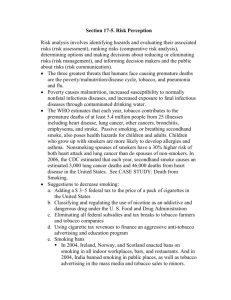

Cost-Benefit Analysis of Proposed

advertisement