VR-3-1996 - Northern Ireland Court Service Online

advertisement

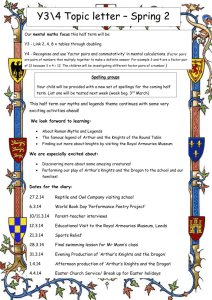

LANDS TRIBUNAL FOR NORTHERN IRELAND LANDS TRIBUNAL AND COMPENSATION ACT (NORTHERN IRELAND) 1964 IN THE MATTER OF AN APPEAL VR/3/1996 BETWEEN THE ORDER OF THE KNIGHTS OF ST COLUMBANUS - APPELLANT AND THE COMMISSIONER OF VALUATION FOR NORTHERN IRELAND - RESPONDENT Lands Tribunal - Mr Michael R Curry FRICS FSVA IRRV ACI.Arb Belfast - 6th March 1998 This was an appeal against the Commissioner's refusal to give charitable exemption to the Order of the Knights of St Columbanus ("the Knights") who occupied a hereditament ("the O'Neill Centre") at 14 York Lane, Belfast. They may be described briefly as a fraternal organization for lay members of the Catholic Church. John Stewart BL instructed by Campbell and Caher, appeared for the Appellant. Stephen Shaw BL instructed by the Crown Solicitor, appeared for the Respondent. Grounds of Exemption A broad brush had been adopted for the Appeal, seeking exemption under three heads of Article 41(2) of the Rates (NI) Order 1977. In outline, the relevant provisions of these headings are: (b) (ii) a church hall, chapel hall or similar building occupied by a religious body and used for purposes connected with that body; or for purposes of any charity. (c) a hereditament, which(i) is occupied by a charity (i.e. a body established for charitable purposes only); and (ii) used wholly or mainly for charitable purposes (of that charity or other charities); or (d) a hereditament, which is occupied by a body(i) which is not established or conducted for profit; and (ii) whose main objects are charitable..; and used wholly or mainly for the purposes of those main objects. In Pemsel [1891] AC 531 Lord Macnaghten set out four principal divisions of legally acceptable charity. These continue to be the recognized groupings and are: -1- trusts for the relief of poverty; trusts for the advancement of education; trusts for the advancement of religion; and trusts for other purposes beneficial to the community, not falling under any of the preceding heads. The stated grounds of this appeal were refined by the contention of the Knights that their objects and use were in the charitable category "the advancement of religion". Some care is required in any comparison with Scotland, where the statutory background is quite different, with England where, in the legislation broadly equivalent to (d)(ii), there is no requirement for the "advancement" of religion, and with the Republic of Ireland where parts of the law relating to religious charities have developed along somewhat different lines. The main focus was on Article 41(2)(d) and, in essence, the Knights claimed to be a body whose main object was the advancement of religion, and the hereditament was used wholly or mainly for the purposes of that main object. The first step is to determine the main object or objects; the next is to examine how the hereditament was actually used. Main Objects and Ambiguity The authorities make clear that, where there is a written statement of objects, the Tribunal must begin with that and, if they are comprehensively set out and there is no ambiguity, the Tribunal must go no further e.g. Berry v St Marylebone [1957] 1 All ER 681. There was no relevant Deed of Trust but the objects were set out in a written constitution. The stated objects were: (a) to promote, by personal and group action, the extension of practical Christianity in all (b) (c) (d) phases of life. to maintain a fraternal order of Catholic lay leadership. to honour the Faith. to prepare its members for the Apostolate. Clearly the Knights’ objects had a strongly religious flavour. For purposes of this appeal, the question was whether the main objects fell within the category of the advancement of religion, perhaps one or more in different ways, with any other objects being merely ancillary or subsidiary. On a preliminary view, the Tribunal would say that the stated -2- objects indicate a number of separate and distinct main objects that included at least one religious object but, if any object had primacy, it would appear to be the first. Not without reservations, the Tribunal accepts that an informed reader of the objects might conclude otherwise and it is appropriate to give the Knights the benefit of the doubt. Otherwise, for reasons explored later, that would be the end of the matter. The broad thrust of a religious object might be either the sustaining and reinforcing of faith within the body of the Knights or advancing of religion in the wider community, or both. If there are a number of distinct objects that are main objects, perhaps relating separately to the good works, lay leadership, and religion, that raises a difficult question for the Knights of whether they each are for the advancement of religion. So, as some or all of the stated objects might be capable of different interpretations in regard to their meaning, relationship and relative primacy, the Tribunal has considered what was in fact done by the Knights. The Knights It may be helpful to begin by briefly setting out a summary of the Tribunal's findings, on the evidence, of the organization and its structure. Although the Order was founded in Belfast in 1915 by J.K. Canon O'Neill, it had since expanded throughout Ireland with headquarters now in Dublin. Membership of the Order was by invitation. Any existing member could make a nomination but there was a rigorous selection procedure and the number had remained