Patel along with Shri Riteshbhai

J. Patel, Shri Vijaykumar Shantilal Nagar, Shri Jaydevbhai Shantilal Nagar, Shri Shantilal

Pithabhai Nagar, Shri Durgaprasad Shamro formed partnership firm and obtained service

tax registration no. AALFR8453MSD001 at registered office. The said firm was dissolved

with effect from 31.11.2010 under dissolution deed dated 08.12.2010. The copy of said

dissolution deed attached as annexure A.

That from December 2010 Mr. Jayantibhai T. Patel one of the partners started

proprietorship concern with the same name Raintech Industrial X-Ray Services.

That they continued to work as proprietor from December 2010 till May 2011.

That the definitions under “Technical Inspection and Certification Service” are as follows:

As per Section 65 (105) (zzi) of Finance Act, 1994,

10

11

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

“Taxable Service” means any service provided or to be provided to any person, by a

technical inspection and certification agency, in relation to technical inspection and

certification.

As per Section 65(108) of Finance Act, 1994,

"Technical Inspection and Certification" means inspection or examination of goods or

process or material or information technology software or any immovable property to certify

that such goods or process or material or information technology software or immovable

property qualifies or maintains the specified standards, including functionality or utility or

quality or safety or any other characteristic or parameters, but does not include any service

in relation to inspection and certification of pollution levels.

That as per Section 65(109) of Finance Act, 1994,

"Technical Inspection and Certification Agency" means any agency or person engaged in

providing service in relation to technical inspection and certification.

That according to department taxable value without considering cum-duty, service tax

payable and paid is as under:

1.

As proprietorship firm in the name and style of Raintech Industrial X-Ray Services

Period

Value

of Service

Service Service Tax

Taxable

Tax

Tax

Not

Service (incl Payable

Paid

Paid/Short

service tax

Paid

2008-09

2405150

297277

0

297277

2009-10

4794469

493830

0

493830

April-10 to

3384184

348571

0

348571

December2010

2011-12

756138

77882

0

77882

2011138547

14270

0

14270

12(Closing

balance of

deters)

As per section 67(2) of the Finance Act, 1994,

“Where the gross amount charged by a service provider, for the service

provided or to be provided is inclusive of service tax payable, the value of such

taxable service shall be such amount as, with the addition of tax payable, is equal to

the gross amount charged.”

That the value of service provided considering cum-duty value is as under:

Period

2008-09

2009-10

Value of

Taxable

Service

(incl.

service

tax

2405150

4794469

Value of Service Service Service

taxable Tax

Tax

Tax Not

service

Payable Paid

Paid/Short

(excl.

Paid

service

tax)

2140575 264575

0

264575

4346753 447716

0

447716

11

12

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

April-10 to 3384184 3068163

December2010

2011-12

756138 685529

2011138547 125609

12(Closing

balance of

deters)

0

316021

70609

12938

0

0

70609

12938

As partnership firm in the name and style of Raintech Industrial X-ray Services

Period

Value of Service Service Service

Taxable

Tax

Tax

Tax

Not

Service(incl Payable Paid

Paid/Short

service tax)

Paid

February2010

to

March2010

April-2010

to

November2010

316021

650016

66,952

28,746

38,206

2262503 233,038

0

233,038

That as per section 67(2) of the Finance Act, 1994, the cum-duty value for this purpose,

service tax payable and paid is as

under:

Period

Value of

Taxable

Service(incl

service tax)

February650016

2010

to

March2010

April-2010 2262503

to

November2010

Value of

Taxable

Service

(excl

service

tax)

589316

Service

Tax

Payable

Service Service

Tax

Tax Not

Paid

Paid/Short

Paid

60,700

28,746

2051226 211,276 0

31,954

211,276

That they have paid Rs.1,00,000/- on 11-10-2013.

That Provision of notification no. 06/2005-ST dated 01.03.2005 as amended from time to

time, is as follows:

“In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994

(32 of 1994) (hereinafter referred to as the said Finance Act), the Central Government, on

being satisfied that it is necessary in the public interest so to do, hereby exempts taxable

12

13

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

services of aggregate value not exceeding ten lakh rupees in any financial year from the

whole of the service tax leviable thereon under section 66 of the said Finance Act”.

That according to department they have contravened provisions of section 67, 68, 70 and

73(1) of the Finance Act,1994 and rule 6 and 7 of the service tax rule 1994 and intended to

evade payment of service tax and invoked extended periods five years under provisions to

section 73(1).

