HERE

advertisement

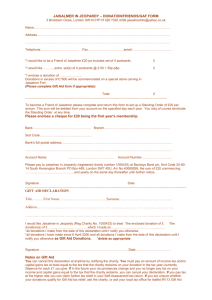

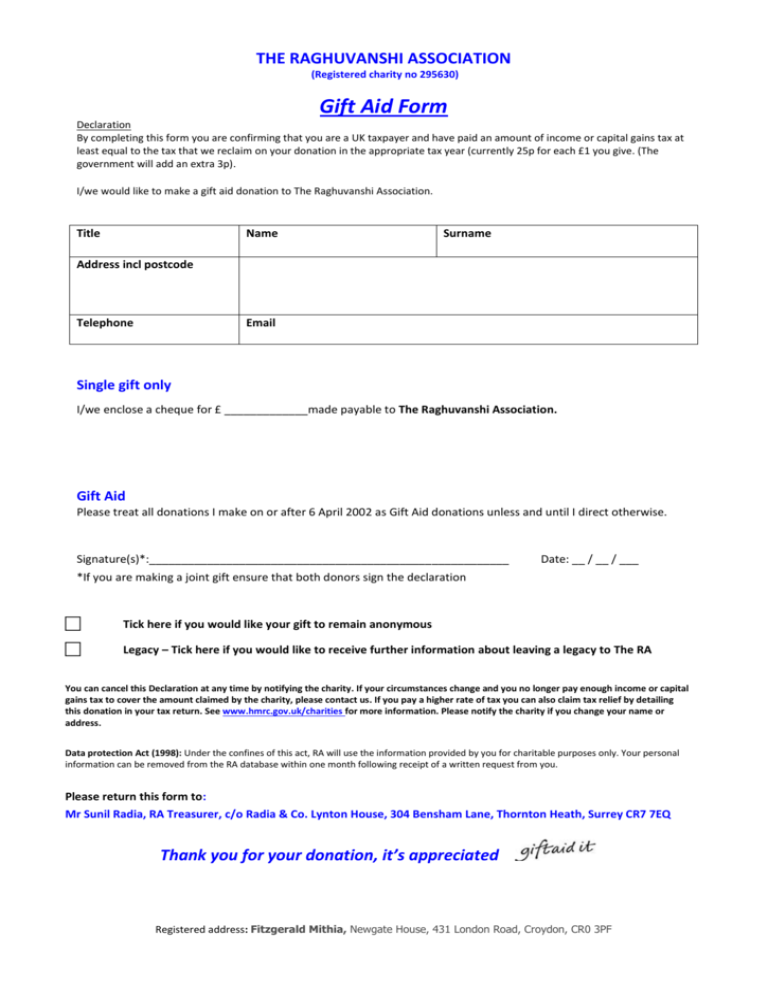

THE RAGHUVANSHI ASSOCIATION (Registered charity no 295630) Gift Aid Form Declaration By completing this form you are confirming that you are a UK taxpayer and have paid an amount of income or capital gains tax at least equal to the tax that we reclaim on your donation in the appropriate tax year (currently 25p for each £1 you give. (The government will add an extra 3p). I/we would like to make a gift aid donation to The Raghuvanshi Association. Title Name Surname Address incl postcode Telephone Email Single gift only I/we enclose a cheque for £ _____________made payable to The Raghuvanshi Association. Gift Aid Please treat all donations I make on or after 6 April 2002 as Gift Aid donations unless and until I direct otherwise. Signature(s)*:________________________________________________________ Date: __ / __ / ___ *If you are making a joint gift ensure that both donors sign the declaration Tick here if you would like your gift to remain anonymous Legacy – Tick here if you would like to receive further information about leaving a legacy to The RA You can cancel this Declaration at any time by notifying the charity. If your circumstances change and you no longer pay enough income or capital gains tax to cover the amount claimed by the charity, please contact us. If you pay a higher rate of tax you can also claim tax relief by detailing this donation in your tax return. See www.hmrc.gov.uk/charities for more information. Please notify the charity if you change your name or address. Data protection Act (1998): Under the confines of this act, RA will use the information provided by you for charitable purposes only. Your personal information can be removed from the RA database within one month following receipt of a written request from you. Please return this form to: Mr Sunil Radia, RA Treasurer, c/o Radia & Co. Lynton House, 304 Bensham Lane, Thornton Heath, Surrey CR7 7EQ Thank you for your donation, it’s appreciated Registered address: Fitzgerald Mithia, Newgate House, 431 London Road, Croydon, CR0 3PF