limited. The basic unit in which members, known as Knights, assembled was a Primary Council, which met monthly. Each Council was led by a Grand Knight, elected by the Knights, had a priest as Chaplain and was managed by a committee known as a Chapter, which also met monthly. These Primary Councils were grouped into 12 Provincial Areas whose boundaries corresponded with ecclesiastical divisions of the Catholic Church in Ireland. For example, the Knights had 11 Primary Councils in Provincial Area No. 2 (Down and Connor) with about 200 Knights in total. Each Area had a Provincial Council that included representatives of each Primary Council within the Area: these were the Grand Knights, their Deputies, and an elected representative from each. It was led by a Provincial Grand Knight, met at least quarterly, and was managed by an Executive Committee, elected by the Knights in the Area. The office bearers included a Provincial Treasurer (one gave evidence). Each Provincial Council had a Provincial Chaplain, who was nominated by the Provincial Grand Knight, subject to the approval of the appropriate ecclesiastical authority. -3- In Provincial Area No. 2, the Provincial Grand Knight (who also gave evidence) reported on activities to the Bishop of Down and Connor, accepted his Episcopal authority and the Knights had the Bishop's approval, support and encouragement. The Supreme Council was the governing body of the Knights, included an elected representative from each Primary Council, and met annually. The head of the Order, the Supreme Knight, was one of a number, elected by the Supreme Council, to hold Supreme Offices. He presided over the Council of Directors who implemented the decisions of the Supreme Council and made appointments, from those elected, including that of Supreme Warden (who also gave evidence); the latter's responsibilities included property matters. So, evidence was given by: Nicholas McKenna, Provincial Treasurer of Area No. 2; Michael Hilton, Provincial Grand Knight of that Area; and Patrick Sylvester John Byrne, Supreme Warden. Mr McKenna was a Director of a Catering Supplies Business, Mr Hilton, a teacher of Religion and English and Mr Byrne, an Architect. The Hereditament The hereditament was part of a building owned by Columbanus Enterprises Ltd. Parts of the building were demised to three other organizations - the Diocesan Resource Centre (the subject of a separate appeal), the Catholic Book Company and the Columban Club. The remainder was the subject of this appeal and the accommodation included an assembly hall, meeting rooms and ancillary accommodation. It was pointed out that, on a plan of the premises, the layout had the appearance of parts being allocated for other purposes and the residue, on various floors, left for the Knights. There was no formal licence or tenancy agreement, and some aspects of the relationships with the Columban Club and Columbanus Enterprises Ltd, relating to the premises, were not entirely clear, but the Commissioner took no issue with whether the hereditament was correctly defined or whether the Knights were correctly identified as the occupier. As these matters were not before the Tribunal, it expresses no view on them but it would appear that although social intercourse and discreet festivity were not excluded from their fellowship object, that activity had largely been siphoned off, from the appeal premises, to the Columban Club. The Activities of the Knights -4- It is a question for the Tribunal and not for the Knights, but Mr Hilton's evidence concerning their objects provided helpful guidance. The Knights' motto translated as "to restore all things in Christ" and that flowed from the commandments "Love God and Love your neighbour". Generally, the Knights relied mainly on evidence of what was done, directly or indirectly connected with this hereditament, rather than on an overview of their activities as a whole throughout Ireland, both to clarify their objects as well as demonstrate their actual use of the premises. Mr McKenna gave explanations of accounts of the Provincial Area and a number of Primary Councils, including some who did not use the premises, but much of the financial administration was said to be based in Dublin. Trading accounts may be relevant for two main purposes; the first is to assist with understanding the nature of the body and the second is as an indicator of how the body actually uses the particular hereditament under appeal. Mr McKenna had been Provincial Treasurer for 2 years and produced trading accounts for Area No. 2. He also gave explanations of items in a number of Primary Council accounts. In the Area No. 2 accounts, in recent years, income and expenditure were of the order of a few thousand pounds. Receipts included Levies from Members; a Capitation fee was charged for new members and then passed on to headquarters in Dublin. On the payments side, the Supreme Knight received a donation that he could use for his chosen charity, it was at his absolute discretion; there was a Supreme meeting at which Knights from all over Ireland attended and lasted for 3 days and delegates were paid expenses to attend; and a donation was made to a fund for the benefit of Widows and Orphans of former members, similarly there was a benevolent fund for members and dependants and these funds were administrated from Dublin. Amount for rent appeared on the accounts but that was a contribution towards heat and light for the building. The 1994 accounts included figures from