That the adjudicating authority issued SCN No. STC/04-39/O&A/13-14 served in the name of

Raintech Industrial X-Ray services on 22.10.2013 to show cause as to why:

(1) Amount of Rs. 1,43,91,007/- should not be considered as taxable value under

“Technical, Inspection, Certification Service”,

(2) Amount of Rs. 15,31,819/- should not be charged and recovered as service tax under

provision of section 73(1) of the act, ibid. and also amount of Rs. 1,28,746/- should not

be appropriated against the said demand,

(3) Interest under section 75 of the act ibid should not be imposed,

(4) Penalties under section 76, 77 and 78 of the act ibid should not be imposed upon the

assessee.

That though the proprietorship and partnership firms are separate, entity is liable to pay tax

separately. That the Show cause notice was issued in the name of Raintech Industrial X-Ray

Services. For both the concerns i.e. Raintech Industrial X-Ray Services and Sun Industrial XRay Services single SCN can not be issued. Thus, SCN issued is vague.

Provision of services:

32.

That they are engaged in the business of capturing of X-ray of pipe lines. The pipe lines

are implanted under ground and are for supply of gas from one place to another place. That

they are using radioisotopes to check for cracks can be accomplished with a technique

called gamma radiography. That Gamma radiography involves placing a radiation source on

one side of the gas pipeline, and a photographic plate on the other. The radiation that can

pass through cracks will show up on the photographic plate. That the exact process is done

by taping a special photographic film over the weld or suspected crack of a pipeline. A pipe

crawler carrying the sealed radiation source is then dispatched down the pipe to the weld

position. The field technician performing the check then sends a remote control message to

the crawler to tell it to expose the radiation. When this happens, the radiation passes

through any cracks that may exist, onto the photographic film taped on the outside. This

film is then developed and checked for cracks or welding deterioration. That the service of

capturing of X-ray includes work provided to the private concern as well as government

entity. That while capturing of X-ray they are required to use material such as X-ray films,

Dosimeter, Lead screen, PVC Cassettes, Digital ultrasonic flow ditector, Lead intensifying

screen etc.

32.1

32.2

That from the transaction involved, it is very well understood that along capturing of Xray service is sale of goods. i.e. films, chemicals, whereas in definition of testing, analysis

service it is mentioned that any services will be taxable.

That in case of works contract, there is transfer of property in goods involved on the

execution of such contract

33. That the activity carried out falls under category of works contract.

33.1 That they are engaged in providing technical inspection and certification service as

defined under section 65(105)(zzi) as under:

13

14

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

Taxable service means, any service provided or to be provided to any person, by a

technical inspection and certification agency, in relation to technical inspection and

certification.

"Technical Inspection and Certification Agency" means any agency or person engaged

in providing service in relation to technical inspection and certification.

33.2

That they rendered technical inspection certification service for this purpose and they

had obtained necessary license from Bhabha Automnic Research Centre. For this

purpose, they had to purchase various types of materials and instruments such as X-ray

films, Dosimeter, Lead screen, PVC Cassettes, Degital ultrasonic flow ditector, Lead

intensifying screen etc. The assessee as a proprietorship purchased this material worth

Rs.6,56,359 during September, 2008 to April, 2009 and October, 2010 to December,

2011 and as a partnership firm purchased material worth Rs 3,800 During May 2010 to

October, 2010.

That for the purpose of technical inspection and certification two items are involved. (a)

material and instruments and (b) certification service. This means for the providing of

this service both the components are required. So, service tax can be charged on total

value reduced by value of material and instruments as it is done in works contract.

That Photography service, which is similar to technical inspection and certification

service. Where, value of goods and value of service is included. It is held that

photography service is a works contract and only service portion can be subject to

service tax.

Various judicial pronouncements declared in photography service as a works contract

are as under:

33.3

33.4

33.5

Jain Brothers Vs. CCE, Bhopal (2009) 13 STR 633(CESTAT, New Delhi)

CCE, Raipur Vs. Ajanta Color Labs (2009) 14 STR 468 (CESTAT, New Delhi)

Agrawal Color Photo Industries Vs. Asst. Commr. Of Cus. & C. Ex., Jabalpur (M.P.)

33.5

Therefore, Show cause notice is issued under the category of "Technical Inspection

and Certification" is vague and is required to be quashed.

34 That the SCN is issued in vague manner and requires to be dropped.

34.1

34.2

34.3

34.4

34.5

34.6

That the adjudicating authority has issued single SCN to the two different assesses.

That the assessee was running his business in the name of M/s. Raintech Industrial X-Ray

Services being the proprietorship concern till February 2010. Thereafter they have

constituted a partnership firm the run the business in the partnership.