fund raising including a dance and 200 Club draw. The accounts for Belfast Primary Council 1 showed a similarly modest scale of financial activities. Receipts included some 20 annual subscriptions, and revenue from fund raising, including quizzes and barbecues. Expenditure included membership fees to Central Funds and a levy to the Provincial Council, expenses for attending the Supreme meeting, Columban Club fees (or donations to Columban Club charities) and room hire for meetings. On an overview, other accounts for Primary Councils using the premises were not dissimilar. -5- Clearly, there was a relationship with the Columban Club; monies from the Order were paid to the Columban Club and there was an overlap, but the Tribunal was informed that the main purpose of that Club was social; not all Knights would espouse the activities of the Club and Knights chose whether to join or not. From time to time, those Club premises were used for fund raising as their premises suited better. If a Council found it necessary to raise funds, that might be organized for them through the Columban Club. The activities, mainly associated with these premises, organized by the Knights included: A Relief Scheme - Members dealt with needy families on a day to day basis, providing appropriate assistance. Members provided hampers of food in Belfast once a month and particularly at Christmas when some 500 were delivered. The hampers generally were produced by members donating goods. This was a substantial exercise and the value of the hampers produced by one Council, for example, was of the order of £50,000. A Holiday Scheme - Members provided transport, food etc. and worked with a number of charities, community groups and religious societies to provide holidays for families in difficulty. A Youth Scheme - This brought low achieving children together and in the summer holidays provided additional schooling both in academic subjects and general life skills. A Job Search Programme and Mock Interview programme helped assist those seeking employment. A Children's Christmas Party - Part of the purpose was to engage deprived and abused children in a family situation along with members’ families so as to both assist the unfortunate children and heighten the Members' families awareness. General - There were a number of other activities to assist the needy, deprived, the sick, the disadvantaged and distressed, for example Members organized outings for those suffering from Alzheimers. Foreign Aid - They assisted with charitable work in the third world and recently for Italy by organizing the assembly of emergency aid (including caravans and tents) and taking it there. A Visitation Scheme - Members visited hospitals and the sick at home. Within the Order they had a number of Eucharistic Ministers who had been selected to administer the sacrament. -6- A Choir - Members and their wives and families formed the Columban Choir. They sang at acts of worship and were available for any council anywhere. An Emigration Assistance Scheme - They provided help and contacts for those emigrating to England. Awareness - Seminars and debates were organized with speakers, including lay and clerical speakers from all areas. For example, once a month, a group called the Northern Area Committee organized activities, discussions and lectures on issues of social importance so the Knights were better informed and were able to provide leadership in regard to these problems in their parishes. There was a focus on educational interest and concerns and it would be the aim to promote members to become governors or members of Parent Teachers Association and to contribute to education in that way. The Use of the Hereditament The accommodation provided a central meeting place for the Knights in Northern Ireland and for Provincial Area No. 2 (Down and Connor). Councils and Chapters met there and it wasused for about 14 evening meetings per month altogether. Council meetings were sometimes held in meeting rooms, sometimes in the main hall. The meeting rooms were barely furnished. Although the hereditament was also used for some administrative work including administration of matters such as the benevolent fund, there was no staff employed and there was no office equipment, no secretarial work went on. The detailed work of administration took place in the Knights own homes and these premises were seldom used during the day. At meetings, normally the Grand Knight would give a spiritual affirmation of the object as the extension of practical Christianity. There would be prayers followed by the business part of the meeting which would be to do with projects or with religious education by a priest or expert or minister. Most of the work, such as the holiday scheme and relief schemes, was planned rather than executed on the premises but the premises did provide a role as a depot for other schemes. Mr McKenna described the meetings as businesslike but with a religious atmosphere. There were 7 Councils of Knights in Belfast and a number of those would use the rooms but Mr McKenna's own Council met in Ballymena, in an hotel. The Centre was really the centre for Area No. 2 and in practice those helped, from the Centre, were generally in Greater Belfast. Clerics were not always present at meetings but there quite often and lectures took place in both the main hall and meeting rooms. -7- Mass was celebrated once a month by priests from either within or without the Order. Of the people at the mass the majority would be