That the partnership firm of the assessee and proprietorship firm of the assesses are

different persons as recognized under the Finance Act, 1994.

That being the different persons as recognized under the act, the assessee have correctly

surrendered the registration under proprietorship firm as soon as they have formed the

partnership and stopped doing any business from proprietorship. Moreover they have

correctly obtained a new service tax registration number in the name of partnership firm.

The allotment of different registration numbers by the department is the acceptance of the

fact that both the proprietorship and partnership of the assessee are different persons.

Therefore, the adjudicating authority is incorrect in issuing a single SCN to the different

assesses.

14

15

34.7

35

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

Therefore SCN is issued in vague manner and required to be quashed.

Works contract service specified other than section 65(105)(zzzza)(ii)

35.1

That they are providing services to the private entity as well as government entity.

35.2

As per section 65(105)(zzzza), the works contract means

““works contract” means a contract wherein,—

(i) transfer of property in goods involved in the execution of such contract is leviable to tax

as sale of goods, and

(ii) such contract is for the purposes of carrying out,—

(a) Erection, commissioning or installation of plant, machinery, equipment or structures,

whether pre-fabricated or otherwise, installation of electrical and electronic devices,

plumbing, drain laying or other installations for transport of fluids, heating, ventilation

or air-conditioning

including related pipe work, duct work and sheet metal work, thermal insulation, sound

insulation, fire proofing or water proofing, lift and escalator, fire escape staircases or

elevators; or

(b) Construction of a new building or a civil structure or a part thereof, or of a pipeline or

conduit, primarily for the purposes of commerce or industry; or

(c) Construction of a new residential complex or a part thereof; or

(d) Completion and finishing services, repair, alteration, renovation or restoration of, or

similar services, in relation to (b) and (c); or

(e) Turnkey projects including engineering, procurement and construction or commissioning

(EPC) projects;”

35.3

That the Capturing of X-ray is not covered under above mentioned definition of works

contract.

36.

Without prejudice to whatever stated above , they further submitted as follows:

36.1

That they are eligible for benefit of small scale service providers exemption.

36.2

Under notification no. 6/2005-ST dated 01-03-2005, as amended from time to time, an

exemption scheme for small service providers has been prescribed. Service providers whose

aggregate value of taxable service provided during the preceding financial year upto

Rs.10,00,000, have been exempted from service tax up to an aggregate value of taxable

service of Rs.10,00,000 in a financial year from 2008-09.

36.3

They started rendering service as a proprietor from September-2007. The assessee

rendered taxable service less then Rs. 7,00,000/- during September-2007 to March-2008.

Therefore they were eligible for benefit ad-hoc exemption of Rs. 10,00,000/- during 200809.

36.4

That the proprietorship firm was converted in to partnership firm from 01-02-2010 and

obtained new registration no. AALFR8453MSD001. The assessee has became a partnership

firm from 01-02-2010 and therefore the assessee was eligible for ad-hoc exemption of Rs.

10,00,000/- during February-March-2010 and Rs.10,00,000/- for the period April-2010 to

November-2010.

15

16

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

36.5 In view of above facts providing the threshold exemption to the assessee available at

different point of time being different assesses shall be as follows, service tax liability of the

assessee would be reduced as under:

a) As a proprietor:

As a Proprietor during 2008-09 taxable value of the assessee would be Rs. 11,40,575/instead of Rs. 24,05,150/- and on which liability of Rs. 1,56,302/- is required to be

reduced.

b) As a partnership firm:

i) As a Partnership Firm taxable value of the assessee under Service Tax for the period

January-February-2010 would be nil as against 5,89,316/- and therefore service tax

liability of Rs. 60,700/- is required to be reduced.

ii) For the period April-2010 to November-2010 taxable value would be Rs.12,62,503/instead of Rs. 20,51,226/- service tax liability would be required to be reduced by

Rs.1,24,762/36.6 Therefore total tax liability of Rs.2,92,952/- which is raised in SCN requires to be reduced on

account of admissibility of ad-hoc exemption as a small service providers.

37

That Cum-Duty Benefit to be given to them.

37.1

The provision of section 67(2) of the Finance Act, 1994 provides as under:

Where the gross amount charged by a service provider, for the service provided or to be

provided is inclusive of service tax payable, the value of such taxable service shall be such

amount as, with the addition of tax payable, is equal to the gross amount charged.

37.2

That it is judicially held in following cases that when assessee has not collected service tax

from recipient of service consideration received has to be treated as cum-tax.