Knights but others would be families of Knights, family and friends. The masses always had a particular purpose, for example, a mass for someone ill or a mass for the dead. There was an area dinner at least once a year, with a Knight at each table entertaining guests. Although there was a degree of use of the subject premises for purposes of fund raising, that was such a limited use that it may be ignored. Main Objects This list is not complete but gives the general picture. Although many activities took place away from the Centre, much of the conception and organization for activities took place there. The Tribunal was referred to Trustees of Belfast YMCA v COV [1969] NI 3. The Tribunal accepts it must reflect a contemporary context and perspective in its application of the principles to the construction of the objects and the judgement of Lord MacDermott LCJ reflected a more liberal view than had been adopted in earlier cases. However, it is one thing to accept that a wide range of activities including organized games may be consistent with an object of the advancement of religion, it is quite another thing to observe a rugby or hockey match and conclude that the objects of the body occupying the playing field are the advancement of religion. The stated objects are the compass for the inferences to be drawn from the activities. Bearing that in mind and looking at what the Knights in fact did in the community the Tribunal finds, their main objects may be stated, in summary, to be as follows. One object was to provide practical assistance to help those in need in the community (for convenience the 'good works' object). Another object was to use their activities, both individually or as a group, to help to sustain or intensify their own faith and in so doing help other Knights to move theirs forward (for convenience the 'religious' object). A further object was that, by becoming better informed in other spheres of community activity, the Knights would become leaders in the lay community (for convenience the 'lay leadership' object). Returning to the written constitution, objects (c) and (d) combine to form a distinct main object with the emphasis on religion (there is, however, a question as to whether that object qualifies as the "advancement" of religion); object (a) is a distinct main object with the emphasis on practical good works: and object (b) is a distinct main object of the Knights -8- sustaining a role as lay leaders. In aid of, or in attaining these main objects, they aimed to become better informed, relied on religious observation and instruction, and fellowship and sharing common experience and goals, for mutual support. These aims and activities were important but, in so far as they may demonstrate objects, the Tribunal finds them to be subsidiary or ancillary to the others. Charitable Objects The Tribunal now turns to the question of whether these main objects all are charitable in the legal sense, and in particular whether, even though they are distinct objects, each can be treated, as claimed, as the advancement of religion. There was a religious object, but the majority, by far, of their activities was consistent with the stated main object of carrying out practical good works. The lay leadership object aimed, through fellowship, to advance the role and influence of Knights in the community. Many of their activities confirmed a desire to exercise a benign influence, based on their faith, in important spheres such as education but the promotion of faith must be regarded as an indirect result rather than a direct objective. Mere socializing was not excluded in connection with their fellowship and, although the Columban Club premises were accepted to be a separate hereditament, the Club itself was directly integrated with the Knights. On the evidence, the Tribunal cannot accept the lay leadership object to be only, or almost only, the advancement of religion, even indirectly. There is no necessary causal connection between doing good works and advancing religion and, looking at the actual activities, although they were obviously extremely worthwhile, there was no overt connection with advancement of religion in the vast majority of them. There was no effort to provide religious education, for example, in connection with the Holiday Scheme or Christmas parties. Religious educational activities were not directed at the public at large but generally were confined to the Knights themselves. All Knights were Roman Catholic but not all beneficiaries were Roman Catholic, and although most might be, the Knight's target was not to evangelize or convert, the Order was based on respect of other traditions and faiths. By giving an example, the desire was that people would recognize their motivation in most of what they did. Although, in the impact of example, others might be led to follow, there was no effort to indoctrinate, there was no overt evangelism in terms of word. So it does not follow that their setting of an example amounted to an advancing of religion. "For a man may persuade his neighbour by example to lead a good life without at the same time leading him to religion." United Grand Lodge v Holborn B.C. [1957] 3 All E.R. -9- The Tribunal cannot accept the contention that the object of doing good works was the advancement of religion and, by reason of that alone, a charitable purpose. There can be no doubt that the religious object was to sustain and reinforce the Knight's own faith but the important questions remain of whether