Turret Industrial Security Pvt. Ltd. vs. CCE& C, Jamshedpur 2008-TIOL-45-CESTAT-KOL

CCE, Patna vs. M/s Advantage Media Consultant 2008-TIOL-548-CESTAT-KOL

Municipal Corpn of Delhi vs. Commissioner of Service Tax, Delhi 2009-TIOL-975-CESTAT-DEL

M/s Robot Detective & Security Agency CCE, Chennai vs. CCE, Chennai 2009-TIOL-238CESTAT-MAD

M/s ABN Amro Bank vs. CCE, Noida 2011-TIOL-1147-CESTAT-DEL

M/s Speedway Carriers Pvt Ltd vs. Commissioner of Central Excise, Jaipur 2012-TIOL-1230CESTAT-DEL

Professional Couriers vs. Commissioner of Service Tax, Mumbai 2013 (32) S.T.R. 348 (TriMumbai)

CCE, Delhi vs. Maruti Udyog Ltd. 2002-TIOL-34-SC-CX-LB

37.3

38

That they have not collected service tax from the service receiver. Therefore, consideration

received is to be treated as cum-tax in terms of section 67(2) of the Act ibid and various

judgments cited above.

That they are eligible for exemption under notification no. 12/2003:

16

17

38.1

38.2

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

That the value charged by them is inclusive of value of material and value of service

provided.

As per the notification no. 12/2003 dated 20.06.2003 the value of material charged is not

subject to service tax.

The relevant extract for the said purpose is as under;

“…..the Central Government, being satisfied that it is necessary in the public interest so to

do, hereby exempts so much of the value of all the taxable services, as is equal to the value

of goods and materials sold by the service provider to the recipient of service, from the

service tax leviable thereon under section (66) of the said Act, subject to condition that there

is documentary proof specifically indicating the value of the said goods and materials.”

38.3

39

Therefore, they are eligible for the exemption on the value of goods sold by them to the

service recipient.

That they are eligible for CENVAT credit:

39.1

Rule 2(l) of CENVAT Credit Rules, 2004, defines “input service”, as reproduced after

amendment made as on 01.03.2011 for the period of April,2011 to June, 2013 :“Input service” means any service,

(i) used by a provider of taxable service for providing an output service; or

(ii) used by a manufacturer, whether directly or indirectly, in or in relation to the

manufacture of final products and clearance of final products upto the place of removal,

and includes services used in relation to modernization, renovation or repairs of a

factory, premises of provider of output service or an office relating to such factory or

premises, advertisement or sales promotion, market research, storage upto the place of

removal, procurement of inputs, accounting, auditing, financing, recruitment and quality

control, coaching and training, computer networking, credit rating, share registry,

security, business exhibition, legal services, inward transportation of inputs or capital

goods and outward transportation upto the place of removal;

39.2

That it was clear from the above mentioned facts that the material purchased by them is

regarding to the renderation of service. Without presence of these materials they cannot

render the service.

Therefore, the material purchased are treated as input goods and are eligible for CENVAT

credit.

39.3

40

40.1

That Provisions of extended period of five years is not applicable:

Extract of provisions of section 11A of Central Excise Act, 1944 is as under;

“Where any duty of excise has not been levied or paid or has been short-levied or shortpaid or erroneously refunded, for any reason, other than the reason of fraud or collusion

or any wilful misstatement or suppression of facts or contravention of any of the

provisions of this Act or of the rules made thereunder with intent to evade payment of

duty,—

the Central Excise Officer shall, within one year from the relevant date, serve notice on the

person chargeable with the duty which has not been so levied or paid or which has been so

17

18

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

short-levied or short-paid or to whom the refund has erroneously been made, requiring him

to show cause why he should not pay the amount specified in the notice;

Where any duty of excise has not been levied or paid or has been short levied or short-paid

or erroneously refunded, by the reason of(a) fraud; or

(b) collusion; or

(c) any wilful mis-statement; or

(d) suppression of facts; or

(e) contravention of any of the provisions of this Act or of the rules made thereunder with

intent to evade payment of duty,

by any person chargeable with the duty, the Central Excise Officer shall, within five years

from the relevant date, serve notice on such person requiring him to show cause why he

should not pay the amount specified in the notice along with interest payable thereon

under section 11AA and a penalty equivalent to the duty

40.2

Honourable Supreme Court of India in case of Continental Foundation Jt. Venture

Vs. CCE, Chandigarh-I 2007 (216) E.L.T. 177 (S.C.) held as under. The said judgment is

enclosed as annexure D. That “Suppression” used in the proviso to section 11A of the