the object included the advancement of religion in the wider community (for convenience only, ‘reaching out’) and, if not, whether the former alone qualifies, in these circumstances, as legally charitable? Often, when dealing with religious orders, the decided cases refer to the former category as ‘self sanctification’ but that does not seem entirely appropriate for this lay body and the Tribunal prefers here to refer to ‘personal strengthening of faith’. It follows from the conclusions outlined above in regard to the good works object, and in the absence of significant other public religious activities, apart from some religious observances to which friends and families were invited, that the Tribunal finds the object was not one of reaching out, as such. Looking at the activities as a whole, it is clear that the Knights engaged in real, practical activities of benefit to others in the community, and that these were good works and charitable in everyday language if not shown to be so in the rating context and the Tribunal has no doubt that the Knights’ objects included personal strengthening of faith. The Tribunal accepts that coming together as a group of apostolates, in this way, to act in charity may constitute an acting out of their faith and in so doing they may advance their own religion. The Tribunal concludes that the religious main object was personal strengthening of faith but that rather than reaching out. In Cocks v Manners (1871) 12 Eq. 574, a distinction was made, as a result of which it was held that a pious purpose was not necessarily a charitable purpose. In particular, personal or self sanctification, perhaps by prayer and pious contemplation, generally was not a charitable object. But, in COV v The Trustees of the Redemptorist Order [1971] N.I. 114, MacDermott LCJ concluded that a body, which would not be charitable for that reason, may yet be charitable in law if, as a means thereto, the members engaged in outside good works. It was so in that case, but it is the view of this Tribunal it is not essential, for this purpose, to show that such good works qualified in their own right as charitable in law; the test should not be as strict as that. That is not to say that the strict charitable test is inappropriate if such works are stated or found to be a main aim. Although raised by the Tribunal at the Hearing, this line of reasoning was not fully explored at the time, and it can lead to sophisticated argument, but the Tribunal concludes, without, it hopes, straying too far from the contentions of the parties, that applying that principle, the religious main object qualifies as the advancement of religion. In reaching that conclusion - 10 - the Tribunal has taken a view on the good works but, for the avoidance of doubt, the Tribunal makes clear that it did not allow consideration of the good works in the context of a wider charitable ambit as that had not been raised either in the Appeal to the Commissioner or in the Statement of Case. It would be too late, the parties must know in advance the case they have to meet, the issues are sophisticated and further, the enquiry into the evidence may have required a different approach. Mr Hilton quoted the Apostle James: "faith without good works is meaningless". Personal strengthening of faith on its own is, as it were, "meaningless" in the legal charitable context and fails the test but when coupled with good works then it becomes meaningful and passes the test. However, as already stated, both the lay leadership and the good works objects also stand on their own feet as main objects and that being so, the Tribunal finds that there are two other main objects and not one overall object of the advancement of religion. As the Tribunal has found the good works to be a main object, and there is much to suggest it to be the most important object, the good works must also be separately considered in that context. The Tribunal finds that whether or not the good works object might, on enquiry, be found to be a legally acceptable charitable object, it does not, of itself, sufficiently facilitate the advancement of religion to qualify as a charitable object of that category. The conclusions of the Tribunal are that stated objects (c) and (d) combine as a main religious object for the advancement of religion and a charitable purpose. But the good works object (a), and the lay leadership object (b) however meritorious, do not qualify as objects for the advancement of religion. The good works object may or may not qualify as a charitable object of another kind or kinds but that would require appropriate investigation. As it follows that they have a main object or objects that do not qualify as charitable, the Tribunal is not persuaded that the Knights are a body established for charitable purposes only, nor a body whose main objects are charitable, for purposes of Article 41. In particular they are not a body established for the advancement of religion only. Strictly, that is the end of the matter, so far as Article 41(2)(c) and (d) are concerned, because it is not a hereditament, which is occupied by a body "established for charitable purposes only" nor is it a hereditament, which is occupied by a body "whose main objects are charitable". The Purposes of the Activities at the Hereditament Having come to that conclusion on the objects of the body as a whole, it is not necessary to consider whether the actual hereditament is itself used wholly or mainly for charitable purposes (of that charity