Central Excise Act, 1944 accompanied by very strong words as “fraud” or “collusion” and,

therefore, has to be constructed strictly. That near omission to give correct information is

not suppression of facts unless it was deliberate to stop the payment of duty. That

suppression means failure to disclose full information with intent to evade payment of duty

when the facts are known to both the parties, omission by one party to do what he might

have been done would not rendered it suppression. That when the Revenue invokes the

extended period of limitation under section 11A the burden is cast upon it to prove

suppression of facts. That as far as fraud and collusion are concerned, it is evident that

intent to evade duty is built into these words. That as far as mis-statement or suppression

of facts are concerned, they are clearly qualified by the word “wilful”, preceding the words

“mis-statement or suppression of the facts” which means with intent to evade duty. The

next set of words “contravention of any of the provisions of this Act or Rules” are again

qualified by the immediately following words “with intent to evade payment of duty”.

Therefore, there cannot be suppression or mis-statement of facts, which is not wilful and

yet constitute a permissible ground for the purpose of the proviso to section 11A. Misstatement of facts must be wilful. Therefore, requires to be recovered by invoking

provisions of extended period of 5 years. That the adjudicating authority has not justified

how suppression or mis-statement involved with intent to evade duty. When the Revenue

invokes the extended period of limitation under section 11A the burden is cast upon it to

prove suppression of facts. The revenue has not proved suppression of facts in show cause

notice. Therefore, SCN cannot be issued beyond period of 12 months as mentioned in

section 11A of Central Excise Act, 1944.

41

That Simultaneous imposition of penalty under both sections 76 and section 78 of the

Finance Act 1994.

18

19

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

41.1

That it is judicially held that simultaneous imposition of penalty under section 76 and 78 is

not allowed. Illustrative case laws are as under.

CCE Raipur Vs. Raj Wines (2012) 35 STT 17 (CESTAT, New Delhi)

Hind Tele Links Vs. CCE Jalandhar 2012 (25) STR 36 (CESTAT, Delhi)

Rahul Trade Links Vs. CCE Rajkot 2012 (25) STR 178 (CESTAT, Ahmedabad)

CCE Vs. First Flight Courier Ltd. (2011) 22 STR 622 (P & H)

Desert Inn Ltd. Vs. CCE Jaipur (2011) 23 STR 234 (CESTAT, New Delhi)

Ideal Securities Vs. CCE Allahabad (2011) 33 STT 26 (CESTAT, New Delhi)

Shashi Kant Mishra Vs. CCE Allahabad (2011) 24 STR 673 (CESTAT, New Delhi)

Chansama Taluka Sarvoday Mazoor Kamdsar Sahakari Mandli Ltd. Vs. CCE

Ahmedabad 2012 (25) STR 444 (CESTAT, Ahmedabad)

United Communications, Udupi Vs. CCE (2012) 34 STT 285 (Karnataka)

Jekson Hydraulic Ltd. Vs. CCE, Ahmedabad (2012) 23 taxmann.com 320; (2012) STT

370 (CESTAT, Ahmedabad)

41.2 That according to amendment made in section 78, with effect from 10-05-2008 if the

penalty is payable under section 78 the provisions of section 76 shall not apply. In case of Jivant

Enterprise V. CST Ahmedabad (2012) 37 STT 691 held that in view of amendment made in section

78 with effect from 10-05-2008, Penalty under section 76 cannot be levied under section 78.

42.

In view of the foregoing submissions, the noticee requested to drop the proceedings sought

to be initiated by the SCN No. STC/04-39/O&A/13-14 dated 22/10/2013.

PERSONAL HEARING

43.

The noticee was granted personal hearing on 13.03.2014. Shri Bishan R Shah (CA)

represented on behalf of the noticee and reiterated the submissions made in their reply dated

19.02.2014, which is taken on record.

DISCUSSIONS AND FINDINGS

44.

I have carefully gone through the facts on records, the show cause notice under reference

and submissions made by M/s. Raintech Industrial X-Ray Services, Ahmedabad vide their letter

dated 19.02.2014 and during the personal hearing.

45.

The main point to be decided in the instant case is whether the taxable amount of Rs.

1,43,91,007/- and the service tax amount of Rs. 15,31,819/- collected from various clients by M/s.

Raintech Industrial X-Ray Services, Ahmedabad, but not deposited into the govt. account, falls

under the category of “Technical Inspection & Certification Services.”

46. I find that M/s. Raintech Industrial X-Ray Services, Ahmedabad has contended the following :

(i)

That when proprietorship and partnership firms are having different entities, the tax

is to be separately paid, and that the issuance of a single SCN is incorrect.