or other charities) and, in particular the advancement of religion. However, for completeness only, the Tribunal briefly sets out its views on that. - 11 - Although, in appropriate circumstances, each may aid interpretation of the other, objects and activities must be separately considered and not confused. It should also be said that, where an object is stated, consideration of an activity should only be used as an aid to clarification of the object and should not be allowed to replace such an object with an object of a different character, even where a wide charitable ambit has been contended for. The authorities e.g. Oxfam v City of Birmingham [1975] 2 All ER 289 and Johnstone v Glasgow City Corp [1965] 1 All ER 730 illustrate the principle that the Tribunal must look for activities that directly facilitate the charitable objects. The question here is whether the activities wholly or mainly directly facilitate the advancement of religion. It follows from the conclusions discussed earlier in connection with the analysis of the objects, that the Tribunal must find the activities directed towards the planning and execution of the good works do not directly advance religion. Having concluded that the religious object was one of personal strengthening of faith which amounted to the advancement of religion, the Tribunal turns to the actual activities to see whether they directly facilitated that object. There was religious observance and education and that clearly must qualify. Meetings to organize the activities began with prayers and, although that is a common practice followed in many organizations, it had a special importance in the context of the religious object of this body. Episcopal authority was accepted, but it was supervision with a light touch rather than close control. The steps the Knights took, on the premises, to become better informed lay leaders did, to an extent, complement the religious education that took place. So, some activities clearly directly facilitated the advancement of religion, but, from the evidence, it is also clear that the main use was to plan in a businesslike way how to facilitate their good works object. This was a lay order rather than a religious order and that important use for the organization and execution of good works was not a qualifying use for the advancement of religion. On balance, the Tribunal is not persuaded that the activities, although highly meritorious, sufficiently directly assisted the advancement of religion to qualify. Each year, the hereditament was used in connection with a religious retreat for girls from St. Louise's Comprehensive School who brought their own teachers and religious educators. For about 3 evenings religious education and guidance was given. The retreats were a use by the school, but Members did assist. The Tribunal's view is that although the school was disqualified from charitable exemption as an occupier (Article 41 para (6)), it may reasonably be presumed to be a charity and the use it made would appear to be a use for charitable purposes of a charity (sub-para (c) (ii)). Although apparently - 12 - educational and advancing religion, the Tribunal must conclude that it was not a use within the stated main objects of the Knights (sub-para (d)). The Tribunal must conclude that the hereditament was not used wholly or mainly for the charitable religious object. Church Hall or Chapel Hall Section 1(1) of the Rating and Valuation (Amendment) Act (Northern Ireland) 1956 provided for the distinguishment as exempt of any hereditament consisting of "a church hall, chapel hall or similar building belonging to or held by a religious body, so long as that hall or building is used mainly or exclusively for purposes connected with that body". The 1972 Rates Order re-enacted that Act with amendments and the provision as it appears in Article 41 of the 1977 Rates Order refers to any hereditament which consists of .... "a church hall, chapel hall or similar building occupied by a religious body and used for purposes connected with that body or for purposes of any charity; .......... together .... with buildings ancillary thereto." When the 1972 Rates Order re-enacted the 1956 Act, the requirement for 'tenure' by a religious body was amended to 'occupation' by a religious body and the scope of qualifying user was widened. Although, to qualify, a hall must be occupied by a religious body, it is not necessary that it should be a 'charitable' religious body. In Mageean v COV [1960] NI 141 C.A., which concerned the Catholic chaplaincy at Queens University, Belfast, it was held that "connected with," were words of wide import which would, for example, cover the activities of all kinds of subordinate organizations whose ultimate purpose was "to further the work or meet the needs of a group or community of worshippers...". A hall, although occupied by a religious body and used for purposes connected with that body, would not necessarily qualify for exemption; the further requirement in the 1956 Act remains: it must be "a church hall, chapel hall or similar building". These words were retained and the Tribunal considers they remain not surplusage nor meaningless and the principles at the heart of Mageean are still relevant. In this case there is no connection with a specific place of public worship but many of the activities were of the nature of those to be found taking place in a church or chapel hall. - 13 - Mageean sets out two ways to test whether such a hall has a church or chapel hall-like character. One is a link with a group of worshippers (per MacDermott LCJ), the other is direct supervision and control by a Church (per Black LJ). A hall may be occupied by a religious body and, although used for purposes connected with that body, lack a sufficiently close link with the element of a group of worshippers, or supervision and control by a church to qualify as a church hall. As previously indicated, the Tribunal finds that, although there were, of course, links with the Church, there was insufficient direct control or supervision by the Church for the Knights to qualify as a subordinate organization under its control. When the Tribunal then addresses the question of whether there is a community of worshippers, it sees that as a requirement that the occupying body is such a group or perhaps an umbrella organization for such groups. Plainly this body is not, because the purpose for which Knights gather together in groups, here or elsewhere in houses or hotels, is not for the purpose of worship but with the object of doing, not worshipping. Where there was worship, although important, that was a subsidiary activity. Religious Body “It is a trite saying that the law is life, not logic. But it is, I think, conspicuously true of the law of charity that it has been built up not logically but empirically.” per Lord Simonds in Gilmour v Coats [1949] A.C. 426, 448-9 "Religious body" is not defined in the statute and, consistent perhaps with that approach of the courts in this branch of the law, there appears to have been a reluctance to lay down any test or series of tests which would define a religious body. "It seems to me that two of the essential attributes of religion are faith and worship; faith in a god and worship of that god." Barralet [1980] 3 All ER 918, per Dillon J. at 924. Although the Knights clearly have religion at their heart and their faith is not in question, it was not a body that, in the ordinary course of their work, gathered together as a main activity, either as a whole, in Councils or other grouping, with the object of worship. On balance and it is only on balance, the Tribunal finds there was insufficient emphasis on worship by the body, for the Knights to be regarded as a religious body. Summary The principal conclusions of the Tribunal are as follows. - 14 - Although the organizational and structural trail was not followed to a conclusion, the Commissioner accepted the identification of the hereditament and made no suggestion that the body was established or conducted for profit. These matters were not before the Tribunal. In summary, the Knights had three main objects. One was to provide practical assistance to help those in need in the community, another was to sustain their own faith both individually and as a group and the third was to provide leadership in the lay community. There was linkage between the three but all three were distinct main objects. The activities of the Knights at the hereditament included the organization of practical activities of benefit to others in the community, fellowship, education and religious observances. The hereditament was not a chapel hall or similar building occupied by a religious body. That was because there was no connection with a specific place of public worship, no sufficiently close link with a group of worshippers or supervision and control by a church and the Knights did not qualify as a religious body. Therefore Article 41(2)(b)(ii) does not apply. The Knights were not a body established for charitable purposes only and, in particular the advancement of religion, the body was not a registered charity, it was not bound by charitable trusts only and its main objects were not all charitable. Although the hereditament was used in a meritorious way, it was not used wholly or mainly for charitable purposes. Therefore Article 41(2)(c) does not apply. The main objects were not all charitable, and in particular were not the advancement of religion. Therefore Article 41(2)(d) does not apply. For the reasons stated above, the Appeal must fail but it is appropriate to endorse the general observation made on behalf of the Commissioner. He accepted that the Order was a group of well-meaning noble people bound together to do good works out of religious conviction. Costs At a further Hearing on costs, Mr Terence Brady of Campbell & Caher, Solicitors appeared for the Appellant. Mrs Ann Kyle, Crown Solicitor, appeared for the Respondent. - 15 - Mrs Kyle applied for costs and submitted that although the Appellant carried out good works there was no reason to deviate from the usual rule that costs should follow the event. Mr Brady submitted that the case really did have to be heard because of its complexity and the Tribunal did find a charitable element in the Appellant’s works. The appeal was hampered by the wording of their constitution which would now be redrafted. The Tribunal is not without sympathy for the Appellant but is not persuaded there is sufficient justification to depart from the usual rule. The Tribunal orders that the Appellant pays the Respondent’s costs. Such costs in default of agreement to be taxed by the Registrar of the Lands Tribunal on the High Court Scale. ORDERS ACCORDINGLY 19th August 1998 M R CURRY FRICS FSVA IRRV ACI.Arb LANDS TRIBUNAL FOR NORTHERN IRELAND Appearances: John Stewart of Counsel instructed by Messrs Campbell & Caher for the Appellant. Stephen Shaw of Counsel instructed by the Crown Solicitor for the Respondent. - 16 -