(ii)

That their activity falls under the category of “Works Contract” and not under

“Technical Inspection & Certification Services.” and are eligible for exemption under

notification No. 12/2003 ST dated 20.06.2003

(iii)

That they are eligible for benefit of small scale service providers exemption under

Notification No. 6/2005-ST dated 1.03.2005.

(iv)

That cum-duty benefit is to be given to them.

(v)

That they are eligible for CENVAT Credit .

47. To decide the issue, I find it relevant to produce the facts of the case as under :

19

20

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

47.1 I find that M/s. Raintech Industrial X-Ray Services, Ahmedabad was started from 2007 as a

proprietorship firm, where Shri Jayantibhai T. Patel was the Proprietor of the said firm and they

were holding service tax registration No. AOZPP 5346M ST001 . For the year 2008-09 and 2009-10

M/s. Raintech Industrial X-Ray Services (Proprietorship firm) had filed ST-3 Return showing their

taxable income as NIL and had not deposited any service tax.

47.2 Further, M/s. Raintech Industrial X-Ray Services, Ahmedabad was converted into

partnership firm from February, 2010. During May, 2010, M/s. Raintech Industrial X-Ray Services,

Ahmedabad (Partnership firm) got their service tax registration No. AALFR 8453M SD001.

However, they had only paid service tax of Rs. 28,746/- and not filed any ST-3 Return.

47.3 M/s. Raintech Industrial X-Ray Services (Partnership firm) was thereafter dissolved w.e.f.

30.11.2010 vide dissolution deed dated 08.12.2010.

47.4 After dissolution of partnership firm of M/s. Raintech Industrial X-Ray Services, Shri

Jayantibhai T. Patel, had continued the firm M/s. Raintech Industrial X-Ray Services as a Proprietor

– ship firm w.e.f. December, 2010 and neither deposited service tax nor filed ST-3 Return.

47.5 Thus, I find that whether being a proprietor or in a partnership, M/s. Raintech Industrial XRay Services, Ahmedabad have always evaded payment of service tax. They had paid just Rs.

28,746/- from the years 2008-09 to 2011-12 to the govt. account, instead of Rs. 15,31,819/- ,

though collecting the same from their customers , detailed as under :

Year

2008-09

2009-10

2009-10

(01.02.2010 to

31.03.2010)

2010-11 (upto

30.11.2010)

Proprietor

Proprietor

Partnership

Value of

taxable

Services/

Income

shown in

Balance

Sheet

24,05,150

47,94,469

6,50,016

Partnership

22,62,503

2,26,250

4,525

2,262

2,33,037

0

2,33,037

2010-11 (from

December,

2010)

2011-12

2011-12

Proprietor

33,84,184

3,38,418

6,768

3,384

3,48,570

0

3,48,570

Proprietor

Closing

Balance of

Debtor

7,56,138

75,614

1,512

756

77,882

0

77,882

1,38,547

13,855

277

139

14,271

0

14,271

1,43,91,007

14,87,204

29,743

14,872

15,31,819

Total

Proprietor/

Partnership

Basic

Service tax payable

Ed.

S. &

Cess

H.S. Ed.

Cess

2,88,618

4,79,447

65,002

5,772

9,589

1,300

Total

Service

tax paid

Differential

service tax

required to

pay

2,886

4,795

650

2,97,276

4,93,831

66,952

0

0

28,746

2,97,276

4,93,831

38,206

28,746

15,03,073

48.

Regarding the first contention of the noticee, I find that the show cause notice has been

issued to M/s. Raintech Industrial X-Ray Services, the proprietary firm, run by Shri Jayantibhai

Tejabhai Patel. No doubt that M/s Raintech Industrial X-Ray Services, the Proprietorship and the

Partnership firms were different entities, with different service tax registration numbers, and that

any tax liability in a Proprietorship firm lies with the proprietor and in case of a partnership firm,

the tax liability lies among the partners of the firm. However, looking at the exceptional and

peculiar nature of the case, the following facts are observed :

20

21

(i)

(ii)

(iii)

(iv)

(vi)

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

M/s Raintech Industrial services, Ahmedabad was run as a proprietary firm and the

proprietor was Shri Jayantibhai Tejabhai Patel from 2008 onwards.

Shri Jayantibhai Tejabhai Patel continued M/s Raintech Industrial services,

Ahmedabad as partnership firm, with him being one of the partners, and which was

in existence for only 10 months from 01.02.2010 to 30.11.2010, and then it was not

in existence any more.

As per para 3 at Page 4 of the dissolution deed dated 08.12.2010 Shri Jayantibhai T.

Patel, had to borne all tax liability of M/s. Raintech Industrial X-Ray Services

(Partnership firm) on it’s dissolution, and all other partners are therefore not liable

for any tax liabilities.

Shri Jayantibhai Tejabhai Patel was involved intrinsically whether in the Proprietor

firm or the Partnership firm. In his statement dated 15.10.2013, Shri Jayantibhai

Tejabhai Patel has stated that “ the Inspection certification can be given by a person

with a license give by BARC (Bhabha Atomic Research Centre), Mumbai and I have

the license from BARC.” Thus it is clear that the services of Shri Jayantibhai Tejabhai

Patel, that of testing & issuance of certificates, could be done only by him and which

is the only work of the firm, whether proprietary or in partnership..

Shri Jayantibhai T. Patel has also admitted that the equipments had been initially

used by his proprietary firm for rendering taxable services and then after the same

had also been used by the partnership firm.

48.1 Thus looking at the unique nature of the case, as discussed above, wherein Shri Jayantibhai

Tejabhai Patel who runs the proprietary firm and who is also responsible for all the liabilities of the

now defunct partnership firm, there was no need to issue separate demands, splitting it into the

Proprietorship firm and the Partnership firms, to demand tax liability from M/s. Raintech Industrial

X-Ray Services, Ahmedabad. Further, the partnership firm is no more in existence and the liabilities

have to be borne by the present owner of M/s. Raintech Industrial X-Ray Services, Ahmedabad.

49.

Now I come to the second issue in which M/s. Raintech Industrial X-Ray Services,

Ahmedabad contends that their services do not fall in the category of “Technical Inspection &

Certification Services.”, but under “Works Contract Services”.

49.1 I find that the above contention of the noticee to be without any weight. First of all they

have themselves registered under the category of “Technical Inspection and Certification Service”

mis-spelt as “Test, Inspection and Certification Service” , which is seen in their ST 3 returns.

Secondly, all through the years from 2008 onwards they have collected the service tax at the full

rates , under the category of ‘Test, Inspection and Certification Service” and which is also

noticeably seen in the Invoices raised by them. Thirdly, the license give by BARC (Bhabha Atomic

Research Centre), Mumbai was for Inspection and certification of capturing X Ray can be classified

under the category of “Technical Inspection & Certification Services.” only. Further, I find that

when M/s. Raintech Industrial X-Ray Services, Ahmedabad has collected service tax, they have to

pay the same to the Govt. whether under “Technical Inspection & Certification Services.” or under

“Works Contract services”, and such an afterthought as to applicability of the Notification no.

12/2003-ST is vague, irrelevant and infructous.

50.

The third issue that M/s. Raintech Industrial X-Ray Services, Ahmedabad has raised is that

they are eligible for benefit of small scale service providers exemption under Notification No.

6/2005-ST dated 1.03.2005 as amended. I find from the Invoices/documents/ledger and the

statement dated 15.10.2013, Shri Jayantibhai Tejabhai Patel, that M/s. Raintech Industrial X-Ray

Services, Ahmedabad had collected service tax continuously since the inception of the firm but had

21

22

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

not deposited the same to the Government account. I find that the Para 2(i) of the said notification

has clearly stated the following :

“G.S.R. (E).- In exercise of the powers conferred by sub-section (1) of section 93 of the

Finance Act, 1994 (32 of 1994) (hereinafter referred to as the said Finance Act), the Central

Government, on being satisfied that it is necessary in the public interest so to do, hereby

exempts taxable services of aggregate value not exceeding four lakh rupees in any financial

year from the whole of the service tax leviable thereon under section 66 of the said Finance

Act:

…………..

“2. The exemption contained in this notification shall apply subject to the following

conditions, namely:(i) the provider of taxable service has the option not to avail the exemption contained

in this notification and pay service tax on the taxable services provided by him and such

option, once exercised in a financial year, shall not be withdrawn during the remaining

part of such financial year;

……”

(emphasis supplied)

50.1 Thus, when a service provider has not availed the option of exemption, he has to pay

service tax. In the instant case, M/s. Raintech Industrial X-Ray Services, Ahmedabad has

continuously collected service tax from its inception till 2011-12, and therefore the Notification

6/2005-ST as amended is not applicable to them.

51.

The fourth contention of M/s. Raintech Industrial X-Ray Services, Ahmedabad is that cumduty benefit is to be given to them. I find that Shri Jayantibhai Tejabhai Patel in his statement dated

15.10.13 has admitted that the income shown in Income Tax return/P&L and Balance Sheet was

the consideration received against the taxable service rendered to their customers. The fact that

the firm has collected service tax on the said income and not deposited, proves that the said

Income is excluding the service tax component, and therefore the contention of M/s. Raintech

Industrial X-Ray Services, Ahmedabad is baseless.

52.

With regard to eligibility of cenvat credit on materials purchased, it is seen that the M/s.

Raintech Industrial X-Ray Services, Ahmedabad has shown NIL figures regarding ‘Cenvat credit’ in

their ST 3 returns. Further, they have also failed to provide any documentary evidence in this

regard. In view of the above, I am not able to give any benefit in this regard.

53.

In view of the above, I confirm the service tax liability of Rs. 15,31,819/- on the taxable

value of Rs. 1,43,91,007/- under the category of “Technical Inspection and Certification Services”

and order it to be recovered under Section 73 read with Section 68 of the Act.

54.

As discussed above, the demand has been held to be sustainable on merits. Thus I find that

it was the duty of M/s. Raintech Industrial X-Ray Services, Ahmedabad to declare such activities,

and receipt towards the same in their ST-3 returns filed by them from time to time. I further find

that the service provider had refused various letter and summons issued to them and showed NIL

ST 3 Returns for the years 2008-09 and 2009-10, and had thereby operated a clever modus

operandi of changing the firm from proprietorship to partnership to proprietorship again with a sole

aim to evade payment of service tax and the same was noticed only when investigation was carried

out by the Preventive section. They had charged and collected Service Tax from the service

recipients on invoice value in respect of services rendered to their clients but short paid the same

22

23

OIO No. 46/STC/AHD/ADC(JSN)/2013-14

in government account in contravention of the provisions of Section 68 of the Act. It, was

therefore, clear that they had failed to make timely payment of the Service Tax as provided in

Section 68 of the Act read with Rule 6 of the Rules. I also find that they were well aware of the

facts regarding such transactions had not been disclosed before the department and therefore

their contention that they have not suppressed the facts is not acceptable in this case. In this

connection, I refer to the judgment in the case involving Aircel Digilink India Ltd. v/s Commissioner

of Central Excise, Jaipur, as reported in 2006 (3) STR 386 (Tri.-Del) and the case involving Bharti

Cellular Ltd. v/s Commissioner of Central Excise, Delhi, as reported in 2006 (3) S.T.R. 423 (Tri.-Del).

In both the cases, the Hon. Tribunal upheld invocation of extended period after taking note of the

fact that appellants had not disclosed certain details and mode of computation in their ST-3 details

and that there was nothing on record to suggest that appellants ever approached the office of the

service tax authorities to ascertain the details of their liability to pay the service tax. Similarly, in

case of Insurance & Provident Fund Department v/s. Commissioner of Central Excise, Jaipur-I, 2006

(2) S.T.R. 369 (Tri.-Del.), Hon. Tribunal held that non-disclosure of full amount of premium collected

would attract invocation of extended period. The ratio of the above judgments can be applied to

the present case also as M/s. Raintech Industrial X-Ray Services, Ahmedabad had kept the

Department in dark about its activities and had not only suppressed the material facts from the

department but has also failed to comply with law and procedures, including payment of service

tax. In view of the above, I hold that in the facts and circumstances of the present case, proviso to

section 73 (1) of Finance Act, 1994, is rightly invoked for raising the demand for service tax against

the noticee. Thus, the suppression with an intent to evade payment, on their part, is proved

beyond doubt and proviso to Section 73(1) of the Finance Act, 1994 has rightly been applied in the

instant case and therefore, by their such act of omission and commission, the noticee have

rendered themselves liable for penalty.

54.1 Hon’ble High Court of Gujarat in the case of CCE, Surat – I Vs Neminath Fabrics Pvt. Ltd.,

reported at 2010 (256) ELT 369 (Guj), while deciding the similar issue in Central Excise, has held

that proviso can not be read to mean that because there is knowledge, suppression which stands

established disappears – concept of knowledge, by no stretch of imagination, can be read into

provisions – suppression not obliterated, merely because department acquired knowledge of

irregularities. The relevant para is reproduced below ;

“20. Thus, what has been prescribed under the statute is that upon the reasons stipulated

under the proviso being satisfied, the period of limitation for service of show cause notice

under sub-section (1) of Section 11A, stands extended to five years from the relevant date.

The period cannot by reason of any decision of a Court or even by subordinate legislation be

either curtailed or enhanced. In the present case as well as in the decisions on which reliance

has been placed by the learned advocate for the respondent, the Tribunal has introduced a